Malaysia Private Banking Market Outlook: Islamic Wealth and Digital Integration Transforming

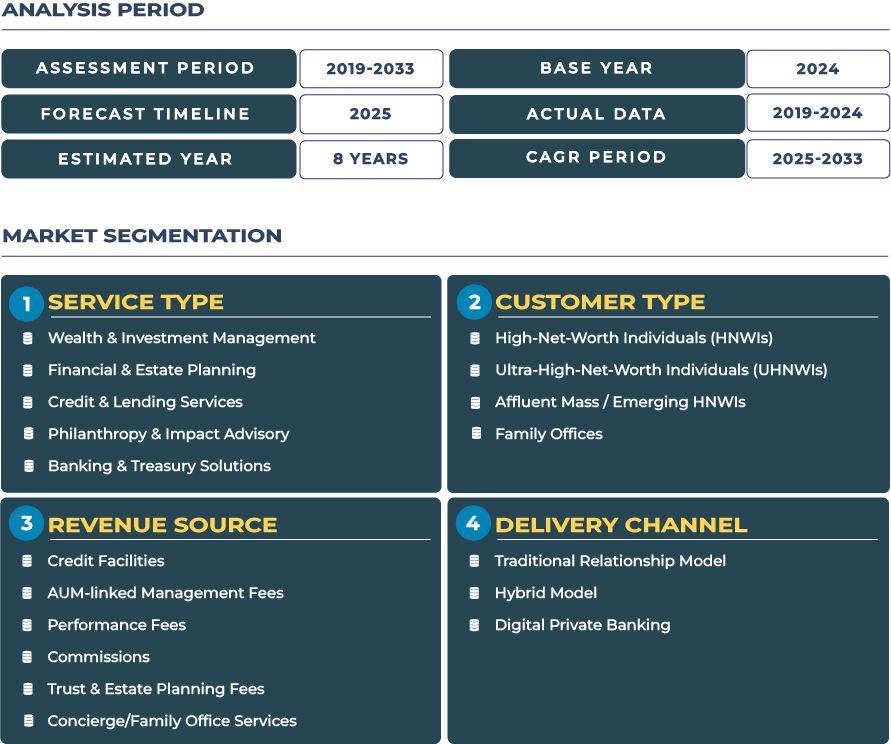

Malaysia private banking market is entering a new chapter where its deep Islamic-finance heritage aligns with digital wealth innovation to craft a differentiated private banking ecosystem. With the market poised to reach approximately USD 10.1 billion in 2025 and forecast to expand to about USD 15.5 billion by 2033-reflecting a CAGR of around 5.6% during the forecast period-the growth trajectory reflects strong high-net-worth individual (HNWI) expansion, regional fintech connectivity and increasing demand for Shariah-compliant wealth services.

Note:* The market size refers to the total revenue generated by banks through various services.

In this environment, private banks in Malaysia are evolving beyond conventional wealth & investment management into comprehensive platforms that integrate Shariah-compliant investment advisory, digital onboarding, global asset access, estate planning and boutique credit/treasury solutions. The region’s Islamic financial infrastructure, led by Bank Negara Malaysia and supported by regulatory frameworks such as the Capital Markets Master Plan, provides a robust base of trust and governance. Meanwhile, geopolitical dynamics in Southeast Asia-including regional trade linkages, fintech disruption and offshore wealth flows-add layers of opportunity and complexity for private banking firms operating in Malaysia market.

Growth Drivers and Structural Impediments in Malaysia Private Banking Market

Islamic Wealth Growth, UHNW Creation and Regional Fintech Linkages

Malaysia private banking industry is buoyed by rapid uptake of Islamic wealth-vehicles. The country positions itself as a hub for Shariah-compliant advisory, Sukuk wealth products and Halal investment structures, which resonate with HNWIs in the domestic and regional Muslim-majority markets. At the same time, the creation of UHNW individuals via tech entrepreneurship, real-estate upside and family-business transitions is expanding the client base for private banking firms. Digital fintech connectivity-especially cross-border wealth flows and ASEAN fintech integration-also supports service extension and platform scalability.

Regulatory Duality, Market Fragmentation And Talent Gap

Yet, Malaysia private banking market faces notable constraints. The dual regulatory system-conventional and Islamic banking-complicates product design, service delivery and advisor training, increasing complexity and cost. The market remains fragmented with many banks and boutique firms competing for a limited HNWI universe, which intensifies fee competition and raises cost-to-serve. Further, there is a shortage of wealth-tech talent specialising in private banking, Shariah advisory and digital-wealth platforms, which hinders pace of service innovation and advisory depth.

Emerging Trends and Strategic Opportunities in Malaysia Private Banking Ecosystem

Rise of Islamic Private Banking, Digital Family Offices and ESG-Linked Sukuk.

One of the most prominent trends is the consolidation of private banking around Islamic financial architecture: banks are launching dedicated Shariah-private banking desks, Halal wealth platforms and Sukuk-rich investment strategies. Digital family offices are also gaining traction, blending wealth management, estate planning, philanthropy and impact advisory on digital platforms. ESG-linked Sukuk and socially responsible investment vehicles tailored for affluent clients further reflect evolving client preferences.

Shariah-compliant Wealth Expansion, Digital Advisory Platforms and ESG-Sukuk funds for HNWIs

Private banking firms in Malaysia are well-positioned to capitalise on several opportunity windows. First, expanding Shariah-compliant private banking services and wealth solutions targeted at regional Islamic HNWI clusters (Middle East, Southeast Asia) offers a growth lever. Second, deploying mobile advisory and digital onboarding platforms provides efficient access to affluent and ultra-affluent clients while addressing advisor-scarcity. Third, designing ESG-linked Sukuk funds and impact-wealth vehicles gives private banks a competitive edge by combining ethical investing, Islamic finance and value-based wealth solutions that appeal to the next generation of wealthy Malaysians and migrants.

Competitive Landscape: Platformisation and Islamic-Digital Strategy in Malaysia Private Banking Sector

The competitive field in Malaysia private banking industry features major local banks and specialist wealth managers competing on digital-wealth, Islamic-private banking and regional reach. A leading institution, Maybank2u Malaysia emphasised growth in its private banking arm, integrating digital advisory, Islamic wealth solutions and cross-border client servicing. Key strategic shifts include segmentation of affluent clients, deployment of wealth-tech platforms, consolidation of Shariah-private banking desks and forming fintech alliances. Firms that succeed will integrate wealth & investment management, estate & planning, credit & lending services, philanthropy & impact advisory and banking & treasury solutions into unified, digital-first ecosystems tailored for Malaysia rising affluent and value-oriented HNWIs.