Chile Retail Banking Transformation Anchored in Mobile Wealth & Advisory

Chile is emerging as a regional leader in integrating digital wealth management and mobile banking into its retail banking ecosystem. Financial institutions are increasingly deploying mobile advisory modules, robo-invest solutions, and integrated digital wallets, enabling consumers to manage deposits, investments, and credit via a single app interface. In parallel, Chile relatively high financial literacy and strong consumer trust give such innovations traction.

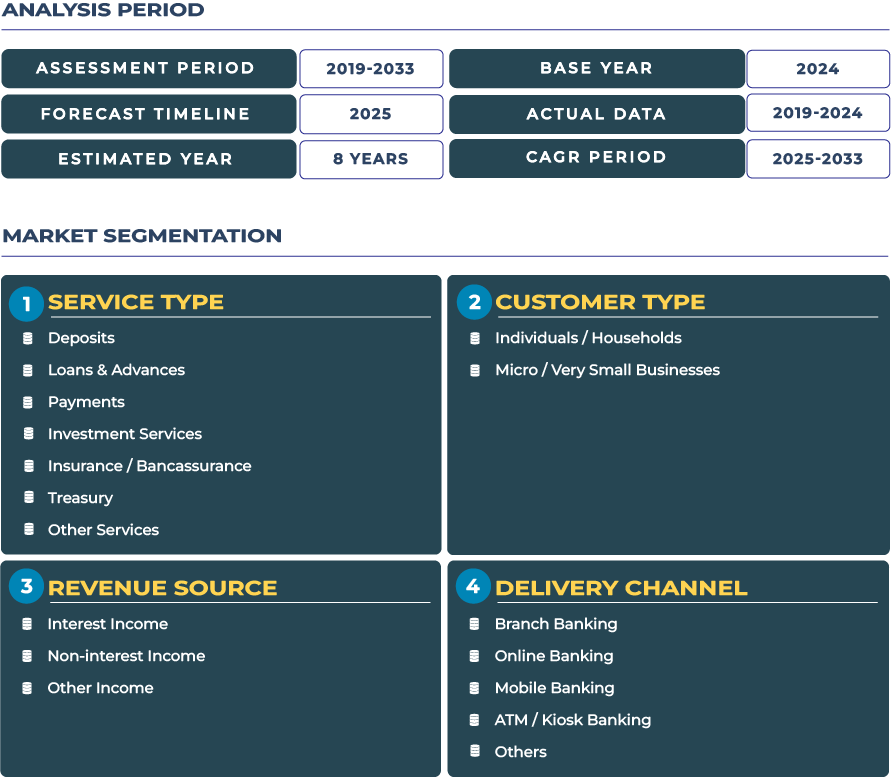

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Market Outlook That Demands Boardroom Focus: Why Chile Retail Banking Growth is Anchored in Wealth and Digital Access

The forecasted climb from USD 21.3 billion to USD 32.6 billion by 2033, at 5.4% CAGR, signals that Chile retail banking market is entering a maturation phase where value shifts from transactional volume to customer lifetime engagement. In this phase, mobile banking becomes the hub of financial life: deposits, payments, digital investments, insurance, and credit offerings will converge inside consumers’ smartphone ecosystems. Institutions that embed advisory, algorithmic asset allocation, savings nudges, and micro-insurance within mobile apps will capture incremental yield beyond deposit-loan margins.

Drivers & Restraints Structuring Chile Retail Banking Trajectory

High Internet Penetration & Financial Literacy: Foundation for Digital Banking Growth

Chile boasts high Internet penetration and a well-developed telecommunications infrastructure, enabling broad digital banking accessibility even in mid-sized cities and semi-urban zones. Complemented by relatively strong financial literacy and trust in formal banking systems, consumers are predisposed to adopt mobile banking and wealth tools. The regulatory environment is also favorable: Chile Comisión para el Mercado Financiero (CMF) instituted Open Finance mandates and regulations enabling information sharing, which bolster modular banking innovation. Simultaneously, Chile has one of the highest levels of bancarization in Latin America-over 98% of adults aged over 15 have access to a banking product. These foundational strengths lower friction for mobile wealth adoption and embedding investment modules into retail banking apps.

In payments and e-commerce, digital adoption continues to expand. Over 60% of Chile consumers now purchase goods via online retailers, reinforcing demand for seamless payment and wallet experiences. Digital transaction volume growth supports revenue models around interchange fees, subscription wallets, and embedded financial products. Together, these conditions frame a conducive environment for retail banking growth centered on mobile and wealth services.

Regulatory Compliance Costs, Operational Overhead & Rural Penetration Constraints

Despite strengths, Chile retail banking expansion is constrained by regulatory burden and cost structures. Compliance with evolving data protection, consumer protection, and anti-money laundering requirements imposes elevated overhead. As banks augment digital offerings, investments in secure APIs, identity verification, fraud detection, and system resilience become nontrivial cost centers.

Moreover, Chile banking industry is concentrated-four major banks control over 60% of relevant credit portfolios and deposits. This concentration restricts the scope of margin compression from innovation and limits competitive differentiation. In addition, rural and remote zones, especially in the southern and mountainous regions, face connectivity and digital literacy gaps, hampering pure mobile adoption. In these areas, hybrid strategies combining agent networks and digital kiosks may be required, but such models carry cost and trust risks. Balancing urban digital momentum with inclusive rural reach remains a structural challenge for Chile retail banking sector.

Trends & Opportunities That Define Chile Retail Banking Frontier

Trend Spotlight: Neobanks, Wallets & Modular Banking Apps Redefining Retail Models

Chile fintech ecosystem is active and competitive-with over 300 fintech startups, bolstered by the 2022 Fintech Law and Open Finance regulation. Fintechs are increasingly applying for banking licenses, enabling them to offer full-stack digital banking. One example is Tanner, which has secured initial regulatory authorizations from the CMF to become a digital bank. Digital wallets, such as Fpay (associated with Falabella) and other retail-linked wallets, are being integrated into banking apps to deepen engagement. As wallets become central interfaces, banks that embed lending, insurance, credit, and advisory modules into the wallet experience will see stronger retention and cross-sell.

Another trend is modular or microservice banking: consumers may subscribe to boutique wealth modules, savings nudges, or insurance covers within the base banking app. This approach decouples product development from monolithic systems and encourages experimentation. It also supports white-label embedding for third-party providers. In cities like Santiago and Viña del Mar, these modular finance strategies are gaining traction among younger, digitally native users seeking personalized investment and credit experiences.

Opportunity Focus: AI-Based Wealth Advisory & Mobile Lending Platforms

A prime opportunity lies in developing AI-based digital wealth advisory platforms that cater to retail and mass-affluent segments. Chile base of depositors and investors is relatively sophisticated, and self-directed portfolios, exchange-traded funds, and robo-advisory can be layered into core banking apps. Banks that offer algorithmic portfolio recommendations, micro-investment products, goal-based savings planners, and holistic advisory modules will capture embedded revenue beyond interest spreads.

Parallel to wealth, mobile lending platforms-particularly small ticket consumer credit, payroll lending, and microloans-are ripe for expansion. By integrating credit offers into wallet or payment flows, banks can scale lending with low friction. The data generated from transaction history, account behavior, and app engagement can refine credit models and limit default risk. In less serviced suburbs or satellite cities, digital lending becomes a tool for dense access. These opportunities, when combined, create a robust growth vector for Chile retail banking sector.

Competitive Landscape: Strategic Movements in Chile Retail Banking Arena

The Chilean banking landscape is led by institutions such as Banco Santander Chile, Banco de Chile, BCI, Banco Estado, and emerging digital challengers. Santander Chile, the largest bank by loans and deposits, is investing heavily in mobile banking, integrating advisory and payments solutions, and advancing open banking APIs. Banco de Chile is also notable for its digital account offerings, such as its “FAN” debit account, which achieved over 1.4 million users, reflecting how combining wallet access and digital onboarding can scale rapidly in a concentrated market.

Fintech entrants like Tanner and Tenpo are seeking to secure banking licenses under the new regulatory framework, intensifying competition around digital-native services. Retailers with embedded wallets, such as Falabella, are converting wallet users into bank customers by migrating digital wallet customers into banking accounts. These strategies blur the line between retail commerce and banking.

Key strategic tracks in Chile retail banking sector include: launching AI-based wealth advisory modules, embedding micro-lending in payment flows, modular banking architecture using APIs, acquiring fintech or wallet platforms, and rationalizing branch infrastructure toward advisory functions while shifting transactional volume to digital. Banks that orchestrate such strategies while preserving risk discipline and regulatory compliance are best poised to capture the next wave of growth in Chile retail banking ecosystem.