BRICS Retail Banking Market Outlook: Fintech Expansion Fuels Next-Gen Financial Inclusion Across Emerging Economies

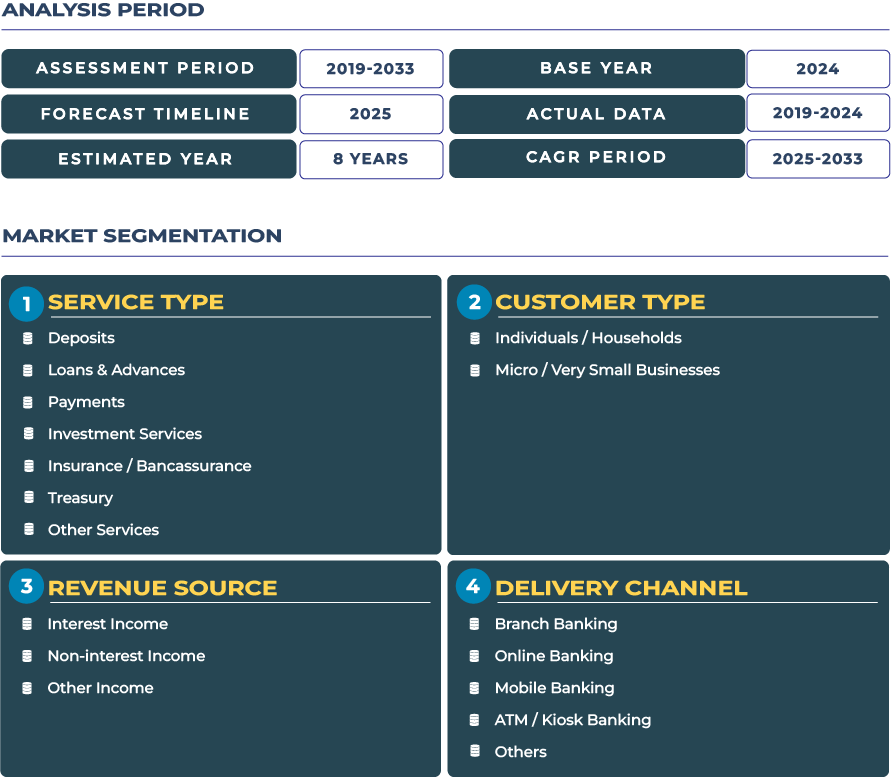

The BRICS retail banking market is undergoing a significant transformation driven by the rapid integration of fintech innovations that are redefining access to financial services across Brazil, Russia, India, China, and South Africa. With expanding mobile connectivity, growing middle-class segments, and government-led digitization programs, BRICS nations are fostering inclusive banking ecosystems that serve both urban and rural populations. As of 2025, the BRICS retail banking market is estimated at USD 277.5 billion and is projected to reach USD 393.1 billion by 2033, growing at a CAGR of 4.5% during 2025–2033. This sustained growth is underpinned by rising demand for digital lending, payments modernization, and microfinance accessibility across diverse economies.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

These emerging economies are leveraging fintech to accelerate financial inclusion through innovations in mobile payments, neobanking, AI-driven advisory tools, and digital credit scoring. Institutions such as Sberbank are investing heavily in AI-based analytics and open banking platforms, while policy coordination through the BRICS cooperative framework encourages financial harmonization and digital transformation. Despite differences in economic maturity and regulatory structures, these markets share a unified objective: democratizing financial access through technology-driven retail banking ecosystems.

Drivers & Restraints: Expanding Economies, Rising Smartphone Usage, and Structural Hurdles

The growth of the BRICS retail banking sector is strongly supported by robust economic expansion and rising consumer income levels. Nations such as India and China are witnessing unprecedented adoption of digital wallets and instant payment systems-UPI in India and WeChat Pay in China-making financial transactions faster and more inclusive. Smartphone penetration across BRICS exceeds 75%, empowering millions of consumers to access mobile banking, insurance, and investment products seamlessly. This expansion is further supported by government-backed financial literacy programs and the development of digital identification systems such as India’s Aadhaar and Brazil’s PIX infrastructure.

However, several restraints continue to shape the market’s trajectory. Political instability and currency volatility in Russia and South Africa have created challenges for foreign investments and long-term planning in banking modernization. Moreover, the persistence of legacy banking infrastructure limits digital transformation speed in some regions. Regulatory fragmentation also hinders cross-border fintech collaboration within BRICS, requiring greater alignment on data governance, cybersecurity, and digital payment interoperability. Addressing these challenges is critical for achieving the full potential of digital retail banking across the bloc.

Trends & Opportunities: Neobank Expansion and AI-Powered Financial Ecosystems Redefining Retail Banking

One of the most notable trends in the BRICS retail banking industry is the surge in neobank adoption and digital payment integration. Platforms like Nubank in Brazil, Tinkoff in Russia, and Paytm Payments Bank in India are redefining customer engagement through frictionless onboarding, low-fee structures, and AI-powered financial planning tools. The increasing reliance on digital lending platforms is also transforming access to credit for small and medium enterprises (SMEs) and unbanked individuals. These developments demonstrate the agility of the BRICS banking landscape in embracing technology-driven innovation.

Significant opportunities lie in the expansion of microfinance and AI-driven financial advisory services. As the demand for personalized wealth management grows, banks are leveraging artificial intelligence to deliver targeted recommendations and predictive risk assessments. Additionally, fintech partnerships focusing on blockchain-based payments and cross-border remittance systems are expanding the operational efficiency of retail banks. The integration of advanced analytics with customer-centric financial tools will remain pivotal in sustaining the sector’s competitiveness through 2033.

Regional Analysis by Country: Diverse Banking Ecosystems, Common Growth Vision

- Brazil: Leads Latin America’s fintech revolution, with neobanks dominating the digital banking market.

- Russia: Continues to innovate despite economic sanctions, focusing on domestic payment networks and localized financial ecosystems.

- India: Stands as a powerhouse for mobile payment adoption, with record UPI transactions driving banking digitization.

- China: Remains the technological anchor of the BRICS bloc, fostering AI, big data, and super-app ecosystems through banks and fintech giants.

- South Africa: Emerging as a leader in mobile banking access for low-income communities through platforms like TymeBank and Capitec.

- Collectively, these markets are diversifying their retail banking models while advancing toward shared objectives of inclusion, innovation, and economic growth.

Competitive Landscape: Strategic Collaborations and Digital Transformation Steering Market Competitiveness

The BRICS retail banking landscape is characterized by intensified competition among traditional and digital-first financial institutions. Major banks such as Sberbank (Russia), ICICI Bank (India), Banco do Brasil (Brazil), China Construction Bank (China), and Standard Bank (South Africa) are prioritizing digital transformation initiatives. In 2024, BRICS banks launched multiple fintech partnerships aimed at scaling microfinance solutions and implementing AI-driven advisory tools for personalized banking experiences. Banks are also integrating ESG frameworks and cybersecurity measures to enhance trust and regulatory compliance. These strategies underscore a unified shift toward digital maturity, customer-centric innovation, and sustainable financial inclusion across BRICS nations.