North America Fintech Outlook: The Convergence of Instant Payments and Enterprise Fintech Infrastructure in North America

North America continues to lead the global fintech market, shaped by a strong funding ecosystem, high digital adoption, and rapid deployment of real-time rails. Instant payments and enterprise fintech partnerships are defining the region’s next growth cycle. With financial institutions under pressure to modernize infrastructure and consumers demanding real-time settlement, the fintech industry has positioned itself as the backbone of digital finance transformation. The region’s established venture capital networks, coupled with cloud-native financial infrastructure, have enabled startups and enterprises alike to build scalable models that integrate directly with banks and corporates. This convergence marks a pivotal shift, where fintech is no longer only consumer-facing but increasingly embedded within enterprise systems to support trade, compliance, and global transactions.

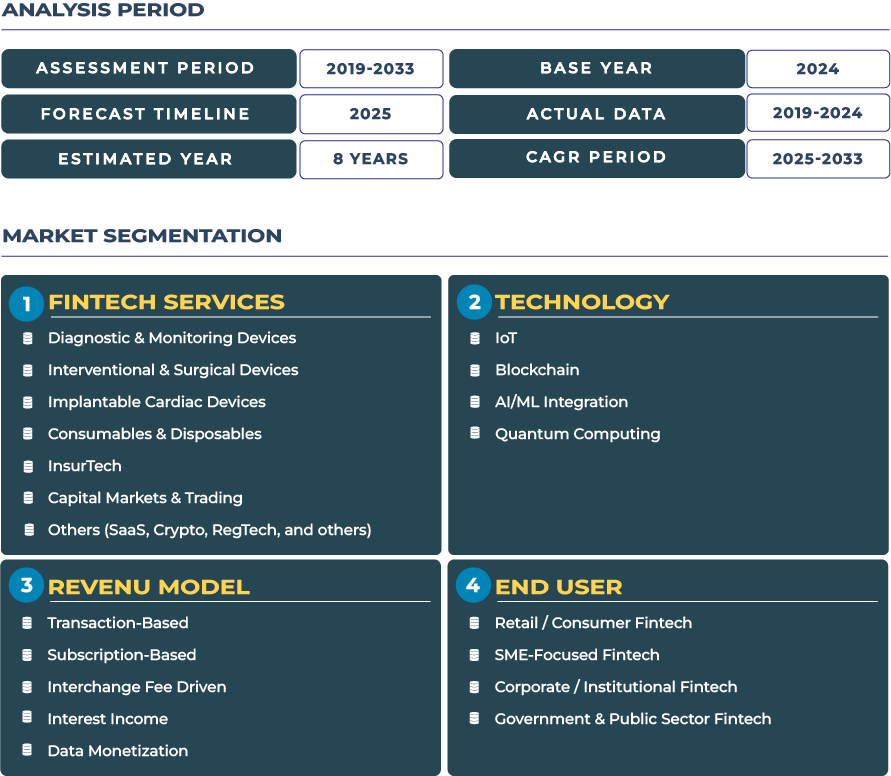

The North America fintech market is expected to grow from USD 123.3 billion in 2025 to USD 268.0 billion by 2033, expanding at a CAGR of 10.2%. This robust trajectory reflects sustained demand for instant payment systems, embedded finance, and enterprise-focused fintech SaaS partnerships. Cities such as New York, Toronto, and San Francisco are central to this growth, acting as fintech capitals due to their concentration of banks, venture funds, and tech talent. As geopolitical tensions, inflationary pressure, and evolving cybersecurity risks reshape global finance, North America’s fintech sector remains resilient, driven by structural demand for efficient, scalable, and compliant financial infrastructure.

Growth Drivers and Inhibitors in the North American Fintech Ecosystem

Key Drivers Supporting Expansion

The market’s growth is strongly underpinned by high smartphone penetration and extensive broadband coverage, which accelerate the adoption of mobile-first financial services. Venture capital availability remains a hallmark, with North America accounting for a significant share of global fintech funding rounds in 2023. The rise of enterprise SaaS fintech models also acts as a major driver, enabling traditional banks to outsource modular infrastructure rather than build in-house systems. In parallel, demand for instant settlement solutions is increasing as corporates push for cross-border trade efficiency. These combined drivers reflect a broader structural shift toward digitized, real-time finance across the region.

Restraints Hindering the Market

Despite these advances, regulatory fragmentation across U.S. states creates significant operational complexity for fintech firms. Differing licensing rules, compliance requirements, and consumer protection standards limit scalability and add cost layers. Incumbent lobbying by legacy banks also slows the rollout of disruptive products, particularly in areas such as decentralized finance and digital asset custody. The U.S. political climate around data privacy and cybersecurity regulations further introduces uncertainties. These challenges underscore that while North America’s fintech sector is leading in innovation, it must balance disruption with regulatory harmonization and consumer trust-building.

Trends and Opportunities Shaping the Next Phase of Growth

Major Trends Emerging Across the Region

Embedded finance is becoming a defining trend, where platforms in retail, healthcare, and logistics integrate financial services directly into customer journeys. Buy Now, Pay Later (BNPL) adoption continues to expand, particularly among younger demographics in the U.S. and Canada, although regulators are closely monitoring its impact on consumer debt. The trend toward alternative credit scoring—leveraging transaction data, utility bills, and digital footprints—supports more inclusive lending models. Another prominent trend is the rise of digital insurance platforms (insurtech) that integrate micro-insurance and embedded coverage directly into digital payment flows.

Opportunities Driving the Market Forward

Cross-border payment optimization is a major opportunity for fintechs in North America, especially given the region’s extensive trade corridors with Europe, Asia, and Latin America. Fintech SaaS partnerships with banks offer significant enterprise growth potential, enabling institutions to deliver modular services while reducing infrastructure costs. Wealthtech platforms are capitalizing on rising digital investment adoption, particularly among retail investors seeking low-cost access to diversified portfolios. With corporate treasuries demanding real-time liquidity, fintechs specializing in cash management and instant settlement are positioned to scale rapidly. These opportunities highlight how fintech is evolving from consumer convenience to enterprise infrastructure.

Regulatory Landscape: Balancing Innovation and Consumer Protection

Regulation plays a pivotal role in shaping fintech performance in North America. The Federal Reserve has accelerated the rollout of instant payments through FedNow, launched in July 2023, which is expected to drive adoption of real-time rails. At the same time, state-level regulatory divergence in the U.S. creates operational hurdles for scaling across jurisdictions. Canada’s Financial Consumer Agency oversees consumer protection while also encouraging digital innovation, particularly in payments and open banking. Mexico’s pioneering fintech law, administered by the CNBV, continues to attract international entrants by offering a clear legal framework for crowdfunding, e-money, and digital platforms. Together, these regulations create a balanced environment that fosters innovation while safeguarding consumer interests, though harmonization across borders remains a work in progress.

Key Impacting Factors Influencing Market Trajectory

The performance of the North American fintech market is impacted by several key factors. Fintech funding rounds remain a leading indicator, with venture flows rebounding in late 2023 after a slowdown earlier in the year. Digital payment volumes in the U.S. are projected to exceed USD 2 trillion annually by 2027, reinforcing demand for instant settlement platforms. Cross-border remittance flows also contribute to sustained demand for low-cost transfer solutions, particularly between the U.S. and Mexico. At a macro level, inflationary pressures and rising interest rates affect consumer borrowing, shaping lending fintech demand. Meanwhile, global cybersecurity threats and compliance requirements influence how quickly fintechs can roll out digital-first products. These factors together demonstrate how North America fintech market trajectory is shaped by both structural enablers and external pressures.

Regional Insights by Country

- United States: The U.S. dominates the North American fintech ecosystem, with instant payment infrastructure (FedNow) and a strong venture capital base fueling expansion. Regulatory fragmentation remains a challenge but innovation hubs like New York and San Francisco drive scale.

- Canada: Canada fintech market growth is supported by high digital penetration and government-led open banking initiatives. Toronto and Vancouver are central to ecosystem development, while regulatory clarity around payments fosters investor confidence.

- Mexico: Mexico is emerging as a fintech hotspot driven by financial inclusion and strong remittance flows. The country’s fintech law and proactive regulatory stance have attracted both domestic innovators and international entrants seeking regional expansion.

Competitive Landscape: Evolving Strategies of Regional and Global Players

The competitive environment in North America is characterized by a blend of local strength and global expansion. U.S. companies like PayPal continue to dominate digital payments, while Canadian startups are scaling wealthtech and insurtech platforms. In October 2023, analysis highlighted that enterprise fintech demand rebounded strongly, with banks increasingly partnering with SaaS providers to modernize core infrastructure. International players such as Revolut have expanded into North America, capitalizing on opportunities in cross-border payments and digital banking. Product launches in real-time settlement solutions and expansion through enterprise partnerships are defining competitive strategies, with players focusing on scalability, compliance, and modular offerings. The convergence of consumer fintech, enterprise SaaS, and cross-border infrastructure sets the competitive tone for the region’s future.

Conclusion: Building a Resilient and Scalable Fintech Future in North America

The North America fintech market stands at the intersection of consumer convenience, enterprise modernization, and regulatory oversight. Instant payments, embedded finance, and cross-border optimization are driving a shift from consumer-centric innovation to enterprise-wide transformation. The sector’s resilience lies in its ability to adapt to evolving geopolitical and economic dynamics while maintaining consumer trust. Regulatory divergence remains a headwind, but growing collaboration between fintechs, banks, and regulators demonstrates a path toward harmonized digital infrastructure. By embracing real-time settlement, modular fintech SaaS partnerships, and inclusive financial access, North America is positioned to consolidate its leadership in the global fintech landscape. The future of the industry will be defined by its capacity to deliver scalable, compliant, and secure digital financial infrastructure that meets the needs of enterprises and individuals alike.