Innovation-Led In-vitro Diagnostic (IVD) Ecosystem Powering Israel’s Medtech Growth

Israel in-vitro diagnostic (IVD) market stands as a core pillar of its globally recognized medtech innovation ecosystem. Renowned for its vibrant startup culture and R&D intensity, the country continues to advance diagnostic precision through the convergence of biotechnology, software engineering, and data analytics. Israeli medtech firms are leveraging AI-driven analytics, molecular testing kits, and next-generation sequencing technologies to transform healthcare delivery. Backed by robust national healthcare infrastructure and strong collaborations between academia and industry, Israel’s IVD ecosystem has emerged as a model for innovation-led healthcare transformation.

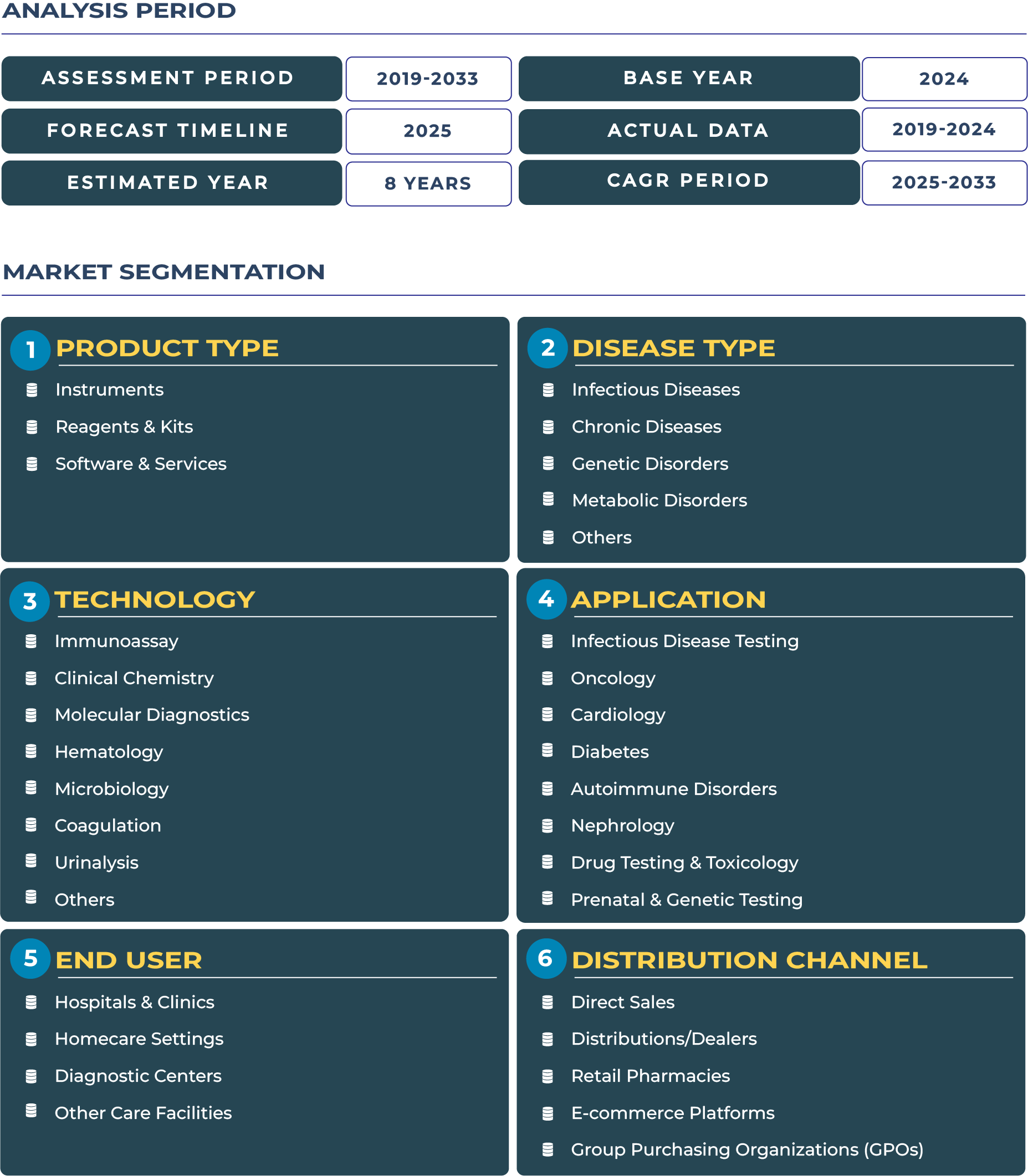

In 2025, the Israel in-vitro diagnostic market is estimated at USD 322.3 million and is projected to reach USD 397.3 million by 2033. The market’s moderate but consistent growth is supported by ongoing R&D investments, expansion of export capabilities, and strong adoption of digital diagnostic technologies. As Israel continues to serve as a testing hub for global IVD companies, its innovation momentum positions it to navigate economic uncertainties and regional challenges while driving long-term resilience and competitiveness in the sector.

High Clinical R&D Intensity and Export Orientation Fuel Market Expansion

A key driver for the Israel IVD industry lies in its exceptionally high R&D-to-GDP ratio, the highest among OECD nations. The country’s biotech research centers and hospitals act as innovation incubators where early-stage diagnostic instruments and molecular reagents are tested and refined. Institutions such as Israel Ministry of Health foster partnerships between academia and private enterprises, creating fertile ground for diagnostic breakthroughs. Moreover, Israeli manufacturers have developed a reputation for export excellence, supplying Europe, North America, and Asia with advanced reagents and point-of-care kits. Export-focused models allow companies to maintain strong growth despite the nation’s small domestic healthcare market.

The software and services segment of the market is also evolving rapidly, as companies integrate predictive analytics, cloud-based lab management tools, and electronic result transmission platforms into their offerings. Israel’s diagnostic laboratories are progressively adopting digital automation and interoperable systems, enhancing data precision and efficiency. Such integration of ICT and IVD underpins the country’s strong positioning in global healthcare digitization initiatives.

Domestic Constraints and Cost Challenges Temper Market Momentum

Despite strong innovation, the Israel IVD market faces structural limitations that moderate growth. The small domestic population restricts large-scale commercial testing and hinders the viability of mass manufacturing. Furthermore, the country’s high operational and labor costs increase the expense of reagent production and clinical validation processes. These cost pressures often compel Israeli firms to prioritize export-oriented development over scaling local supply chains, thereby limiting domestic adoption of advanced diagnostic technologies.

Geopolitical tensions and regional instability also add an element of uncertainty to the country’s healthcare supply chains, affecting logistics and foreign investment sentiment. However, the government’s proactive health policy, supported by strategic alliances with European and U.S. medical device firms, helps mitigate such risks. The Israeli IVD landscape thus requires continuous policy support to expand local consumption while maintaining export competitiveness.

Emerging Trends and Technology Opportunities Transforming the IVD Landscape

Israel IVD sector is undergoing a digital and molecular revolution, marked by trends such as hybrid cloud integration for lab data, precision biomarker testing, and AI-enhanced pathology. Startups in Tel Aviv and Haifa are developing microfluidic-based diagnostic platforms capable of real-time analysis using minimal samples. The collaboration between IVD companies and digital health startups has accelerated the emergence of remote diagnostic monitoring solutions, which are gaining traction in post-pandemic healthcare models.

Opportunities are also rising in co-development partnerships with multinational firms. Israel’s strong clinical trials infrastructure, experienced medical workforce, and regulatory clarity attract global players seeking to localize R&D. Companies are forming alliances to create next-generation reagents and diagnostic instruments tailored for niche applications such as infectious disease detection and oncology screening. Additionally, growing interest in data-driven clinical validation offers export opportunities in Europe and Asia, reinforcing Israel’s status as an innovation testbed for the global IVD sector.

Competitive Landscape: Strategic Alliances and Innovation Clusters Strengthen Market Position

The Israel in-vitro diagnostic market features a competitive mix of local innovators and international corporations. Global leaders such as Roche Diagnostics and Abbott Laboratories operate in close collaboration with Israeli technology startups to co-develop high-precision instruments and diagnostic software. Local companies like MeMed Diagnostics and Itamar Medical have gained global recognition for their novel infection and cardiovascular diagnostic tools. Recent developments include joint R&D programs between Israeli startups and multinational IVD firms aimed at enhancing automation and reagent efficiency.

Israel continues to position itself as a regional hub for medtech innovation, where pilot programs for digital diagnostics are tested before global deployment. The growing presence of innovation clusters in Jerusalem and the Negev, combined with government-backed grants, supports product diversification and export resilience. The competitive landscape is increasingly shaped by mergers, co-development deals, and technology transfer agreements that strengthen Israel’s role as a knowledge-driven hub in the global in-vitro diagnostic ecosystem.