Hong Kong Electric Vehicle Battery Market Growth and Performance

- The growing transition towards electric mobility led to a XX% rise in the EV battery market in the Hong Kong in 2024, bringing the total market size to US$ XX million.

- Over the forecast period ending in 2033, the market is anticipated to grow at a CAGR of XX%, ultimately reaching a value of US$ XX million.

Hong Kong Electric Vehicle Battery Market Outlook

Hong Kong is steadily positioning itself as a strategic node in Asia's electric vehicle battery ecosystem—not by sheer production volume, but through financial ingenuity and regulatory flexibility. The city’s role is being redefined not as a manufacturer, but as a capital conduit and innovation amplifier for EV battery giants seeking global scalability. Its well-established financial markets, international investor access, and proximity to mainland China make it a natural choice for companies that want to navigate geopolitical uncertainty while maintaining access to global funds.

This backdrop sets the stage for China’s leading EV battery manufacturer to pursue an ambitious capital-raising move in Hong Kong. The approval granted in April 2025 for CATL's IPO in the city wasn’t just about listing shares—it was a calculated maneuver to establish a financial beachhead outside mainland China. By doing so, CATL and others are looking to fortify their global footprint, attract institutional investment from the West, and signal trust in Hong Kong’s regulatory clarity. It reflects a forward-looking trend: Hong Kong is increasingly becoming the financial “charge port” for electrification ventures eyeing global scale.

Hong Kong Electric Vehicle Battery Market Drivers

Hong Kong’s battery sector is being driven by a confluence of pragmatic urban needs and future-oriented infrastructure strategy. The region’s high vehicle density, space constraints, and pressure to meet carbon neutrality targets by 2050 have accelerated demand for innovative battery solutions. Here, traditional EV charging models are being re-evaluated in favor of modular, efficient alternatives that can better suit Hong Kong’s fast-paced, space-limited environment.A notable driver is the rise of battery swapping technology as a practical solution for electric fleets and last-mile logistics operators. In March 2025, Visionary Mobility’s strategic collaboration with PEGASUS International wasn’t just a business expansion—it was a response to systemic urban mobility pain points. Their investment in battery swap stations reflects a desire to minimize EV downtime, decouple energy supply from fixed charging points, and offer scalable energy access to high-usage commercial EVs. This development is being framed as a backbone infrastructure project—paving the way for real-time energy management and operational efficiency for transport operators in Hong Kong.

Hong Kong Electric Vehicle Battery Industry Trends

There is a notable shift in how Hong Kong is being perceived by global EV stakeholders: from a high-end EV consumption market to a vital hub for battery-related financial and technological expansion. Industry stakeholders are now treating Hong Kong not merely as a transit economy, but as a launchpad for regional and global ambitions.This repositioning is especially evident in the growing appetite among Chinese battery giants to use Hong Kong as their international capital raising center. According to a February 2025 industry intelligence briefing, multiple EV battery firms are targeting Hong Kong for primary or secondary listings. But this isn't just about stock market access. The deeper trend is strategic insulation—companies want to reduce overreliance on mainland capital markets while tapping into ESG-conscious, international funds. The city’s positioning allows these players to bridge Western investors with Eastern innovation, transforming Hong Kong into an EV battery capital market hub that supports R&D investment, regional branding, and global export strategies.

Hong Kong Electric Vehicle Battery Industry Development

As global climate goals become more urgent and electrification timelines more aggressive, Hong Kong is actively building the foundations of a future-ready battery value chain. While large-scale cell manufacturing may remain limited due to space and labor costs, the city is cultivating a high-value segment of the EV battery industry—one that blends financial services, green technology incubation, and distributed energy innovation.This maturation is underscored by Hong Kong’s ability to attract landmark battery-related IPOs, such as the upcoming CATL listing approved in April 2025. Far beyond capital accumulation, this move is expected to ignite ecosystem-level developments: from green bond issuances and investor-focused ESG products to downstream opportunities like battery recycling, smart storage systems, and AI-driven fleet energy analytics. Such developments mark the emergence of a holistic battery innovation environment—where technology, finance, and infrastructure co-evolve to meet the next frontier of mobility.

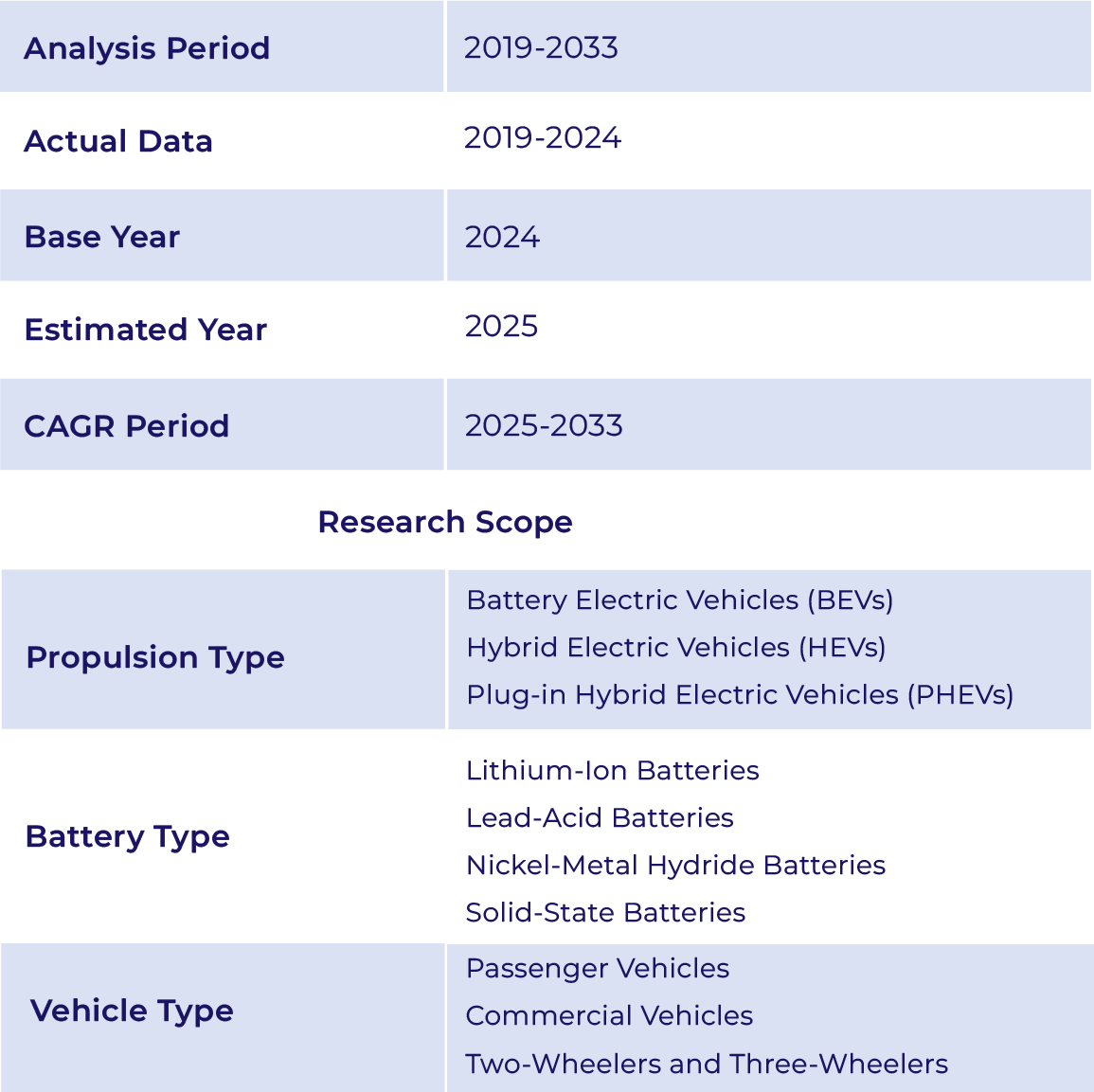

Hong Kong Electric Vehicle Battery Market Scope