Indonesia In-vitro Diagnostic Market Outlook: Expanding Insurance Coverage Boosts Access and Growth Potential

Indonesia’s healthcare transformation has reached a pivotal juncture as the nation’s expanding national insurance programs reshape diagnostic access and affordability. The widening scope of BPJS Kesehatan, Indonesia’s universal healthcare insurance, is accelerating diagnostic adoption across both urban and rural communities. This trend is equally visible in the country’s in-vitro diagnostic (IVD) market, which stands as a cornerstone for precision medicine, early disease detection, and hospital-based decision-making. As healthcare infrastructure modernizes, the in-vitro diagnostic industry is evolving into a strategic pillar supporting Indonesia’s vision for equitable healthcare.

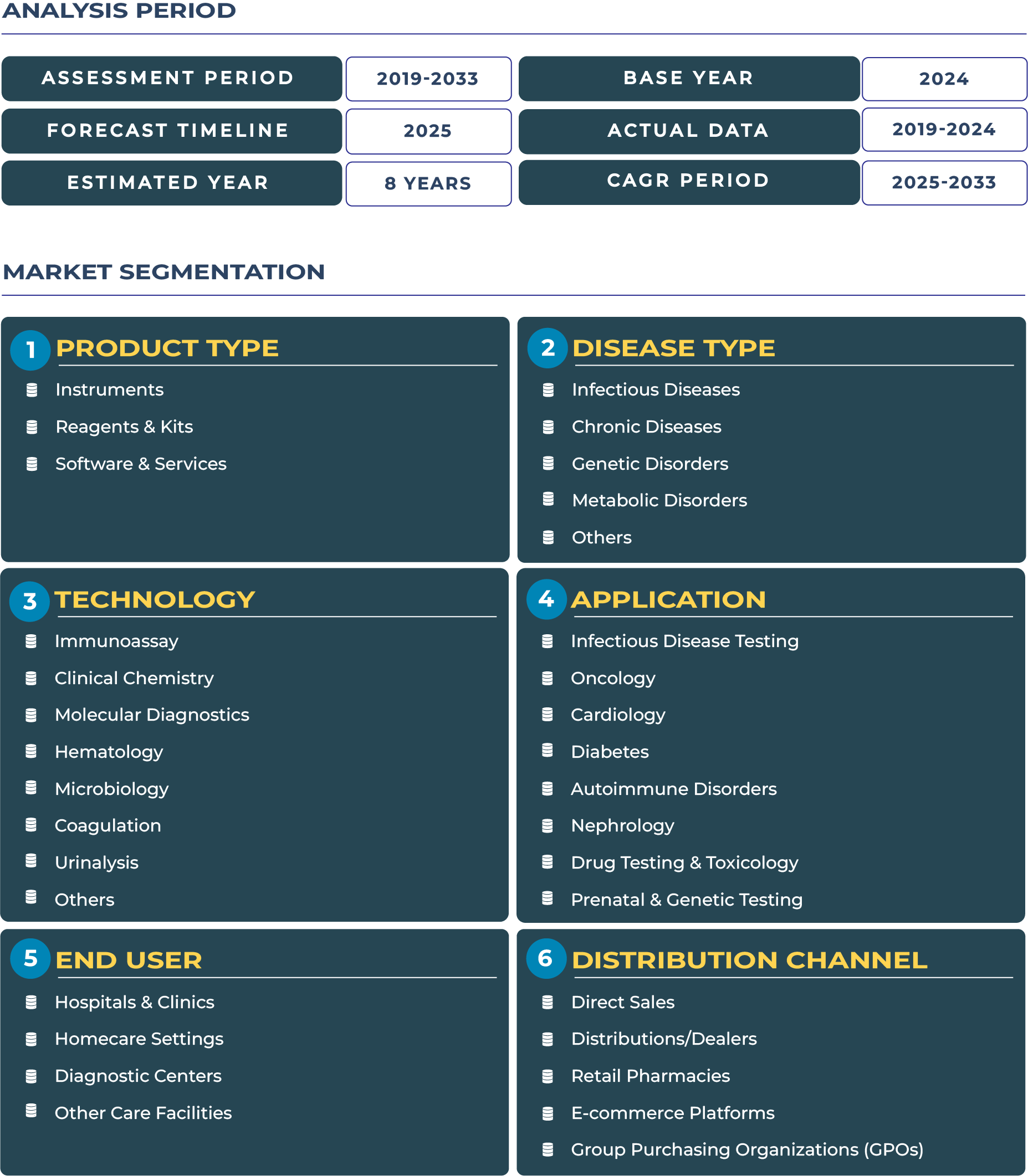

The Indonesia In-vitro Diagnostic Market is estimated at USD 2.15 billion in 2025 and is projected to reach USD 5.10 billion by 2033, growing at a healthy CAGR of 11.4% between 2025 and 2033. This remarkable growth trajectory is underpinned by government-led healthcare reforms, digital transformation in hospitals, and the surge of local manufacturing in reagents and diagnostic kits. Additionally, insurance-driven affordability is unlocking new diagnostic opportunities, particularly in rural and secondary-tier healthcare facilities.

Expanding Healthcare Access Through Insurance-Driven Diagnostics

Indonesia’s national health insurance initiative has catalyzed a substantial shift in diagnostic testing accessibility. The government’s commitment to healthcare equity through Kementerian Kesehatan Republik Indonesia has encouraged the proliferation of in-vitro diagnostic equipment in provincial hospitals and regional health centers. These facilities now increasingly deploy advanced instruments and software platforms for real-time testing and patient monitoring. Moreover, public-private collaborations have enhanced availability of affordable reagent kits, enabling faster adoption even in resource-constrained areas. As the program’s coverage widens, demand for both point-of-care and centralized laboratory testing is expected to accelerate across the country’s 17,000 islands.

Key Drivers Fueling Market Expansion Across Indonesia

Rising Healthcare Accessibility and Private Hospital Expansion Create Diagnostic Momentum

One of the principal drivers behind Indonesia IVD market is the ongoing expansion of private hospitals and specialized diagnostic centers. Facilities such as Siloam Hospitals and Mayapada Healthcare are increasingly investing in digitalized diagnostic laboratories integrated with advanced data systems. These investments are aligning with the rapid urbanization of major cities like Jakarta, Surabaya, and Medan, where high patient inflows demand accurate and rapid diagnostic solutions. Additionally, the private sector’s focus on personalized medicine is fostering partnerships with IVD software providers to enable predictive analysis and data integration.

Insurance-Linked Demand and Underpenetrated Populations Enhance Market Scope

With over 275 million citizens, Indonesia remains largely underpenetrated in clinical diagnostics, particularly in eastern regions and remote islands. The expansion of BPJS Kesehatan coverage has lowered cost barriers and introduced mass-scale preventive testing programs. Reagent and kit providers are benefiting from the volume growth of insured patients, while hospitals gain consistent testing demand through insured treatment cycles. This dynamic interplay between insurance coverage and diagnostic utilization is expected to sustain double-digit growth in the coming decade.

Restraints Limiting Uniform Market Penetration

Fragmented Logistics and Regulatory Variability Slow Market Maturity

Despite robust growth, Indonesia’s archipelagic geography poses logistical challenges for IVD manufacturers and distributors. Transporting sensitive diagnostic reagents and instruments across islands demands cold-chain infrastructure and reliable supply networks, both of which remain unevenly developed. Additionally, differing regional regulatory interpretations under the Badan Pengawas Obat dan Makanan (BPOM) framework complicate product registration and compliance timelines. These operational constraints often delay market entry for international players seeking to expand into rural markets.

Price Sensitivity and Cost Competition Influence Procurement Behavior

Affordability remains a key challenge. Local hospitals and government procurement systems tend to favor low-cost diagnostic solutions, putting pressure on multinational firms offering premium instruments and advanced kits. This cost-conscious environment forces companies to adopt dual-pricing or tiered-service models to sustain competitiveness. Balancing quality assurance with pricing flexibility will remain crucial for market success in Indonesia’s evolving healthcare ecosystem.

Trends & Opportunities: The Shifting Dynamics of Indonesia Diagnostic Landscape

Private Chains and Local Manufacturers Accelerate Diagnostic Access

Private diagnostic chains are rapidly expanding their presence in Indonesia’s largest islands, introducing advanced testing services and integrating AI-driven data management platforms. Meanwhile, local reagent manufacturers are leveraging technology transfer partnerships to produce standardized test kits domestically. This localization effort enhances cost-efficiency and reduces reliance on imports, positioning Indonesia as an emerging manufacturing base for Southeast Asia IVD sector.

Insurance-Driven Demand and Regional Training Hubs Create Strategic Opportunities

The government’s insurance reforms have created opportunities for localized training academies and regional diagnostic hubs. These hubs, particularly in Java and Sumatra, are designed to improve workforce skills and ensure diagnostic accuracy. Furthermore, rising investments in laboratory automation and cloud-based reporting platforms are enabling healthcare providers to reach patients in remote regions through telepathology and digital diagnostics.

Competitive Landscape: Localization, Partnerships, and Strategic Expansion

Indonesia in-vitro diagnostic ecosystem features a competitive mix of international giants and emerging domestic players. Global leaders like Roche Diagnostics and Abbott are expanding their reagent manufacturing capabilities and strengthening distribution networks in collaboration with local partners. In parallel, Indonesian firms are innovating with low-cost point-of-care kits designed for rural use cases. Key strategies observed in the market include setting up regional hubs in Jakarta and Surabaya, introducing affordable instrument ranges, and developing local surgeon and technician training programs to ensure proficiency in diagnostic interpretation.

In 2024, partnerships between diagnostic technology providers and public hospitals gained traction, focusing on tele-diagnosis and remote testing. These alliances align with Indonesia’s digital transformation roadmap, aiming to integrate diagnostics with national health data systems and predictive analytics for population health management.