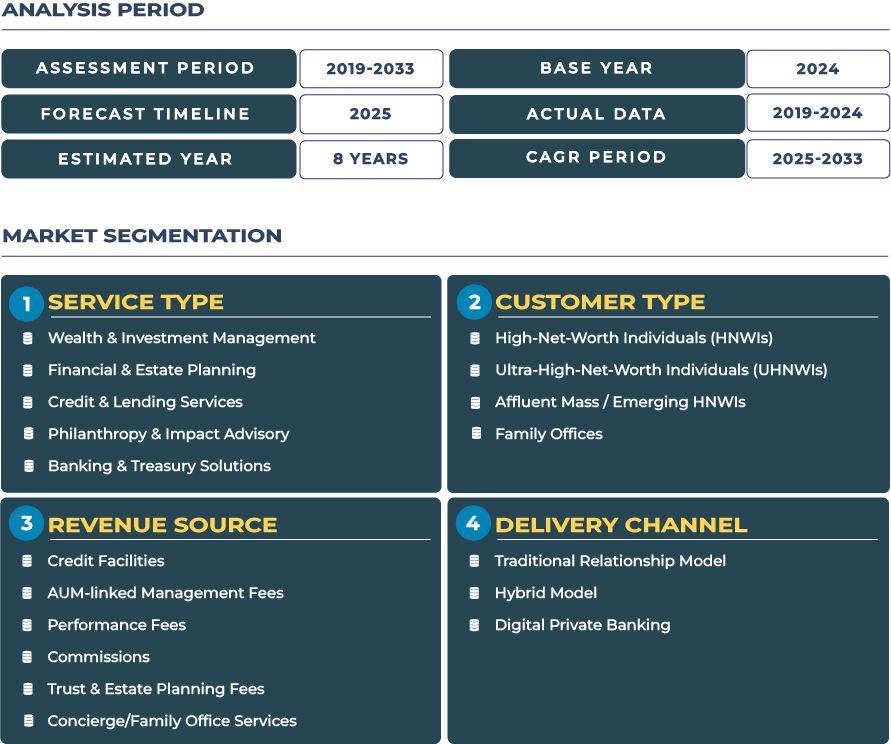

Market Outlook: Strategic Growth Pathways for the Nordics Private Banking Ecosystem Through 2033

The market outlook for the Nordics private banking industry indicates a healthy trajectory driven by value addition rather than pure volume. From USD 18.3 billion in 2025 to USD 28.5 billion by 2033, the growth at a CAGR of ~5.7% reflects favourable macro conditions-including high savings rates, wealth transfer between generations, and tech-enabled service transformation. For private banks operating in the Nordics, this means capitalising on digital-wealth platforms, impact advisory, credit & lending overlay and integrated banking & treasury services.

Note:* The market size refers to the total revenue generated by banks through various services.

However, the path to growth is nuanced. The Nordics face constraints such as a comparatively small ultra-high-net-worth-individual (UHNW) base relative to traditional wealth hubs, upward cost pressure from technology investments and tightening regulatory demands on transparency and ESG. Still, the region’s strength in sustainable finance, fintech readiness and client trust offers a credible platform. For private banks that expand beyond legacy advisory models and focus on integrated wealth-ecosystems delivering personalised digital-first experiences, the 5.7% CAGR is both achievable and strategically meaningful.

Driving Forces & Structural Constraints: Key Catalysts and Barriers in the Nordic Private Banking Sector

Growth catalysts: The Nordics private banking market is driven by several high-impact factors. First, the region’s tech-savvy affluent population coupled with strong real-income accumulation supports demand for advanced wealth management, credit/lending services and high-net-worth investment platforms. Second, the leadership in sustainable finance across the Nordics encourages wealthy clients to seek private banking that combines investment returns with ESG impact-making philanthropy & impact advisory a core offering. Third, Nordic banks benefit from robust digital ecosystems (open banking, fintech innovation, seamless payments) which enable private banks to integrate treasury/banking solutions and wealth platforms more efficiently.

Structural constraints: Despite the favourable context, Nordic private banking faces several headwinds. The limited size of the domestic UHNW population restricts scale growth, forcing firms to differentiate rather than expand through volume. Technology investment costs and the need to sustain low cost-to-income ratios place pressure on profitability. Additionally, tax and regulatory frameworks-particularly around transparency, anti-money-laundering and sustainability disclosures-raise compliance burdens and cost-to-serve. For example, large Nordic banks are already reporting increased operating expenses even as revenue growth moderates. These factors suggest that Nordic private banks must lean into efficiency and service innovation to achieve their growth potential.

Trend-Vectors & Opportunity Frameworks: Digital Wealth Platforms, ESG-First Portfolios and Cross-Border Expansion in the Nordics Private Banking Market

Emerging trends: A number of trend-vectors are defining the Nordic private banking landscape. Digital wealth platforms-offering mobile onboarding, portfolio dashboards, integrated payments/treasury, and advisor-client hybrid models-are now mainstream expectations among next-gen affluent. ESG-first portfolios are gaining dominance: wealth-management professionals in the region increasingly incorporate climate, social and governance factors into investment advice. Moreover, cross-border wealth mobility-Nordic clients investing abroad and global clients choosing Nordic private banks for trust, transparency and green portfolios-is gaining traction.

Opportunity frameworks: Private banks in the Nordics can seize growth by focusing on ESG-as-a-service-building dedicated impact-investment vehicles, green credit and lending solutions, and philanthropy advisory modules for wealthy clients; fintech-private banking alliances-partnering with Nordic fintechs to deliver digital onboarding, real-time payments and treasury, alternative-asset access, and data-driven insights; and cross-border digital banking models-targeting wealthy clients in neighbouring geographies and offering wealth structuring through the Nordics as a jurisdiction for ethical, transparent private banking. Institutions that execute these strategies effectively will maximize the 5.7% CAGR and unlock hidden growth opportunities.

Competitive Landscape: Strategic Moves Reshaping the Nordics Private Banking Value Chain

The competitive structure in the Nordic private banking market is undergoing strategic realignment. One notable player, Nordea Bank Abp, which operates across Finland, Denmark, Sweden and Norway, underscores the region’s integrated advisory and wealth-management platform approach. Market strategies being adopted include segmented service models—targeting UHNW, next-gen affluent, and globally mobile clients; platform orchestration—integrating advisory, investment, treasury, credit, and philanthropy into a seamless client journey; and partnerships and acquisitions—particularly in fintech, digital wealth, and sustainability sectors to expand service offerings and enhance operational efficiency. As Nordic banks navigate margin pressures and increasing global competition, those that transition from stand-alone product delivery to comprehensive wealth ecosystems will lead the next phase of the market.