Asia Pacific Fintech Market Outlook: Low-Cost Cross-Border Rails Driving Asia Pacific Fintech Growth

The Asia Pacific region has evolved into a distribution-first fintech market, where marketplaces and super-app ecosystems have become primary gateways for delivering financial services. Unlike mature Western economies where banks dominate digital transformation, Asia Pacific is shaped by platforms like Grab, Gojek, Alipay, and Paytm that integrate finance into everyday services such as ride-hailing, food delivery, and e-commerce. This “distribution before product” model allows financial products—from microloans to multi-currency wallets—to scale faster and reach underserved populations across diverse markets.

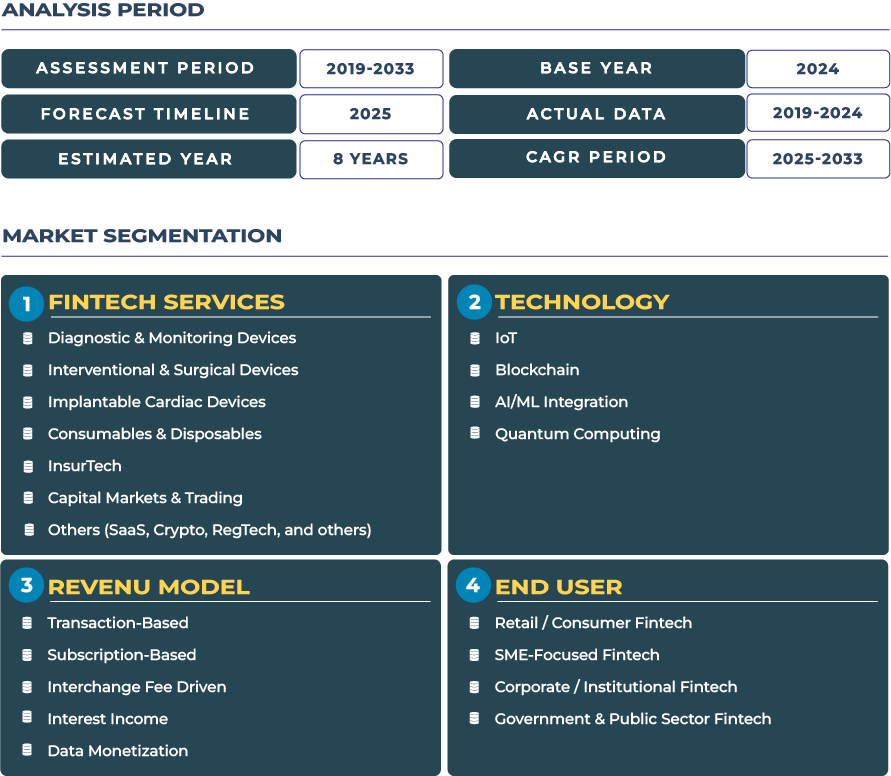

According to DataCube Research, the Asia Pacific fintech market is projected to grow from USD 98.3 billion in 2025 to USD 338.8 billion by 2033, reflecting a robust CAGR of 16.7% between 2025 and 2033. This momentum is underpinned by super-app dominance, cross-border payment innovation, and the massive digital consumer base across emerging and advanced economies in the region. Localized multi-currency payment rails and embedded finance in marketplaces are significantly lowering distribution costs, further accelerating adoption.

Why Asia Pacific Is Poised for Global Fintech Leadership

Asia Pacific fintech sector is entering a new phase of regional leadership, defined by scale, innovation, and distribution efficiency. With a population exceeding 4.5 billion, mobile-first digital adoption rates remain unmatched globally. In countries such as India, Indonesia, and Vietnam, mobile penetration is creating leapfrog opportunities, enabling fintech firms to bypass traditional banking infrastructure and directly embed solutions within super-app ecosystems.

The projected market size growth—from USD 98.3 billion in 2025 to USD 338.8 billion in 2033—is not just a function of demographics but also of technology and regulation. The rise of multi-currency wallets, localized credit scoring, and low-cost cross-border remittance services are aligning with the surge in cross-border e-commerce. Governments across the region are simultaneously pushing for digital inclusion, with initiatives such as India’s Unified Payments Interface (UPI) and Singapore’s Smart Nation framework driving large-scale adoption. These forces collectively position Asia Pacific not only as a high-growth market but as a model for global fintech distribution strategies.

Drivers & Restraints: Accelerators and Roadblocks in Asia Pacific Fintech Expansion

Unprecedented Smartphone Penetration and Digital Payments Adoption Driving Market Growth

The single most important driver for Asia Pacific fintech industry is its massive digital consumer base. Markets like India, with over 800 million smartphone users, and China, with near-universal mobile penetration, create fertile ground for app-based financial services. The rapid shift from cash to mobile-based payments has been exemplified by the success of UPI in India and Alipay/WeChat Pay in China. Additionally, financial literacy programs and SME digitization initiatives are further fueling the ecosystem.

Regulatory Fragmentation and Uneven Financial Inclusion as Market Restraints

While the opportunity is immense, the region’s regulatory heterogeneity presents challenges. Each country has its own licensing frameworks, data privacy laws, and cross-border compliance requirements. For example, while Singapore provides a progressive environment for digital banks, countries like Vietnam and the Philippines still face legacy banking resistance. Moreover, financial inclusion remains uneven, with rural populations in Southeast Asia still outside the formal financial system. This creates a two-speed fintech ecosystem where mature economies like Australia and Japan adopt sophisticated wealthtech solutions, while emerging economies still grapple with digital onboarding and access issues.

Trends & Opportunities: Emerging Themes That Will Define Asia Pacific Fintech

Super-Apps Redefining Payments, Insurance, and Lending in Everyday Life

One of the most notable trends in Asia Pacific is the consolidation of services into super-app ecosystems. Companies like Grab, GoTo, and Kakao have bundled payments, lending, wealthtech, and even insurtech services within consumer apps. This trend is not limited to Southeast Asia—Japanese players are integrating insurance with e-commerce, while Indian firms are combining micro-credit with mobile wallets. The convergence of services under a single user interface reduces friction and amplifies adoption rates.

Cross-Border E-Commerce and Remittance Market Opportunities

Another major opportunity is the rapid growth of cross-border e-commerce and remittance flows. Platforms integrating multi-currency wallets and localized rails are reducing transaction costs, directly benefiting SMEs and migrant workers. In markets like the Philippines and Indonesia, payroll-linked remittance solutions are growing, while Singapore and Hong Kong are strengthening their roles as financial hubs offering cross-border liquidity. This creates a flywheel effect where trade, e-commerce, and fintech adoption reinforce each other across the region.

Government Regulation: Harmonization and Innovation Driving Market Confidence

Regulation plays a pivotal role in shaping the Asia Pacific fintech landscape. Initiatives such as the ASEAN Digital Integration Framework are designed to harmonize cross-border regulations and build trust in digital payments. Governments across the region are proactively supporting innovation while also strengthening consumer protection. For example, the Monetary Authority of Singapore (MAS) has introduced a digital banking license framework to encourage innovation while ensuring financial stability. Similarly, Australia Australian Securities and Investments Commission supports sandbox environments that allow fintech companies to test new models under supervision.

Key Impacting Factors: Macro and Micro Dynamics Reshaping the Market

Several structural factors are reshaping Asia Pacific fintech trajectory. Rising mobile payment transaction values—expected to exceed USD 5 trillion across the region by 2027—are pushing fintech players to innovate faster. The surge in monthly active users (MAUs) of fintech apps demonstrates consumer stickiness, with super-apps in Indonesia and India showing double-digit MAU growth in 2024. Meanwhile, the geopolitical environment, particularly U.S.-China tensions and regional trade realignments, is influencing capital flows and technology partnerships in the fintech ecosystem. These external pressures will define both risks and opportunities in the coming decade.

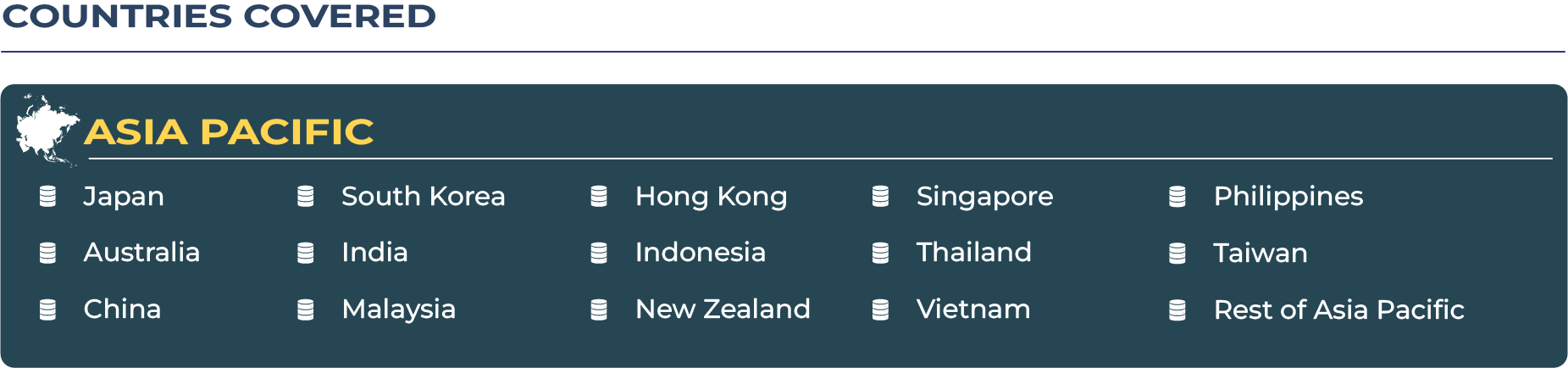

Regional Analysis by Country

- India: Mobile-first economy with UPI leading digital payments; rapid rise in lending tech and insurtech adoption by SMEs.

- China: Dominated by Alipay and WeChat Pay; expanding into wealthtech and cross-border e-commerce fintech rails.

- Japan: Sophisticated insurtech and wealthtech ecosystem; regulatory clarity supports institutional fintech growth.

- South Korea: Strong neobank adoption (KakaoBank, K-Bank); focus on embedded finance in super-app ecosystems.

- Australia: Mature fintech landscape; open banking and wealthtech adoption lead the ecosystem.

- New Zealand: Smaller but growing fintech hub; focus on sustainable finance and SME platforms.

- Malaysia: Government-driven digital banking licenses; key role in Southeast Asia’s fintech expansion.

- Hong Kong: Cross-border finance hub; emphasis on multi-currency wallets and capital markets fintech.

- Indonesia: Mobile-first adoption; leading in BNPL and SME-focused payments within super-app models.

- Singapore: Regulatory hub with MAS digital banking framework; fintech testbed for Asia Pacific expansion.

- Thailand: Growing SME adoption; BNPL models expanding into retail and e-commerce ecosystems.

- Vietnam: High growth potential; alternative credit scoring and microfinance platforms driving inclusion.

- Philippines: Remittance-driven fintech growth; mobile wallets integrating with insurtech services.

- Taiwan: Focus on institutional fintech; strong adoption of wealthtech and regulatory-driven innovation.

Competitive Landscape: Super-App Consolidation and Product Localization Defining Strategy

The competitive landscape of Asia Pacific fintech is marked by rapid consolidation and product localization. In May 2025, reports surfaced of Grab potential acquisition of Indonesia GoTo, signaling a wave of super-app consolidation in Southeast Asia. This highlights the strategic focus on distribution dominance through super-app ecosystems. Product innovation is equally critical—firms are increasingly launching localized cross-border e-commerce payment rails and multi-currency wallets to support SMEs engaged in international trade. Companies like Paytm, Grab, Kakao, and Ant Group are leading this evolution by embedding financial services within broader consumer ecosystems.

Conclusion: Asia Pacific Fintech as the Blueprint for Global Distribution-First Innovation

The Asia Pacific fintech market is redefining how scale and innovation converge. Unlike traditional banking-led ecosystems, Asia Pacific is demonstrating the power of distribution-first models built on super-apps and marketplaces. This approach has proven to reduce customer acquisition costs, accelerate adoption, and expand financial inclusion across diverse economies. The integration of cross-border rails, multi-currency wallets, and embedded insurance or lending solutions underscores the transformative potential of fintech in the region.

Over the next decade, the region will not only dominate in size but also shape the strategic blueprints for fintech globally. By combining government-backed digital frameworks, high consumer engagement through super-apps, and strong cross-border connectivity, Asia Pacific has positioned itself as both a growth leader and an innovation laboratory. The interplay of regulation, technology, and consumer behavior ensures that the Asia Pacific fintech sector is not just following global trends—it is creating them.