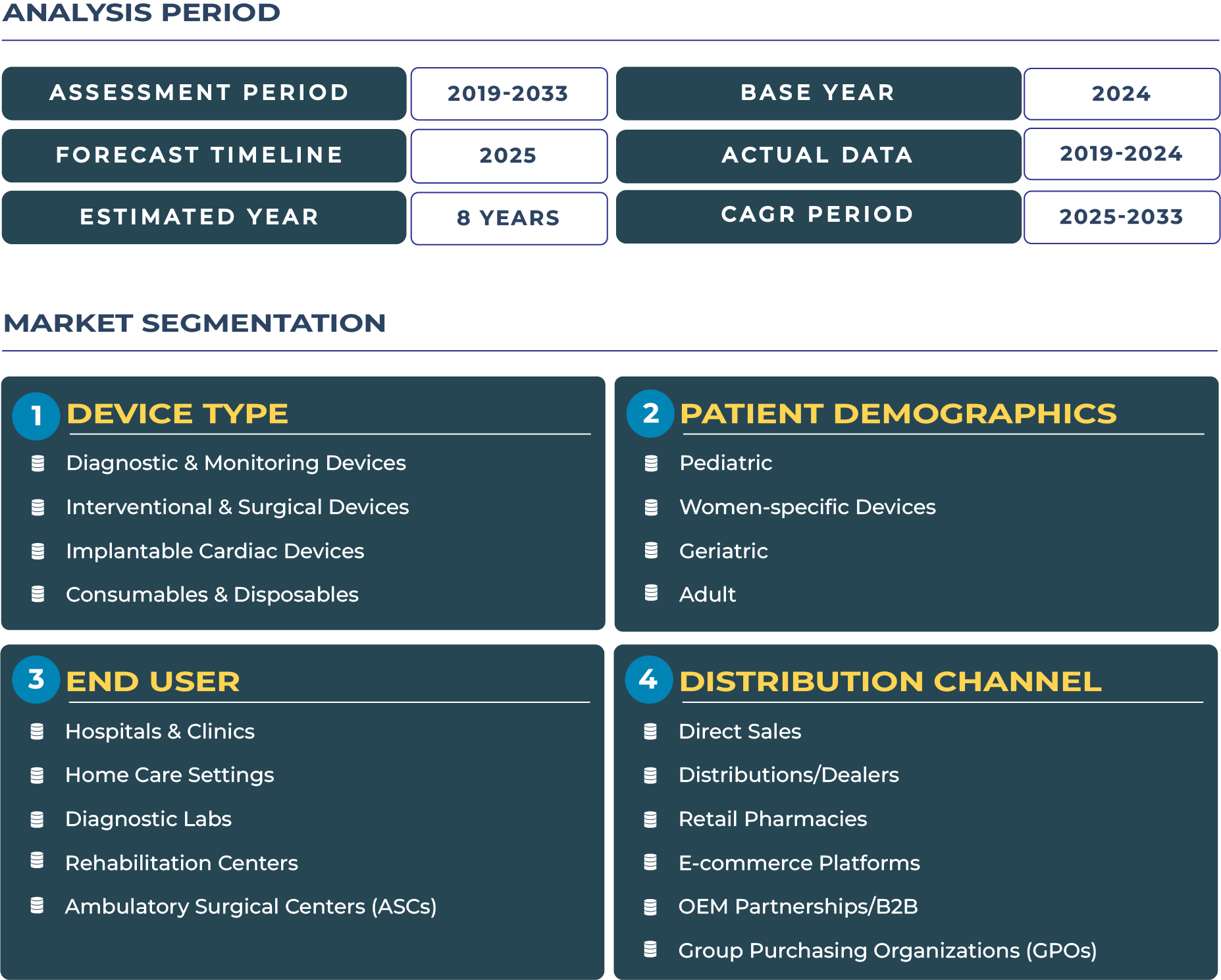

Oman Cardiovascular Devices Market Outlook: Public Sector-Led Modernization Driving a Sustainable Healthcare Transformation

The Oman Cardiovascular Devices Market demonstrates a strong alignment with public healthcare modernization goals. Valued at USD 343.4 million in 2025, the market is expected to reach USD 432.5 million by 2033 at a CAGR of 2.9%. This performance is underpinned by ongoing government investments in tertiary care, expansion of diagnostic monitoring systems, and structured tender-based procurement processes. However, constraints such as a small population, limited private sector participation, and budget prioritization influence overall growth momentum. Still, modernization efforts are creating consistent demand for consumables, implantable cardiac devices, and durable interventional solutions, making Oman a reliable albeit smaller cardiovascular devices landscape within the Gulf region.

Government-Led Modernization Fueling the Next Wave of Cardiac Care in Oman

Oman is increasingly being recognized as a cardiovascular devices market where modernization is steered by strong public-sector investments. The country’s healthcare strategy, led by the Ministry of Health Oman, has prioritized upgrading government hospitals into advanced tertiary facilities capable of handling complex cardiac procedures. This is directly stimulating demand for durable implantable cardiac devices, interventional equipment, and diagnostic monitoring solutions. The broader cardiovascular devices ecosystem in Oman is being reshaped by these reforms, ensuring that hospitals across Muscat, Sohar, and Salalah are aligned with global best practices. While affordability and small market size pose limitations, government tenders have created structured opportunities for both international suppliers and local distributors. In effect, Oman is not only modernizing its healthcare infrastructure but also redefining expectations for reliability, training, and after-sales support in the cardiovascular devices industry.

Drivers & Restraints: Balancing Government Commitment with Market Realities

Government Investments and Tertiary Healthcare Expansion Driving Growth

The growth of Oman cardiovascular devices sector is anchored in strong state-led investments. The government has consistently increased healthcare allocations to strengthen tertiary services in urban hubs such as Muscat and Sohar. Public hospitals are procuring advanced diagnostic monitoring systems and interventional devices, reinforcing their ability to deliver comprehensive cardiovascular care. Moreover, Oman’s long-term national health vision emphasizes durability, reliability, and vendor training support, making the market attractive for manufacturers that can meet these criteria. Telehealth integration for rural areas is another driver, improving continuity of care for patients outside major cities and expanding the market for connected cardiovascular devices.

Budget Constraints and Limited Private Sector Involvement as Market Hurdles

Despite modernization, the cardiovascular devices ecosystem in Oman faces structural challenges. The small market size and reliance on public funding limit scalability for device suppliers. Tender-based procurement often emphasizes cost-effectiveness, which can deter premium device adoption unless justified by durability and lifecycle benefits. The private healthcare sector remains underdeveloped compared to regional peers, curbing opportunities for premium segment expansion. Furthermore, while consumables and disposables enjoy consistent demand, long procurement cycles for high-value devices sometimes delay adoption. These factors together slow market dynamism, requiring manufacturers to align with the realities of Oman’s healthcare system by emphasizing value-driven pricing and after-sales support.

Trends & Opportunities: How Oman Cardiovascular Sector is Shaping Its Future

Public Hospital Upgrades and Telehealth Expansion as Emerging Trends

Oman cardiovascular devices industry is witnessing steady transformation through continuous upgrades of public hospitals. Facilities in Muscat and Salalah are increasingly equipped to perform advanced interventional cardiology procedures, which raises demand for high-quality implantable cardiac devices and surgical equipment. Another significant trend is the rollout of telehealth platforms to serve remote governorates. This telecardiology approach is improving follow-up care and enhancing demand for connected monitoring solutions. Consumables such as catheters, stents, and disposable monitoring accessories are also seeing heightened adoption, reflecting the push for volume-based efficiency within public healthcare systems.

Opportunities in Public Tender Participation and Training Partnerships

For international and regional cardiovascular device companies, Oman offers specific opportunities in public tender participation. Engagement in structured procurement cycles provides predictability and access to long-term partnerships. Additionally, the government’s emphasis on capacity building has opened avenues for training programs, where suppliers are expected to offer workshops and technical education to hospital staff. Telehealth rollouts present another opportunity, enabling companies to introduce connected diagnostic solutions that can be integrated into Oman’s healthcare infrastructure. Durable, low-maintenance devices that align with tender requirements are particularly well positioned to succeed in this market.

Competitive Landscape: Aligning with Government Procurement and Durability Demands

The competitive landscape of Oman cardiovascular devices market is shaped by both global and regional players. International companies such as Medtronic play a major role by supplying advanced implantable and interventional devices through public hospital procurements. Regional distributors support supply chain reliability, ensuring consumables and disposables are consistently available. Recent years have seen tenders awarded for upgrades of Muscat’s tertiary hospitals, alongside pilot programs for telecardiology in remote governorates. The market rewards companies that emphasize durability, lifecycle support, and technical training programs tailored to local healthcare professionals. Oman’s cardiovascular devices landscape is therefore less about rapid expansion and more about creating sustainable, long-term partnerships anchored in government healthcare priorities.