Malaysia Dental Devices Market Outlook: Leveraging Tourism and Middle-Class Growth

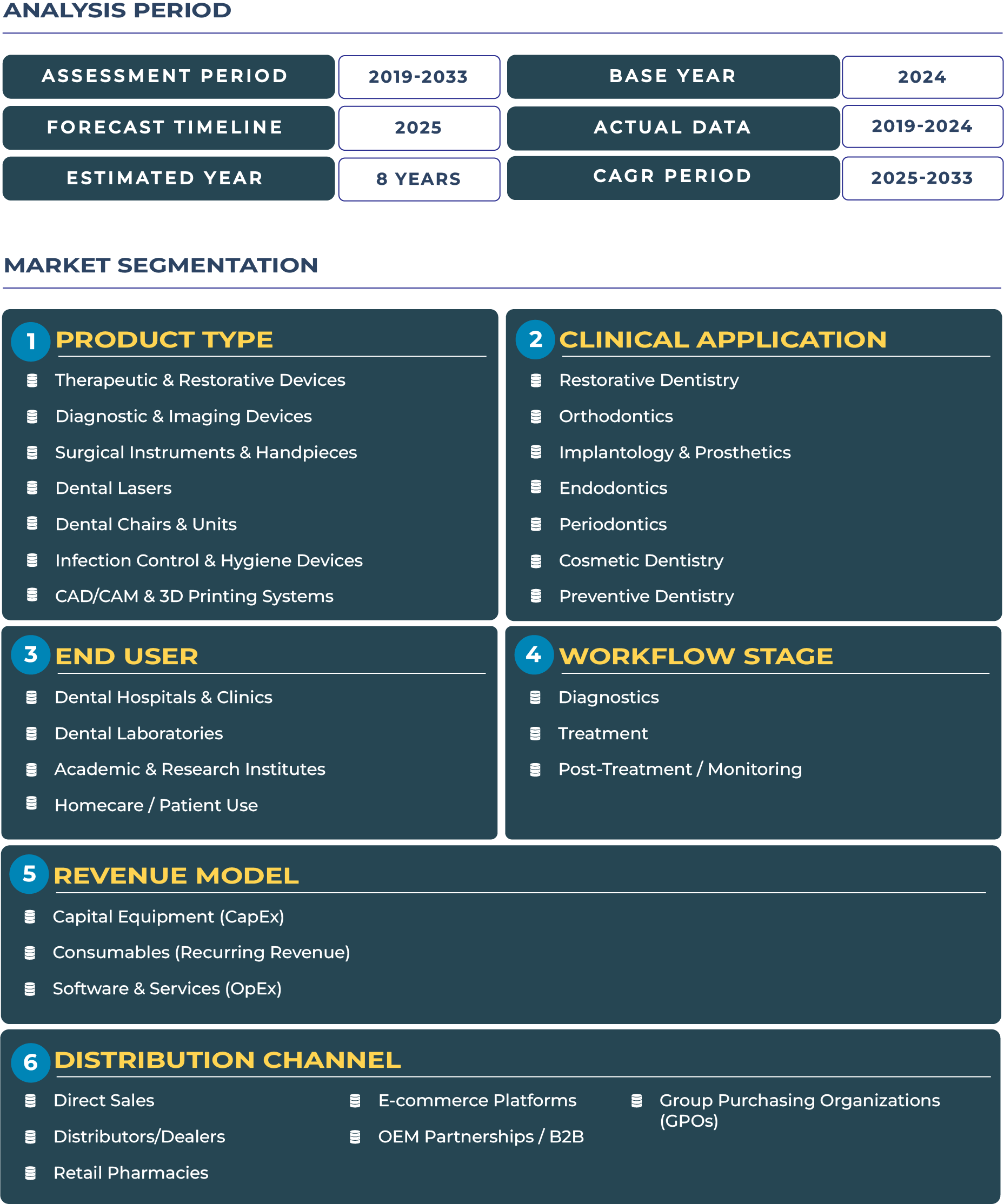

Malaysia has established itself as a recognized hub for dental tourism, attracting patients from neighboring Southeast Asian countries and the Middle East due to its affordability, quality standards, and skilled professionals. This favorable positioning not only strengthens the country’s healthcare service exports but also accelerates adoption of advanced technologies across the dental devices market. Coupled with a growing domestic middle class that increasingly prioritizes preventive and cosmetic dental care, Malaysia presents an evolving ecosystem for industry growth. According to DataCube Research, the Malaysia Dental Devices Market is valued at USD 172.7 million in 2025 and is projected to reach USD 289.3 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The steady trajectory is supported by public-private partnerships, increasing clinic modernization, and rising consumer demand for cosmetic and restorative treatments.

Dental Tourism and Middle-Class Aspirations Shaping Market Growth

The Malaysia Dental Devices Market outlook is closely tied to the nation’s healthcare and tourism strategy. Malaysia promotes itself as a leading medical tourism destination, with dentistry emerging as a top service category. Clinics in Kuala Lumpur and Penang are heavily investing in CAD/CAM systems and 3D printing solutions to cater to dental tourists seeking crowns, implants, and orthodontics with shorter turnaround times. At the same time, the expanding middle-class population is creating local demand for therapeutic and restorative devices, dental chairs & units, and infection control systems, driven by rising awareness and lifestyle changes. This dual growth from international patients and domestic consumers underscores the sector’s resilience despite regional competition and global uncertainties. The integration of high-tech imaging systems further solidifies Malaysia’s position in the dental devices industry, enabling clinics to balance volume and quality.

Key Drivers Fueling the Malaysia Dental Devices Market Expansion

Three major drivers underpin market momentum. First, Malaysia’s medical and dental tourism industry continues to attract patients due to its competitive pricing—often 30–50% lower than Western counterparts—without compromising clinical quality. Second, private clinic investments in urban hubs like Kuala Lumpur, Johor Bahru, and Penang are reshaping the dental devices landscape, with clinics adopting dental lasers, surgical handpieces, and digital workflows to attract affluent clientele. Third, government incentives for healthcare technology adoption, supported by the Ministry of Health Malaysia, have encouraged modernization and capacity expansion. Collectively, these drivers position Malaysia as a strong growth market for global and regional suppliers aiming to expand their presence.

Restraints: Structural and Regional Challenges Constraining Growth

Despite the positive outlook, the market faces challenges that require attention. Distribution fragmentation outside Klang Valley continues to hinder efficient delivery of dental devices to rural regions, leading to higher logistics costs. Additionally, price sensitivity in smaller towns and rural clinics reduces adoption rates of advanced technologies, particularly CAD/CAM & 3D printing systems. Malaysia also faces competition from regional hubs such as Thailand, which offers similar dental tourism services with stronger international visibility. These barriers highlight the importance of streamlined supply chains, local training hubs, and differentiated offerings to sustain growth in the dental devices sector.

Emerging Trends and Opportunities Defining the Market Trajectory

The Malaysia Dental Devices Market is experiencing distinct trends that are shaping investment priorities. One significant trend is the growth of hub laboratories in Kuala Lumpur and Penang, which centralize production of prosthetics using digital scanners and 3D printing, enhancing efficiency for both local and tourism-focused clinics. Another key trend is the rise of inbound dental tourists seeking cosmetic dentistry, fueling demand for restorative and imaging devices. Furthermore, mid-tier clinics across urban areas are increasingly adopting digital scanners to shorten treatment cycles and improve patient satisfaction. Opportunities lie in creating tourism-clinic clusters with bundled training, consumables, and service contracts. Establishing a regional parts depot in Kuala Lumpur can also ensure faster device servicing, reducing downtime for high-volume clinics. Collectively, these dynamics present pathways for manufacturers and distributors to strengthen their foothold in Malaysia’s evolving dental devices ecosystem.

Competitive Landscape: Strategic Moves Defining Market Leadership

The competitive environment is characterized by both global leaders and local players competing to serve Malaysia’s high-growth dental sector. Companies like Dentsply Sirona and Straumann continue to expand their product portfolios, while regional distributors collaborate with clinics to deliver tailored offerings. Two strategies stand out: first, targeting tourism-clinic clusters with fast service support and consumables bundles to maximize patient throughput; second, launching mid-tier digital solutions specifically designed for Malaysia’s urban clinics. Recent developments highlight Malaysia’s focus on medical tourism and health technology incentives, as reported by the Ministry of Health Malaysia between 2022 and 2025. These measures encourage global players to strengthen local partnerships and expand their product pipeline in alignment with Malaysia’s healthcare modernization goals.