Nigeria Retail Banking Market Outlook: Mobile-First Digital Banking Revolution Redefining Retail Finance

Nigeria retail banking market is at the forefront of Africa’s financial inclusion movement, propelled by the mobile-first digital transformation sweeping across the country. With one of the continent’s largest populations and rapid smartphone adoption, Nigeria is leveraging digital wallets, mobile lending, and fintech-driven platforms to bring millions into the formal financial ecosystem.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

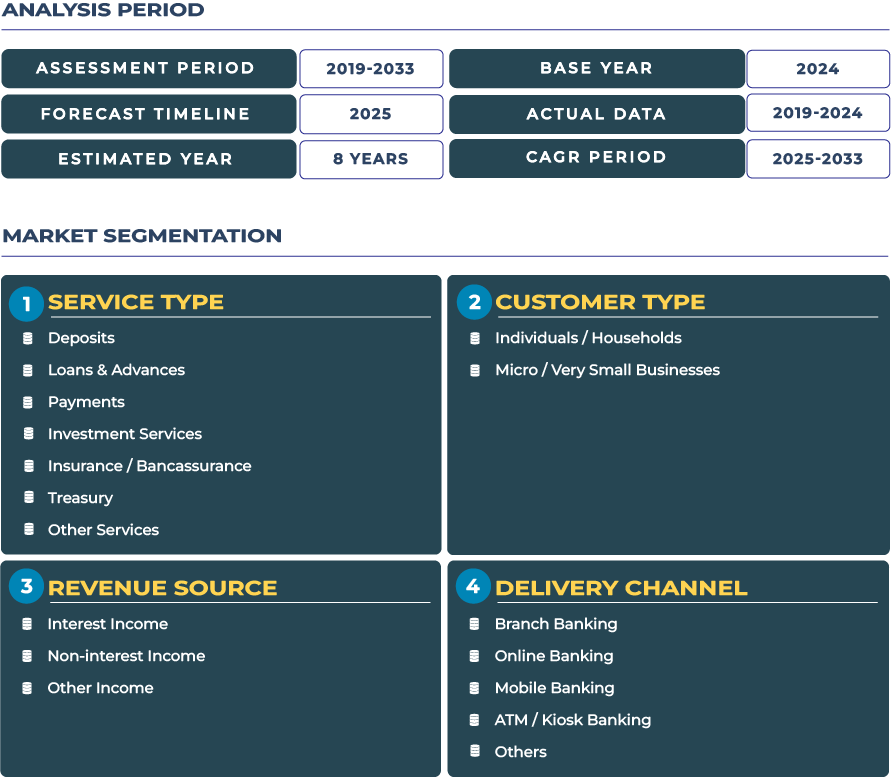

In this evolving landscape, the Nigeria Retail Banking Market is projected to expand from USD 32.4 billion in 2025 to USD 45.9 billion by 2033, registering a 4.4% CAGR from 2025 to 2033. This steady growth reflects the country’s accelerated push toward mobile money adoption, micro-lending, and digital credit ecosystems supported by government-led financial inclusion policies. The transition is not merely technological-it represents a structural shift toward democratized finance, where accessibility, speed, and trust define competitiveness in the retail banking sector.

A Digital-Driven Future Anchored in Financial Inclusion and Technological Expansion

The Nigerian retail banking market is undergoing a structural modernization, driven by digital banking reforms and expanding fintech participation. With a large unbanked population and high youth demographic, the market presents a fertile environment for financial innovation. The Central Bank of Nigeria (CBN) accelerated its “Cashless Nigeria” policy to promote electronic transactions and improve transparency. Initiatives such as the eNaira-Nigeria Central Bank Digital Currency (CBDC)-are strengthening digital payment infrastructure and promoting cross-border trade efficiency. Meanwhile, mobile banking applications from institutions like Access Bank and United Bank for Africa (UBA) are transforming how Nigerians manage savings, loans, and payments through intuitive digital interfaces.

The market’s evolution is further supported by digital credit and wealth solutions that cater to previously underserved customers. Retail banks and fintech startups alike are integrating digital lending and microfinance tools to extend credit to small business owners and individuals. While macroeconomic challenges, including inflationary pressures and naira devaluation, continue to test liquidity, digital adoption is cushioning these shocks by reducing transaction costs and enabling real-time financial access. As digital banking infrastructure matures, Nigeria is positioned as a financial technology powerhouse within West Africa, aligning inclusive growth with digital innovation.

Drivers & Restraints: Forces Shaping the Nigeria Retail Banking Landscape

Population Scale, Mobile Penetration, and Financial Inclusion Fueling Market Momentum

One of the strongest growth catalysts in Nigeria retail banking industry is its vast population-over 220 million people-with mobile penetration exceeding 90%. The proliferation of smartphones and affordable data plans has transformed mobile devices into powerful banking tools. Platforms such as Paga, OPay, and PalmPay are expanding access to banking services in urban and semi-urban areas, while partnerships between banks and telecom operators are bridging last-mile access for rural customers. The CBN’s National Financial Inclusion Strategy aims to reduce the financial exclusion rate below 20% by 2030, driving collaboration between retail banks, fintechs, and microfinance institutions.

Payments, remittances, and micro-lending are the most dynamic segments, powered by mobile-first technology and rising consumer trust in digital transactions. Moreover, the Nigerian government’s support for financial literacy programs and fintech regulations has created a conducive environment for new entrants. As a result, digital banking ecosystems are rapidly integrating with Nigeria everyday economy-from online commerce to transportation and bill payments-making retail banking a daily necessity rather than a luxury.

Infrastructure Gaps, Cybersecurity Risks, and Regulatory Complexity Limiting Rapid Growth

Despite strong digital momentum, several challenges constrain Nigeria retail banking expansion. Infrastructural deficits such as unstable internet connectivity, power supply inconsistencies, and limited rural coverage hinder seamless banking experiences. Additionally, cybersecurity threats and fraud incidents continue to rise with digital adoption, prompting the Nigeria Deposit Insurance Corporation (NDIC) and the CBN to tighten compliance and security frameworks. Regulatory complexity, including evolving KYC and Anti-Money Laundering (AML) standards, increases operational costs for banks and fintechs.

Political and economic instability, including inflationary volatility and foreign exchange constraints, has also pressured banks’ profitability and loan quality. However, continuous monetary reforms by the CBN, alongside digital transformation policies, are gradually stabilizing market confidence. The key for Nigerian banks is balancing compliance rigor with innovation speed to maintain competitiveness and customer trust in an evolving retail banking landscape.

Trends & Opportunities: How Mobile Banking and Fintech Are Redefining Financial Access in Nigeria

Trend Focus: Rapid Adoption of Mobile Banking and Fintech Applications Across Urban Nigeria

Mobile banking has become the cornerstone of Nigeria retail banking transformation. In Lagos, Abuja, and Port Harcourt, mobile payment adoption has surged through platforms like OPay and Moniepoint, which now process millions of daily transactions. Traditional banks are responding by investing in digital branches and cloud-native platforms. Consumer demand for convenience and real-time services is driving the integration of biometric authentication, instant account opening, and AI-enhanced credit evaluations in retail banking apps. The growing adoption of contactless payments, digital remittances, and micro-investment apps reflects a cultural shift toward digital-first financial behavior.

Opportunity Focus: Digital Lending, Credit Scoring, and Wallet Expansion Unlocking New Market Potential

Nigeria financial inclusion gap represents one of the largest opportunities in Africa. AI-based credit scoring models, though in early stages, are being explored by banks and fintechs to serve individuals without traditional credit histories. Micro-lending platforms are enabling small enterprises to access working capital quickly, fueling entrepreneurship. Digital wallets-powered by interoperability across mobile operators and banking apps-are also reshaping payment ecosystems. As banks and fintechs partner to launch co-branded mobile products, the convergence between telecoms and finance will define the next phase of retail banking in Nigeria. The rise of cross-border digital payments within the ECOWAS region further enhances scalability and regional integration opportunities.

Competitive Landscape: Strategic Alliances and Mobile-First Innovation Defining Nigeria Banking Future

Nigeria retail banking market is dominated by major players such as Access Bank, Zenith Bank, Guaranty Trust Holding Company (GTCO), and First Bank of Nigeria. Access Bank continues to expand its digital presence through its mobile app “AccessMore,” which integrates lifestyle services and real-time transfers. GTCO has strengthened its retail franchise with GTWorld, an app combining payments, investments, and digital banking. First Bank of Nigeria is advancing digital literacy campaigns to promote inclusion among underserved segments. Meanwhile, fintech entrants like OPay and Moniepoint have achieved nationwide reach, providing low-cost financial services to millions.

Strategically, Nigerian banks are investing heavily in data infrastructure, blockchain pilots, and mobile-first lending platforms. The CBN’s regulatory sandbox allows banks and fintechs to test innovative products in controlled environments, fostering ecosystem growth. As banks embed AI-driven analytics and alternative data credit scoring, their ability to extend inclusive lending will accelerate. The Nigerian retail banking landscape is thus evolving from a traditional branch-based model to an agile, mobile-first ecosystem built around user experience, security, and affordability.