ASEAN Insurance Brokerage Market Outlook: Aggregator-Driven Student and Gig Worker Insurance in Mobile-First Economies

ASEAN insurance brokerage ecosystem is entering a transformative phase, where digital aggregators are redefining how students, SMEs, and gig workers access insurance. With economies such as Indonesia, Vietnam, and the Philippines leading in mobile-first adoption, brokers are leveraging aggregator-led platforms to bring affordable and flexible coverage directly to underserved populations. This embedded insurance model is particularly relevant in the gig economy, where millions of workers require micro-duration health, accident, and motor insurance. Similarly, universities and educational platforms are collaborating with brokers to design affordable group health plans for students, addressing a demographic traditionally left out of conventional insurance products.

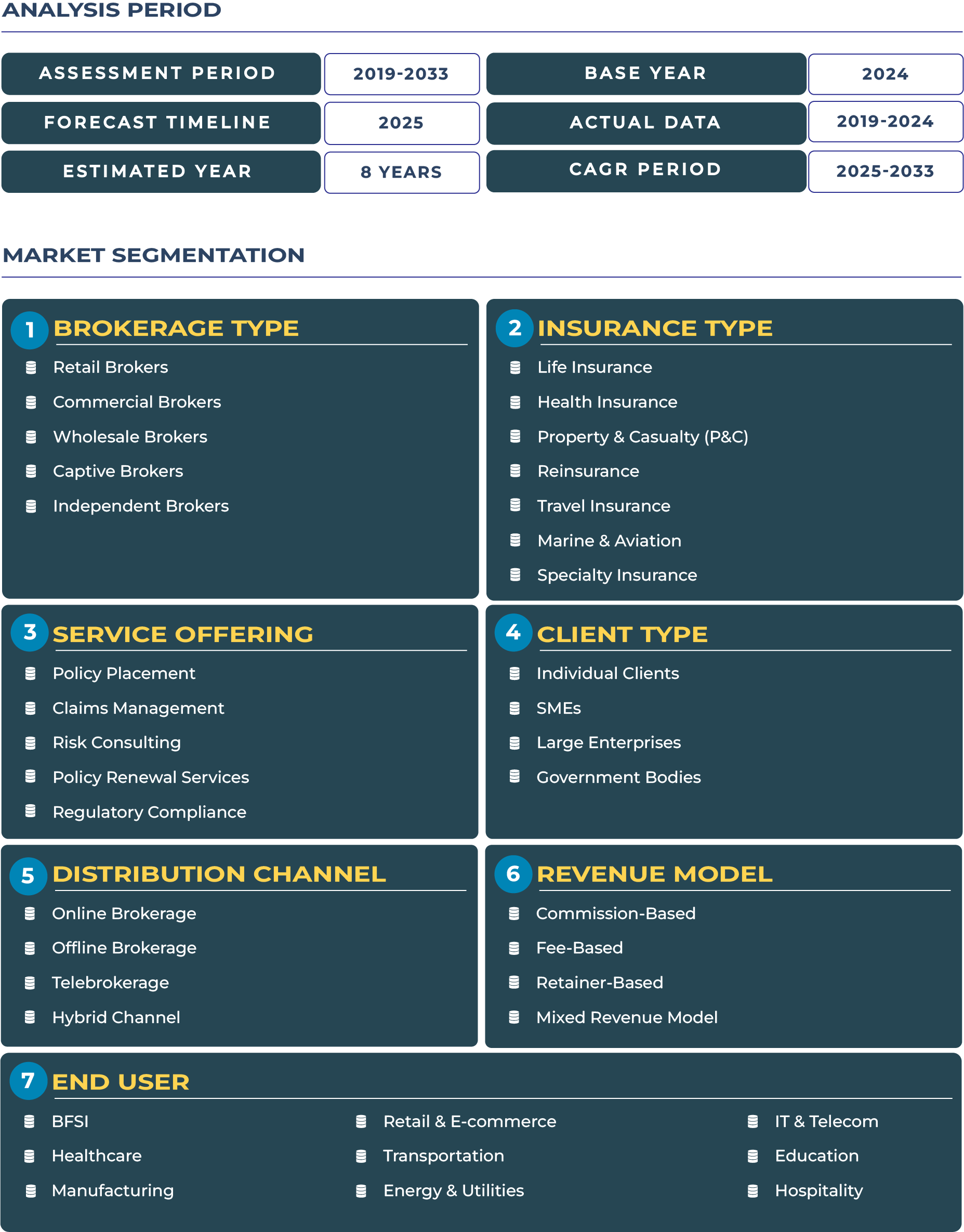

The ASEAN insurance brokerage market is estimated at USD 19.92 billion in 2025 and is projected to reach USD 41.57 billion by 2033, registering a CAGR of 9.6% between 2025 and 2033. Growth is fueled by fintech liberalization, cross-border e-commerce expansion, and regulatory support for digital brokerages. Brokers are increasingly working with online marketplaces, e-wallets, and super-apps to distribute policies via APIs, ensuring insurance is available where consumers shop, transact, or study. However, gaps in regulation, geopolitical tensions, and informal sector reliance continue to present challenges, making localized brokerage strategies critical.

Drivers and Restraints: Factors Influencing the Growth of ASEAN’s Insurance Brokerage Ecosystem

Gig Economy Coverage Needs and Digital Onboarding Growth as Core Drivers

The ASEAN region is home to over 35 million gig economy workers, many of whom lack formal insurance coverage. Brokers are stepping into this gap with short-term, pay-as-you-go policies accessible via digital platforms. For instance, in Indonesia, mobile-first brokers have launched health insurance plans tailored for ride-hailing and delivery workers, often costing less than USD 2 per week. Digital onboarding technologies, such as biometric verification and e-KYC, are further accelerating adoption. In the Philippines, fintech-driven onboarding reduced policy issuance time from days to minutes, boosting penetration in rural provinces. These advancements highlight how digital-first strategies are expanding broker-led insurance access.

Regulatory Fragmentation and Emerging Risks Hindering Market Expansion

Despite rapid digitalization, ASEAN insurance brokerage industry faces significant restraints. Regulatory fragmentation across the bloc creates barriers for brokers attempting to scale regionally. For example, a broker licensed in Singapore must navigate entirely different compliance frameworks in Malaysia or Vietnam. Moreover, emerging risks such as crypto asset protection and AI-driven underwriting present challenges in risk assessment. Brokers often lack standardized guidelines to evaluate these risks, slowing adoption of innovative products. Geopolitical uncertainties, such as South China Sea tensions, also impact cross-border corporate insurance brokerage, adding complexity to commercial and wholesale broker operations in ASEAN.

Trends and Opportunities: Shaping the Future of ASEAN Insurance Brokerage Market

Usage-Based Insurance Models and Broker-InsurTech Collaborations as Major Trends

One of the most notable trends in ASEAN’s insurance brokerage landscape is the rise of usage-based insurance models. In Thailand and Malaysia, brokers are offering motor insurance priced per kilometer, catering to urban consumers who drive less frequently. Similarly, health insurers in Vietnam are collaborating with brokers to deliver wellness-linked policies where premiums are adjusted based on fitness tracker data. Another emerging trend is the collaboration between brokers and insurtech firms. These partnerships enable independent brokers to integrate advanced analytics and AI-driven pricing tools, improving policy personalization and claims efficiency across the ASEAN insurance brokerage sector.

Group Student Insurance and Drone Coverage Emerging as Key Opportunities

ASEAN’s large student population—over 220 million students as per UNESCO (2023)—presents a lucrative opportunity for brokers to expand group insurance solutions. Universities in Malaysia and the Philippines are already piloting student health insurance schemes distributed via brokers, providing affordable coverage bundled with tuition packages. Similarly, the rise of drones for delivery, agriculture, and surveillance across Indonesia and Vietnam is creating demand for drone liability and aviation insurance. Brokers specializing in niche risks are collaborating with regulators and insurers to design frameworks for drone-based coverage, representing a new growth frontier for wholesale and independent brokers.

Regulatory Framework: Evolving Governance Shaping Insurance Brokerage Competitiveness in ASEAN

Regulatory oversight plays a critical role in shaping the insurance brokerage landscape across ASEAN. In Singapore, the Monetary Authority of Singapore (MAS) has introduced digital licensing frameworks to encourage online brokerage expansion. Similarly, in Indonesia, the Otoritas Jasa Keuangan (OJK) is pushing brokers to adopt transparent digital practices and enhance consumer protection. Thailand’s Office of Insurance Commission (OIC) is spearheading reforms to simplify online policy distribution. These regulatory developments support digital brokerage innovation but also require constant compliance upgrades, especially for brokers aiming for regional operations. Harmonization of standards under the ASEAN Economic Community could significantly reduce compliance complexity and encourage cross-border brokerage expansion.

Key Impacting Factors: Macro-Economic and Social Influences on ASEAN Insurance Brokerage Sector

ASEAN insurance brokerage industry is heavily influenced by broader macroeconomic and social factors. Informal sector employment, which accounts for more than 60% of the workforce in Cambodia, Myanmar, and parts of Vietnam, underscores the need for flexible micro-insurance products distributed through brokers. At the same time, foreign investment regulations impact the ability of international brokerage firms to expand. For example, Indonesia’s foreign ownership caps limit full-scale foreign broker participation, compelling partnerships with local players. Additionally, rising climate risks and natural disasters, such as the 2023 flooding in Thailand, are increasing demand for catastrophe coverage, spurring wholesale broker activity across the region.

Regional Analysis by Country

- Indonesia insurance brokerage market is expanding rapidly due to mobile-first solutions targeting gig workers and SMEs. Regulatory reforms by OJK are fostering digital adoption, though foreign ownership restrictions remain a limiting factor.

- In the Philippines, insurance brokers are focusing on micro-insurance products for farmers and informal workers. Fintech partnerships are helping extend insurance to rural populations with simplified mobile onboarding processes.

- Thailand insurance brokerage ecosystem is modernizing with usage-based models, particularly in motor and health insurance. Regulatory support from the OIC is accelerating the shift toward online policy distribution.

- Vietnam is witnessing strong growth in embedded insurance, especially in consumer electronics. Independent brokers are increasingly partnering with e-commerce platforms to distribute device protection policies nationwide.

- Malaysia insurance brokerage sector is evolving through aggregator partnerships, with companies collaborating with e-wallets and marketplaces to distribute affordable student and gig worker insurance products.

- Singapore remains the regional hub for insurance brokerage headquarters, supported by MAS’s liberalized licensing framework. The market emphasizes high-value corporate and reinsurance brokerage services for multinational firms.

Competitive Landscape: Aggregator Partnerships Reshaping ASEAN Insurance Brokerage Strategies

The competitive landscape of ASEAN’s insurance brokerage sector is increasingly shaped by digital partnerships and aggregator-driven models. In January 2024, Tune Protect partnered with Shopee in Malaysia and Vietnam to enable insurance brokerage distribution via aggregator APIs, demonstrating how e-commerce platforms are becoming vital brokerage channels. In Singapore, international brokers are leveraging MAS reforms to expand digital-first operations, while in Indonesia, local brokers are collaborating with ride-hailing apps to launch gig worker accident insurance. Captive brokers in Thailand are embedding policies into retail platforms, ensuring consumers access coverage at the point of sale. These strategies highlight how brokers are balancing aggregator partnerships, digital compliance, and localized product development to remain competitive across the diverse ASEAN insurance brokerage market.

Conclusion: Building Aggregator-Led Inclusive Brokerage Models for ASEAN’s Diverse Demographics

The ASEAN insurance brokerage market is on a growth trajectory, expected to more than double in value by 2033. Yet, the sector’s long-term sustainability lies not merely in digital adoption but in inclusivity. Aggregator partnerships are proving essential in extending coverage to students, SMEs, and gig economy workers, while niche opportunities such as drone coverage are emerging in fast-growing economies. Brokers that embrace hybrid models—leveraging both mobile-first digital ecosystems and localized advisory services—will gain a competitive edge. Harmonization of regulatory standards under the ASEAN Economic Community could further strengthen cross-border brokerage potential, enabling multinational players to scale seamlessly while empowering local brokers with global partnerships. Ultimately, the ASEAN insurance brokerage landscape will be defined by its agility to adapt to digital-first demand, regulatory diversity, and socio-economic complexities, ensuring that insurance access becomes universal across the region’s diverse markets.