Corporate Banking Amid Regulatory Evolution in Europe: Balancing Innovation with Compliance

In 2025, the Europe Corporate Banking Market stands at an estimated USD 533.6 billion and is projected to grow to USD 666.7 billion by 2033, reflecting a CAGR of approximately 2.8 %. This outlook captures a corporate banking ecosystem in flux: regulatory pressures from evolving EU directives, banks racing to modernize digital platforms, and corporates demanding seamless treasury, trade finance, and risk-management services. PSD2 and open banking rules have opened APIs, enabling banks to deliver real-time cash management, account information services, and third-party integrations.

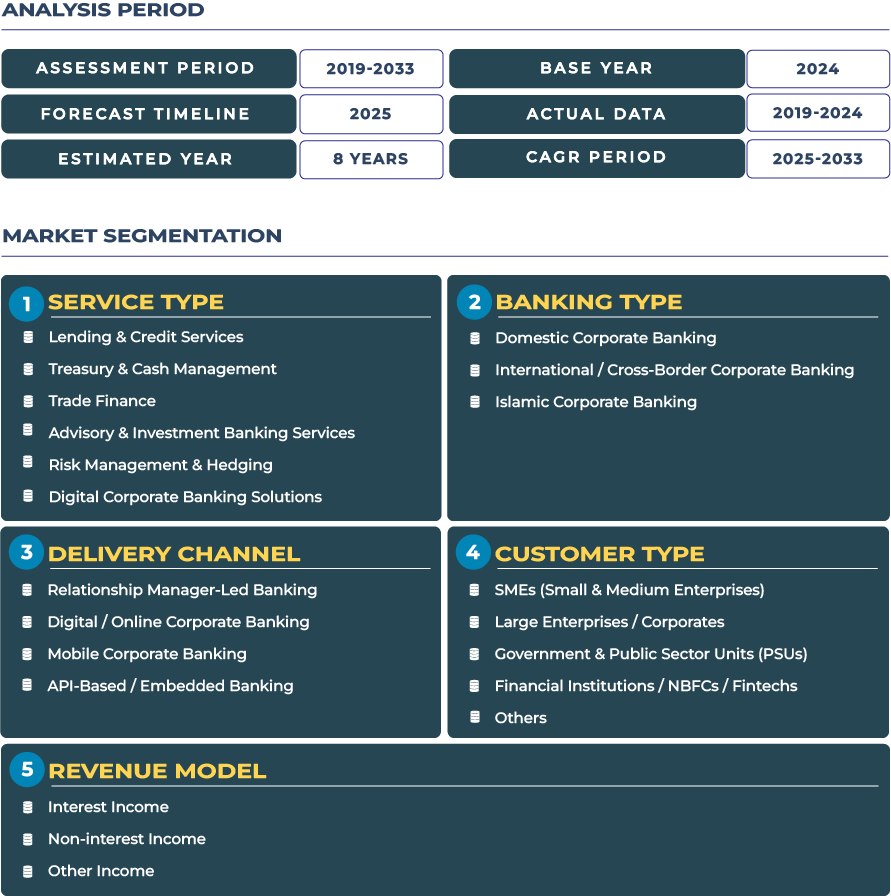

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

At the same time, ESG regulation, especially under the European Banking Authority and new mandates, forces banks to embed sustainability into credit risk models, product development, and reporting frameworks. Clients now expect banking partners to be as much compliance advisors as product providers. The CAGR may seem modest relative to emerging markets, but it reflects maturity in Europe: growth will come not from expanding volumes alone but from increased value per client, deeper digital engagement, and compliance-driven product innovation.

Drivers & Restraints: Forces Shaping Europe Corporate Banking Growth Trajectory

Why Europe Corporate Banking Sector Continues to Grow: Sustainability Loans, Cross-Border Activity & Advanced Treasury Needs

One of the strongest growth drivers in Europe corporate banking industry is the increasing corporate demand for sustainability-linked loans (SLLs) and green finance. Banks are integrating ESG KPIs into loan pricing, and many corporate clients now demand that their financing be tied to measurable sustainability outcomes. The European Banking Authority reports that a growing number of banks (74% in the NFC segment) offer performance-based sustainability-linked loans, and proceeds-based green loans are offered by 88 % of banks.

Cross-border trade within the EU and across Europe remains a major driver. Corporates operating in multiple jurisdictions seek centralized cash management, corporate credit lines that cross borders, and FX hedging spread across subsidiaries. As supply chains internal to Europe re-configure due to geopolitical tensions, corporate treasurers rely heavily on regional banks to deliver seamless solutions. Lending by EU/EEA banks to non-financial corporations (NFCs) rose by approximately EUR 90 billion year-on-year to EUR 6.4 trillion as of December 2024, indicating sustained corporate financing demand despite macro uncertainty.

Large corporates in sectors such as energy, manufacturing, and transport are demanding sophisticated treasury functions: real-time liquidity pooling, intra-company cash sweeping, centralized receivables and payables modules, and risk management tools. As corporates consolidate treasury hubs, banks that can deliver robust digital platforms and API-driven solutions are well positioned to monetize treasury and cash management services beyond traditional interest margins.

Key Challenges: Fragmented Regulation, SEPA/Settlement Friction & Divergent Digital Adoption

Despite growth tailwinds, the Europe corporate banking sector faces headwinds. One significant challenge is fragmented regulatory implementation across EU 27. Although directives such as PSD2, Digital Operational Resilience Act (DORA), and the Capital Requirements Regulation (CRR III) aim to harmonize regulatory frameworks, national deviations, delays in implementation, and variations in enforcement create complexity for banks operating across Europe. Banks must manage compliance in multiple jurisdictions, increasing cost and slowing rollout of unified corporate platforms.

Another friction point is settlement latency and interoperability challenges in SEPA and instant payments infrastructure. While SEPA has unified euro payments, corporate clients demanding instant settlement across regions still face delays or processing gaps that reduce the usefulness of real-time cash management tools. These infrastructure limitations hamper the delivery of seamless treasury and receivables/payables solutions across borders.

Moreover, uneven digital adoption across Eastern and Western Europe means banks in newer EU members may lag behind in offering advanced API treasury or trade finance platforms. Corporates in those regions may not benefit from the same level of digital corporate banking, slowing overall market growth. SMEs in some countries continue to be underserved due to lack of digital onboarding and formal credit data for underwriting.

Trends & Opportunities: Where European Corporate Banking Will Evolve

Open Banking 2.0, ESG Financing & Centralization: The Innovation Frontier

PSD2 and open banking have matured. Banks are moving from compliance to value creation, embedding APIs not just for account information and payments but for corporate liquidity hubs, real-time working capital optimization, and integration of cash management into ERP systems. Banks are developing Open Banking 2.0 initiatives that integrate analytics, treasury dashboards, and ESG reporting into corporate banking suites. This trend is accelerating adoption of APIs as core revenue drivers.

Sustainability-linked lending is rapidly becoming mainstream. Banks are bundling ESG advisory, risk-management, and loan structuring into integrated offers. The European Banking Authority is pushing banks to deepen ESG risk reporting, scenario modeling and transparency, which will drive further product innovation and increase demand for ESG-linked facilities.

Another trend is centralized treasury hubs. Many corporates are moving treasury operations to EU centers (e.g. Frankfurt, Luxembourg) to centralize cash pooling, intercompany netting, trade finance approvals, and risk hedging. Banks that offer pan-European treasury platforms backed by compliance and analytics will win clients seeking efficiency and liquidity optimization across borders.

Key Growth Opportunities: Digital Cash Pooling, ESG Syndicated Loans & Cross-Border Receivables Financing

European banks should prioritize pan-European digital cash pooling solutions: cross-jurisdiction sweeping, notional pooling, and real-time cash visibility will be critical as corporates consolidate treasury. These platforms can drive fee income, increase stickiness, and deepen client relationships.

ESG-linked syndicated loan platforms also represent a massive opportunity. Large corporates issuing syndicated facilities want ESG certification, KPI monitoring, and reporting baked into the loans. Banks that can coordinate pan-European ESG underwriting, audit compliance, and syndication will differentiate.

Cross-border receivables financing is another high potential area. As intra-Europe supply chains deepen, corporates often require receivables financing across borders. Banks offering integrated corporate receivables financing tied to treasury platforms and FX hedging will capture new volumes in working capital finance.

Regional Analysis by Country

Western Europe

In Western Europe, corporate banking remains dominated by Germany, France, Benelux, and the UK. Strong SME economies, cross-border trade in the eurozone, and corporate appetite for ESG financing have driven demand for digital cash management, syndicated lending, and green finance. Corporates in Germany increasingly adopt centralized treasury hubs in Frankfurt; French banks are expanding ESG product suites tied to syndicated loans; UK banks continue to lead in trade finance and FX derivatives, despite regulatory uncertainty post-Brexit.

Eastern Europe

Eastern Europe is catching up rapidly. Corporates in Poland, Russia, and Rest of Eastern Europe are demanding digital onboarding and API-based corporate banking platforms. Though regulatory divergence and uneven infrastructure slow rollout, local banks are partnering with fintechs and regional players to deliver receivables financing, trade finance, and cash management across the region. As those markets mature, Eastern Europe represents one of the fastest growth corridors in Europe corporate banking ecosystem.

Competitive Landscape: Leading Players & Strategies Rewriting Europe Corporate Banking

Major European players such as BNP Paribas Fortis and Commerzbank are aggressively expanding corporate banking suites. BNP Paribas Fortis is packaging ESG-linked syndicated loans, centralized cash pooling, and open banking APIs for large corporates. Commerzbank emphasizes cross-border trade finance and API-integrated liquidity platforms for German exporters.

To remain competitive, banks are adopting strategies such as:

- Building pan-European API treasury hubs that integrate cash management, receivables, and trade finance into one standardized platform across multiple geographies.

- Standardizing ESG financing product suites that can be syndicated, reported, and monitored across jurisdictions to meet EU regulatory and corporate demands.

- Offering centralized receivables financing and payables solutions for corporates operating in multiple EU countries to reduce working capital and improve liquidity.

- Investing in digital onboarding to scale SME access, risk scoring, and treasury modules embedded in corporate ERPs.

These strategic directions allow European banks to differentiate not just by credit availability, but by depth of integration, compliance, and value-added services embedded in the corporate banking stack.