Eastern Europe Dental Devices Market Outlook: Transitioning Through Modernization and Affordability

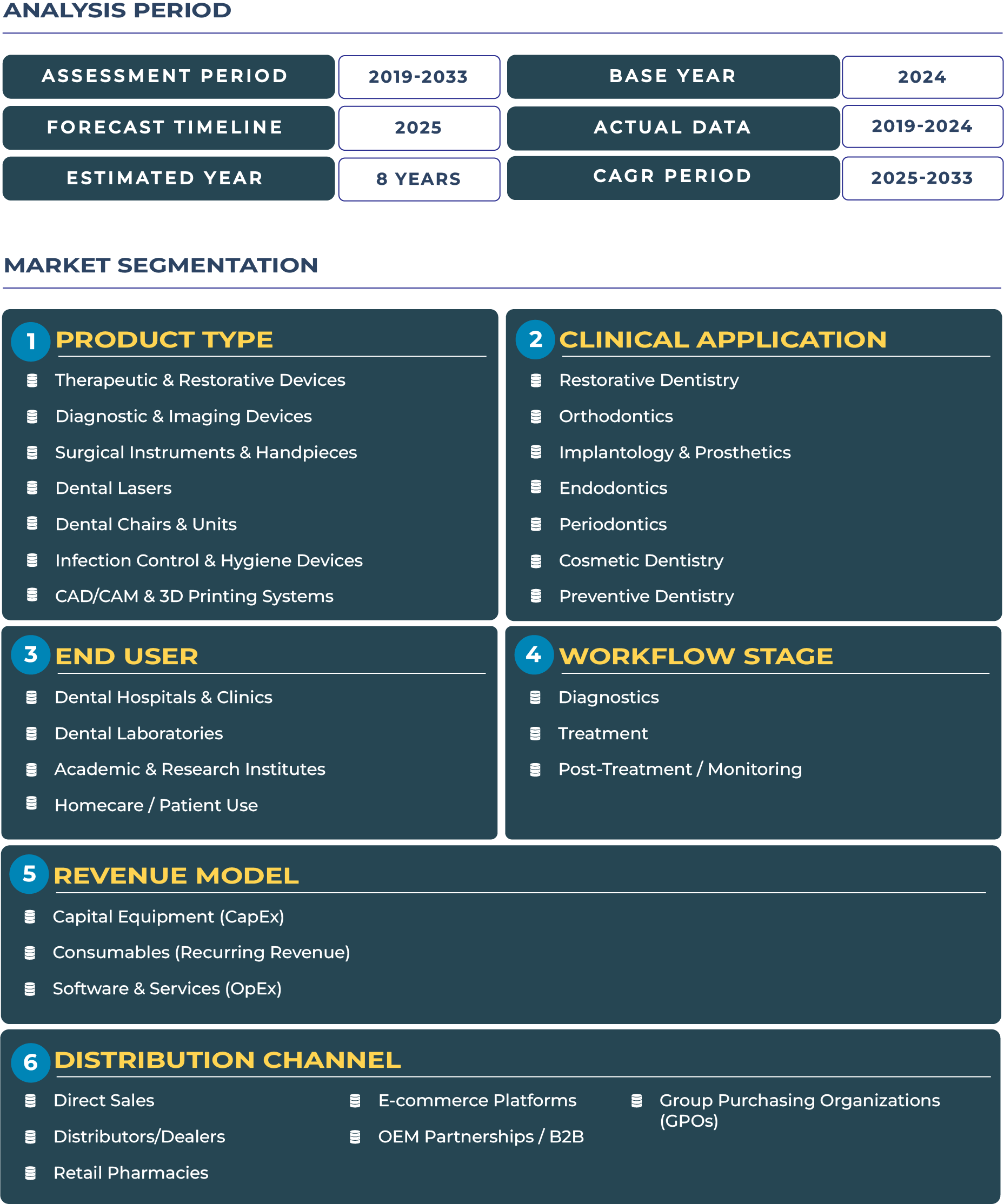

The Eastern Europe dental devices market is undergoing a significant transition, balancing modernization with affordability. As healthcare systems in the region continue to evolve, countries such as Poland, Hungary, and Czechia are investing in dental infrastructure upgrades, while private clinics increasingly target middle-income populations. At the same time, patients’ rising expectations for quality care and digital dentistry are accelerating adoption of diagnostic imaging, CAD/CAM systems, and infection control solutions. By 2025, the Eastern Europe dental devices industry is projected to reach USD 1.19 billion and further expand to USD 1.45 billion by 2033, growing at a modest CAGR of 2.5% during 2025–2033. This reflects the complex dynamics of affordability, import dependence, and gradual modernization that define the dental devices landscape across the region.

Why Modernization and Affordability Are Shaping the Eastern Europe Dental Devices Sector

The dental devices market in Eastern Europe is positioned for steady but cautious growth, driven by the expansion of private clinics in urban centers and the modernization of dental labs. Governments across the region have made incremental investments in healthcare infrastructure, but affordability remains a defining constraint. Many patients continue to rely on out-of-pocket payments, especially for premium restorative devices and implant systems. At the same time, dental tourism hubs such as Hungary are generating international demand, creating new revenue streams for local clinics and laboratories. While inflationary pressures, currency fluctuations, and geopolitical uncertainty continue to weigh on the region’s healthcare sector, the growing emphasis on modernization ensures that the dental devices ecosystem in Eastern Europe will remain resilient. The challenge for manufacturers and distributors will be to align device portfolios with both affordability and modernization imperatives, ensuring sustained adoption across fragmented markets.

Key Drivers and Restraints Influencing Growth in the Eastern Europe Dental Devices Industry

Drivers propelling market growth include fast clinic expansion in urban centers, particularly in Poland and Romania, where private operators are investing in new dental chairs, infection control systems, and CAD/CAM technology. Growing patient segments able to pay privately for premium procedures are also fueling demand for restorative devices and implant systems. In addition, dental labs are slowly modernizing, supported by imports of digital scanners and affordable CAD/CAM units from Western European suppliers, creating pockets of advanced practice within a broader cost-sensitive landscape.

Restraints limiting the Eastern Europe dental devices sector include persistent currency volatility, which impacts imports as most advanced equipment originates from Western Europe or Asia. Lower reimbursement rates from public health systems constrain adoption of high-cost devices, while fragmented distribution networks hinder large-scale deployments. Independent small clinics dominate the region, often lacking the financial capacity for rapid digital adoption. This creates a dual-speed market where modernization is concentrated in urban hubs, while smaller towns remain underserved by advanced dental technologies.

Trends and Opportunities Transforming the Eastern Europe Dental Devices Landscape

Trends shaping the market include the rising adoption of lower-cost digital scanners, particularly in Poland and Hungary, where distributors are offering affordable SKUs. Dental tourism continues to be a key trend, with Hungary emerging as one of Europe’s largest hubs for international patients seeking affordable but high-quality restorative treatments. Regional outsourcing of lab work is also gaining momentum, with cross-border service models allowing laboratories in Czechia and Slovakia to serve wider markets at competitive prices.

Opportunities for stakeholders include introducing cost-efficient digital scanner SKUs to capture price-sensitive clinics, implementing distributor-led training programs to support device adoption, and building hub-and-spoke service models for regional laboratories. By leveraging these opportunities, manufacturers can expand penetration in fragmented markets while supporting modernization initiatives across the dental devices industry in Eastern Europe.

Regional Analysis by Country

Russia

The Russia dental devices market is challenged by sanctions, import restrictions, and currency volatility, leading to slower adoption of premium devices. Domestic players are attempting to fill gaps, but advanced imaging and CAD/CAM solutions largely depend on imports. Despite these barriers, demand for basic restorative devices and infection control equipment remains steady, particularly in urban centers such as Moscow and St. Petersburg.

Poland

The Poland dental devices market is one of the fastest-growing in Eastern Europe, driven by private-pay patients and a flourishing dental tourism sector. Clinics in Warsaw, Kraków, and Wrocław are investing heavily in CAD/CAM systems, digital scanners, and dental lasers. Poland’s EU membership facilitates imports and modernization, making it a critical hub for both regional distribution and advanced dental practice development.

Competitive Landscape: Strategies Defining the Eastern Europe Dental Devices Sector

The competitive dynamics of the dental devices industry in Eastern Europe are marked by both global leaders and regional distributors focusing on affordability and localization. Companies such as Dentsply Sirona and Straumann have established distribution partnerships to strengthen market penetration. Between 2022 and 2025, reports in EU regional press highlighted Poland and Hungary’s lab modernization and growth in dental tourism, underscoring the demand for cross-border dental workflows. Strategies gaining traction include launching low-cost digital SKUs supported by local distributor training, and establishing hub-and-spoke service centers to serve fragmented regional markets. These models allow global companies to adapt to affordability constraints while driving modernization in the Eastern Europe dental devices ecosystem.