Chile Investment Banking Industry Outlook: Accelerating Sustainable Mining and Energy Advisory Momentum

Chile investment banking market is entering a new phase of strategic transformation, driven by the nation’s increasing focus on sustainable mining, renewable energy financing, and ESG-linked advisory. The country’s vast mineral wealth, especially in copper and lithium, paired with a strong commitment to energy transition has elevated the role of financial intermediaries in structuring green capital projects. Investment banks are increasingly aligning their advisory services with Chile’s national sustainability goals, as outlined by the Ministry of Finance of Chile and supported by the Financial Market Commission (CMF). The investment banking sector is not only serving as a bridge between institutional investors and infrastructure developers but also as a catalyst for accelerating Chile’s clean energy ambitions.

Note:* The market size refers to the total revenue generated by banks through various services.

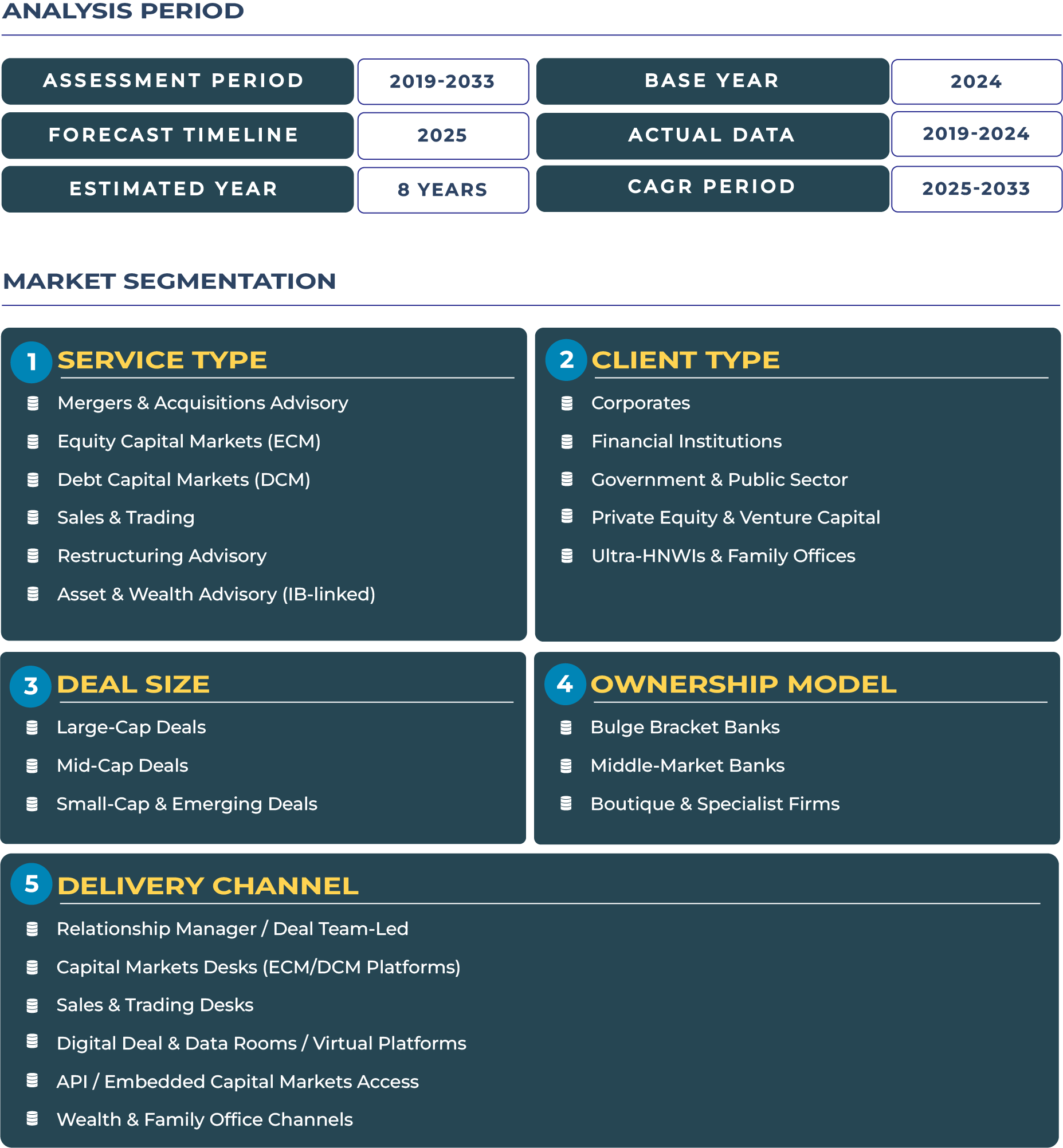

According to DataCube Research, the Chile investment banking market is expected to reach USD 1.7 billion in 2025 and grow to USD 2.4 billion by 2033, registering a CAGR of 4.3% from 2025 to 2033. This growth is supported by surging renewable energy projects, rising merger and acquisition activity in the mining value chain, and a favorable regulatory environment promoting capital market deepening. The industry’s evolving focus on sustainable finance, coupled with strong cross-border partnerships, is helping Chile position itself as a regional financial hub for energy and infrastructure advisory in Latin America.

Green Finance Advisory Fuels Chile Investment Banking Evolution

The outlook for Chile investment banking industry remains promising as global investors seek exposure to sustainable projects within the Andean region. Chile’s leadership in renewable energy, especially in solar, wind, and green hydrogen, has created robust demand for specialized financial advisory. Investment banks are structuring debt and equity capital solutions for public-private partnerships (PPPs), energy infrastructure, and technology-driven efficiency projects. The growing participation of global ESG funds in Chile’s mining sector, driven by the government’s sustainability initiatives, underscores the increasing convergence between finance and environmental stewardship.

The Chilean government’s efforts to attract foreign capital into sustainable infrastructure are reinforced by fiscal incentives, streamlined project approval frameworks, and policies under the Corporación de Fomento de la Producción (CORFO). This institutional support has accelerated activity across Equity Capital Markets and Debt Capital Markets, as banks facilitate green bonds, sustainability-linked loans, and merger and acquisition transactions in the renewable energy and materials sectors. The overall market resilience, despite global macroeconomic volatility, reflects the country’s diversified investment pipeline and proactive regulatory stance.

Drivers & Restraints: Mining and Energy Corporate Growth Against Market Concentration Risks

Strong Corporate Financing Demand from Mining and Energy Sectors

Chile’s mining and energy corporates continue to dominate deal flows within the investment banking ecosystem. With copper and lithium demand projected to surge due to global electrification, banks are increasingly focusing on project finance and corporate advisory for large-scale expansions. Strategic merger and acquisition activity has intensified as international mining firms pursue acquisitions to secure long-term resources. Concurrently, renewable energy companies are leveraging structured financing and ECM transactions to scale their capacity, strengthening the role of investment banks as capital market facilitators. These developments are propelling fee-based revenues and boosting competition in advisory segments.

Market Concentration and Limited Domestic Diversification Challenge Growth

However, market concentration among a few leading banks remains a restraint for Chile investment banking industry. The dominance of major players such as Banchile Inversiones and international entities like JP Morgan and Citigroup limits the participation of smaller firms in large-scale deals. This concentration creates competitive barriers and reduces innovation across mid-tier advisory segments. Additionally, macroeconomic fluctuations, policy transitions, and exposure to global commodity price volatility can impact investor sentiment. Addressing these challenges will require regulatory reforms that enhance transparency and broaden access to capital market instruments for local institutions.

Trends & Opportunities: ESG-Linked Finance and Sustainable Energy Advisory Redefine the Market

Rise of ESG and Green Financing Advisory Across Chilean Capital Markets

A defining trend in the Chilean investment banking landscape is the rapid rise of ESG and green financing. Banks are embedding sustainability principles into their advisory and underwriting processes to meet investor demand for responsible investment products. The issuance of green bonds and sustainability-linked instruments has surged, especially in sectors like renewable energy, water management, and clean transport. International investors view Chile as a stable jurisdiction with transparent regulatory practices and strong ESG reporting, making it an attractive destination for sustainable capital allocation. This shift towards ESG advisory underscores the transformation of Chile investment banking industry into a sustainability-driven ecosystem.

Advisory Opportunities in Sustainable Energy and Infrastructure Projects

Investment banks in Chile are positioned to capture significant opportunities in energy transition projects. Advisory for wind, solar, and hydrogen infrastructure financing is gaining traction, supported by global energy companies expanding their footprint in Latin America. Additionally, restructuring advisory is becoming critical as firms recalibrate balance sheets post-pandemic to optimize debt structures for long-term sustainability. Cities such as Santiago, Antofagasta, and Valparaíso are emerging as hotspots for capital-intensive projects, where banks play an essential role in aligning investors with government sustainability frameworks and PPP initiatives. The convergence of infrastructure, ESG, and capital markets is expected to drive steady growth through 2033.

Competitive Landscape: Strategic Collaborations and ESG Advisory Teams Define Market Dynamics

The Chilean investment banking sector features a mix of domestic and global institutions competing on advisory innovation and sector specialization. Leading banks such as Banchile Inversiones, BTG Pactual, and LarrainVial continue to strengthen their ESG-focused capabilities by investing in dedicated sustainability advisory teams. International players including Goldman Sachs and Morgan Stanley are expanding their local presence through partnerships with regional corporates to support green project financing. A key strategic focus in 2024–2025 has been on advising large-scale merger and acquisition in the mining sector and arranging sustainability-linked debt for energy firms. These strategies are designed to capture growing capital flows into Chile’s decarbonization and resource modernization agenda.

Additionally, digital transformation in investment banking operations, through automation of compliance, analytics, and risk management, has become a competitive differentiator. Banks that integrate technology with sustainability-focused investment frameworks are well-positioned to capitalize on the next phase of Chile’s green economic transition. As the investment banking ecosystem matures, collaboration between regulators, corporates, and global investors will remain essential to sustaining growth momentum.