Commodity and Infrastructure Corporate Advisory Driving the Latin America Investment Banking Market

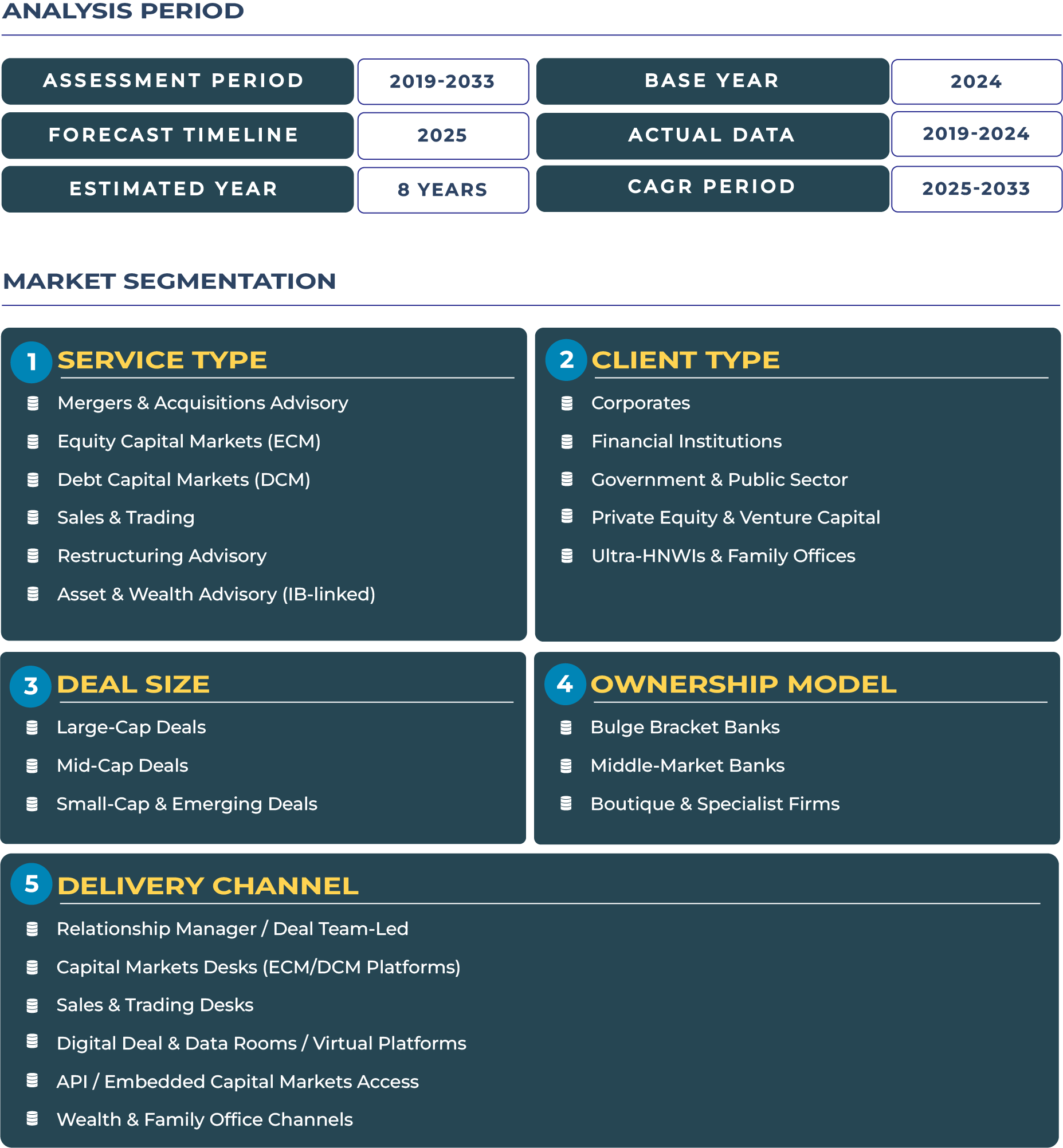

Latin America investment banking ecosystem is undergoing a structural transformation, driven by the region’s deep commodity base, expanding infrastructure pipeline, and growing appetite for cross-border financing. As global investors seek exposure to emerging-market yield and infrastructure-backed securities, Latin America’s financial institutions are increasingly positioning themselves as key intermediaries between sovereign initiatives, private capital, and multinational corporates. The investment banking market in Latin America was valued at USD 16.9 billion in 2025 and is projected to reach USD 21.2 billion by 2033, reflecting a CAGR of 2.8% during 2025–2033. The relatively moderate growth rate underscores a market balancing commodity cycles, regulatory reforms, and geopolitical complexities with strong institutional resilience.

Note:* The market size refers to the total revenue generated by banks through various services.

The region’s investment banks are evolving from traditional transactional intermediaries into strategic advisors, particularly in commodity-backed corporate finance, infrastructure development advisory, and SME financing structures. Countries like Brazil, Chile, and Colombia are seeing increasing deal activity in energy transition, digital infrastructure, and logistics corridors, supported by both domestic funds and cross-border capital inflows. With projects in renewable energy, transportation, and urban development gaining traction, investment banks are providing advisory and syndication services to match global capital with Latin America’s structural investment needs.

Institutional support from regional authorities, such as the Inter-American Development Bank (IDB) and fiscal reforms by national ministries like Chile’s Ministry of Economy, have also catalyzed greater participation from both local and international players. The ongoing push for sustainable and resilient financing structures has further expanded opportunities for investment banking firms specializing in environmental and infrastructure-linked deals.

Latin America Investment Banking Market Outlook: Infrastructure and Commodity-Linked Advisory Reshaping Latin America Investment Banking Industry

The Latin American investment banking market outlook remains cautiously optimistic, anchored by a new wave of infrastructure financing and energy-transition projects. As governments seek to bridge infrastructure gaps and stimulate regional integration, investment banks are increasingly central to the execution of large-scale financing strategies. From renewable energy ventures in Brazil and Argentina to transportation corridor upgrades in Peru and Colombia, these projects underpin a vibrant advisory pipeline.

Commodity-linked economies are leveraging resource-backed corporate financing as a mechanism to unlock development funding. Banks are structuring hybrid debt and equity instruments that tie financing to production flows in sectors like lithium, copper, and oil, ensuring long-term investor confidence. Simultaneously, macroeconomic stabilization policies, underpinned by prudent monetary frameworks in countries like Chile and Uruguay, are improving risk perception among global investors, enabling more stable debt capital markets activity.

Despite moderate GDP expansion forecasts, the investment banking sector is benefiting from institutional strengthening, digitalization of financial markets, and increased cross-border capital movement. These structural shifts are reinforcing Latin America’s position as an emerging hub for infrastructure and commodity-linked finance, ensuring sustained growth momentum through 2033.

Drivers and Restraints: Understanding Forces Shaping Latin America Investment Banking Ecosystem

Commodity-Backed Financing and Infrastructure Development Catalyzing Market Expansion

The resurgence of commodity prices and infrastructure expansion are core drivers for the Latin American investment banking sector. The region’s dependence on natural resources, spanning metals, oil, and agricultural commodities, has turned into a financing opportunity. Investment banks are increasingly structuring corporate loans, mergers, and debt instruments backed by commodity assets. Brazil’s growing renewable energy portfolio, and Argentina’s lithium mining investments have generated sustained demand for project financing and advisory mandates. These dynamics, coupled with regional economic integration initiatives under frameworks such as ECLAC, are strengthening the cross-border merger and acquisition and capital-raising ecosystem across Latin America.

Currency Volatility, Political Risk, and Regulatory Constraints Limiting Sector Agility

However, political transitions, inflationary pressures, and currency depreciation continue to challenge investment banks in Latin America. Nations such as Argentina and Venezuela have faced fluctuating foreign exchange regimes, complicating long-term financing strategies and cross-border settlements. Additionally, divergent regulatory policies across Brazil and Chile create fragmentation in deal execution. Political uncertainty, especially around fiscal policies and trade reforms, can dampen investor confidence, slowing activity in equity capital markets and debt syndication. While institutional reforms are advancing, inconsistent enforcement and legal complexities remain hurdles to full market integration.

Trends and Opportunities: Redefining Investment Banking Practices in Latin America

Increasing Cross-Border and Digital Advisory Transforming Deal Execution Models

A defining trend in the Latin American investment banking landscape is the rise of cross-border digital advisory. With growing regional integration and the proliferation of digital banking platforms, investment banks are adopting advanced analytics and fintech partnerships to enhance deal origination and execution. Cities like São Paulo, Santiago, and Bogotá are emerging as innovation hubs for digital finance and capital markets. Digital transformation is enabling banks to reach mid-market enterprises and family-owned corporates that were previously underserved. This has opened new channels in sales and trading as well as restructuring advisory, improving market depth and transparency.

Advisory Opportunities in Natural Resources and Infrastructure Finance

Latin America’s expanding infrastructure and energy transition projects represent long-term opportunities for investment banks. Advisory services in sectors such as renewable energy, logistics, transportation, and digital infrastructure are becoming key profit centers. With the global shift towards decarbonization, regional economies rich in lithium, copper, and nickel are drawing institutional investors seeking sustainable financing opportunities. Investment banks are now designing tailored solutions for green bonds, ESG-linked merger and acquisition, and infrastructure securitization. This trend is expected to strengthen as public-private partnerships (PPPs) gain momentum, creating recurring advisory mandates across the region.

Regional Analysis by Country

-

Brazil

Brazil remains the anchor of Latin America investment banking industry, driven by robust equity capital markets and infrastructure financing. The government’s renewed privatization agenda and green bond issuances are boosting deal flow, while São Paulo continues to dominate as the region’s financial center.

-

Argentina

Argentina investment banking market shows gradual recovery, supported by increased investor confidence in its lithium sector. Investment banks are focusing on restructuring advisory and project finance linked to mining and energy infrastructure, though political volatility remains a concern.

-

Peru

Peru investment banking ecosystem benefits from its mineral wealth and growing energy projects. Cross-border merger and acquisition in mining and infrastructure continues to attract foreign institutional investors, reinforcing Lima’s role as a key capital markets hub.

-

Colombia

Colombia investment banking landscape is buoyed by economic diversification efforts and increasing participation in ESG-linked financing. Infrastructure and renewable energy projects are providing consistent deal flow in debt and equity syndication.

-

Chile

Chile’s stable regulatory framework and emphasis on sustainable finance make it a leading destination for capital markets activity. The country’s financial institutions are central to regional bond issuances and green project financing, underpinning its solid investment banking position.

Competitive Landscape: Regional and Global Players Strengthening Cross-Border Advisory Networks

The competitive landscape in Latin America investment banking market is marked by a blend of established regional players and global institutions. Local firms like Pactual and Itau BBA continue to lead in merger and acquisition advisory and capital markets, while international banks such as JPMorgan and Santander maintain a strong presence in syndicated loans and infrastructure finance. Recent strategic developments include BTG Pactual’s 2024 initiative to expand its cross-border advisory networks, supporting growth in the energy transition and infrastructure segments. Similarly, several banks are developing partnerships to support private-public collaboration for renewable energy and logistics projects across Brazil and Mexico.

Market strategies increasingly emphasize integrated advisory, covering equity, debt, and wealth advisory linked to investment banking. Firms are focusing on regional deal origination, sustainable finance, and digital transformation to maintain competitiveness amid macroeconomic volatility. The ongoing reconfiguration of regional supply chains, supported by nearshoring trends and multilateral financing from organizations such as the IDB, will continue to shape strategic priorities across the investment banking ecosystem.