Inclusion & Cross-Border Specialty MGA Growth: Latin America’s InsurTech Market Enters a New Era

Market Outlook: Payments, Alt-Data & MGAs Set to Unlock Latin America’s InsurTech Potential

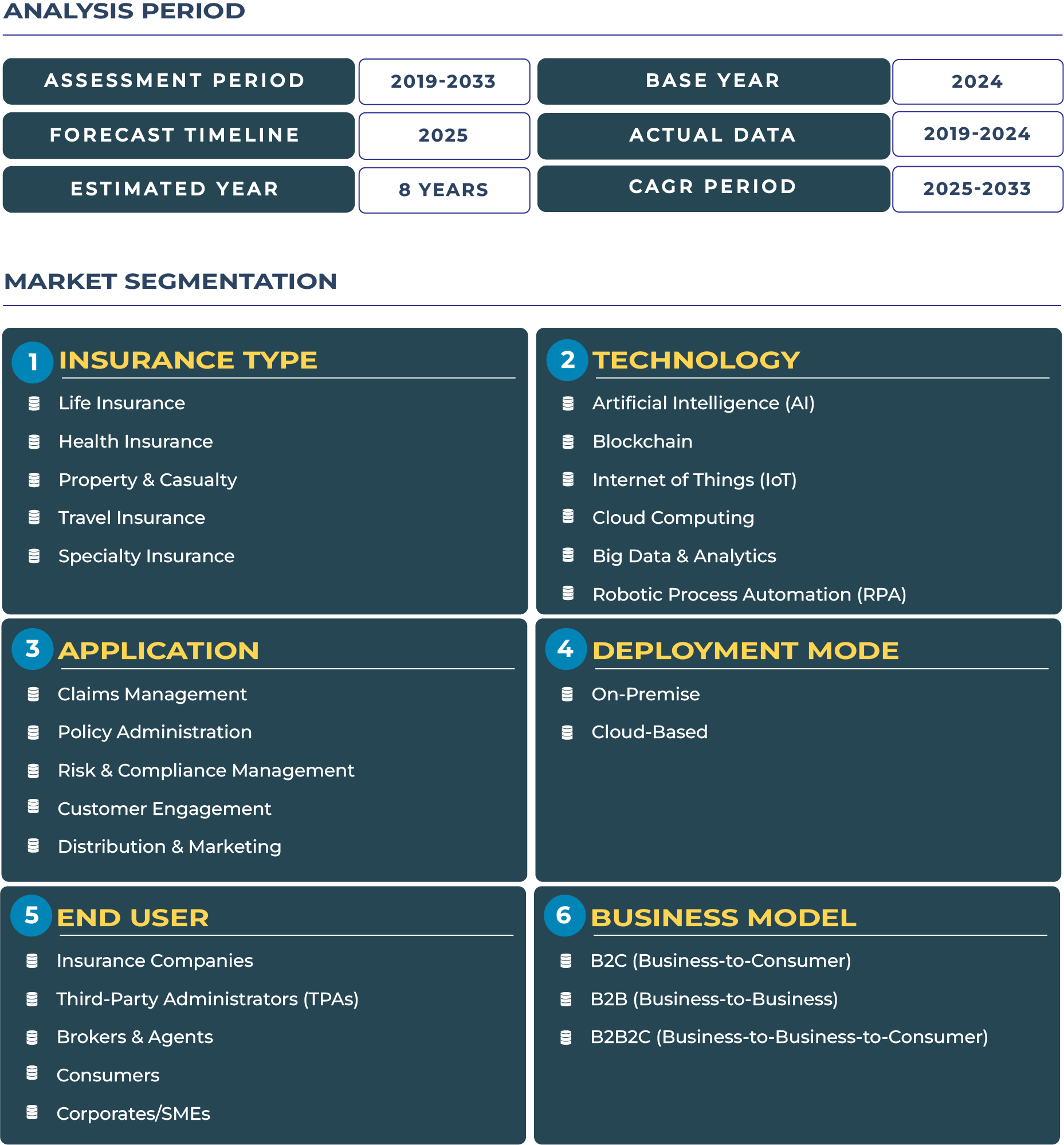

Latin America is undergoing a significant InsurTech transformation, shaped by rising demand for specialty covers, expanding payments infrastructure, and growing acceptance of alternative underwriting data. Digital platforms powered by fintechs are extending the reach of insurance into underinsured and informal populations, while Managing General Agents (MGAs) and cross-border specialty products are gaining traction. The region’s market size is projected to expand from approximately USD 551.6 million in 2025 to USD 5,623.7 million by 2033, achieving a strong Compound Annual Growth Rate (CAGR) of about 33.7% over 2025-2033. This forecast reflects expectations for digital insurance penetration to deepen across life, health, property & casualty, travel, and specialty lines, with specialty and embedded products expected to pull ahead in innovation and margins.

Drivers & Restraints: What’s Fueling Growth and What’s Slowing It Down

Growth Drivers: Inclusion, Alternative Data & MGA-Led Models Accelerate Adoption

Several forces are underpinning Latin America’s rapid InsurTech sector expansion. First, insurance penetration remains relatively low, especially in life and health across many Latin American countries, which creates significant room for growth. Consumers are increasingly exposed to digital payments and mobile money platforms, enabling easier premium collection and embedded insurance models. Second, the rise of MGAs specializing in cross-border or specialty risk (for example trade corridors, mobility, climate event risk) is helping to fill coverage gaps that traditional insurers may underwrite slowly or not at all. Third, the use of alternative data sources—telco usage, satellite imagery, utility data—permits underwriting in under-served or low-data communities, reducing friction and improving risk accuracy. These drivers collectively are reshaping the InsurTech ecosystem, accelerating innovation in distribution, underwriting, and product design.

Constraints: Chargebacks, Political Transitions & Regulatory Fragmentation Impede Scaling

Nevertheless, growth is constrained by several structural and systemic challenges. High chargeback rates and fraud risks in e-payments weaken premium sustainability, especially in markets with weak digital identity verification. Political transitions often bring abrupt regulatory pivots—changes in tax law, foreign ownership restrictions, or insurance licensing policies—that introduce uncertainty for investors. Regulatory fragmentation across countries, or even within countries (states, provinces), complicates cross-border launches. Currency risk and inflation are additional drag factors, especially for non-life lines, where claims costs escalate rapidly. Finally, digital literacy and trust remain uneven, particularly in rural and informal sectors, contributing to low conversion even when demand is latent.

Trends & Opportunities: Where InsurTech Innovation Is Emerging Most Forcefully

Alternative Underwriting Signals & Regional Specialty MGAs Gain Momentum

A strong trend in Latin America is the increasing use of alternative signals—such as mobile telco activity, geospatial data, and satellite imagery—to underwrite risks in regions where traditional actuarial history is scarce or unreliable. This permits lower entry barriers for micro-insurance and specialty covers. Alongside, MGAs focused on specialty territories—such as cross-border trade-corridor risk, export credit protection, mobility risk for delivery fleets—are scaling. Such MGAs offer nimble product design and localized risk adjustment, which positions them as vital bridges between reinsurers and underserved markets.

Opportunities: Embedded Insurance, Climate Risk Products & Cross-Border Expansion

Embedded insurance (insurance bundled in payment apps, e-commerce platforms, or even mobile wallets) represents a clear opportunity to serve low-income and informal sector consumers. Climate-related covers—parametric agriculture, flood, storm risk, drought—are especially promising in Latin America, where extreme weather events are rising in frequency. There is also opportunity for cross-border SME trade protection products, which hedge against counterparty risk and payments defaults across regional supply chains. Additionally, growth in digital claims automation and fraud detection via AI/ML enables efficiency gains and trust-building among consumers and regulators.

Government Regulation: Evolving Frameworks to Support Innovation & Consumer Protection

Regulatory bodies across Latin America are gradually updating frameworks to enable InsurTech innovation. For example, Mexico, Brazil, Chile, Colombia, and Peru are engaging in open insurance / API regulation discussions, data privacy enforcement, fintech-friendly licensing, and sandboxes for new product trials. These regulatory reforms aim to balance consumer protection with agility for digital risk distribution. Also, reinsurance regulation is evolving, enabling MGAs to manage more delegated underwriting authority and cross-border risk sharing, helping to fill gaps in catastrophe exposure and specialty risks.

Key Impacting Factors: Economic Volatility, Digital Infrastructure & Consumer Trust

Latin America’s InsurTech market is highly sensitive to macroeconomic volatility—currency devaluations, inflation, and interest rate fluctuations affect both premium adequacy and claims reserves. Digital infrastructure—broadband access, mobile penetration, digital ID systems—is improving but remains uneven, which limits reach into many rural or underserved areas. Finally, consumer trust—built through transparent claims, speed of payout, product simplicity—is crucial. Companies that deliver clear value, minimize complexity, and resolve claims efficiently are likely to succeed in winning long-term customer loyalty.

Regional Analysis by Country

- Brazil: Largest market in Latin America. InsurTech investment is heavily concentrated here, especially in life & care and mobility lines. Brazilian regulatory advances in open insurance and bancassurance (via partnerships with banks and fintechs) are enabling embedded insurance models.

- Argentina: Though macroeconomic instability presents risks, Argentina’s InsurTech startups are innovating in digital distribution and specialty lines. Foreign attraction and cross-border expansion are increasing despite inflation pressures.

- Colombia: Surge in mobility-insurance for delivery fleets, community flood insurance, and high usage of AI fraud detection. Regulatory clarity and fintech-insurtech partnerships are accelerating growth.

- Chile: A hub for parametric agriculture, climate risk specialty covers, and digital twin applications in export sectors (vineyards, mining suppliers). Increasing regulatory sandbox adoption helps pilots.

- Peru: Strong growth in mobile-first microinsurance for informal merchants, agriculture parametrics, and informal sector inclusion. Cross-border MGAs view Peru as scalable pilot market due to favorable regulatory incentives.

Competitive Landscape: Multilatinas, MGAs & Traditional Insurers Racing for Digital Edge

Latin America InsurTech competitive landscape is comprised of a mix of digital-first startups, established insurers transforming their distribution, and cross-border MGAs bridging specialty and underserved markets. Firms such as Insurama—present in multiple Latin American markets—are expanding their geographic footprint and partnering locally to navigate regulatory differences. Several traditional insurers are launching digital arms or investing in InsurTech incubators. Meanwhile, MGAs that can operate with delegated underwriting authority are attracting capital because they can be more agile, tailor products, and absorb cross-border risk more efficiently. Reinsurers are also participating more directly by offering capacity through MGAs and supporting parametric and climate risk products.

Conclusion: Latin America InsurTech Future Anchored in Inclusion, Specialty Covers & Regulatory Momentum

Latin America InsurTech market is entering a phase of structural maturation. The growth outlook reflects not just rising premium volumes, but systemic shifts: embedded distribution, alternative underwriting, specialty risk covers, and MGAs with cross-border reach. Markets that navigate the tension between regulatory compliance, consumer protection, and innovation agility will drive the next wave of value creation.

Players who succeed will be those that build trust via fast and transparent claims, invest in distribution in informal markets, leverage alt-data to underwrite underserved populations, and partner locally to adjust to regulatory nuances. Additionally, macroeconomic shocks—such as inflation or political change—must be managed carefully, likely through indexed product features and cost-hedging. Ultimately, Latin America is poised to become a global leader in inclusive InsurTech innovation, specialty MGAs, and embedded finance during this coming decade.