Trust-Centric Banking Transformation: Australia’s Path to Resilient Growth

Australia’s banking industry in 2024 is framed around a trust-centric transformation that aligns with evolving customer expectations and market challenges. Building confidence through robust digital onboarding processes is no longer optional; it has become the foundation for sustainable banking relationships in a volatile macroeconomic environment. Banks are focusing on seamless digital KYC, transparent lending practices, and ESG-linked financial products to retain and expand their customer base. These measures are particularly vital in an era marked by geopolitical uncertainties, fluctuating FX markets, and inflationary pressures. The banking sector is positioning itself as a stabilizing force, offering reliable access to credit for SMEs while guiding individuals toward sustainable investment practices.

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

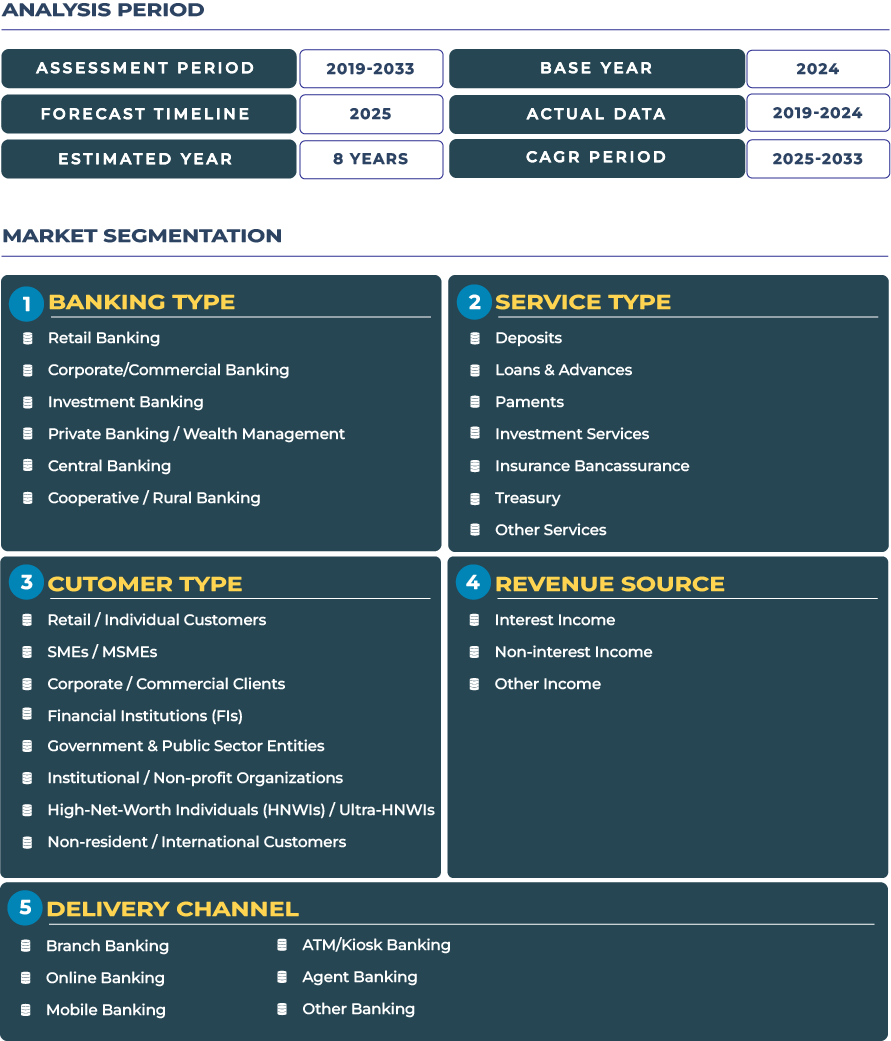

The Australia Banking Market is valued at USD 156.7 billion in 2025 and is projected to reach USD 211.0 billion by 2033, expanding at a CAGR of 3.8% from 2025–2033. This growth trajectory is supported by a dual emphasis on inclusivity and innovation: inclusivity through enhanced SME lending frameworks that cushion businesses against global disruptions, and innovation through integration of ESG-linked financing, conversational banking, and wealth management solutions tailored for high-net-worth individuals. This dual focus enables the sector to balance resilience with modernization, ensuring long-term market stability.

Drivers & Restraints: Navigating Growth Catalysts and Market Barriers in Australia’s Banking Sector

SME Lending and Cross-Border Infrastructure Driving Market Growth

SME lending remains one of the most significant growth levers in Australia’s banking ecosystem. Small and medium enterprises account for nearly 98% of businesses in the country, and their financial health directly influences broader economic resilience. Banks have introduced tailored products, faster approval cycles, and collateral-light lending schemes to support SMEs’ working capital needs. This shift is particularly important amid global supply chain realignments, as SMEs seek financing for export diversification and digital transformation. Additionally, the expansion of cross-border payments infrastructure is positioning Australian banks as vital intermediaries in regional trade. Real-time payments integration across Asia-Pacific corridors is enabling faster and cheaper transactions, strengthening Australia’s role in global commerce and enhancing competitiveness in financial services.

Macroeconomic Volatility and FX Risks Restricting Market Expansion

Despite positive momentum, the market faces notable restraints. Persistent risks from global recessionary trends and inflationary pressures challenge banks’ profitability and capital adequacy. Currency fluctuations, particularly against the USD and Asian trade currencies, introduce earnings volatility in both investment banking and corporate financing segments. The Australian dollar’s sensitivity to commodity prices adds another layer of uncertainty, directly impacting corporate banking portfolios exposed to the mining and energy sectors. Furthermore, tightening global liquidity and elevated interest rates could dampen credit demand in retail and corporate banking, curtailing short-term growth prospects. The sector is responding with hedging strategies and diversification in product offerings, yet macroeconomic volatility remains a constraining factor.

Emerging Trends & Opportunities: Shaping the Future of Australia’s Banking Landscape

Conversational Banking and ESG Innovation Reshaping Customer Engagement

Conversational banking, powered by intelligent chat platforms and voice-enabled interfaces, is redefining customer interaction in retail banking. Major institutions are integrating natural language-based platforms to deliver personalized financial advice, automate routine inquiries, and enhance service accessibility across rural regions. Simultaneously, ESG-linked product innovation is gaining momentum. Banks are increasingly tying loan terms to sustainability outcomes, such as carbon reduction commitments, aligning with corporate Australia’s transition to greener operations. This trend is particularly relevant for investment and wealth management segments, where ESG portfolios are attracting strong inflows from institutional investors and high-net-worth clients seeking long-term value.

Opportunities in AI-Driven Advisory and Super-App Ecosystems

The next frontier for the Australian banking sector lies in AI-driven sustainable investment advisory services. Personalized wealth management tools leveraging advanced analytics are helping clients align their portfolios with ESG priorities while optimizing returns. Another opportunity emerges from insurance-finance bundled offerings integrated into super-app ecosystems. Banks collaborating with insurers and fintechs are creating unified platforms that combine payments, wealth management, insurance, and lending, enhancing customer stickiness and cross-selling potential. As super-app models expand across Asia-Pacific, Australian banks are uniquely positioned to tap into regional digital ecosystems, leveraging cross-border synergies to expand market reach.

Regulatory Framework and Policy Shifts: Steering the Banking Market Towards Resilience

The regulatory landscape in Australia is evolving in response to rapid digitalization and market risks. The Australian Prudential Regulation Authority (APRA) continues to emphasize risk management, cybersecurity, and prudential oversight to safeguard financial stability. Meanwhile, the Australian Treasury is actively reviewing policies to enhance SME access to finance, expand digital identity frameworks, and ensure compliance with global anti-money laundering standards. The central banking authority, the Reserve Bank of Australia (RBA), has also prioritized payment infrastructure modernization through initiatives such as the New Payments Platform (NPP), which enhances real-time settlement efficiency. Collectively, these measures are strengthening consumer trust and shaping an ecosystem where innovation aligns with stability.

Key Impacting Factors: Workforce Dynamics, Penetration Rates, and Risk Appetite

Beyond traditional drivers, several structural factors are influencing the trajectory of the Australian banking sector. Banking penetration rates remain high in urban centers such as Sydney and Melbourne but show potential for deeper financial inclusion in rural areas, where cooperative and rural banking institutions play a crucial role. Workforce dynamics are also evolving, with risk appetite in banking talent shifting toward digital-first roles and sustainable finance expertise. A growing demand for professionals skilled in ESG advisory, cybersecurity, and data-driven risk management reflects the sector’s transition. Additionally, consumer expectations for transparency and ethics are reshaping product design and service delivery. Together, these factors highlight the interconnectedness of workforce evolution, market penetration, and innovation in shaping performance.

Competitive Landscape: Strategic Shifts Among Australia’s Leading Banks

Competition in the Australian banking market is intensifying as both domestic majors and international players innovate to secure market share. The Big Four banks—Commonwealth Bank of Australia, Westpac, ANZ, and NAB—are advancing digital onboarding solutions and expanding ESG-linked financing portfolios. For example, in July 2025, Commonwealth Bank announced enhancements to its digital KYC platform to reduce customer onboarding time by 40%, reinforcing its commitment to customer trust. Similarly, NAB expanded its SME lending facility in 2025, targeting renewable energy and agribusiness sectors. Regional and cooperative banks are carving out niches through hyper-localized lending and customer engagement strategies, particularly in rural and agricultural communities. International institutions operating in Australia are focusing on investment banking and wealth management opportunities, leveraging Australia’s strong capital markets and growing demand for ESG products. Together, these competitive strategies underscore a broader industry pivot toward trust-centric and innovation-led growth.

Conclusion: Building a Future-Ready, Trust-First Australian Banking Industry

Australia’s banking sector is navigating a transformative journey where trust, innovation, and resilience converge as guiding principles. The focus on seamless digital onboarding reflects a structural shift toward customer-first engagement, while ESG-linked finance demonstrates the industry’s alignment with long-term sustainability imperatives. SME lending expansion highlights the sector’s commitment to supporting national economic resilience, particularly in volatile global environments. At the same time, the adoption of conversational banking and super-app ecosystems illustrates how institutions are future-proofing their operating models.

However, challenges such as macroeconomic volatility, FX risks, and inflationary pressures remain persistent. Addressing these will require strategic alignment between regulators, banks, and technology providers. The competitive landscape shows a clear momentum toward digital-first solutions, sustainable investment advisory, and rural financial inclusion—each reinforcing the trust-centric foundation of the market. Looking ahead, Australia’s banking sector is poised to strengthen its role as a regional financial hub, balancing resilience with innovation to deliver sustainable growth and enduring customer trust.