Inter-Generational Wealth Transition: Catalysing Kuwait Private Banking Evolution

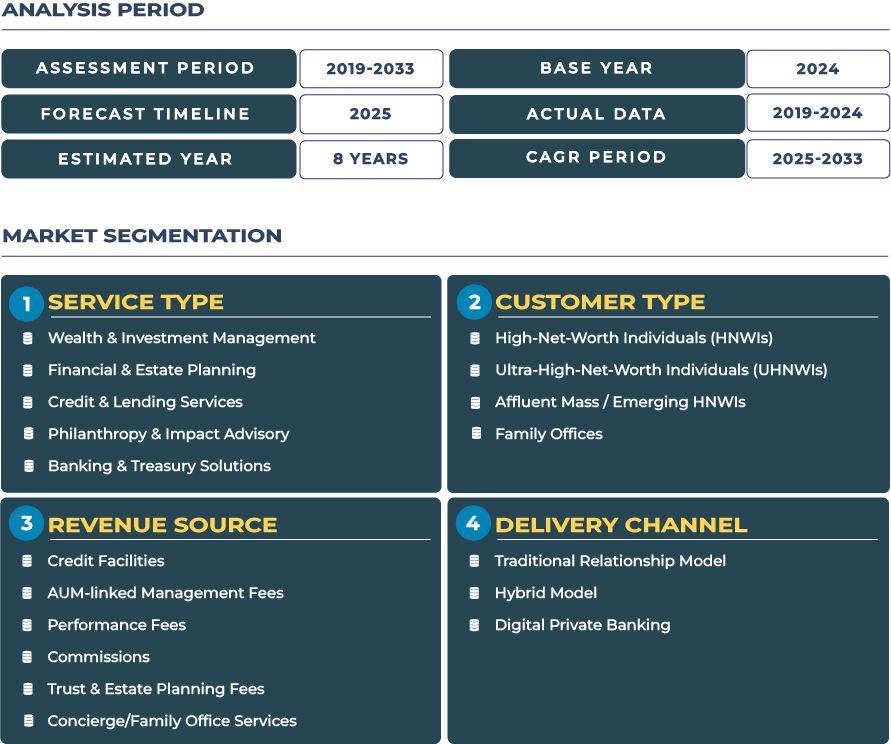

In Kuwait, the private banking ecosystem is increasingly focused on managing inter-generational wealth transitions as family fortunes built on oil, real estate and sovereign assets pass to younger heirs. The Kuwait private banking market is projected at approximately USD 3.8 billion for 2025 and is forecast to rise to about USD 6.7 billion by 2033, implying a CAGR of roughly 7.2%. This growth underscores a renewed need for customised wealth & investment management, multi-jurisdiction estate planning, and banking & treasury solutions tailored to next-gen affluent families. Private banks in Kuwait must therefore evolve from transaction-centric models toward holistic advisory frameworks that integrate credit & lending services, philanthropy & impact advisory and inter-generational governance structures.

Market Outlook – Navigating Kuwait Private Banking Landscape with Legacy-Wealth Strategies and Diversification Imperatives

The outlook for Kuwait private banking industry is grounded in both structural wealth themes and strategic service evolution. The country’s large sovereign wealth fund, high household savings rates and rising number of affluent families generate a robust client base for private banks. Firms are enhancing their offerings to include dedicated family-office solutions, global investment access, and lending tied to business interests, thereby upgrading the private banking ecosystem. Moreover, Kuwait regulatory and economic push to diversify away from oil and deepen its financial services sector provides tailwinds for private banking growth. The high forecasted growth rate for 2025-2033 reflects these underlying drivers.

Note:* The market size refers to the total revenue generated by banks through various services.

However, there are specific structural and regional challenges. The domestic base of ultra-wealthy families is relatively small compared to larger Gulf hubs, and the market is subject to regional geopolitical tensions and global oil-price swings, which can affect investor sentiment and asset allocation behaviour. To remain competitive, private banking providers must focus on differentiated value propositions: global asset access, bespoke advisory, multi-currency treasury, and enhancing their digital infrastructure. Success in Kuwait private banking market will therefore depend on the ability of providers to deliver both legacy-wealth solutions and modern wealth-management capabilities.

Drivers & Restraints – The Forces Steering Kuwait Private Banking Growth Path

Growth Drivers: Large Sovereign AUM, Inter-Generational Transfer Needs and Regional Banking Hub Ambitions

Kuwait private banking market growth is underpinned by several key forces. First, the presence of large sovereign-wealth pools and high household savings provides a foundational client base for wealth & investment management and banking & treasury services. Second, as established family-led fortunes enter a transfer-to-next-gen phase, demand for estate planning, wealth transition advisory and structured credit & lending is rising. Third, Kuwait ambition to become a regional financial services hub is encouraging private banks to build cross-border capabilities, offshore partnerships and global private-banking suites, thereby enhancing the private banking ecosystem’s sophistication and reach.

Growth Restraints: Limited Diversification, Regulatory Rigidity and a Small Domestic Affluent Base

Despite favourable drivers, impediments temper growth in Kuwait private banking sector. The domestic affluent base, though affluent, is modest in absolute size relative to other Gulf wealth hubs, limiting domestic scale. Regulatory frameworks in the wealth-management sphere remain conservative, sometimes restricting product innovation and offshore advisory structures. Furthermore, asset-allocation patterns among Kuwaiti wealthy families remain concentrated-often local real estate or domestic equities-limiting diversification and constraining broader wealth-management penetration. To overcome these constraints, private banks must enhance global product access and advisory depth, while working with regulators to expand service flexibility.

Trends & Opportunities – Strategic Growth Arenas in Kuwait Private Banking Ecosystem

Major Trends: Family-Office Evolution, ESG Sukuk Emergence and Digital Migration

Three major trends are shaping Kuwait private banking market. Firstly, the evolution of family-office models: Kuwaiti families are formalising governance, succession and wealth-transition frameworks, and private banks are responding with family-office advisory services embedded in their offering. Secondly, the emergence of ESG-compliant sukuk and sustainable-finance instruments is capturing the interest of affluent Kuwaiti clients seeking purpose-aligned investment and banking & treasury solutions. Lastly, digital migration is gaining momentum: private banks are investing in mobile wealth platforms, account-aggregation tools and digital advisory to meet the expectations of younger affluent Kuwaitis and expatriate clients.

Strategic Opportunities: Cross-Border Wealth Advisory, ESG Sukuk Funds and Digital Private-Banking Platforms

The Kuwait private banking market offers clear strategic opportunities. Banks can build cross-border wealth-advisory models that serve wealthy Kuwaitis with international portfolios, global lending solutions and multi-jurisdiction estate-planning. Launching ESG-sukuk-fund advisory and sustainability-aligned investment vehicles tailored to Kuwaiti investors represents a growth niche. In addition, developing digital private-banking platforms that combine hybrid advisory (digital + human), real-time analytics and seamless onboarding can help capture the next generation of Kuwaiti affluent clients and improve access to international private banking solutions.

Competitive Landscape – How Private Banking Firms Are Positioning in Kuwait Market

The competitive environment in Kuwait private banking sector features both domestic leaders and expanding international banks. A prominent institution is National Bank of Kuwait (NBK), which has been awarded “Best Private Banking Services” in Kuwait for consecutive years and is actively evolving its private banking proposition. The bank is enhancing global product access, launching dedicated private-banking teams and deepening family-office capabilities. International players are also entering or expanding in Kuwait, attracted by the market’s growth potential and wealth-diversification trends. Strategic thrusts include building cross-border digital hubs, launching ESG-driven private-wealth solutions, and investing in fintech partnerships to broaden access and scale service delivery. The firms that succeed in integrating local trust with global expertise and digital enablement will lead Kuwait private banking landscape.

Strategic Imperatives for Stakeholders in Kuwait Private Banking Market

To capture value within Kuwait private banking market, stakeholders must concentrate on four strategic imperatives. First, building robust advisory frameworks focused on wealth transition, global investment access and family-office services is essential. Second, digital transformation must be accelerated-private banks need to deliver hybrid client-engagement models, mobile platforms and data-driven advisory to cater to younger wealthy clients and international families. Third, service models must incorporate ESG and sustainable-finance solutions such as sukuk to attract value-aligned investors. Fourth, risk-management capability is vital-structuring multi-currency, offshore assets, and treasury solutions that protect wealth amid regional and global uncertainty will be differentiators. Delivering on these imperatives will enable private banking providers to deepen client relationships, scale effectively and secure leadership in Kuwait evolving wealth-management ecosystem.