Israel’s Cyber-First InsurTech Export Strategy: National Threat Intel & SaaS Underwriting Powers Growth

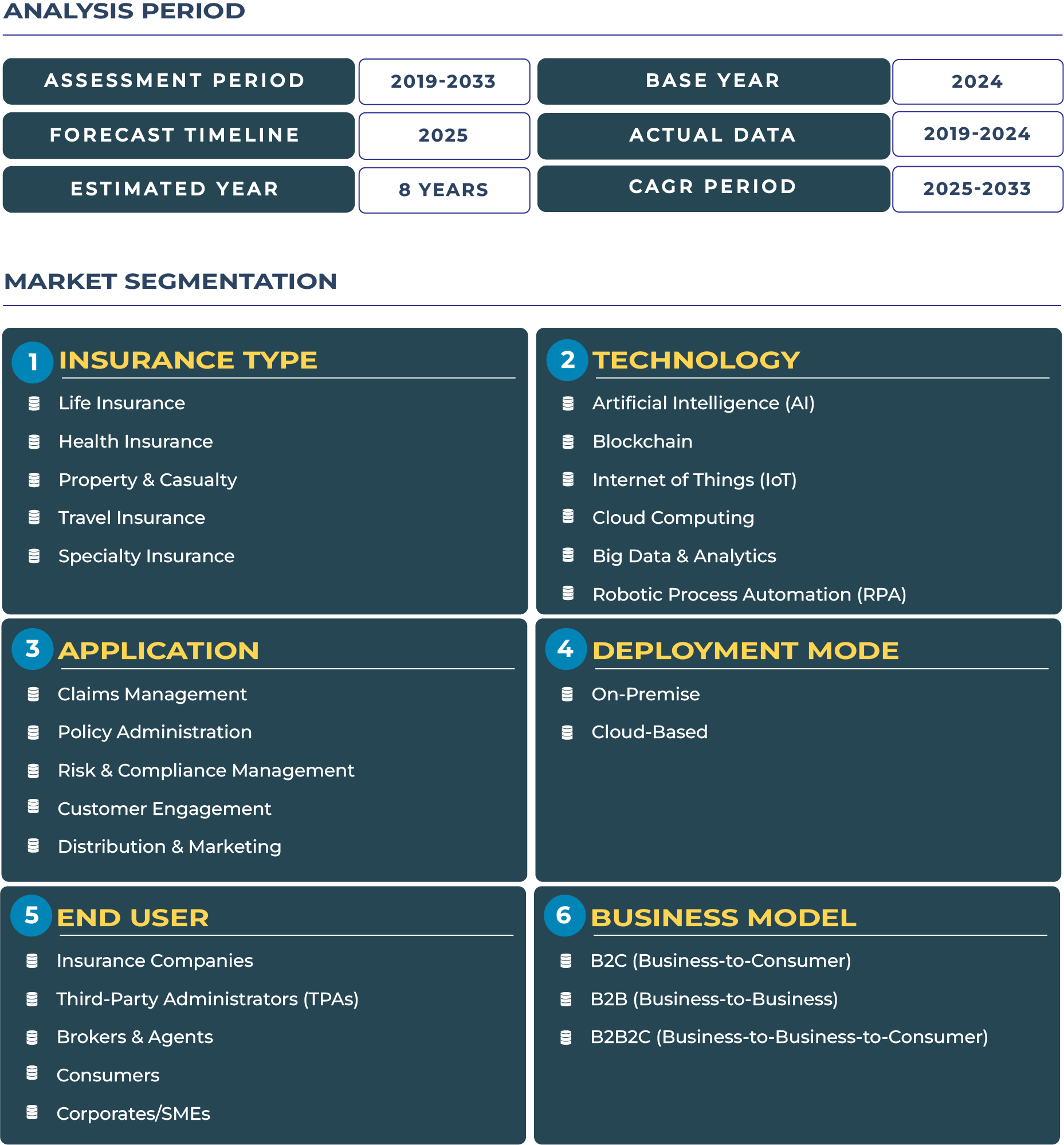

Israel is emerging as a cyber-centric InsurTech exporter, where national threat intelligence, strong cybersecurity R&D, and software-as-a-service underwriting tools drive global insurance innovation. While in 2024 the Israel InsurTech market remained nascent, DataCube Research projects expansion from approximately USD 3.0 million in 2025 to USD 23.0 million by 2033, at a CAGR of about 29.2%. This forecast rests on Israel’s deep talent pool (not least from defense and tech sectors), elevated cyber threat exposure, robust infrastructure for threat sharing, and growing regulatory clarity. Core product lines expected to lead include cyber insurance for enterprises, specialty underwriting (e.g. supply chain risk, breach liability), travel-related health/specialty cover enhancements, and life & health covers augmented by technology such as digital identity, analytics, and automation. The export potential is substantial: InsurTech firms that embed national threat intelligence, that can offer automated underwriting via SaaS, and that align with both global regulatory standards and client needs will be well positioned in the global market.

Drivers & Restraints: Forces Accelerating Israel’s InsurTech Market and Frictions Slowing it

Rapid Growth in Cybersecurity Insurance Innovation & Emergence of Global InsurTech SaaS Exporters

One major driver of Israel’s InsurTech industry is its strong cybersecurity industry infrastructure: high investment into cyber startups, advanced capabilities in IoT, cloud, threat detection, and an ecosystem that produces risk intelligence. As noted by Munich Re and others, Israel has over 100 active InsurTech ventures, many of which integrate cyber risk, automation, underwriting tools, or exporting capabilities. The Israel National Cyber Directorate (INCD) has made cyber risk awareness and resilience a national priority, supporting policy frameworks, public-private coordination, and threat intelligence which feed directly into risk modelling and product design. Startups and insurers are increasingly offering SaaS underwriting tools that allow clients globally to leverage Israel’s cyber intelligence, thus enabling cross-border product deployment. Moreover, advanced automation, RPA (robotic process automation), AI-driven claims & fraud detection, and digital policy administration are reducing costs and enabling faster scale, especially in life, specialty and travel sub-segments.

Security-Driven Operational Contingencies and Multilingual Servicing Complexity as Key Hindrances

However, Israel’s InsurTech growth faces constraints. First, the geopolitical and security environment imposes high business continuity / disaster recovery burdens: infrastructures must be resilient under conflict, cyber-attack, and threat of disruption. This raises costs for InsurTech firms in system redundancy, cybersecurity compliance, and risk governance. Second, servicing a diverse domestic market that includes Hebrew, Arabic, Russian, English speaking populations increases product & support complexity. Localizing policy terms and communications, adapting digital platforms, and adhering to multilingual regulatory obligations add overhead. Third, although cyber threats are higher, cyber insurance penetration remains low among SMEs. Studies indicate only a minority of firms currently hold cyber policies, often large enterprises dominate uptake. Lack of awareness, limited historical claims data, margin uncertainty and insurer reluctance to offer broad cover for new types of cyber risk limit product complexity. Furthermore, regulatory uncertainty remains in some areas (e.g. breach-notification obligations, standard contract wording, imported risk, reinsurance terms) which can slow underwriting innovation.

Trends & Opportunities: What’s Emerging in Israel’s InsurTech Landscape & Where to Play

Rapid Export of InsurTech SaaS Tools for Global Carriers & Advancement of Cyber-Underwriting Platforms Leveraging Threat-Intel Feeds

A trend gaining traction is the export of InsurTech SaaS tools developed locally for global insurers. Platforms offering underwriting calibration, threat intelligence feeds, risk scoring dashboards, and incident response tools are being packaged as product-line extensions. Israeli carriers and InsurTechs are also working with reinsurers to distribute cyber liability and breach products globally, often integrating national intelligence data, IoT sensor data, and cloud monitoring into underwriting. Travel insurance is also being enriched via real-time cancellation and delay triggers, enhanced medical protection, and embedded offerings with global mobility. Specialty insurance (e.g., for supply chain exporters, media, broadcast infrastructure) is increasingly designed with parametric or semi-parametric triggers. Life and health sub-segments are experimenting with wellness & telemetry integrations, telemedicine, and policy portability for expatriate populations.

Exporting Cyber-Risk Underwriting Models & Commercializing National Threat-Intel Integration for Cyber Policies as Opportunity Zones

Opportunity lies in commercializing Israel’s excellence in threat intelligence. Insurers can integrate national cyber monitoring (via INCD), SOC (Security Operations Center) output, and automated threat scoring to refine underwriting, reduce moral hazard, and price premiums more granularly. Exporting cyber-risk policies—especially tailored for tech-intensive, fintech, cloud, or SaaS companies globally—is a high potential area. Also, Israeli InsurTechs can develop parametric cyber breach products, supply chain risk modules, and multi-jurisdiction exposure covers. Travel and specialty insurance (e.g. for event-equipment, international medical) also present opportunities for innovation leveraging real-time systems and portability. Life & health products can be differentiated through behavioral health, wellness, and predictive analytics, particularly for global or mobile workers. Overall, opportunity is largest for InsurTechs combining strong technical risk intelligence, global regulatory compatibility, and scalable SaaS-platform distribution.

Government Regulation & Policy: Ensuring Balance Between Innovation & Risk in Israel’s InsurTech Sector

Data Privacy Laws, National Cyber Strategy & Regulatory Support Steering InsurTech Evolution

Israel’s regulatory environment is evolving to support InsurTech growth while maintaining strict protection of data and national security. Key regulations include the Protection of Privacy Law (1981), the Data Security Regulations (2017), and transfer/international data-rules, which apply across sectors including insurance and finance. The national strategy for cyber security 2025, published by the government in early 2025, emphasises threat intelligence, risk management, and promoting resilient, secure digital infrastructure. The emergency regulations passed during heightened conflict periods underscore expectations for reporting, incident response, and business continuity. Regulatory support for FinTech / InsurTech includes startup grants, accelerators, and regulatory‐sandbox-type mechanisms via the Ministry of Finance and financial regulator oversight. The Insurance Authority in Israel (part of Ministry of Finance) also regulates insurance companies, licensing, solvency, product terms, and consumer protection—key to ensuring trust in new insurance models.

Key Impacting Factors: Economic, Technological, Structural Variables That Shape Israel’s InsurTech Industry Performance

Abundant Cyber-Tech Talent, High Digital Trust & Elevated Threat Exposure vs Reinsurance Cost & Claims Data Scarcity

Israel benefits from an extremely capable tech workforce, strong record of cybersecurity innovation, high internet penetration, widespread adoption of cloud, mobile, and digital platforms, and a population that generally trusts digital services. These factors boost consumer acceptance of digital insurance, and support underwriters in applying advanced analytics and automation. Furthermore, Israel’s elevated threat exposure (cyberattacks, critical infrastructure risk) makes risk transfer relevant and urgent across corporate sectors, encouraging uptake. However, challenges include scarcity of historical claims data for many cyber risk domains (this makes premium pricing difficult), reinsurance margins for these emerging risks are often high and tend to reflect global uncertainty. External conflict or regional instability can also raise perception of risk, increasing cost of capital and risk loading. Inflation, exchange rate fluctuations, and regulatory burden in cross-border servicing or product export can also impact viability.

Competitive Landscape: Who Is Leading Israel’s InsurTech Frontier and How They Are Innovating in 2024-25

Sapiens’ Software Reach & PassportCard’s Real-Time Travel Innovation Represent Key Moves

Sapiens International Corporation stands out as a leader supplying insurance software globally—its core systems support property & casualty, life, digital product administration and underwriting services. Its export strength lies in modular software, core insurance platforms, and global carrier partnerships. Another high visibility player is PassportCard, Israel’s largest travel insurer, which has innovated travel & international medical insurance with real-time claim settlement via prepaid cards, eliminating traditional reimbursement models. Local InsurTech startups are also innovating fast—building SaaS underwriting tools, risk scoring, embedded specialty lines, cyber breach instruments, and digital distribution platforms. Investments in cyber InsurTech rose significantly in 2024, particularly seed and growth rounds, even amidst geopolitical tension. These players are positioning Israel as not just a domestic market but a global InsurTech knowledge export hub.

Why Israel’s InsurTech Premiums Are Expected to Multiply Via Cyber Exports & SaaS Underwriting by 2033

For insurers, investors, tech entrepreneurs, and regulators in Israel, the next decade promises fine-grained transformation. InsurTech premium pools will shift heavily toward cyber, specialty, hybrid travel & health covers, and exportable underwriting modules. Digital risk transfer models, real-time claims / payout triggers, threat intelligence integration, parametric or semi-parametric instruments, and embedded insurance in digital ecosystems will dominate premium growth. New product architectures will need to meet both domestic standards (privacy, security, solvency) and global expectations (cross-border data regulation, reinsurance terms). By 2033, Israel will likely not only see growth in size of its InsurTech market (aligned to the USD 23.0 million projection) but also in its influence—InsurTech solutions developed in Israel will become components of international risk portfolios, especially for cyber and specialty risks. Entities that build robust SaaS platforms, maintain strong security, comply with regulatory norms, and demonstrate domain expertise (especially in cyber risk) will capture outsized returns. The marketplace will reward precision, trustworthiness, and export readiness.

Conclusion: Israel’s InsurTech Unique Selling Proposition in Cyber Intelligence, SaaS Export & Resilience

Israel InsurTech market distinguishes itself in three interlocking dimensions: national threat intelligence feeding underwriting; exportable SaaS capacities; and regulatory, structural resilience even under instability. Its strengths lie in its human capital—cyber R&D, security operations, high-tech entrepreneurship—and in regulatory frameworks that protect privacy, promote cyber vigilance, and support fintech-type innovation. Though adoption is still low among SMEs and many traditional segments, this underinsurance gap presents opportunity. Challenges—multilingual servicing, claims data scarcity, reinsurance pricing, operational continuity under security demands—are real but manageable by leveraging partnerships, technology, and strong governance. Israel’s USP in the global InsurTech landscape will not be merely in size but in exporting underwriting intelligence, modular cyber products, and trusted platforms. For global and domestic audiences, the forecasted growth is not just in premiums but in paradigm shift—insurance viewed not just as coverage but as integrated risk management infused with threat signals, automation, and software-driven scale.