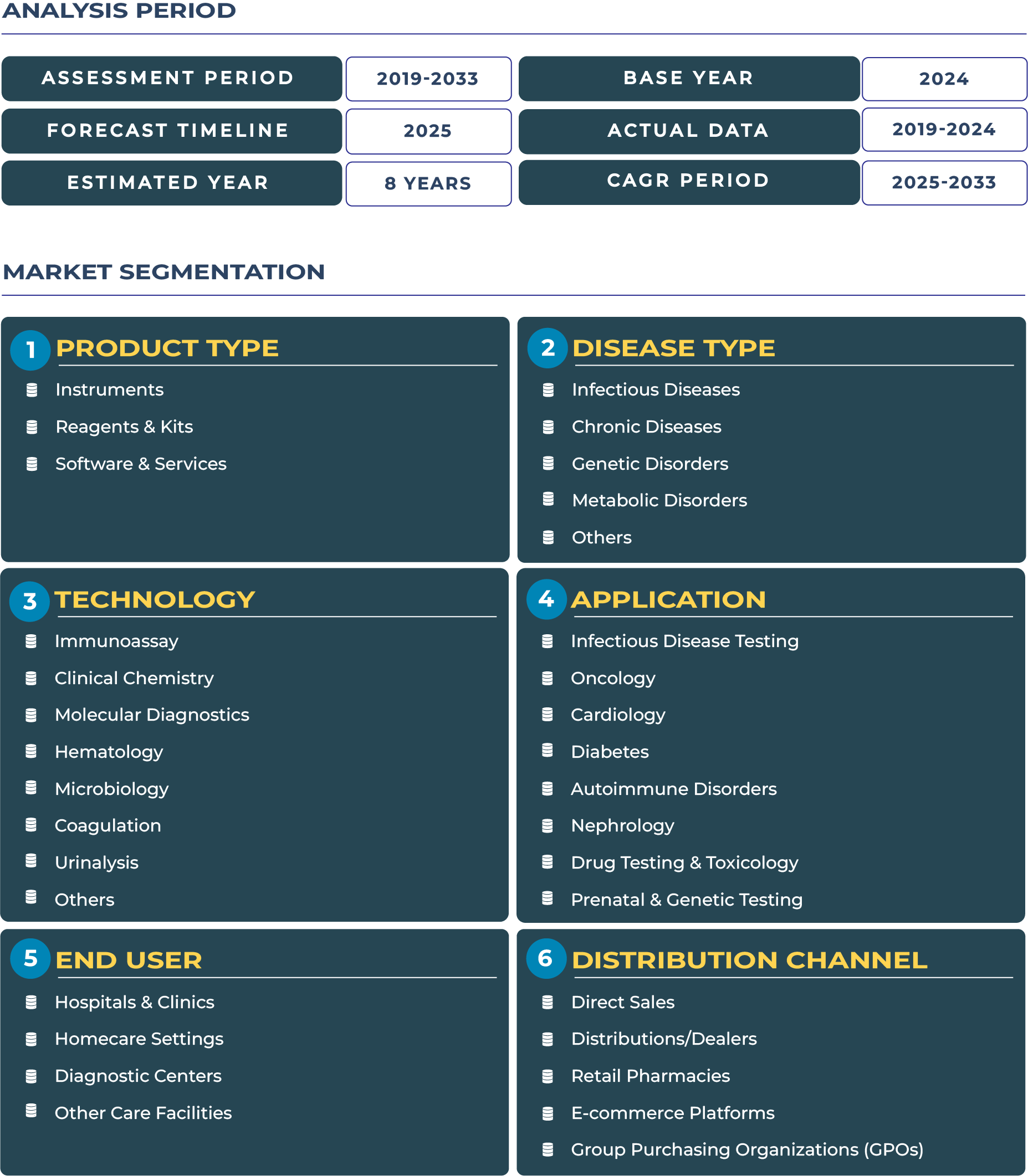

Brazil In-Vitro Diagnostic Market Outlook: Powerhouse of Latin America’s Diagnostic Expansion

Brazil commands the largest share of the Latin American orthopedic and diagnostic ecosystem, its scale, institutional complexity, and healthcare demand make it the region’s de facto laboratory and diagnostic anchor. As Brazil continues to modernize hospitals, expand private care networks, and drive diagnostic innovation, its in-vitro diagnostic (IVD) market is evolving into a critical growth frontier. For companies seeking long-term engagement in Latin America, Brazil often serves as both the pilot market and regional hub.

In Brazil, the In-Vitro Diagnostic Market is projected to expand modestly from approximately USD 1.83 billion in 2025 to USD 2.43 billion by 2033. While this growth is not meteoric, it reflects the country’s structural realities: a large public system, regional inequalities, and import dependencies. Nonetheless, Brazil remains the benchmark for IVD penetration in Latin America, drawing investment, regulatory reforms, and diagnostic scale strategies. The country’s combination of public (SUS) and private sectors, its status as a regional hub, and its sheer volume of hospital infrastructure position it at the center of Latin America’s diagnostic expansion.

Brazil’s healthcare system, anchored by the Sistema Único de Saúde (SUS), is constitutionally designed to reach virtually the entire population through a network of municipal, state, and federal facilities. SUS functions as a massive buyer and adjudicator of diagnostic services, defining which IVD assays can be reimbursed. Meanwhile, approximately 23% of the population opts for parallel private health insurance coverage, fueling demand for premium diagnostic services and advanced reagents. This duality creates a layered market dynamic where IVD companies must navigate both public tender systems and private payers to succeed.

Drivers & Restraints: Brazil’s Diagnostic Trajectory Under Mw and Headwinds

Driving Forces: Market Scale, Private Hospital Networks & Middle-Class Growth

Brazil’s sheer population and urban concentration create an intrinsic advantage for diagnostic scale. Its mature private hospital networks, particularly in São Paulo, Rio de Janeiro, and the Southeast, are among the most advanced in Latin America and continually seek automation, high-throughput systems, and precision diagnostics. The rising middle class is increasingly demanding earlier screenings, biomarker tests, and specialty assays. In parallel, regional reference laboratories are consolidating smaller diagnostics labs to optimize reagent sourcing, logistics, and centralized quality control. These forces support steady demand growth for IVD instruments, reagent kits, and diagnostic software solutions.

Restraints: Economic Volatility, Import Tariffs & Regional Access Challenges

Yet this growth is constrained by structural challenges. Brazil experiences currency volatility and inflation, which raises the cost of imported instruments and reagents, making local pricing more precarious. High import duties and complex tax structures further erode margins unless local manufacturing or tariff mitigation strategies are deployed. Additionally, regional inequity in healthcare infrastructure, vast rural areas in the North and Northeast, limits access to advanced diagnostics outside metropolitan centers. Finally, public procurement cycles through SUS are lengthy and bureaucratic, requiring IVD firms to navigate complex registration, price negotiation, and inclusion in public tenders.

Trends & Opportunities: Paths to Deepening Diagnostic Penetration

Trend: Growth of Local OEMs and Consolidation of National Lab Networks

One notable trend is the gradual rise of local OEMs (Original Equipment Manufacturers) and reagent producers aiming to compete on cost and logistics. This helps reduce import dependency and buffer against currency swings. Concurrently, major diagnostic groups like DASA are consolidating laboratories and deploying centralized automation and data platforms across their network, prompting efficiencies in reagent usage, turnaround time, and scale leverage.

Opportunity: City-Hub Strategy, Clinical Partnerships & Training Programs

IVD firms can adopt a city-hub strategy in key Brazilian metros to serve surrounding regions more efficiently, reducing logistical burdens. Partnering with top-tier hospitals for clinical pilots, KOL collaborations, and infrastructure grants can accelerate adoption in new states. Diagnostic firms that invest in training programs, quality assurance, and local service capabilities will win trust from both private and public buyers. Moreover, diagnostic bundling tied to orthopedic or specialty procedures (pre-op labs, follow-up biomarkers) can create integrated pathways that embed IVD into clinical trajectories. Innovation in low-cost, point-of-care assays adapted to Brazil’s epidemiology (e.g., infectious disease, tropical disease, chronic disease panels) represent high-potential niches for differentiation.

Competitive Landscape: Key Players and Strategic Moves in Brazil IVD Ecosystem

The competitive landscape blends international powerhouses and robust national titans. Roche, Abbott, Siemens Healthineers, and Thermo Fisher maintain strong market presence via reagent supply, instrument sales, and service contracts. On the domestic front, Diagnósticos da América (DASA) is a leading clinical diagnostics group with extensive laboratory and imaging services and a growing footprint in genomics and precision assays. DASA recently acquired and consolidated hospital operations and labs to integrate vertical service offering.

Newer entrants and local players engage in joint ventures, regional lab alliances, and reagent co-development to localize cost structure and regulatory compliance. Many global companies are also exploring Brazilian manufacturing or assembly to reduce import dependence and align with public procurement preferences. Top private hospitals like Hospital Sírio-Libanês coordinate innovation, evaluating new tests and collaborating with the public system (SUS) under health technology assessment frameworks to pilot next-gen diagnostics.