Peru Dental Devices Market Outlook: Unlocking Growth Through Dental Tourism and Emerging Demand

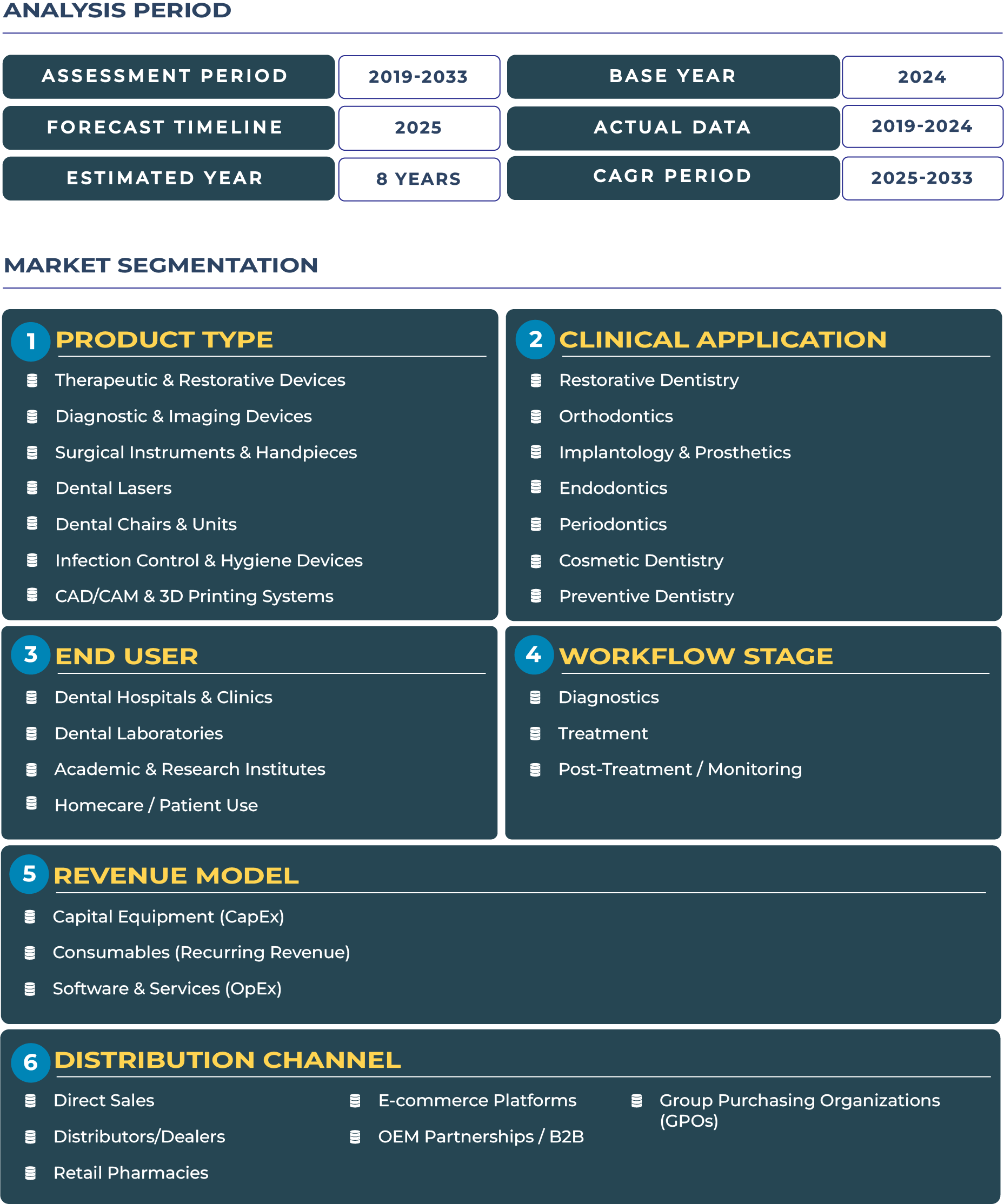

Peru has been steadily rising as a competitive hub in Latin America’s healthcare ecosystem, particularly within the dental devices market. Economic reforms, healthcare modernization, and its positioning as a cost-effective destination for dental tourism have reshaped the outlook for this sector. By 2025, the Peru dental devices industry is estimated to reach USD 204.5 million, and projections suggest it will expand to USD 381.9 million by 2033, growing at a healthy CAGR of 8.1% between 2025–2033. This growth highlights both the rising affordability of advanced procedures in Peru and the increasing willingness of both domestic and international patients to invest in restorative, cosmetic, and diagnostic dental solutions.

A Dental Devices Sector Strengthened by Tourism and Local Demand

The Peru dental devices market stands out due to its alignment with medical tourism, especially in coastal hubs and metropolitan areas like Lima. International patients from North America and Europe are choosing Peru for procedures such as implantology and orthodontics, given the lower costs and strong clinician expertise. At the same time, a growing middle class in Lima is investing more in private dental care and cosmetic treatments, fueling demand for diagnostic and imaging devices, dental chairs, and infection control solutions. Despite some structural inefficiencies in the healthcare ecosystem, these factors are collectively creating a robust market outlook, where affordability, modernization, and global patient inflow serve as strong pillars of growth.

Drivers & Restraints: Balancing Opportunity with Infrastructure Gaps

Strong Growth Drivers Powering the Peru Dental Devices Industry

Several drivers are shaping Peru dental devices sector. Lima’s private clinics are at the forefront, adopting modern equipment and offering advanced cosmetic procedures that demand dental lasers and surgical handpieces. Cosmetic dentistry is growing quickly, with procedures like teeth whitening, aligners, and implants driving the adoption of CAD/CAM systems and consumables. Additionally, medical tourism in coastal cities is boosting demand for dental restorative devices, as international patients look for affordable yet reliable procedures. These drivers indicate that Peru’s urban centers, particularly Lima, Trujillo, and Cusco, will remain the hotspots for premium dental device adoption.

Key Restraints Hindering Market Expansion

Despite the positive momentum, there are restraints slowing down the dental devices landscape in Peru. Distribution remains fragmented, with clinics outside Lima struggling to access the latest devices at affordable prices. Price sensitivity is a major barrier in provinces, where disposable income is lower, and dental procedures are often considered discretionary. Furthermore, limited laboratory capacity for advanced procedures outside urban hubs restricts the adoption of prosthetics and CAD/CAM-based devices. These challenges highlight the need for strategic distribution partnerships and localized training initiatives to ensure broader adoption of advanced dental technologies across Peru.

Trends & Opportunities: Building Momentum in a Transforming Dental Devices Ecosystem

Major Market Trends Reflecting Regional Dynamics

The modernization of coastal tourism clinics is a defining trend. Cities such as Cusco and Trujillo are upgrading their clinics with dental imaging systems and 3D printing technologies to attract global patients. Private chains in Lima are also consolidating and bringing standardization in service delivery, boosting demand for infection control devices. Furthermore, the adoption of clear aligners in urban centers reflects a shift toward aesthetics-driven dentistry, creating growth potential for companies focusing on orthodontic consumables and equipment.

Key Opportunities Shaping Future Market Expansion

The dental devices industry in Peru holds significant opportunities. Targeting Lima’s private clinics with premium consumable bundles can accelerate recurring revenue. Building partnerships with dental laboratories in coastal cities can enhance procedure efficiency and scale. Mobile service vans offering preventive and diagnostic services in remote regions represent another untapped growth opportunity, allowing manufacturers to penetrate underserved markets while increasing brand recognition. Together, these opportunities underscore a transformative shift in Peru’s dental devices ecosystem.

Competitive Landscape: Strategies and Developments Shaping the Market

The competitive landscape of the Peru dental devices sector reflects both international and local engagement. Global companies such as Straumann and Dentsply Sirona are strengthening their presence by offering flexible financing and consumable packages tailored to Peru’s inflation-sensitive market. Local clinics and distributors are forming partnerships with laboratories to support advanced prosthetic procedures. Strategies such as targeting Lima and coastal tourism clinics with premium bundles, as well as lab partnerships in regional hubs, are gaining traction. National press coverage has reported on the expansion of private clinics in Lima and the modernization of coastal clinics to attract international patients. These strategies are helping Peru’s dental devices market navigate infrastructure limitations while capitalizing on tourism-driven demand.