Market Outlook: Charting China Private Banking Growth Trajectory Through 2033

Looking ahead, the China private banking industry is clear: from an estimated USD 63.9 billion in 2025 to USD 104.0 billion by 2033, the sector commands a significant growth horizon. This projection is underpinned by the rising numbers of HNWIs and ultra-HNWIs, surging investable asset bases, evolving wealth-service expectations and the digital transformation of private banking ecosystems. Institutional players must therefore invest not only to accommodate asset-growth, but also to refine service models-moving from traditional account management to high-touch, tech-enabled advisory, multi-jurisdictional treasury, and legacy solutions for family-wealth dynasties.

Note:* The market size refers to the total revenue generated by banks through various services.

Key enablers of this trajectory include China domestic innovation economy-from technology, biotech and manufacturing sectors generating new wealth-to reforms allowing foreign wealth-management participation and onshore-wealth-service liberalisation. Wealth-managers are expected to build digital platforms, deploy advanced analytics, partner with fintechs and scale across Chinese wealth hubs such as Shanghai, Shenzhen, Beijing and Hangzhou. Meanwhile, macro-risks including slowing GDP growth and property-sector correction necessitate that private banks prioritise portfolio resilience, diversified investment structures and robust advisory frameworks.

Growth Catalysts & Structural Headwinds: Core Drivers and Constraints in China Private Banking Sector

Key growth drivers: Several structural factors power the private banking market in China. Firstly, the rapid expansion of ultra-wealthy individuals drives demand for private-banking services tailored to complex wealth-structures, cross-asset exposure and family legacy planning. Research indicates that Chinese HNWI wealth is expected to grow by 10-12 % annually through 2026. Secondly, strong domestic innovation-tech entrepreneurs, manufacturing growth, and global consumer brands-creates a new-wealth cohort with global investment expectations. Thirdly, digital-wealth infrastructure is maturing: private banks are deploying mobile-wealth apps, integrated treasury/credit flows, robo-advisory overlays and AI-driven client segmentation to capture the affluent and next-gen client base.

Growth constraints: Despite opportunity, several constraints temper rapid expansion. Capital-account controls and stringent outbound-investment policies limit full offshore diversification, presenting barriers for clients seeking global portfolios. Regulatory tightening-especially around wealth-management products, data security and fintech integration-adds complexity and cost to private banking operations. Additionally, market volatility, particularly in the real-estate sector, and economic slowdowns pose risk to investable-asset growth and advisory fee bases. These dynamics require private banks in China to navigate carefully, offering advisory robustness, compliance discipline and value-added service models rather than relying solely on asset-growth momentum.

Trend-Vectors & Opportunity Windows: On-shore Wealth Migration, Green-Wealth Platforms & Family-Office Formalisation in China Private Banking Market

Emerging trends: China private banking market is evolving along multiple trend-vectors. One is the growing on-shore wealth migration: affluent Chinese families are opting to domicile wealth management services domestically, supported by liberalisation of wealth-service models and improved advisor infrastructure. Another trend is green-wealth platforms: HNWIs increasingly demand ESG-aligned investment, sustainable-asset exposure and advisory that links with China domestic climate and infrastructure agenda. Finally, family-office formalisation is gaining traction, as entrepreneurial families establish multi-generation governance, domestically and internationally, and require integrated private-banking support across investment, legacy and philanthropy.

Opportunity windows: For private banking providers, major opportunities lie in developing on-shore ultra-high-net-worth advisory platforms for Chinese wealth families, offering comprehensive investment access, cross-asset structuring, legacy planning, and treasury solutions. Expanding green-wealth and impact advisory services that align portfolios and tax-efficient structures with China’s sustainability goals and the global ESG agenda will further strengthen market positioning. Additionally, integrating digital-RMB wealth applications and domestic asset-allocation tools within China’s payment and fintech super-app ecosystems can embed wealth management, credit, and treasury flows into clients’ digital experiences. Firms that prioritise these opportunities will be well positioned to capture a disproportionate share of the country’s forecasted growth.

Competitive Landscape: Strategic Positioning and Ecosystem-Execution in China Private Banking Industry

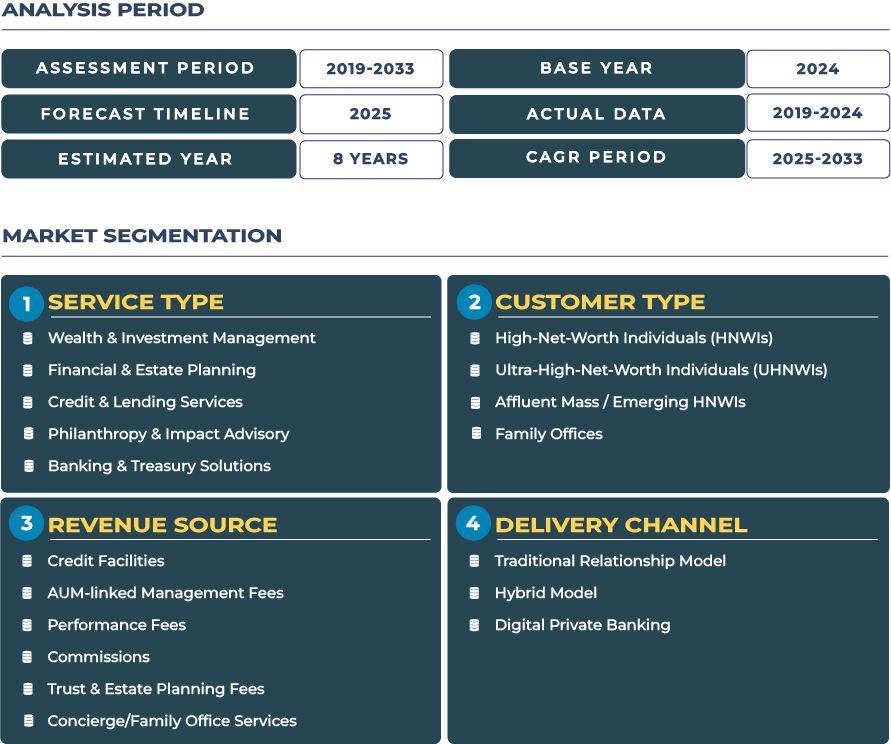

The competitive dynamics in China private banking sector are evolving rapidly. A leading institution, Industrial & Commercial Bank of China (ICBC), is expanding its private-banking capabilities domestically and increasingly integrating cross-border wealth-solutions for its affluent client base. Players are focusing on key strategic levers: segmentation, platform-deployment, and ecosystem partnerships. Success in this market will be determined by how well private banks integrate wealth & investment management, estate & legacy planning, credit & lending services, philanthropy & impact advisory and banking & treasury solutions into unified, client-centric platforms adapted for China affluent clients.