India Banking Market Outlook: Embedded Finance as a Driver of Financial Inclusion

India banking market is undergoing a structural shift where embedded finance and AI-powered advisory solutions are advancing financial inclusion, particularly for underserved communities and micro, small, and medium enterprises (MSMEs). The sector is evolving from a traditional transaction-driven framework to a digitally integrated ecosystem, where wealth management, tokenized assets, and embedded financial services are transforming the banking landscape. With Reserve Bank of India spearheading digital initiatives, the nation is blending financial inclusion with advanced digital solutions such as UPI-linked embedded payments, tokenization of digital gold, and AI-based credit assessments.

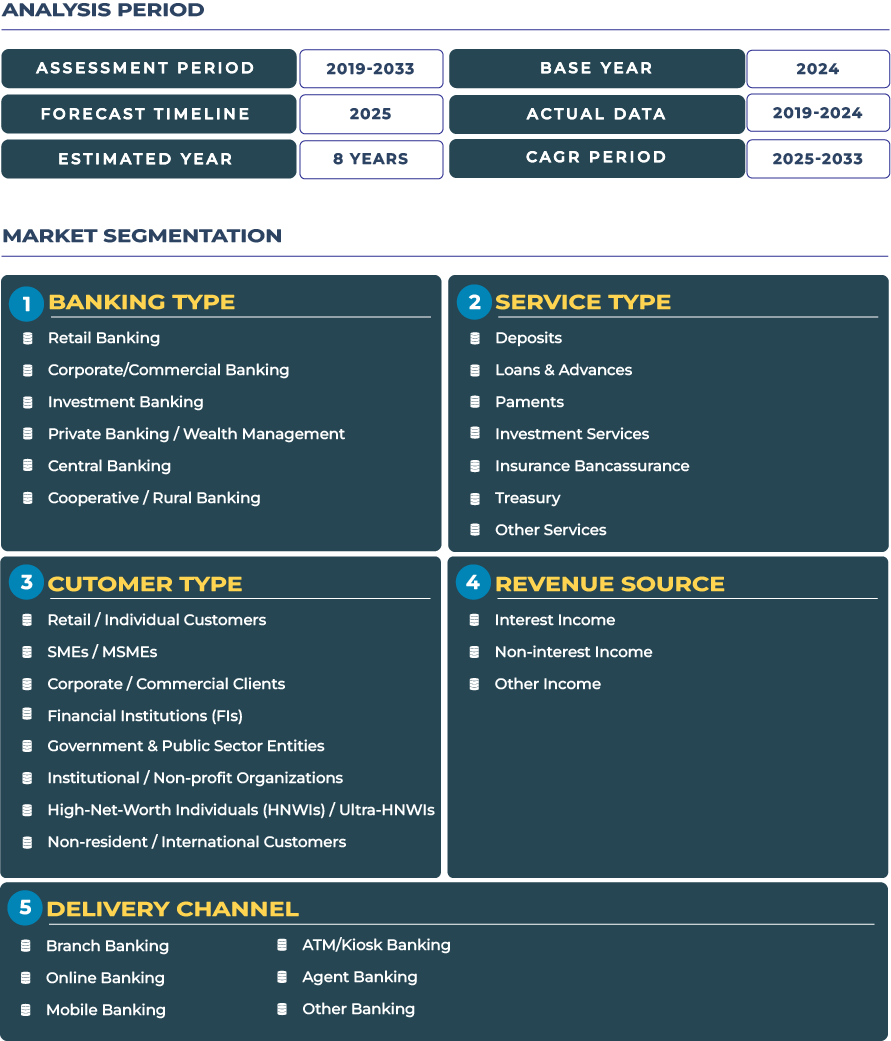

Note:* The banking market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

The India banking market is estimated at USD 396.2 billion in 2025 and projected to reach USD 622.6 billion by 2033, registering a CAGR of 5.8% (2025–2033). This sustained growth reflects a combination of regulatory reforms, embedded payment systems, cloud-driven infrastructure, and a surge in retail digital adoption. The ability of Indian banks to merge traditional customer trust with embedded solutions for MSMEs and retail clients is expected to sustain competitive advantage and create new business models. Rising geopolitical risks and global economic uncertainties have only accelerated India’s pursuit of digital resilience, underlining its importance in the regional and global banking ecosystem.

Drivers and Restraints Shaping the Growth of India’s Banking Industry

AI-Driven Data Analytics and Omnichannel Engagement Accelerating Growth

One of the most significant growth drivers for India banking sector is the adoption of AI-powered data analytics to enhance customer engagement, risk assessment, and lending. Banks are leveraging predictive analytics to expand personalized lending for MSMEs while integrating digital onboarding across omnichannel touchpoints such as mobile-first platforms, ATMs, and rural banking kiosks. Enhanced engagement through WhatsApp-based customer support and AI chatbots has positioned Indian banks as leaders in customer-centric banking innovation. The widespread adoption of UPI (Unified Payments Interface) continues to revolutionize retail banking by enabling real-time digital transactions, pushing financial inclusion to new heights.

Rising NPAs and Low Interest Rate Environments Limiting Momentum

Despite its growth trajectory, the Indian banking industry faces challenges in managing non-performing assets (NPAs) and sustaining profitability in a low interest rate environment. Public sector banks, in particular, are under pressure due to legacy loan portfolios, with NPA ratios creating balance sheet stress. Rising regulatory compliance costs, including cybersecurity obligations and capital adequacy norms, further challenge profitability. The risk of fraud in digital channels also raises concerns, as cyber threats and data breaches expand with increased digitization. These constraints necessitate stronger internal risk governance, improved digital security frameworks, and enhanced asset quality management.

Trends and Opportunities Redefining India’s Banking Landscape

Cloud-Native Banking and Real-Time Payment Infrastructure Leading Transformation

The transition to cloud-native core banking systems is becoming a cornerstone for the modernization of Indian banks. Cloud adoption enables banks to handle large-scale digital transactions, facilitate API-based ecosystems, and deliver embedded services in real-time. Cities such as Mumbai, Bengaluru, and Hyderabad are at the forefront of implementing cloud-enabled platforms, supported by collaborations with fintech players. Alongside, the deployment of real-time payments infrastructure, built around UPI 2.0 and RuPay credit card integrations, is setting global benchmarks for efficiency and interoperability in retail payments.

Digital Gold, Tokenization, and MSME Credit Advisory as Emerging Opportunities

Opportunities in the Indian banking market are increasingly centered around digital gold investment platforms and the tokenization of assets, offering a new dimension in retail wealth management. Embedded finance products are enabling youth and first-time investors to diversify into tokenized assets with minimal transaction sizes. At the same time, MSMEs are benefiting from AI-powered credit advisory services that simplify loan access, enhance risk evaluation, and optimize financial planning. These opportunities highlight how embedded finance is enabling Indian banks to expand beyond transactional roles into holistic financial advisors for individuals and businesses alike.

Government Regulation and Policy Support Driving Banking Market Resilience

The regulatory framework in India, guided by the Ministry of Finance and Reserve Bank of India, has played a pivotal role in modernizing the banking ecosystem. Initiatives such as the Digital Banking Units (DBUs), priority sector lending mandates, and new frameworks for digital lending have accelerated financial inclusion. The RBI’s emphasis on tokenization for card transactions and enhanced cybersecurity guidelines demonstrates India’s proactive approach to safeguarding consumer trust. Furthermore, initiatives under Digital India continue to build a robust environment for innovation, enabling banks to reach deeper into semi-urban and rural segments.

Key Impacting Factors Influencing the Performance of India’s Banking Sector

Several external and structural factors are influencing the trajectory of India’s banking market. Cross-border transaction volumes have surged due to globalized trade and remittance flows, with India remaining the largest global recipient of remittances. Meanwhile, the Non-Performing Asset (NPA) ratio, although improved post-2019, still impacts credit expansion in high-risk sectors. Adoption of cloud infrastructure and blockchain-based KYC systems are enabling banks to streamline compliance processes and reduce costs. The geopolitical landscape, including global oil price volatility and supply chain disruptions, also indirectly affects liquidity and credit deployment, underscoring the need for resilient risk management frameworks.

Competitive Landscape: Embedded Finance Strategies Redefining Indian Banking

The Indian banking sector is witnessing rapid transformation, driven by both public and private banks alongside international players. HDFC Bank, for instance, has expanded its embedded finance offerings by integrating BNPL solutions and digital wealth management tools to attract younger demographics (2024). State Bank of India continues to focus on rural banking digitization, while also strengthening cloud-based lending for MSMEs. International banks such as HSBC India are investing in corporate banking digitization and sustainable financing models (2024). Key strategies revolve around embedded finance adoption, AI-powered fraud detection, and the rollout of tokenized investment solutions. These initiatives demonstrate how Indian banks are aligning their digital roadmaps with evolving consumer expectations, regulatory compliance, and global best practices.

Conclusion: Embedded Finance and Digital Advisory at the Heart of India’s Banking Future

India’s banking market is not merely expanding in size but transforming in scope, where embedded finance, tokenized assets, and AI-powered advisory are redefining the banking ecosystem. The nation’s inclusive approach—driven by government-backed reforms, technological innovation, and rising mobile penetration—is bridging financial gaps and empowering both retail and corporate segments. While challenges such as NPAs, regulatory costs, and cybersecurity threats remain, the industry’s resilience is anchored in its ability to adapt to digital-first paradigms. As embedded finance deepens its role, particularly for MSMEs and rural segments, India’s banking sector will continue to emerge as a benchmark for inclusive, digital, and sustainable growth in the global financial landscape.