Eastern Europe Investment Banking Market Outlook: Navigating Privatization, Fintech Growth, and Geopolitical Complexity

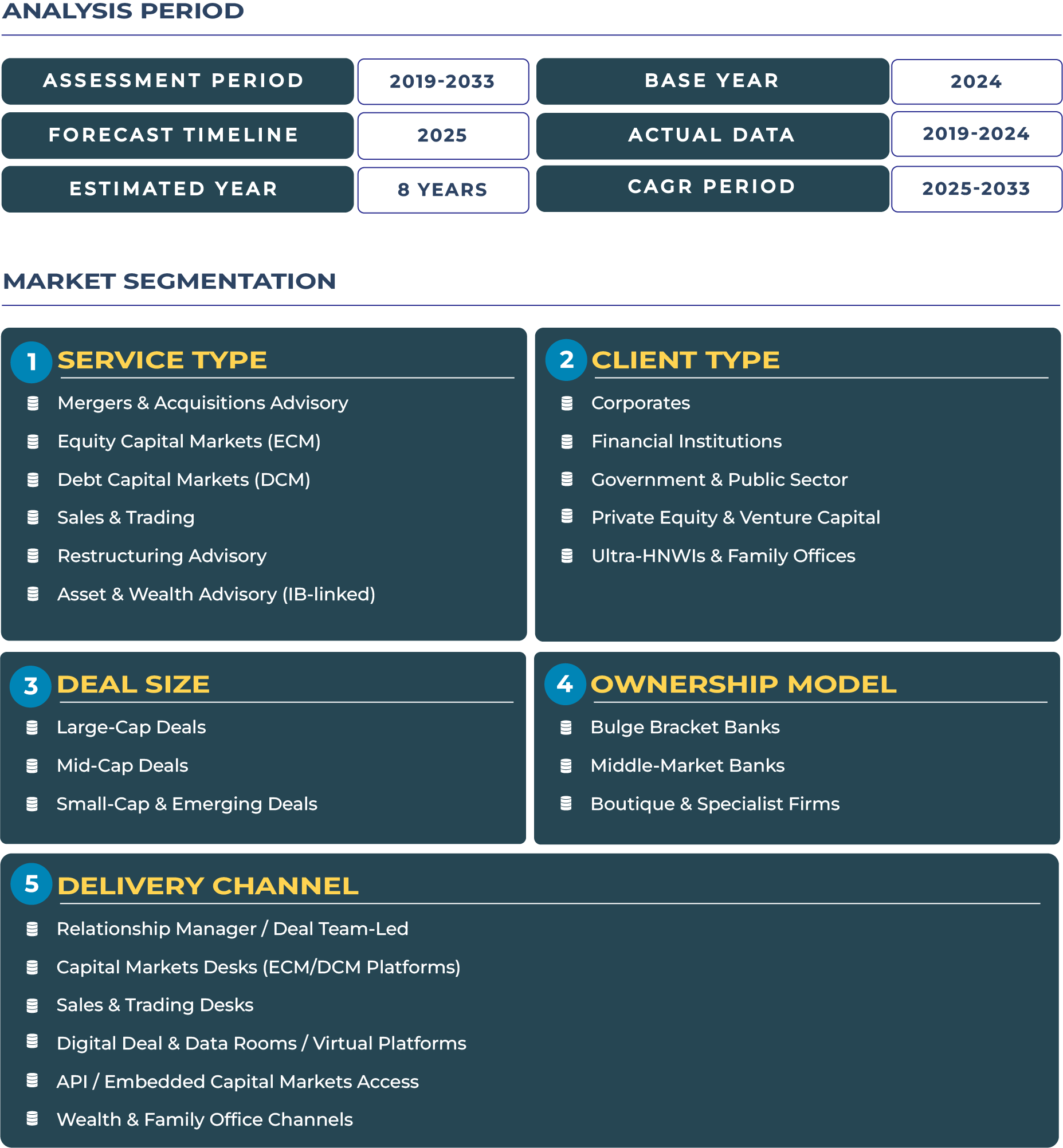

The Eastern Europe Investment Banking Market is undergoing a structural transformation driven by privatization initiatives, rising fintech adoption, and regional cross-border deal flows. As the region balances growth ambitions with geopolitical uncertainty, investment banks are repositioning to serve both state-led and private sector transactions. The integration of digital banking infrastructure and evolving capital market dynamics has established a fertile ground for advisory and financing services. According to DataCube Research, the Eastern Europe Investment Banking Market is expected to grow from USD 12.8 billion in 2025 to USD 16.3 billion by 2033, expanding at a CAGR of 3.1%. The market’s forward momentum is primarily influenced by expanding merger activity in sectors such as energy, telecommunications, and financial services.

Note:* The market size refers to the total revenue generated by banks through various services.

Privatization Wave and Fintech Inclusion Define the Next Growth Cycle

Eastern Europe investment banking landscape is shaped by an ongoing transformation in ownership and governance models. Governments in Poland, Romania, and Bulgaria are accelerating privatization programs aimed at enhancing efficiency and unlocking foreign capital inflows. This trend has created robust pipelines for mergers & acquisitions advisory and debt capital markets transactions. The region’s integration with the European Union (EU) financial ecosystem has further strengthened liquidity, enabling multinational firms to diversify their portfolios through equity and bond issuances.

Moreover, emerging fintech ecosystems, particularly in markets like the Czech Republic and Hungary, are reshaping how investment banking institutions provide financial advisory services. Digital platforms now support SME listings, sustainability-linked financing, and real-time market analytics. These developments underscore Eastern Europe’s growing role as an attractive frontier for cross-border investment flows. Despite challenges from the ongoing Russia-Ukraine conflict and inflationary pressures, the sector’s resilience highlights its adaptability to economic volatility and policy shifts.

Drivers & Restraints: Balancing Privatization Momentum with Geopolitical Headwinds

Strong Privatization Programs and Corporate Restructuring Drive Market Expansion

A major growth catalyst for the Eastern Europe investment banking industry is the region’s privatization momentum. Countries such as Poland and Romania are divesting stakes in state-owned enterprises (SOEs), attracting major investment banks to provide advisory and underwriting services. For example, Poland’s renewed focus on public offerings and infrastructure bond programs has drawn attention from international players seeking to capitalize on local debt and equity capital market opportunities. Similarly, regional corporates are increasingly restructuring operations to improve governance and transparency, leading to stronger demand for restructuring advisory and debt capital solutions.

Geopolitical Risks and Inflationary Pressures Temper Transaction Volumes

While growth potential is evident, persistent geopolitical tensions have constrained large-scale deal-making across Eastern Europe. The prolonged conflict in Ukraine has disrupted regional capital flows and reduced foreign direct investment (FDI) in risk-sensitive sectors. Additionally, inflationary conditions and rising interest rates have dampened corporate borrowing appetite, limiting activity within debt capital markets. Market volatility has led investment banks to focus on defensive sectors such as energy infrastructure and defense manufacturing, where transaction visibility remains relatively higher.

Trends & Opportunities: Fintech Transformation and Cross-Border Deal Integration

Fintech Integration Reshaping Investment Banking Ecosystem

The integration of fintech into investment banking operations marks a pivotal shift across Eastern Europe. Regional banks are collaborating with digital solution providers to streamline securities issuance, automate client onboarding, and enhance ESG data reporting. Fintech platforms are increasingly supporting secondary trading and liquidity management for mid-cap corporates, an area previously underdeveloped. This evolution aligns with broader EU financial digitalization objectives, supported by frameworks such as the European Commission’s Capital Markets Union, which promotes efficient capital mobility across the continent.

Cross-Border merger and acquisition Advisory Creates Competitive Advantage

The expansion of cross-border mergers and acquisitions is generating substantial opportunity for international and domestic banks alike. Central and Eastern European corporates are targeting partnerships with Western European investors to accelerate technology transfer and market access. For instance, advisory firms are facilitating acquisitions in the renewable energy and telecom sectors, positioning Eastern Europe as a strategic bridge between EU and Eurasian markets. These transactions underscore the demand for specialized merger and acquisition advisory and asset and wealth management-linked investment banking services.

Regional Analysis by Country

-

Russia Investment Banking Market

The Russia Investment Banking Market is marked by high volatility due to ongoing geopolitical tensions and sanctions. Domestic institutions continue to focus on sovereign debt issuance and local corporate restructuring, while foreign participation remains limited. However, emerging sectors such as commodities, energy logistics, and domestic fintech are sustaining deal activity at a measured pace.

-

Poland Investment Banking Market

The Poland Investment Banking Market stands as Eastern Europe’s most active hub, driven by robust IPO pipelines, government privatizations, and EU-backed funding mechanisms. Warsaw’s capital market is increasingly recognized as a regional leader in ESG-linked bond issuance and merger and acquisition activity. Strong institutional stability and pro-market reforms continue to attract cross-border investors and multinational corporations.

Competitive Landscape: Consolidation and Regional Integration Redefine Competition

The Eastern Europe investment banking sector is witnessing consolidation as local players merge to enhance capital strength and regional footprint. A notable example is the merger between Intesa Sanpaolo Bank Romania and First Bank (October 2025), signaling increased collaboration between European and local institutions. This consolidation trend underscores a strategy to develop regional cross-border merger and acquisition advisory platforms, enabling consistent execution across diverse regulatory jurisdictions.

Furthermore, global banks are expanding ESG-linked debt advisory services to align with both EU sustainability directives and domestic market demand. The competitive environment now favors banks capable of integrating technology with advisory, offering end-to-end solutions encompassing debt issuance, equity placements, and asset advisory. As Eastern Europe deepens its participation in regional financial integration, investment banks with diversified service portfolios are well-positioned to capture long-term growth opportunities.