Argentina Banking Sector: Wealth Management Expansion and Cybersecurity Integration Driving a New Era of Transformation

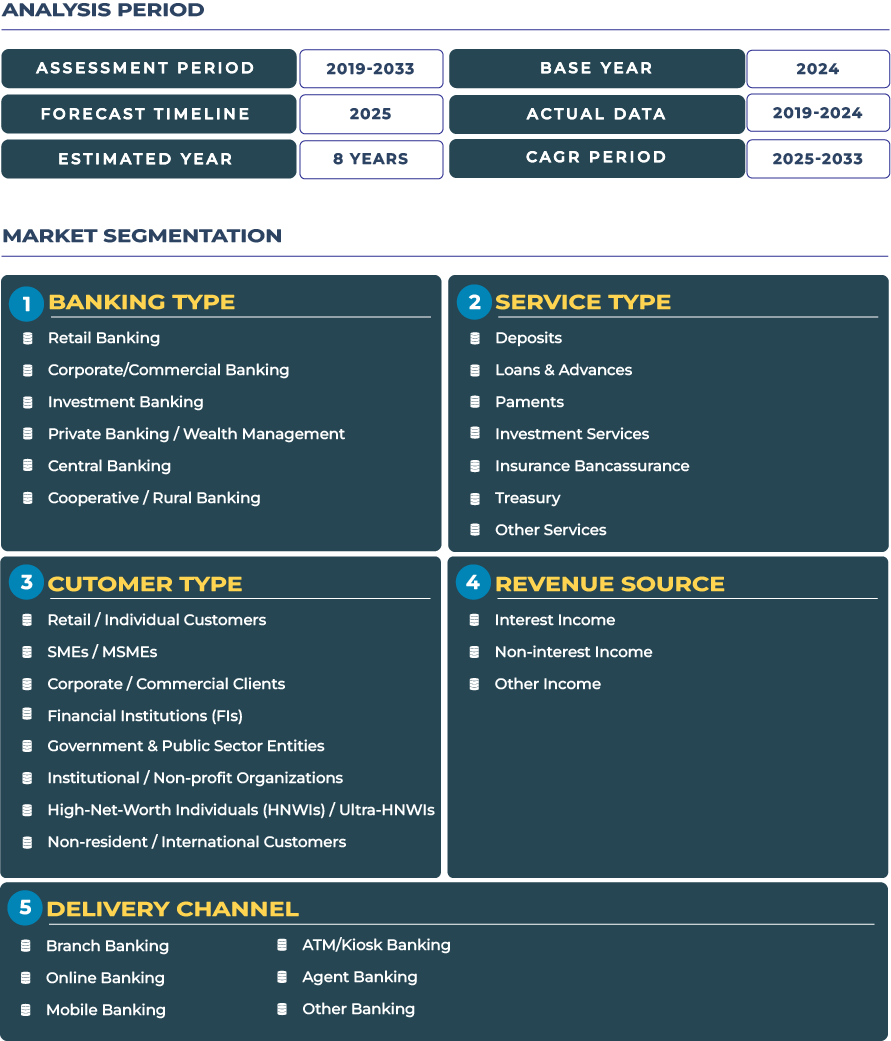

Argentina banking industry is entering a decisive phase where digital transformation meets the imperatives of legacy modernization, cybersecurity, and wealth management growth. The market is evolving as financial institutions balance innovation with compliance, aiming to strengthen trust and expand services for affluent clients. In 2025, the Argentina banking market is estimated to reach USD 50.3 billion and is projected to grow to USD 59.5 billion by 2033, registering a compound annual growth rate (CAGR) of 2.1% during 2025–2033. This moderate yet steady trajectory reflects both the challenges of macroeconomic volatility and the strategic digital acceleration across key banking segments, including retail banking, investment services, private wealth management, and cooperative banking networks. Rising digital adoption, an emerging cybersecurity-as-a-service model, and tailored financial offerings for affluent and mass-affluent consumers are reshaping the country’s banking ecosystem.

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Market Outlook: Digital Transformation Anchored in Wealth Management and Cybersecurity

Argentina banking landscape is undergoing a profound transformation. The financial system, historically shaped by economic fluctuations and regulatory complexities, is now focusing on creating a resilient and future-ready ecosystem. A notable development is the rapid evolution of private banking and wealth management services, targeting high-net-worth individuals (HNWIs) and younger affluent segments. These clients are increasingly expecting personalized digital platforms that integrate investment advisory, asset diversification, and tax planning services within secure and compliant frameworks. The acceleration of mobile banking usage in Buenos Aires, Córdoba, and Mendoza has led banks to prioritize cybersecurity infrastructure to protect digital channels and ensure trust.

Despite the presence of legacy core systems, Argentina’s banks are modernizing through cloud migration strategies and API-driven integration to enhance operational agility. The expansion of digital payment platforms and increased smartphone penetration have catalyzed this shift. Additionally, geopolitical developments and domestic policy adjustments have influenced foreign investment inflows, indirectly shaping the capital adequacy strategies of major banks. As a result, the market is becoming increasingly competitive, with both local and international players enhancing digital capabilities while navigating inflationary pressures and evolving monetary policies set by the Banco Central de la República Argentina.

Drivers & Restraints: Technology Push Meets Regulatory and Infrastructure Challenges

Accelerating Digital Transformation and Mobile Banking Adoption

Argentina’s banking market is experiencing a surge in digital transformation initiatives, driven by customer expectations, smartphone proliferation, and regulatory encouragement of financial inclusion. Retail banking has seen increased adoption of digital onboarding, biometric verification, and mobile-based financial products, especially among younger demographics in urban regions. Banks are increasingly investing in cybersecurity-as-a-service platforms and AI-powered fraud detection to strengthen digital trust. Wealth management platforms are also digitizing, offering real-time portfolio tracking and advisory services, which align with the global trend toward hybrid human-digital wealth solutions.

Legacy Core Banking Systems and Compliance Costs as Barriers

Despite this progress, Argentina’s banking ecosystem faces notable restraints. Many institutions still rely on legacy core systems that hinder real-time processing, interoperability, and product innovation. Modernization efforts are expensive and time-consuming, requiring phased investments that challenge profitability. Additionally, regulatory compliance costs remain high due to frequent changes in monetary policy, anti-money laundering (AML) frameworks, and capital adequacy norms. These constraints particularly affect smaller cooperative and rural banks, limiting their ability to innovate at the same pace as larger commercial players. Furthermore, inflationary pressures and currency volatility introduce uncertainties that impact lending, investment banking operations, and wealth preservation strategies.

Trends & Opportunities: Open Finance, Zero-Trust Cybersecurity, and Affluent Segment Personalization

Open Finance and Zero-Trust Cybersecurity Models Leading the Next Wave

One of the dominant trends shaping Argentina banking sector is the gradual adoption of open finance models beyond traditional banking. Banks are increasingly integrating third-party fintech platforms through open APIs, enabling new financial products such as embedded lending, cross-border investment tools, and personalized savings ecosystems. This is particularly evident in major urban centers where consumers demand seamless omnichannel experiences. Parallelly, the rise of zero-trust cybersecurity frameworks is becoming essential as digital touchpoints expand. Banks are investing in continuous authentication, encryption, and network micro-segmentation to secure customer data and transaction flows, aligning with international security standards.

Cybersecurity-as-a-Service and Personalized Digital Wealth Advisory as Strategic Opportunities

Opportunities are emerging for banks to position themselves as cybersecurity providers, offering cybersecurity-as-a-service solutions to smaller rural and cooperative banks lacking internal expertise. This model not only enhances sector-wide resilience but also creates new revenue streams. Additionally, the growing affluent class presents a significant opportunity for personalized digital wealth advisory. Banks are launching specialized wealth apps that integrate algorithmic portfolio advice with human expert consultations, targeting both expatriates and local affluent households. These developments indicate a market shift toward service diversification and higher value creation per client, moving beyond traditional lending and deposit activities.

Government Regulation: Evolving Frameworks Supporting Stability and Innovation

Regulatory bodies play a crucial role in shaping the Argentine banking industry’s trajectory. The Banco Central de la República Argentina oversees monetary policy, banking supervision, and financial stability initiatives. Recent regulatory updates have focused on enhancing digital payment interoperability, strengthening cybersecurity reporting standards, and promoting financial inclusion. Government-led digital identity programs and AML tightening measures are encouraging banks to adopt secure onboarding technologies and digital KYC frameworks. These evolving regulations are creating a more structured environment that supports both innovation and systemic stability, enabling the market to navigate economic uncertainties while advancing toward digital maturity.

Key Impacting Factors: Economic Structure, Asset Ratios, and Demographics

The performance of Argentina’s banking sector is significantly influenced by macroeconomic and demographic factors. The banking sector’s assets-to-GDP ratio remains lower than many emerging markets, indicating untapped potential for financial deepening. Economic recovery patterns post-pandemic and after recent geopolitical adjustments are impacting lending appetite, investment flows, and capital adequacy ratios. Argentina’s age distribution, with a growing base of digitally savvy younger consumers, is influencing demand for mobile-first retail banking services and investment products. Moreover, the gradual formalization of informal economic activities is expanding the addressable customer base for both commercial and cooperative banking institutions, further shaping sector dynamics.

Competitive Landscape: Strategic Shifts Among Leading Financial Institutions

Argentina banking market is characterized by the presence of major local and international players such as Banco Galicia, Banco Macro, and international institutions like Santander Argentina. These banks are actively modernizing infrastructure and launching new service lines. In March 2024, Banco Galicia announced the expansion of its wealth management services targeting younger affluent demographics through digital advisory platforms. Santander Argentina enhanced its cybersecurity systems in late 2024 to comply with new reporting regulations. Local cooperative banks are forming strategic partnerships with fintechs to expand rural outreach and introduce secure digital payments. These strategic moves underline how competitive positioning is increasingly based on digital capability, cybersecurity strength, and wealth management differentiation rather than traditional branch networks alone.

Conclusion: Resilience Through Strategic Integration of Wealth and Security

Argentina banking market stands at a pivotal juncture. Digital transformation, once considered an operational enhancement, has become the central pillar of competitiveness. By integrating wealth management solutions tailored for the affluent and mass-affluent segments with robust cybersecurity frameworks, banks are reshaping their business models for long-term resilience. Regulatory modernization and economic stabilization efforts provide a supportive backdrop, while technological innovation enables banks to overcome legacy barriers. As open finance, zero-trust security, and personalized digital services continue to evolve, Argentina’s banking ecosystem is poised to deliver sustainable value across both urban and rural segments, reinforcing trust and driving financial inclusion in an uncertain global economic landscape.