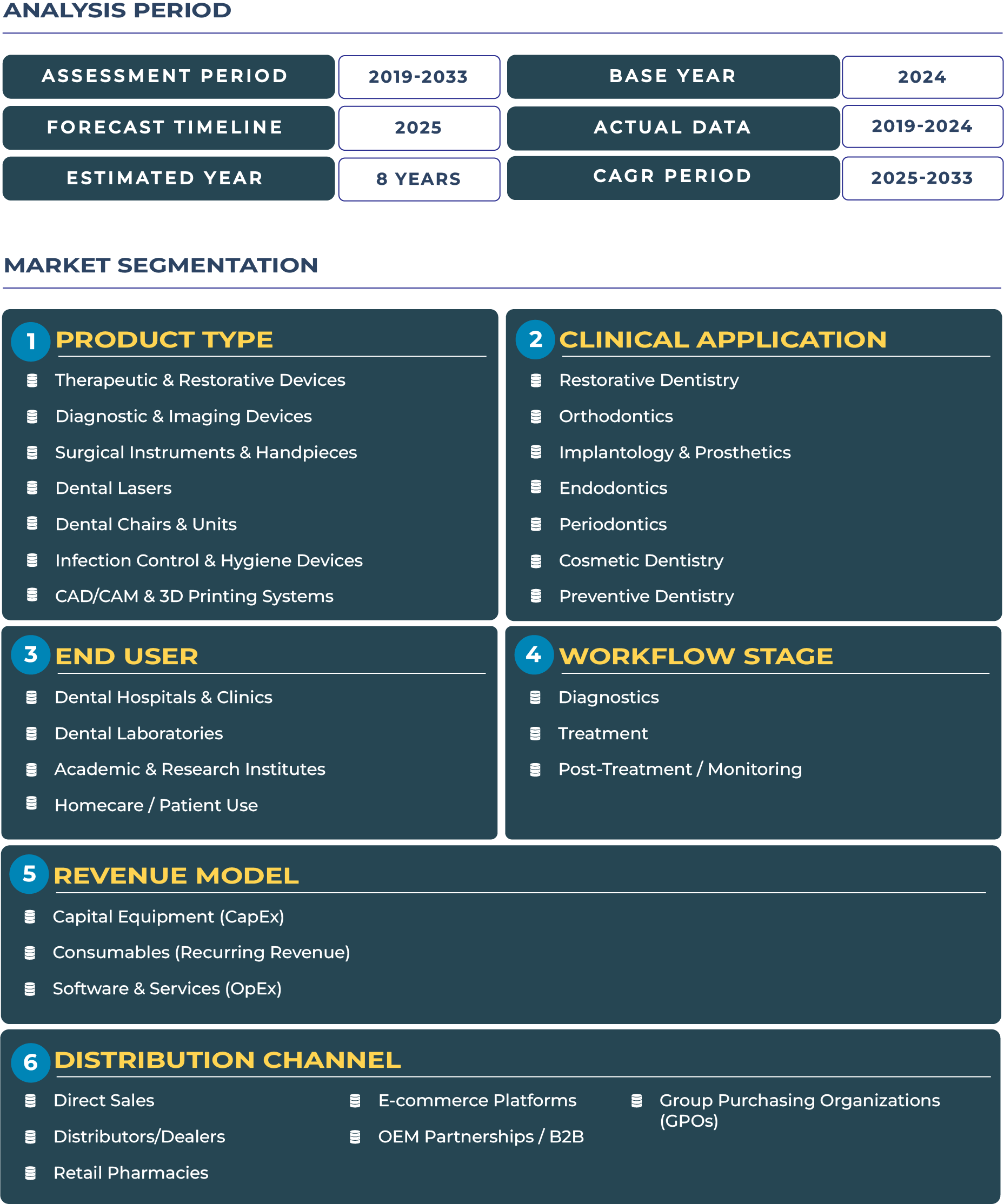

Colombia Dental Devices Market Outlook: Rising Middle Class and Cosmetic Dentistry Fuel Sector Growth

Colombia has emerged as one of Latin America’s most promising destinations in the dental devices market, fueled by a rapidly expanding middle class and the rising appeal of cosmetic dentistry. With more Colombians investing in advanced dental procedures, the sector is evolving from essential care to high-value treatments such as implants, orthodontics, and clear-aligner therapies. According to DataCube Research, the Colombia dental devices industry is projected to grow from USD 324.5 million in 2025 to USD 593.0 million by 2033, reflecting a strong CAGR of 7.8%. This performance underscores the dual drivers of affordability and demand sophistication, where private clinics, medical tourism, and cosmetic preferences are reshaping the dental devices ecosystem in Colombia.

Cosmetic Dentistry and Middle-Class Spending Drive Device Demand

The dental devices sector in Colombia is witnessing a transformation as rising disposable incomes allow middle-class families to access advanced procedures that were previously considered luxury. Cosmetic dentistry, especially implants and clear aligners, is gaining traction in major cities like Bogotá, Medellín, and Cali, where private clinics are investing heavily in dental imaging systems, CAD/CAM solutions, and surgical handpieces. Alongside domestic demand, Colombia’s emergence as a dental tourism hub adds another layer of opportunity. International patients, particularly from the United States and Canada, are increasingly traveling to Colombia for cost-effective treatments without compromising on quality. This convergence of local affordability and international inflow makes Colombia’s dental devices landscape a strategically positioned market for long-term growth.

Drivers & Restraints: Opportunities Accelerated by Tourism, Limited by Regional Disparities

Growth Accelerators Strengthening the Colombia Dental Devices Industry

Several structural factors are propelling the dental devices ecosystem in Colombia. First, the expansion of medical and dental tourism is creating high-value opportunities for clinics to invest in advanced therapeutic and restorative devices. Second, the growing enrollment in private insurance schemes is increasing patient access to orthodontic and prosthetic procedures, thereby boosting the adoption of dental lasers and infection control devices. Third, significant urban investments, particularly in Medellín and Bogotá, have enabled clinics to expand with state-of-the-art dental chairs and CAD/CAM systems. Together, these drivers position Colombia as a market with both short-term revenue potential and long-term resilience.

Market Restraints Hampering Uniform Growth Across Colombia

Despite the positive trajectory, challenges remain within the dental devices sector in Colombia. Security and logistical issues in rural and remote regions limit accessibility for suppliers, creating an uneven distribution network. Price sensitivity is another key restraint, particularly outside metropolitan areas, where patients often prioritize affordability over advanced treatment. Fragmented procurement processes in smaller clinics further delay technology adoption, hindering the widespread use of 3D printing systems and other premium devices. These limitations suggest that while urban markets continue to thrive, expanding access to rural areas remains an ongoing challenge for manufacturers and service providers alike.

Trends & Opportunities: Urban Growth, Dental Tourism, and Financing Models

Key Trends Shaping the Colombia Dental Devices Market

Several trends are reshaping the dental devices landscape in Colombia. Dental tourism is expanding rapidly, with Bogotá and Medellín emerging as key hubs for international patients seeking affordable implants and orthodontic procedures. The adoption of clear aligners and implant systems reflects growing patient interest in aesthetic-driven care, further boosting demand for diagnostic and imaging devices. Private dental chains are consolidating in major urban centers, standardizing services and investing in infection control and hygiene devices to align with global patient expectations. These trends point to a maturing market ecosystem capable of serving both domestic and foreign demand.

Opportunities for Expanding the Dental Devices Ecosystem in Colombia

Ample opportunities exist for stakeholders in the Colombia dental devices industry. Partnerships with tourism-focused clinics could allow manufacturers to secure predictable device demand linked to international patient flows. Offering patient financing and installment plans can help clinics overcome affordability challenges, particularly for implants and prosthetic devices. Establishing regional distribution centers in Medellín or Bogotá would also streamline supply chain management and improve device availability across the country. These opportunities can not only enhance revenue streams but also accelerate the adoption of advanced technologies in Colombia dental devices sector.

Competitive Landscape: Strategic Partnerships and Distribution Models Lead the Way

The Colombia dental devices market is becoming increasingly competitive with the participation of global and regional companies. International leaders such as Straumann and Dentsply Sirona are expanding their footprint by collaborating with dental tourism clinics and providing financing solutions to address Colombia’s price-sensitive environment. National press highlighted Colombia’s growing role in medical and dental tourism, reinforcing the importance of patient-centric strategies. Additionally, regional distributors are setting up operations in Medellín and Bogotá to reduce procurement fragmentation and deliver faster access to CAD/CAM and imaging devices. By combining financing, tourism partnerships, and regional distribution models, players in the dental devices ecosystem are successfully navigating Colombia’s dynamic healthcare landscape.