China Corporate Banking Market Outlook: Digital Wallets and Instant Payment Integration for Chinese Corporates Redefining Cash Management

China corporate banking ecosystem is undergoing a profound transformation, driven by the fusion of digital wallets, instant payments, and fintech-based treasury solutions. As one of the most advanced markets in digital payments, China’s banks are reimagining cash management frameworks to align with the demands of enterprises operating in a high-speed, data-driven environment. The China Corporate Banking Market was valued at USD 234.9 billion in 2025 and is projected to reach USD 309.2 billion by 2033, growing at a CAGR of 3.5%. This evolution reflects the synergy between technology adoption, regulatory modernization, and the global expansion of RMB-denominated services.

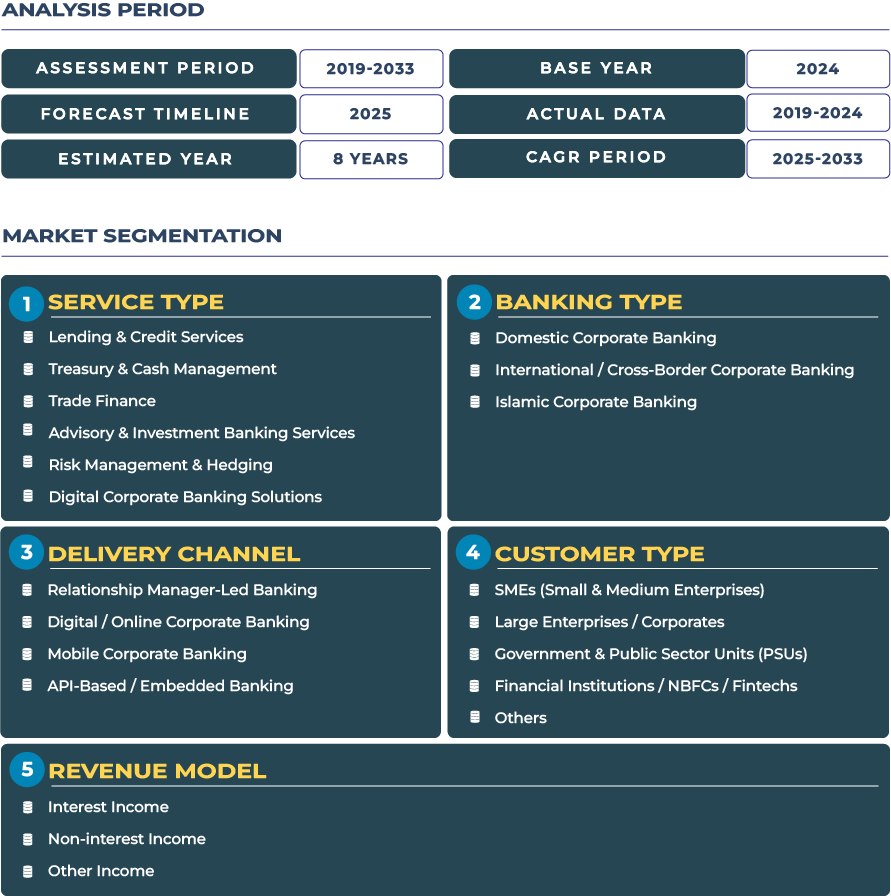

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

The integration of mobile payment ecosystems like Alipay and WeChat Pay into enterprise treasury platforms underscores a paradigm shift, corporates are no longer confined to legacy banking channels but are embracing real-time, API-led payment orchestration. This modernization is transforming liquidity management, cross-border settlements, and supply-chain finance across industries, positioning China at the forefront of digital corporate banking innovation.

The Rise of Digital Cash Management in China Corporate Banking Sector

As China advances toward a digitally connected financial infrastructure, the corporate banking sector has emerged as a strategic enabler for business efficiency. The growing appetite for instant payment systems, enterprise e-wallets, and blockchain-based reconciliation tools is redefining how corporates manage liquidity and working capital. The People’s Bank of China (PBoC) continues to push the boundaries with the Digital Yuan (e-CNY) initiative, enabling faster and transparent B2B transactions with real-time data validation. These developments not only enhance transaction speed but also improve compliance traceability, particularly in high-volume corporate payment ecosystems.

Moreover, China’s manufacturing-led economy, alongside its strong export orientation, has led to high demand for advanced trade finance, FX risk management, and treasury centralization services. The modernization of cross-border RMB settlement corridors and enhanced liquidity management solutions are fostering a more resilient financial environment for enterprises navigating volatile global markets.

Driving Forces: Fintech Integration and Cross-Border RMB Expansion Fuel Growth

China corporate banking market expansion is driven by an intersection of technology, policy, and globalization. One major driver is the rising demand among mega-corporates for integrated treasury and cross-border RMB services. As the Belt and Road Initiative (BRI) continues to scale infrastructure projects, the need for sophisticated cash and trade finance solutions has surged. Chinese financial institutions are offering enhanced treasury automation, multi-currency liquidity pools, and AI-driven credit risk assessment to meet the dynamic needs of multinational enterprises.

Another key growth catalyst is the rapid adoption of fintech and corporate super-app ecosystems. Leading banks like ICBC and Bank of China are collaborating with payment super-apps and cloud fintech players to embed digital banking within enterprise workflows. Such integrations streamline fund transfers, enable instant settlements, and improve working capital cycles, especially for SMEs participating in digital trade ecosystems. This convergence of banking and fintech accelerates China’s leadership in cashless corporate ecosystems.

Challenges: Navigating Capital Controls and Regulatory Complexities

Despite remarkable progress, the China Corporate Banking Market faces structural constraints. Capital controls and stringent regulatory approvals for cross-border flows continue to hinder operational flexibility for global corporates. Complex foreign exchange compliance, coupled with restricted profit repatriation rules, can delay large-scale treasury movements.

Additionally, state dominance in major corporate credit allocation often limits private sector participation, particularly in high-value lending portfolios. This concentration of credit distribution can distort competition and reduce innovation in credit risk modeling. Moreover, geopolitical tensions and export restrictions, notably involving the United States and European markets, pose further uncertainty for corporate clients seeking international expansion. These headwinds emphasize the need for diversified financing channels and digital-led liquidity solutions.

Emerging Trends: Integration of Enterprise Platforms and Belt & Road Trade Finance Corridors

The acceleration of digital transformation has positioned China’s banks to deliver end-to-end financial automation. Enterprise clients increasingly integrate their ERPs with corporate banking APIs, enabling predictive liquidity forecasting, digital invoicing, and intelligent treasury routing. Furthermore, the rise of RMB internationalization through the Belt and Road corridors has opened new opportunities for cross-border lending, settlement, and trade finance. Chinese banks are deploying blockchain-based documentary credit platforms to streamline trade transactions and reduce fraud risks.

In major business hubs such as Shanghai, Shenzhen, and Guangzhou, the adoption of corporate super-app banking models, combining digital treasury, FX hedging, and compliance modules, has redefined financial agility for enterprises. These innovations are encouraging companies to manage regional operations through centralized, RMB-denominated hubs, minimizing currency risk and enhancing real-time liquidity visibility.

Opportunities: Export Financing and Corporate Super-App Banking Ecosystems

Looking ahead, the most promising opportunities lie in export financing via RMB corridors, onshore cash-management hubs, and integrated corporate super-app banking. The internationalization of the RMB, supported by cross-border payment system (CIPS), continues to create favorable conditions for global corporates transacting in China. Additionally, the integration of AI-based credit analytics and embedded risk management tools will further strengthen credit transparency and enable more efficient capital allocation.

Corporate banks focusing on green finance and ESG-linked lending are also gaining traction. The alignment of financial products with China’s sustainability agenda has led to increased corporate participation in low-carbon financing programs. As China accelerates its digital and green transformation, these factors will converge to shape the future trajectory of corporate banking growth.

Competitive Landscape: Strategic Alliances and RMB-Denominated Service Expansion

The competitive environment in China corporate banking sector is characterized by both state-owned and private banking giants enhancing their digital infrastructure. China Construction Bank (CCB) has strengthened its AI-enabled corporate credit assessment tools and launched a multi-layered digital treasury system in 2024. Similarly, Agricultural Bank of China (ABC) has expanded its cross-border RMB liquidity management network across ASEAN markets. Global banks, including HSBC China, continue to align with domestic partners for RMB corridor trade financing and digital supply-chain solutions.

Key strategies observed in 2025 include building RMB-native cash management and cross-border solutions, partnering with super-apps for embedded corporate services, and offering Belt & Road corridor trade finance. This multidimensional approach allows banks to capture liquidity flows from domestic and outbound Chinese enterprises, reinforcing China’s role as a global financial powerhouse.