Indonesia Investment Banking Market Outlook: Accelerating Growth Through Commodity and Infrastructure Financing Advisory

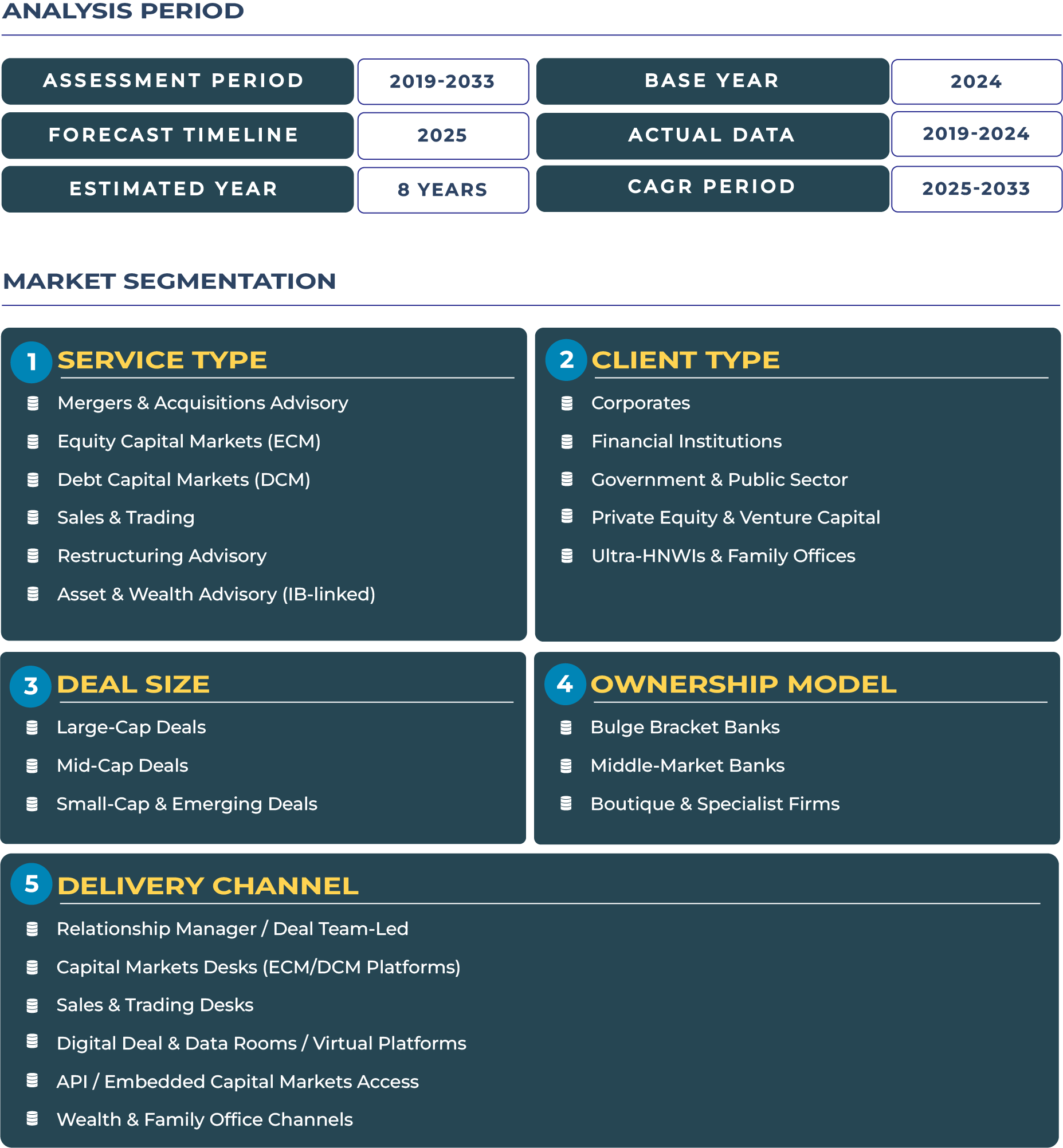

Indonesia, Southeast Asia’s largest economy, is undergoing a financial transformation fueled by rapid industrialization, expanding infrastructure projects, and booming commodity exports. The Indonesia Investment Banking Market has evolved as a key enabler of corporate financing and infrastructure development, playing a critical role in supporting energy, metals, and logistics investments. The market is projected to grow from USD 3.0 billion in 2025 to USD 6.4 billion by 2033, registering a robust CAGR of 9.9% during 2025–2033, according to DataCube Research. This impressive performance is underpinned by growing demand for commodity-backed project financing, public-private partnerships (PPPs), and SME advisory services, all pivotal to Indonesia’s national development agenda.

Note:* The market size refers to the total revenue generated by banks through various services.

Expanding Investment Banking Horizons in Indonesia’s Commodity and Infrastructure Sectors

Indonesia investment banking industry is witnessing structural shifts, driven by its growing emphasis on infrastructure financing, industrial diversification, and sustainable development. The Bank Indonesia and the Otoritas Jasa Keuangan (OJK) have strengthened financial sector reforms to improve liquidity and attract foreign capital inflows. The government’s long-term focus on infrastructure development, ranging from toll roads and energy grids to new capital city projects, has generated significant demand for corporate advisory, debt capital markets, and mergers and acquisitions services.

The investment banking sector is also benefiting from Indonesia’s strong position in commodity markets such as nickel, palm oil, and natural gas. Investment banks are increasingly structuring financing models linked to commodity revenues, helping corporations manage market volatility and access global credit lines. With increasing investor appetite for green and infrastructure-linked assets, Indonesia investment banking landscape is becoming more diversified, resilient, and digitally enabled, marking a new phase of capital market sophistication.

Drivers & Restraints: Core Factors Steering Indonesia Investment Banking Growth

Commodity-Backed Corporate Growth Fuels Financing Demand

A primary driver of the Indonesia investment banking market is the expanding role of the commodity sector in corporate growth. As a leading producer of coal, palm oil, and nickel, Indonesia has become a magnet for foreign and domestic investment. The country’s commodity boom has led to large-scale corporate mergers and strategic capital raising through debt and equity markets. Banks are increasingly offering tailored advisory services to mining, energy, and agriculture companies seeking to diversify portfolios or list on the Indonesia Stock Exchange. In addition, rising global demand for nickel, driven by electric vehicle battery production, is propelling financing opportunities for ESG-aligned projects.

Regulatory Complexity and Limited Market Depth Constrain Rapid Expansion

Despite the sector’s upward trajectory, the investment banking ecosystem in Indonesia faces constraints related to regulatory complexities, compliance challenges, and limited domestic institutional investor participation. Approval processes for large-scale transactions remain lengthy, often influenced by multi-agency oversight and evolving tax structures. Moreover, fluctuating foreign exchange rates and regional geopolitical shifts add uncertainty to cross-border capital flows. While reforms by the OJK aim to streamline the process and enhance transparency, these challenges continue to moderate the pace of expansion. Strengthening institutional investor confidence and simplifying regulatory compliance will be crucial to unlocking the market’s full potential.

Trends & Opportunities: Digital Advisory, SME Financing, and Infrastructure Transformation

Increased Digital SME Financing Advisory Strengthens Inclusivity

A notable trend reshaping the investment banking landscape in Indonesia is the rise of digital and SME-focused financial advisory services. As SMEs contribute nearly 60% to the national GDP, digital advisory solutions and fintech collaborations are enabling smaller enterprises to access capital markets. Investment banks are forming alliances with technology platforms to streamline loan syndication, credit evaluation, and private placements for SMEs. This shift toward digital advisory and automation not only enhances accessibility but also strengthens transparency and reduces transaction costs, reinforcing Indonesia’s vision of financial inclusion.

Advisory for Infrastructure and Commodity Projects Unlocks Strategic Opportunities

Indonesia’s commitment to infrastructure development offers vast opportunities for investment banking growth. The government’s ambitious plans, such as developing the new capital city Nusantara and expanding renewable energy capacity, are generating advisory demand for PPPs, project finance, and sovereign debt issuance. Investment banks are structuring hybrid financing models that blend traditional instruments with green bonds and sustainability-linked loans. Moreover, the commodity-linked financing model remains an untapped opportunity, particularly in energy transition and mineral resource projects. These evolving dynamics are positioning Indonesia as a leading frontier for infrastructure and project finance in Southeast Asia.

Competitive Landscape: Domestic and Global Players Strengthening Market Position

The Indonesia investment banking sector is characterized by a blend of local and global players, including Mandiri Sekuritas, Danareksa Sekuritas, Citigroup Indonesia, and Standard Chartered Indonesia. In 2024, Mandiri Sekuritas enhanced its infrastructure financing team to support green project advisory, while Citigroup Indonesia launched a new digital deal origination platform targeting mid-cap corporations. Similarly, Danareksa expanded its corporate restructuring and DCM services to align with domestic capital market reforms. These developments reflect growing specialization among banks, as they align their strategies with Indonesia’s infrastructure and sustainability ambitions.

Global investment banks are also expanding partnerships with local institutions to deepen market penetration. Collaborative ventures aim to leverage regional expertise while ensuring compliance with domestic financial regulations. Strategic investments in advisory talent, digital innovation, and ESG integration are enabling these firms to capture a larger share of Indonesia’s high-growth sectors, particularly energy transition, logistics, and construction financing.