Diverse Economies, Unified Momentum: The MEA Dental Devices Market Landscape

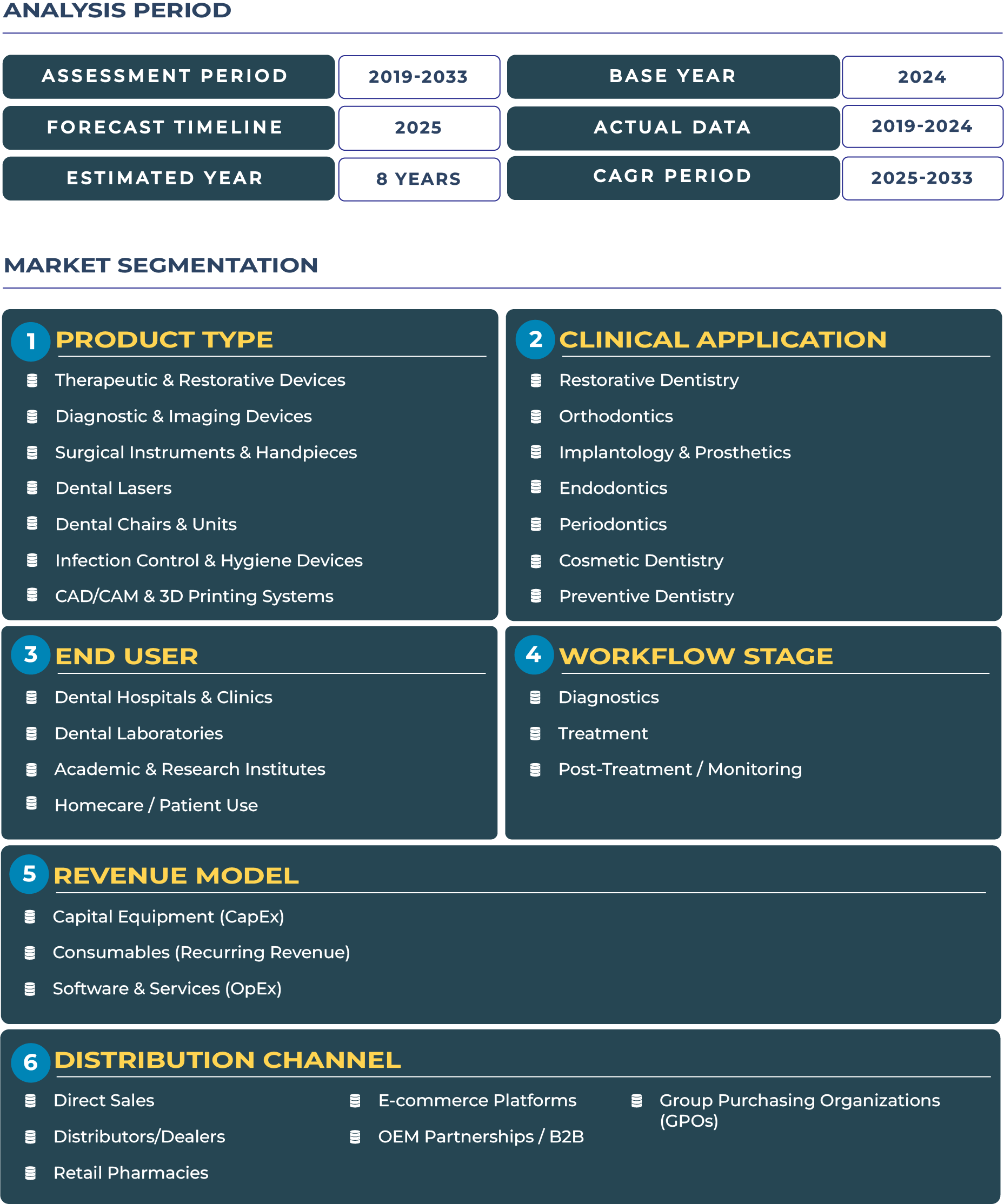

The Middle East and Africa (MEA) represent a region of contrasts—wealthy Gulf Cooperation Council (GCC) economies with advanced healthcare infrastructure coexisting with fragmented yet rapidly evolving African markets. Regulatory reforms in dentistry, coupled with growing private investment, are shaping the MEA dental devices market. By 2025, the industry is projected to reach USD 977.5 million and expand to USD 2,001.9 million by 2033, growing at a CAGR of 9.4%. This growth underscores the interplay of modernization, regulatory harmonization, and rising consumer awareness, positioning the dental devices ecosystem as a strategic healthcare pillar across MEA.

Bridging Regulatory Diversity with Modernization in the MEA Dental Devices Industry

The outlook for the MEA dental devices sector is promising, driven by regulatory shifts and socio-economic transformation. GCC nations are investing heavily in premium dental infrastructure, aligning with their broader healthcare diversification strategies. Countries like Saudi Arabia and the UAE are prioritizing oral health programs, supported by government initiatives to expand private and public clinics. Meanwhile, Africa demonstrates strong demand for cost-efficient devices such as diagnostic imaging equipment and infection control solutions, fueled by urbanization and rising dental awareness. The steady adoption of CAD/CAM and 3D printing technologies across both GCC and African markets further accelerates modernization. Despite currency volatility and geopolitical pressures in select African states, resilient demand for dental restorative systems highlights the market’s robust growth trajectory.

Drivers & Restraints: Dual-Speed Dynamics Reshaping the MEA Dental Devices Landscape

Large-Scale GCC Investments and African Private Networks Accelerating Growth: In recent years, GCC governments have strategically invested in advanced dental clinics, creating opportunities for dental laser devices and surgical handpieces. Simultaneously, African countries such as Nigeria and Kenya are experiencing rapid growth in private dental clinic networks, enabling wider adoption of restorative and therapeutic devices. Medical tourism into GCC hubs like Dubai and Riyadh further boosts the region’s role as a premium dental care destination.

Regulatory Fragmentation and Import Costs Limiting Expansion: Despite these advances, the MEA dental devices industry faces challenges. Fragmented regulatory frameworks across two continents complicate cross-border approvals. In Africa, high logistics and import duties raise the cost of devices, restricting access in price-sensitive markets. Additionally, political instability and currency risks in nations like Zimbabwe and Nigeria weigh on overall expansion. Addressing these barriers through regional regulatory alignment and localized service hubs remains essential for long-term scalability.

Trends & Opportunities: Regional Transformation in the MEA Dental Devices Ecosystem

Premium GCC Adoption vs. African Volume Growth: A distinct trend in the MEA dental devices landscape is the divergence between GCC and Africa. GCC nations, with higher purchasing power, are increasingly adopting premium dental chair units and CAD/CAM systems, while African markets prioritize high-volume, low-cost diagnostic devices. This dual-speed adoption highlights the need for split go-to-market strategies.

Emerging Opportunities in Service Models and Product Tiers: Strategic opportunities lie in tailoring offerings to distinct regional needs. Premium device portfolios in the GCC can cater to medical tourism and affluent consumers, while African markets demand value-oriented infection control solutions and simplified restorative systems. Establishing regional service hubs in Dubai and Riyadh could streamline logistics, enhance after-sales service, and mitigate import-related delays across Africa, cementing MEA’s role as a hub for dental innovation.

Regional Analysis by Country

Saudi Arabia

Saudi Arabia dental devices market benefits from Vision 2030 healthcare investments, with strong demand for premium dental chairs and CAD/CAM systems in urban centers like Riyadh and Jeddah.

Kuwait

Kuwait shows steady adoption of diagnostic and imaging devices as private clinics expand their service offerings and align with rising consumer expectations for cosmetic dentistry.

UAE

The UAE is a hub for dental medical tourism, with advanced dental laser systems and restorative technologies widely used in Dubai and Abu Dhabi.

Oman

Oman dental devices industry is gradually modernizing, with increased uptake of infection control systems to comply with regional hygiene standards.

Bahrain

Bahrain emphasizes affordable therapeutic and restorative devices, supported by growing public-private healthcare partnerships.

Qatar

Qatar dental devices market thrives on investments ahead of global events, focusing on advanced dental imaging technologies and chairside restorative systems.

South Africa

South Africa demonstrates robust adoption of surgical instruments and private clinic networks, positioning itself as Africa’s largest dental devices hub.

Israel

Israel leads with innovation in 3D printing and CAD/CAM systems, supported by a strong domestic R&D base and global technology exports.

Nigeria

Nigeria’s fast-growing urban centers drive demand for diagnostic and hygiene devices, though import costs challenge broader adoption.

Kenya

Kenya dental devices sector is expanding rapidly, particularly in infection control devices and low-cost imaging solutions for mid-sized clinics.

Zimbabwe

Zimbabwe dental devices market remains price-sensitive, with demand concentrated in affordable restorative and hygiene products despite economic volatility.

Competitive Landscape: Divergent Strategies Defining MEA Dental Devices Industry Growth

The MEA dental devices industry is characterized by both multinational leaders and local players. Companies such as Straumann have expanded their regional footprint with premium implant systems, while local distributors focus on accessible restorative solutions for African markets. Recent health investments in GCC states (2022–2025) highlight government backing for premium device adoption, while African private clinic growth continues to stimulate demand for affordable alternatives. A clear bifurcation of strategies is emerging: premium offerings in GCC, and low-cost SKUs in Africa. The establishment of regional service hubs in Dubai and Riyadh is proving vital in bridging logistics gaps and offering after-sales support tailored to regional requirements.