Asia Pacific’s Diagnostic Imaging Devices Wave: Digital Transformation and Imaging Accessibility in Focus

The Asia Pacific diagnostic imaging devices market is gaining momentum, driven by a dual force: the embrace of digital health platforms and the push for wider imaging accessibility across both mature and emerging economies. With the market estimated at approximately USD 11.1 billion in 2025 and forecast to reach about USD 17.4 billion by 2033, implying a CAGR of roughly 5.8%, the region is rapidly evolving in its diagnostic imaging devices ecosystem. Key national healthcare systems are upgrading X-ray and ultrasound fleets, expanding tier-2 and tier-3 city access to CT and MRI, and integrating remote imaging workflows via cloud and networked platforms. The scale of the challenge is significant: diverse healthcare infrastructure, large populations, and varying reimbursement models mean that imaging device manufacturers and service providers must customise their approach to India, China, Southeast Asia and other growing markets.

In this environment, the diagnostic imaging devices industry in Asia Pacific is transforming from simple equipment sales to end-to-end solutions, combining modality hardware with imaging IT, servicing, training and adoption of remote workflows. For example, numerous hospitals in India and China are deploying mobile ultrasound and portable CT scanners to reach underserved locations. At the same time, governments are promoting medical-device manufacturing, distribution networks and skill development to support growth in diagnostic imaging. The result is that the diagnostic imaging devices sector in Asia Pacific is not only expanding in volume, but increasingly shifting in value, emphasising connectivity, scalability and cost-effectiveness for high-volume markets.

Asia Pacific Diagnostic Imaging Devices Market Outlook: A Deep Dive into the Asia Pacific Diagnostic Imaging Devices Sector’s Forward Path

The outlook for the Asia Pacific diagnostic imaging devices sector reflects strong growth potential underpinned by demographic, economic and technology-driven tailwinds. The growth drivers include large-scale public-health infrastructure investment, particularly in nations such as China and India, private hospital and diagnostic-centre expansion in urban and semi-urban areas, and rising demand for digital and remote imaging solutions that support value-based care.

However, this growth path is not without complexity. The Asia Pacific diagnostic imaging devices ecosystem must contend with heterogeneity in regulatory frameworks, fragmented payer and reimbursement systems, and wide disparities in healthcare access between urban and rural settings. Political and geopolitical dynamics, impacts of pandemics, supply-chain disruptions and trade restrictions also remain relevant risk factors. For device manufacturers and service providers operating in this region, success will require a nuanced strategy: localised product and service models, regional manufacturing or assembly, flexible financing or leasing models, and partnerships with digital-health and cloud-platform providers. The market is evolving, and those able to tailor their offering will capture meaningful growth in the diagnostic imaging devices sector through 2033 and beyond.

Drivers & Restraints: Key Forces Shaping the Asia Pacific Diagnostic Imaging Devices Market’s Growth Trajectory

Driving factors: large-scale public health infrastructure investments and private hospital expansion

Significant public-health infrastructure investment across Asia Pacific is fueling growth in diagnostic imaging devices. Governments are allocating capital to replace ageing radiology equipment, expand diagnostic capacity in regional hospitals, and support imaging-center networks. At the same time, rapid urbanisation and private hospital development in tier-1 and tier-2 cities are creating strong demand for advanced imaging modalities, from higher-slice CT systems to mid-field MRI and portable ultrasound units. These twin forces are major drivers of expansion in the diagnostic imaging devices ecosystem within Asia Pacific.

Restraining factors: wide disparity in healthcare access and regulatory heterogeneity complicating roll-outs

On the other hand, the market is constrained by structural challenges. Healthcare access in Asia Pacific remains uneven: urban centres may benefit from advanced imaging, while rural regions often lack basic diagnostic services. Payer frameworks and reimbursement models vary significantly from country to country, complicating procurement and scaling of imaging devices. Regulatory heterogeneity further slows deployment, different national medical device authorities have varying certification, import and approval rules, and many markets are still streamlining oversight for digital imaging systems. These factors moderate the pace of adoption in the diagnostic imaging devices market in the region.

Trends & Opportunities: Emerging Currents and Strategic Openings in the Asia Pacific Diagnostic Imaging Devices Landscape

Trend: accelerated adoption of point-of-care ultrasound and portable X-ray, and localisation of manufacturing

A prominent trend in Asia Pacific is the broad adoption of point-of-care ultrasound and portable digital X-ray systems, especially in outpatient clinics, mobile diagnostic units and rural hospitals. At the same time, OEMs are localising manufacturing or assembly in regional hubs to reduce cost, shorten lead-times and adapt to local price sensitivity. These shifts reflect a transition in the diagnostic imaging devices ecosystem from top-tier, high-cost models toward scalable, affordable imaging platforms customised for local demand.

Opportunity: scale low-cost, high-volume portable imaging production and offer tiered product families with local service partnerships

For manufacturers and service providers, Asia Pacific offers strategic opportunities. One such opportunity lies in launching tiered imaging-device families, from basic to premium, tailored to different market segments and supported by local service and parts-networks. Another is to develop low-cost, high-volume portable imaging manufacturing in regional hubs, combining local supply-chain advantages with remote servicing models and digital-health connectivity. By aligning strategy to local manufacturing, service ecosystems and volume pricing, players can capture growth in the diagnostic imaging devices sector in Asia Pacific at scale.

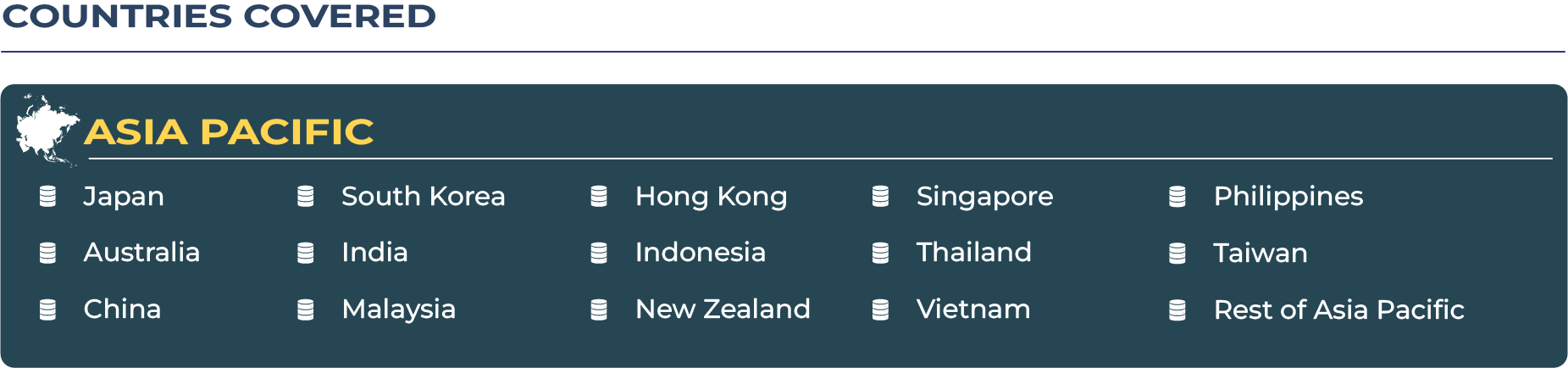

Regional Analysis by Country

India

India represents one of the fastest-growing markets for diagnostic imaging devices in Asia Pacific. Government initiatives promoting “Make in India”, large hospital construction drives, and rising demand for diagnostic centres in metro and Tier-2/3 cities are driving demand for CT, MRI and ultrasound systems. Private imaging chains are expanding rapidly, supporting growth in the diagnostic imaging devices ecosystem.

China

China remains the largest single market in Asia Pacific for diagnostic imaging devices, thanks to high hospital renewal cycles, heavy investment in tertiary-care campuses, and rising demand for advanced imaging workflows and remote reporting systems. Domestic OEMs are increasingly competitive, and digital-health initiatives further amplify device uptake.

Japan

Japan’s mature healthcare infrastructure and high technology adoption place it as a leader in advanced imaging devices. Growth in Japan diagnostic imaging devices market is supported by replacement cycles, ageing-population needs and demand for premium systems. Service quality, device connectivity and digital imaging workflows are important differentiators.

South Korea

South Korea diagnostic imaging devices market is driven by high technology penetration, demand for next-generation modalities and export-oriented manufacturing. The private sector is active in deploying imaging-device systems and integrating digital radiology workflows across hospital networks.

Australia

Australia has a well-established healthcare system with high per-capita imaging capacity. The market growth for diagnostic imaging devices focuses on replacement of older fleets, integration with digital health systems and remote diagnostic access. Service contracts and upgrade programmes are central to vendor strategy.

New Zealand

New Zealand, though smaller in scale, benefits from government investment in regional imaging networks and mobile diagnostic units covering remote areas. Vendors supporting remote servicing and mobile deployments are well-positioned in the diagnostic imaging devices market here.

Malaysia

Malaysia diagnostic imaging devices market is marked by private hospital expansions in Kuala Lumpur and Penang, investment in diagnostic centres and efforts to reduce import dependency through regional manufacturing. Mobile ultrasound and compact CT systems are gaining adoption.

Hong Kong

Hong Kong diagnostic imaging devices market is sophisticated and technology-advanced, with demand focused on high-end MRI, PET/CT systems and digital-imaging workflows. Vendors emphasise service excellence, integration and premium differentiation in this diagnostics equipment ecosystem.

Indonesia

Indonesia presents strong growth potential for the diagnostic imaging devices market due to government healthcare expansions, medical-tourism ambitions and outpatient diagnostic network growth. Demand for portable X-ray, ultrasound and modular CT is high in emerging cities and remote islands.

Singapore

Singapore acts as a regional hub for diagnostics and imaging-device innovation in Asia Pacific. With advanced healthcare infrastructure and high standards, the market emphasises next-generation imaging systems, digital radiology platforms and regional service-support models for neighbouring countries.

Thailand

Thailand diagnostics imaging devices market landscape is driven by both public and private hospital upgrades, regional catering for ASEAN markets and medical-tourism. Deployments of mid-tier MRI and CT systems and outpatient imaging services present growth opportunities in the diagnostic imaging devices sector.

Vietnam

Vietnam is witnessing a ramp-up of imaging devices in both public hospitals and private diagnostic centres. Foreign and domestic OEMs are engaging in local partnerships to deliver imaging-device systems and servicing for growing diagnostic volumes in tier-2 cities and provincial hospitals.

Philippines

The Philippines is expanding imaging infrastructure across island provinces and metropolitan centres. Demand is strong for compact CT and ultrasound systems, and remote servicing or leasing models are gaining traction in the diagnostic imaging devices ecosystem.

Taiwan

Taiwan diagnostic imaging devices market is supported by advanced imaging-technology adoption, high per-capita healthcare spending and export-oriented manufacturing. Vendors that deliver premium performance, connectivity and servicing gain competitive advantage in this rich but competitive ecosystem.

Competitive Landscape: Strategic Moves Defining Asia Pacific Diagnostic Imaging Devices Market

The competitive landscape in the Asia Pacific diagnostic imaging devices market is characterised by global OEMs localising production, partnering with regional service networks and offering tiered product portfolios. For example, Samsung Medison Official Website announced next-generation mobile CT systems for India (Aug 2025) aimed at improving accessibility in underserved regions, signalling targeted product adaptation for Asia Pacific markets. Device manufacturers are increasingly shifting focus from premium high-end systems to modular, price-sensitive platforms suitable for high-volume deployment. In parallel, regional service-and-maintenance networks are becoming a distinguishing factor: vendors providing remote servicing, training, leasing models and digital-imaging IT support are gaining traction. Overall, success in the Asia Pacific diagnostic imaging devices ecosystem will favour those organisations that combine device hardware, cloud connectivity, local manufacturing or assembly and flexible service models tailored for the region’s unique healthcare-delivery context.

In conclusion, the Asia Pacific diagnostic imaging devices sector stands at a pivotal juncture, rising diagnostics demand, digital-health transformation and manufacturing localisation converge to create substantial opportunity. Vendors and service providers aligned to these imperatives and adapting to the region’s diverse markets stand to capture significant value in the evolving diagnostic imaging devices landscape.