ASEAN as an Emerging Orthopedic Tourism & Diagnostic Hub: The Rising In-Vitro Diagnostic Narrative

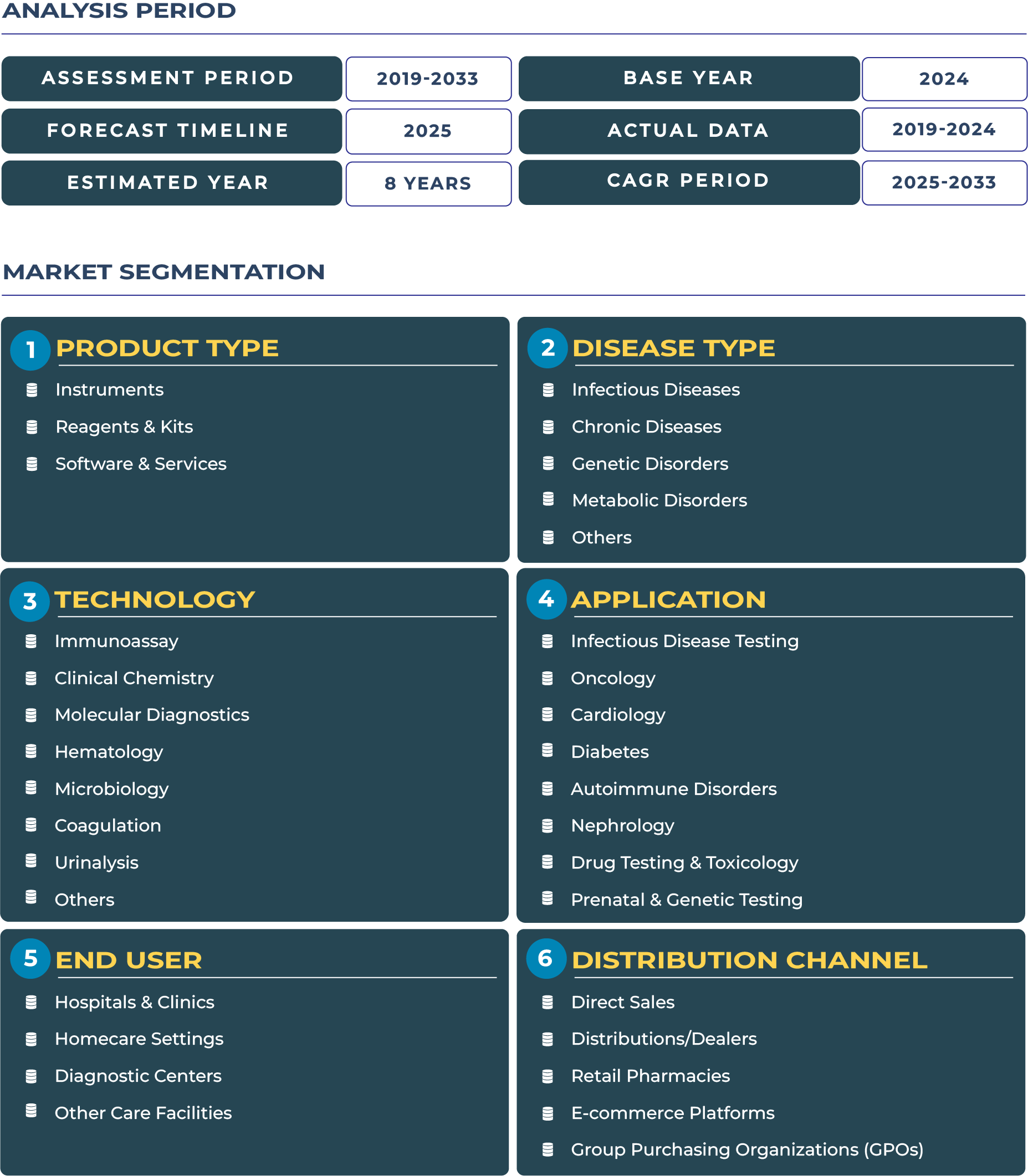

The Association of Southeast Asian Nations (ASEAN) is gaining prominence as a destination for orthopedic and elective care, blending affordability, quality medical infrastructure, and cross-border patient flows. This medical tourism momentum interlinks tightly with the region’s in-vitro diagnostic (IVD) market, because preoperative screening, postoperative monitoring, infection surveillance, and biomarker tracking become essential adjuncts to surgical care. As ASEAN positions itself not only as a surgical hub but also as a diagnostic anchor, the regional IVD ecosystem is scaling rapidly in lockstep with healthcare services. Analysts estimate that the ASEAN IVD market could grow from approximately USD 3.73 billion in 2025 to USD 9.05 billion by 2033 (CAGR ~11.7%), reflecting how medical tourism and diagnostic upgrade initiatives reinforce each other under the same health infrastructure investments.

ASEAN In-vitro Diagnostic Market Outlook: Diagnostic Modernization Driven by Tourism, Demand & System Upgrades

The ASEAN IVD market outlook is anchored in three intertwined pillars: escalating medical tourism, health infrastructure investment, and rising chronic disease burden. Countries such as Thailand, Malaysia, Singapore, and Indonesia have long marketed themselves as elective care destinations, particularly for orthopedics and joint surgeries, attracting patients from neighboring countries who demand diagnostic continuity before, during, and after care. As these regions expand surgical capacity and invest in hospital upgrades, the installed base of analyzers, molecular instruments, and clinical chemistry platforms also increases. The spillover demand for reagent kits, quality assurance instrumentation, and diagnostic software is substantial.

Furthermore, government-backed health initiatives and regional integration efforts, such as through the ASEAN Economic Community, are pushing for harmonized regulatory frameworks, pooled procurement, and health data interoperability. These policies reduce entry friction, encourage cross-border diagnostic service models, and incentivize economy-of-scale deployment of lab systems. Combined with the region’s youthful demographics transitioning toward chronic conditions, the diagnostic sector is set to transform from underpenetrated to foundational across health systems within ASEAN.

Drivers & Restraints: Youth, Private Chains, and Regulatory Frictions in Tension

Young Demographics, Expanding Private Providers & Middle-Class Growth Fuel Diagnostic Surge

A key driver in ASEAN IVD growth is its demographic dividend: a relatively large young to middle-age population elevating demand for preventive screening, sports medicine, fertility diagnostics, and chronic disease monitoring. At the same time, private hospital chains across Malaysia, Thailand, Indonesia, and the Philippines are scaling aggressively, establishing diagnostic laboratories in conjunction with surgical facilities. As middle-class incomes rise, patients increasingly prefer premium diagnostic tests (molecular, genetic, multiplex assays) that were once only available in developed markets. This rising willingness-to-pay for accuracy, combined with growth in elective orthopedic and spine procedures, amplifies demand across reagent kits, advanced instrument modules, and diagnostic software support services.

Heterogeneous Regulation, Currency & Logistics, and Underfunded Public Systems Constrain Reach

Yet, the ASEAN IVD industry faces structural headwinds. Each member country maintains distinct regulatory paths for diagnostic device registration, import tariffs, and quality compliance, making region-wide rollout complex and costly. Currency fluctuations and logistical challenges, especially for reagent cold chains across archipelagic geographies, raise operating risk. In several lower-income ASEAN states, public healthcare budgets remain limited, curbing the ability to adopt high-end diagnostics in rural or provincial settings. Thus, while adoption in urban and medical tourism hubs accelerates, full-national coverage remains constrained by affordability and regulatory friction.

Trends & Opportunities: Medical Tourism Resurgence, Regional Hubs & Affordable Lines

Trend: Medical Tourism, Private Clinic Rollouts & Decentralized Diagnostics Uptake

Large-scale private hospital groups in Bangkok, Kuala Lumpur, Jakarta, and Manila are actively expanding diagnostic network footprints to support inbound medical tourism. As patients travel for orthopedic or cardiac procedures, diagnostic services, from molecular panels to post-op biomarker monitoring, are being bundled into surgical packages. This trend reinforces the integration of lab services into hospital chains.

Opportunity: Regional Distribution Hubs, Low-cost Testing Lines & Training Ecosystems

A compelling opportunity lies in establishing regional diagnostic distribution hubs in strategic markets (e.g., Singapore, Malaysia, Thailand) to optimize reagent logistics, reduce tariff exposure, and ensure quicker support for neighboring nations. Manufacturers can introduce “value-tier” IVD lines tailored to price-sensitive markets, stripping non-essential features yet maintaining core performance. Additionally, local capacity building via training programs in provincial labs or “satellite labs” can expand service adoption. This layered approach allows diagnostic providers to capture both premium and mass-access segments within ASEAN.

Regional Snapshot: Key ASEAN Markets Diagnostics Dynamics

Thailand

Thailand is a flagship medical tourism destination. Its advanced hospitals in Bangkok and Phuket draw patients for orthopedic surgeries, driving demand for high-end diagnostics, molecular testing, and post-op biomarker panels.Malaysia

Malaysia’s private hospital network and government support for health tourism create an enabling environment for diagnostic adoption. Its location also supports distribution to Indonesia and smaller markets.Singapore

Singapore functions as both a diagnostic innovation hub and regulatory gateway. It often hosts regional launches of novel IVD instruments and reagents, benefiting from robust regulatory and infrastructure frameworks.Indonesia

Indonesia’s large population and geographic spread demand decentralized diagnostic access. Rapid expansion of lab networks and digital connectivity are boosting uptake of POC and reagent systems.Philippines

The Philippines faces access disparity across islands. Diagnostic distributors with tele-lab logistics or reagent consignment models have higher potential traction in remote regions.Vietnam

Vietnam’s public health labs are upgrading, and private diagnostic firms are expanding molecular and immunoassay offerings, particularly in Ho Chi Minh City and Hanoi.

Competitive Landscape: Cluster-Based GTM, Affordable Lines & Training Investments

Competition in ASEAN IVD market revolves around balancing global scale with local adaptation. Major players such as Roche, Abbott, Siemens Healthineers, and bioMérieux maintain leading positions, but increasingly adopt cluster-based go-to-market (GTM) strategies, grouping countries by regulatory and economic similarity to reduce complexity. Many global firms are forging local manufacturing partnerships, enabling reagent co-production and lower tariff exposure. In addition, companies invest in diagnostic pilot programs and clinical validation studies within regional orthopedic tourism hubs to demonstrate outcomes-based value. Local distributors often receive training sponsorships, equipment support, and flexible payment terms to thrive in price-sensitive markets. Collectively, these strategies allow diagnostic firms to scale across ASEAN while managing regulatory, logistical, and pricing challenges.