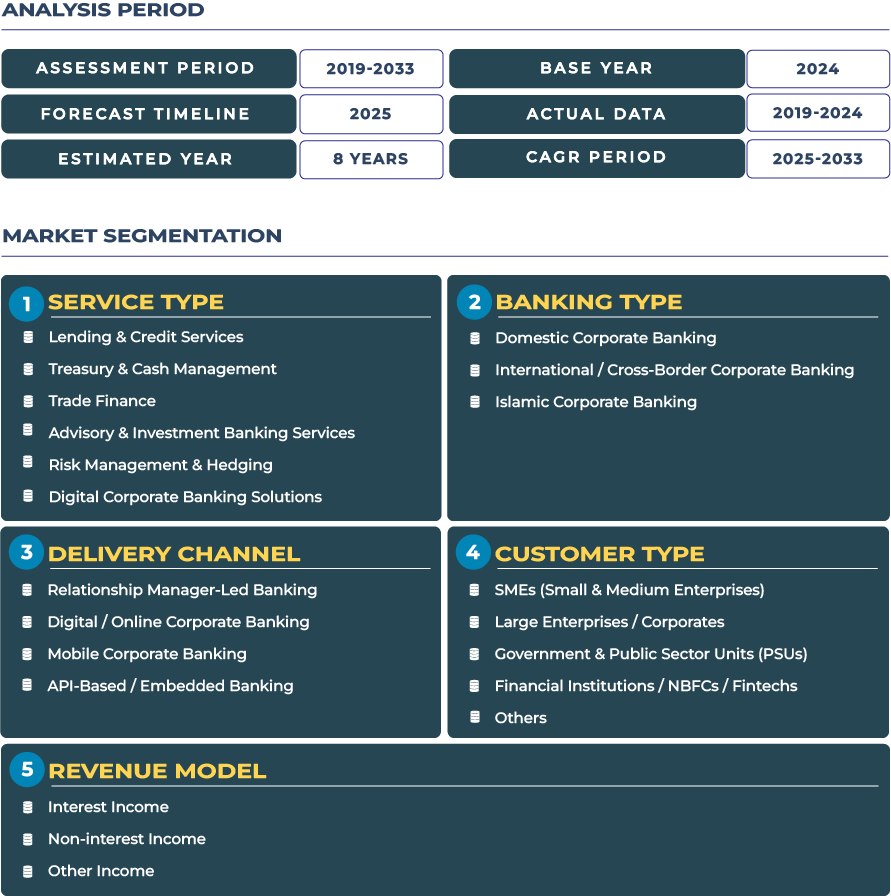

Oman Corporate Banking Market Outlook: Digital Treasury Transformation and SME Empowerment Reshaping the Financial Future

The Oman Corporate Banking Market is evolving toward a digitally driven financial ecosystem that prioritizes efficiency, transparency, and accessibility for businesses of all sizes. Omani banks are undergoing a transformative shift by integrating digital corporate banking, treasury management, and SME-focused financing into their service models. This evolution is driven by the nation’s broader economic diversification efforts under Oman Vision 2040, which emphasizes private sector development and financial inclusion. The market is projected to grow from USD 1.0 billion in 2025 to USD 1.1 billion by 2033. Despite the moderate growth, the sector’s strategic focus on digitalization, green project financing, and export-oriented corporate banking services is redefining Oman’s financial landscape.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Digital Corporate Banking Transformation in Oman, Enhancing Treasury and SME Financing

Oman corporate banking sector is entering a phase of strategic modernization. The shift toward digital corporate banking is enhancing efficiency in cash management, trade finance, and treasury operations. Institutions are reengineering their offerings to meet the needs of SMEs, large enterprises, and multinational corporations operating in logistics, energy, and manufacturing. Under the guidance of the Central Bank of Oman (CBO), the sector has accelerated the adoption of digital solutions, real-time payments, and cross-border liquidity management platforms that align with international standards.

Corporate banks such as Bank Muscat and Sohar International are leading this transformation. They are integrating cloud-based treasury management systems and offering customized digital dashboards that help enterprises optimize working capital and streamline payables. The focus on SME financing has intensified as Oman seeks to diversify its economy beyond hydrocarbons, empowering small businesses through fintech partnerships and digital credit evaluation tools. As Omani corporates embrace automation, the nation corporate banking industry is becoming more resilient, agile, and inclusive, creating a strong foundation for long-term financial sustainability.

Market Drivers and Restraints: Strategic Infrastructure Investments Fuel Growth Amid Sectoral Constraints

The Oman corporate banking industry is gaining momentum due to its strategic role in supporting national development projects. A key growth driver is the rising demand for project finance in logistics, ports, and renewable energy. Oman’s major infrastructure initiatives, including the Port of Duqm and Sohar Industrial Port expansions, have boosted corporate financing requirements for construction, logistics, and energy projects. Furthermore, corporate banks are increasingly participating in export finance for non-oil sectors such as minerals, fisheries, and manufacturing, facilitating international trade and foreign investment inflows.

Another major growth catalyst is the growing interest in financing green desalination and renewable energy projects. As the country moves toward energy transition and sustainability, banks are aligning their risk management and lending frameworks with ESG principles. However, challenges persist. Oman’s smaller banking sector faces limitations in syndication capacity, often relying on GCC-based institutions for large-scale project funding. Additionally, the need for capacity building in specialized financial areas such as derivatives, hedging, and structured finance constrains rapid innovation. Balancing modernization with capability enhancement remains essential for sustaining sectoral growth in the coming decade.

Trends and Opportunities: Port Development, Renewable Financing, and Export Credit Expansion Define the Next Decade

Several emerging trends are reshaping the trajectory of the corporate banking ecosystem in Oman. Port and logistics project finance is becoming increasingly significant as Oman positions itself as a regional trade hub connecting Asia, Africa, and the Middle East. Banks are participating in syndicated lending arrangements that support port infrastructure, free zones, and industrial clusters in Duqm and Sohar. These projects are generating opportunities for financing, treasury management, and insurance-linked instruments for both domestic and international enterprises.

Another strong trend is the growing emphasis on green desalination and renewable energy lending. Financial institutions are aligning their portfolios with Oman’s sustainability goals, particularly in solar, hydrogen, and water projects. The emerging demand for structured export finance in fisheries, minerals, and industrial manufacturing further reinforces the sector’s diversification agenda. Corporate banks are introducing API-based treasury management systems and AI-assisted credit risk assessment tools to streamline financing and enhance compliance transparency. These advancements signify a progressive step toward integrating technology and sustainability in Oman’s financial sector.

Opportunities also lie in the expansion of supply-chain finance and digital trade documentation. As businesses across Muscat, Sohar, and Salalah adopt paperless and blockchain-enabled trade workflows, corporate banks can strengthen their role as key intermediaries supporting liquidity and global trade efficiency. The government’s infrastructure pipeline, coupled with a stable regulatory environment, positions Oman to attract long-term foreign capital and technical expertise through innovative corporate banking partnerships.

Competitive Landscape: Local Champions and Global Entrants Accelerate Innovation in Oman’s Corporate Banking Market

The Oman corporate banking sector continues to witness consolidation and innovation led by domestic and regional financial institutions. Bank Muscat, the largest corporate bank in Oman, is actively modernizing its treasury management and digital platforms. In 2024, it introduced an enhanced digital corporate banking suite designed for real-time transaction monitoring and liquidity management, enabling clients to manage operations across multiple jurisdictions. Similarly, National Bank of Oman (NBO) has strengthened its corporate portfolio by offering sustainability-linked loans and trade finance solutions for exporters.

International banks such as HSBC Oman and Standard Chartered Oman are expanding their footprint by focusing on advisory, structured finance, and project partnerships aligned with Oman’s economic diversification strategy. Recent developments include syndicated lending arrangements supporting renewable and infrastructure projects, reflecting a coordinated push toward sustainable corporate financing. The market’s competitive dynamics are therefore shifting toward innovation-led service delivery, risk diversification, and client-centric banking ecosystems that combine digital agility with strategic capital deployment.