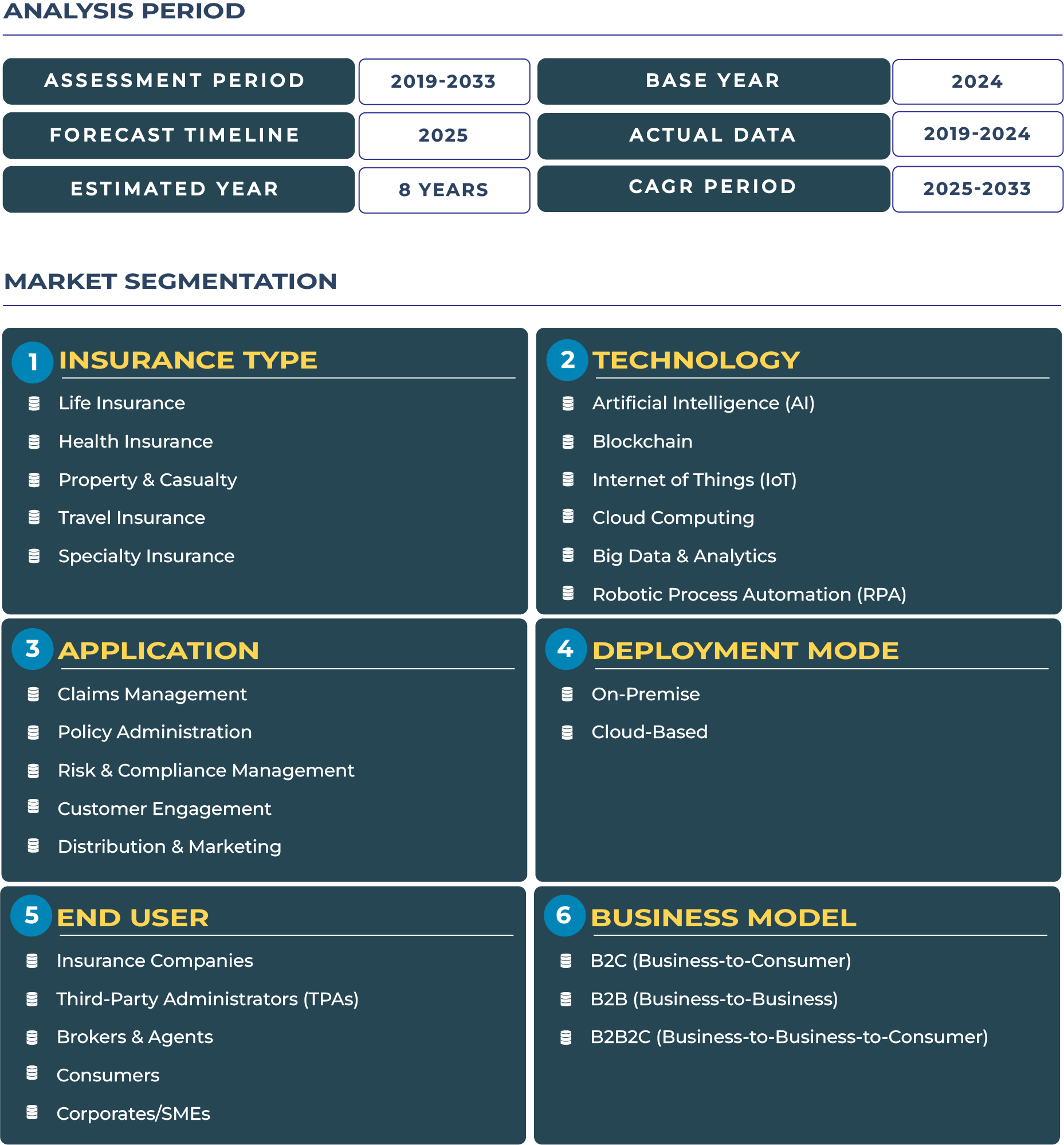

Germany InsurTech Market: Scaling RPA, Corporate Wellness Insurance, and Cybersecurity-Led Growth

Germany has long stood at the intersection of industrial resilience and digital innovation, and its InsurTech industry is no exception. As the nation increasingly aligns automation with corporate wellness insurance, Germany’s insurtech ecosystem is shaping new pathways for insurers, startups, and policyholders alike. The current trajectory places emphasis on robotic process automation (RPA) in claims handling, alongside partnerships for workplace wellness coverage, particularly benefiting expatriates and employees in manufacturing sectors. With Germany’s strong cybersecurity posture, industrial IoT-linked insurance offerings and secure telehealth integrations are also gaining traction, making the country a strategic hub in Europe’s digital insurance transformation.

Market Outlook: Robust Expansion Driven by RPA and Corporate Wellness Insurance

Germany’s InsurTech market is set to expand rapidly, with the market projected to grow from USD 666.2 million in 2025 to USD 4,906.4 million by 2033, reflecting a CAGR of 28.3% between 2025 and 2033. The growth trajectory highlights not just strong consumer adoption but also significant institutional engagement across the insurance value chain. Manufacturing-heavy regions such as Bavaria and Baden-Württemberg are driving adoption of industrial IoT-linked property and casualty insurance. Meanwhile, urban centers such as Berlin and Munich are strengthening health and life insurance adoption through wellness-integrated platforms.

The post-pandemic emphasis on employee well-being has accelerated demand for workplace wellness insurance, offering employees coverage for both preventive and digital health services. RPA is simultaneously being deployed to streamline claims processing, cutting operational inefficiencies and delivering faster settlements. This dual focus—corporate wellness and automation—aligns with Germany’s long-term industrial and social protection policies, supported by the country’s disciplined regulatory approach. Despite macroeconomic pressures from geopolitical tensions in Europe and supply chain disruptions, insurers and startups are finding resilience through technology-driven efficiencies and demand for transparent, customer-first insurance solutions.

Drivers & Restraints: Factors Defining Market Acceleration and Challenges

Automation and Pension Innovation Fuel Growth Momentum

A key driver of the German InsurTech sector is the integration of RPA in claims and underwriting. Insurers are investing heavily in automated systems that not only reduce human error but also lower operational costs. The push for digital pension and retirement solutions further enhances growth, particularly given Germany’s aging population and its reliance on long-term life and health policies. Startups are introducing mobile-first platforms that allow retirees and employees to seamlessly manage pensions, while insurers are offering bundled financial wellness packages. These developments support broader adoption across corporate clients and individuals, with demand reinforced by Germany’s strong labor laws and employee protection frameworks.

Labor Oversight and Technical Standards Hamper Rapid Scaling

On the flip side, the InsurTech landscape in Germany faces structural challenges. Works councils, which protect employee rights, complicate rapid digital operating-model transitions, especially in larger insurers. Strict evidentiary standards for telematics in auto insurance also raise compliance hurdles, with device calibration and validation creating additional costs. Moreover, inflationary pressures on claims—particularly in property and casualty insurance—are eroding margins for smaller startups. Regulatory scrutiny, while ensuring transparency, has also increased compliance costs, requiring startups to invest heavily in audit trails and explainable systems, slowing down their speed to market.

Trends & Opportunities: From Workplace Wellness to Industrial IoT Insurance

Workplace Wellness and Cyber-Risk Aggregation Redefining Insurance Models

Germany’s corporate landscape is seeing growing institutionalization of wellness-insurance partnerships. Employers are collaborating with insurtech startups to embed health monitoring and preventive wellness into corporate insurance policies, aligning with EU and national labor safety frameworks. This trend is particularly visible in Berlin and Frankfurt, where digital-first wellness insurance solutions are being bundled with employee benefits. Parallelly, with rising cyberattacks targeting SMEs, demand for cyber-risk aggregation services is growing. Insurtech startups are offering real-time cyber monitoring with risk-adjusted premium models, making cyber-insurance more accessible and tailored for small businesses.

Industrial IoT Insurance and Expatriate Health Platforms as Untapped Opportunities

Germany’s manufacturing dominance provides a unique opportunity for industrial IoT insurance. Insurtech startups are exploring connected device data from production lines to offer predictive maintenance insurance, reducing unplanned downtime and claims. This model is particularly appealing to mid-sized manufacturers in North Rhine-Westphalia. Additionally, Germany’s position as a global hub for expatriates is fueling opportunities in cross-border health platforms. Insurers and startups are experimenting with multi-jurisdiction claims handling systems that integrate with EU-wide health networks, making expatriate coverage seamless, compliant, and digitally managed.

Government Regulation: Strong Oversight with Digitalization Incentives

The Federal Financial Supervisory Authority (BaFin) plays a pivotal role in regulating Germany’s digital insurance market. BaFin’s strong emphasis on consumer transparency and fair treatment has made compliance a central pillar for InsurTechs. Meanwhile, national digitalization strategies and the EU’s Digital Finance Package are enabling innovation in insurance APIs and data sharing. These frameworks create a balanced ecosystem where innovation thrives within well-defined guardrails. However, regulatory adherence requires substantial investment in compliance technology, especially for smaller InsurTech players seeking to scale rapidly.

Key Impacting Factors: How Talent and Cybersecurity Shape the Ecosystem

The availability of tech talent and Germany’s high ranking in the EU Digital Economy and Society Index are accelerating growth of the InsurTech industry. Berlin and Munich have emerged as startup hotspots, attracting both domestic and international venture capital. Equally critical is Germany’s cybersecurity posture, which is among the strongest in Europe. With cyber insurance becoming mainstream, insurers are leveraging this readiness to integrate secure digital platforms, telehealth services, and real-time cyber monitoring. These factors combined make Germany a favorable environment for scalable and sustainable InsurTech solutions.

Competitive Landscape: Telehealth Integration and New Insurance Distribution Models

The competitive landscape of Germany’s insurtech market is marked by strong local players and innovative collaborations. Companies such as wefox have pioneered digital insurance distribution models, while global players are strengthening their German presence. In 2024–25, insurers and startups accelerated telehealth integration into health and life products, reflecting both consumer demand and regulatory approval for digital health services. Digital bancassurance models are also expanding, with banks and insurtechs collaborating on app-based distribution using APIs. Partnerships in this space provide customers seamless access to insurance directly within their existing financial apps, reinforcing cross-industry convergence.

Conclusion: Germany’s InsurTech Industry Positioned for a Decade of Automated, Wellness-Oriented Growth

Germany’s InsurTech market stands at the cusp of transformative growth, driven by robotic process automation, corporate wellness partnerships, industrial IoT insurance, and telehealth-enabled offerings. Despite structural challenges such as labor oversight and stringent technical standards, the market’s fundamentals remain robust. Regulatory frameworks ensure transparency and consumer protection, while cybersecurity readiness and access to skilled tech talent continue to attract capital inflows and partnerships. InsurTech providers who align with Germany’s industrial heritage, wellness-driven culture, and digital-first economy will find long-term, scalable opportunities. The ecosystem is moving towards a future where insurance is not just reactive but preventive, embedded, and automated—reshaping the very definition of protection in a digital age.