Europe InsurTech Market: Open Europe’s ESG & Cloud-Native Market Moving toward Cross-Border Digital MGAs and Climate-Aware Underwriting

The European InsurTech landscape is rapidly evolving as an open, ESG-driven and cloud-native market. Under pressure from regulatory frameworks and shifting customer expectations, insurance providers are adopting cross-border digital Managing General Agents (MGAs), climate-aware underwriting models, and sustainable product offerings. ESG compliance, particularly under EU Sustainable Finance regulations, is no longer optional. The demand for transparency in underwriting, the integration of climate risk data into pricing, and operating models that are cloud-first are reshaping the way life, health, property & casualty, travel, and specialty insurance are conceived and delivered. This evolution is intersecting with growing interest in pan-European SME cyber bundles and risk sharing, as capitals across Europe confront more frequent natural perils and more stringent sustainability mandates.

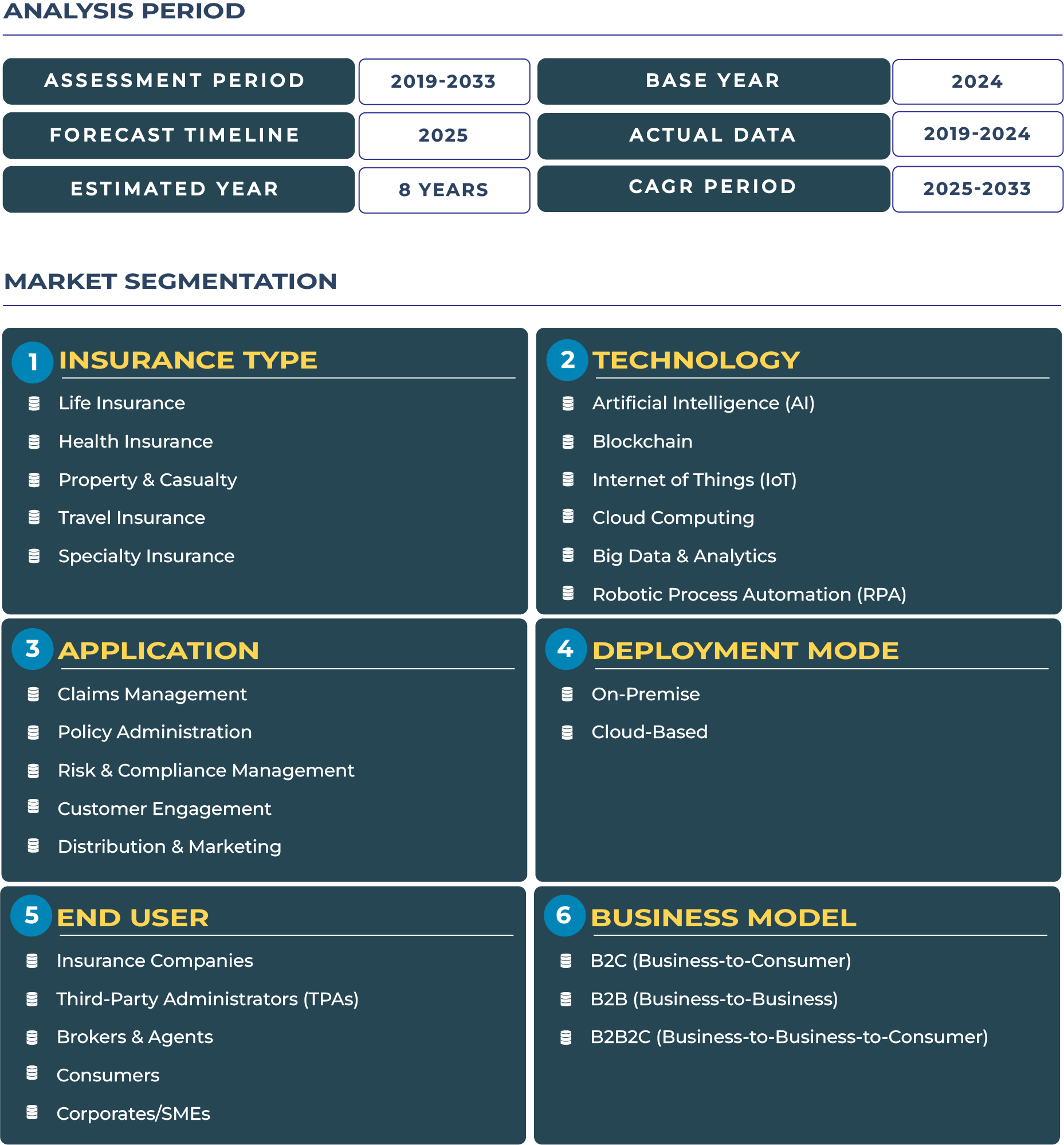

According to market forecasts, the Europe InsurTech market is expected to grow from USD 3.50 billion in 2025 to USD 24.96 billion by 2033, with a CAGR of 27.8% over that period. This trajectory reflects strong tailwinds: increased investment in climate risk analytics, regulatory momentum (e.g., SFDR, AI regulation, and new digital finance laws), widespread adoption of cloud-native insurance platforms that reduce legacy burdens, and rising customer demand for sustainable, usage-based, and more personalized protections. At the same time, political uncertainty (e.g. around cross-border regulation post-Brexit), inflation, and rising reinsurance costs present headwinds. Still, the combined strength of regulatory alignment, technology infrastructure, and evolving customer willingness to pay for ESG-aligned risk coverage gives Europe a strong foundation for accelerating InsurTech innovation.

Drivers & Restraints: Harnessing ESG and Cloud, while Navigating Liability & Complexity

Driving Factors: From ESG Mandates to Cloud-Native Platforms

A major driver is the push toward sustainable and ESG-linked insurance products. The EU’s Sustainable Finance Disclosure Regulation (SFDR), Corporate Sustainability Reporting Directive (CSRD), and the taxonomy for sustainable economic activities require insurers to not only report on ESG metrics but often to embed social and environmental risk into product design. This has led to more climate-aware underwriting (e.g., pricing that reflects flood risk, wildfire risk, carbon intensity) across property & casualty; also, life and health insurers are increasingly offering wellness and preventive programs aligned with environmental or social outcome goals.

Another key enabler is the proliferation of cloud-native core insurance platforms, which reduce friction associated with legacy systems and enable faster product launches, better data analytics integration, and more modular, scalable risk engines. With the EU’s push for digital finance, open banking/data frameworks, and regulations like GDPR enforcing strong data protection, these platforms ensure that data handling, identity verification, and customer privacy can be managed securely and efficiently. For example, the growing use of e-KYC and identity verification services tightly integrated with cloud infrastructure supports both speed and compliance.

Restraints: Cross-Border Regulatory Frictions & Elevated Model Governance Overheads

Despite these strengths, several constraints limit growth or slow innovation. Cross-border passporting frictions, especially after Brexit, remain an obstacle for smaller MGAs or startups attempting to scale across EU member states. Differences in product regulation, distribution licensing, and supervisory oversight continue to require localization, which increases cost and time to market. Also, evolving rules around AI liability (e.g. requirements for explainability, high-risk AI usage, transparency) mean that implementing models for underwriting or claims automation faces elevated governance overheads, higher audit, validation, and compliance costs.

Another restraint is the rising cost of reinsurance, particularly for coverage of climate perils, which pushes attachment points higher and may make some insurance products unaffordable in certain high-risk regions unless underwritten carefully with parametric triggers or loss mitigation built in. Inflation (both general and input inflation in construction, health care, etc.) also erodes margins unless pricing can keep up, which is difficult in highly competitive markets with regulatory caps or customer resistance to price rises.

Trends & Opportunities: Carbon Scoring, Digital MGAs, SME Bundles, and More

Trends Reshaping Product and Distribution Innovation

One of the emerging trends is the integration of carbon-footprint scoring into premium calculations. Insurers are refining risk models to factor in emissions or environmental behavior (e.g., low emissions homes, sustainable farming practices) as inputs to pricing. Another is the rise of cross-border digital MGAs specializing in climate risk, cyber risk for SMEs, and embedded insurance. These MGAs rely on modular tech stacks and cloud platforms, enabling them to underwrite or distribute products across multiple jurisdictions with regulatory compliance baked in.

Usage-based and subscription insurance models are also expanding. Travel, mobility, device protection, and even health or wellness add-ons are being delivered as monthly or pay-as-you-use subscriptions, rather than annual or fixed term policies. Embedded insurance (insurance offered at point of sale of non-insurance goods or services) is growing rapidly, especially via e-commerce, mobility, and logistics platforms. Also, there is growing interest in bundling coverage for SMEs across multiple perils—cyber, business interruption, property—under single-pane admin platforms to simplify procurement and claims.

Opportunities for Pan-European Innovation and Risk Pooling

There are strong opportunities in packaging multi-country SME cyber bundles, where a single product can be sold across EU states with local adaptation primarily in regulation and claims handling. Also affinity programs targeting cross-border professional services (consultants, digital firms, freelancers) offer scale and relatively uniform risk profiles. There is opportunity in specialty climate-linked products, parametric triggers for extreme weather, flood, storms, drought, especially in southern Europe. The specialty insurance market also can expand, providing coverage for renewable energy asset performance, carbon capture, nature-based solutions. Health-linked products emphasizing preventive care and wellness (including mental health) linked with behavior or environment are another opportunity area.

Government Regulation: ESG Rules, AI Act, GDPR, and Financial Data Strategy Steering the Industry

The regulatory landscape is central to Europe’s InsurTech transformation. GDPR remains foundational for personal data protection and is strictly enforced. Beyond that, the EU’s AI Act is shaping how insurers can deploy AI in underwriting and claims, classifying many use cases as “high risk” and demanding transparency, auditability, and model governance. Regulations like the SFDR, CSRD, EU taxonomy, and Digital Operational Resilience Act (DORA) impose requirements around sustainability reporting, environmental risk, operational resilience, and cyber risks. Together, these frameworks are not only compliance burdens but also competitive differentiators, as firms that exceed regulatory expectations often earn customer trust, regulatory flexibility, and partnership opportunities.

Key Impacting Factors: Cost of Capital, Climate Risk, Data Protection, and Consumer Trust

Insurance penetration remains uneven across Europe; countries with higher per capita income and mature digital infrastructure (UK, Germany, Nordics) tend to adopt InsurTech innovations faster. The cost of capital—especially given increased risk from climate change and geopolitical instability—affects reinsurance pricing, investment in innovation, and startup viability. Data protection (via GDPR and local data protection laws) has high importance, both for compliance and for maintaining consumer trust. Also, customer expectations about transparency, speed of claims, personalization, and sustainability are high; those InsurTech players who fail to deliver on these dimensions risk reputational damage or regulatory scrutiny.

Regional Analysis by Country

- UK: Strong in identity & subscription-insurance models; high regulatory maturity via the FCA; embedded insurance expansions; Brexit complicates some cross-border licensing.

- Germany: Advanced cloud platform adoption; strong digital identity infrastructure; high reinsurance costs for P&C climate risks; BaFin scrutiny on usage-based models.

- France: Embedded travel & insurance bundles; health / wellness add-ons tied to ESG; regulation by ACPR and EU SFDR pushing sustainable product design.

- Italy: Growth in specialty insurance (cultural heritage, tourism), SME-focused digital platforms; IVASS oversight and alignment with EU ESG and digital finance rules.

- Spain: Parametric agriculture and drought risk; mobility and logistics embedded insurance; DGSFP and open data initiatives enabling product innovation.

- Benelux: Municipal flood parametrics; sustainability rating integration; identity & digital wallet usage; regulators coordinating ESG practices.

- Nordics: On-demand mobility/travel; climate risk analytics; strong digital trust and public digital ID infrastructure helping rapid scaling; regulatory frameworks in Sweden, Denmark, Finland aligned with EU ESG policy.

- Russia & Poland: (if included) Poland is seeing rising SME digital insurance uptake; Russia faces geopolitical risk, regulatory uncertainty, and capital restrictions making InsurTech scaling more challenging.

Competitive Landscape: Wefox, Octo Telematics, and Neo-Insurers Leading Cross-Border Innovation

Several InsurTech players are distinguishing themselves through pan-European scale and ESG- or cloud-native innovations. Wefox Group, for example, operates across Germany, Austria, Italy, and Spain, providing digital platform-based insurance leveraging agent networks, cloud infrastructure, and emerging embedded models. Octo Telematics is another leader in usage-based auto insurance via telematics; its fleet and mobility data services support embedded policies and risk scoring across multiple European markets. Neo-insurers and digital platforms like INZMO and Clark are expanding cross-border through modular product architectures and leveraging digital identity / e-KYC services to streamline onboarding. These firms are also among those experimenting with climate-aware underwriting, carbon scoring, and parametric insurance pilots. Strategic partnerships between insurers, reinsurers, tech providers, and public/private entities are increasingly central to competitive advantage.

Conclusion: ESG, Cloud-Native Platforms, and Cross-Border MGAs Will Define Europe’s InsurTech Decade

Europe’s InsurTech market is entering a stage where size targets are ambitious, but quality, compliance, sustainability, and customer trust will determine success. The forecasted growth points to strong market momentum. However, this will only yield durable returns for players who align product innovation with regulatory requirements (ESG, AI, data privacy), invest in cloud-native, modular tech stacks, and prioritize identity verification and customer experience.

Cross-border digital MGAs, climate-aware underwriting, and ESG-linked product features offer major upside. Meanwhile, risks from high reinsurance costs, regulation complexity, inflation, and inconsistent licensing regimes remain. The competitive edge will belong to those who can operate at scale across multiple jurisdictions, manage model governance effectively, and deliver sustainable value. As Europe embraces open finance, digital identity, and ESG mandates, the InsurTech sector has a clear path to becoming not just larger, but more resilient, ethical, and deeply integrated into how society manages risk in an era of climate change and technological disruption.