Loyalty Programs for Expanding Middle-Class Insurance Uptake: Market Outlook in Peru Insurance Brokerage Sector

Peru insurance brokerage market is entering a transformative phase, fueled by a growing urban middle class that increasingly values stability and loyalty-driven financial products. Brokers are pivoting their strategies toward long-term retention programs, combining wellness benefits and multi-year policies to reinforce client relationships. Unlike short-term sales approaches, this loyalty-driven model offers added incentives such as preventive health check-ups, family protection plans, and wellness-linked policy discounts. These initiatives resonate strongly with middle-class households in Lima, Arequipa, and Trujillo, where rising disposable income is creating demand for continuity and reassurance in financial planning.

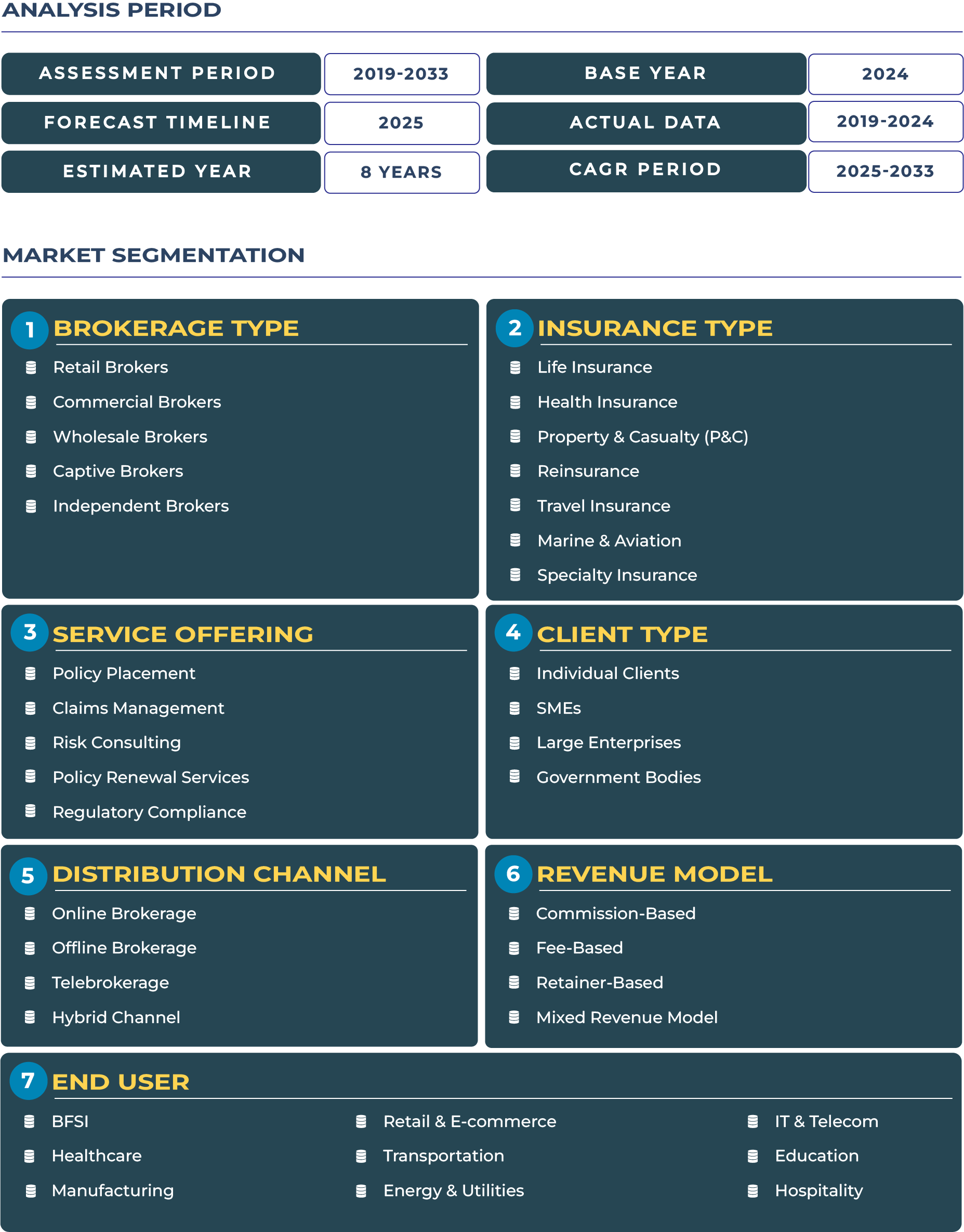

The insurance brokerage industry in Peru is projected to grow from USD 1,054.7 million in 2025 to USD 2,443.8 million by 2033, reflecting a robust CAGR of 11.1% between 2025 and 2033. This expansion is supported by higher penetration of health and life insurance, rising digital adoption, and an expanding gig economy seeking risk protection. At the same time, loyalty and retention initiatives are strengthening brokers’ ability to build long-term revenue streams in a market traditionally challenged by low insurance penetration rates. The brokerage ecosystem is evolving into a hybrid structure where independent brokers focus on specialized products, retail brokers strengthen urban engagement, and commercial brokers tailor group policies for SMEs. As a result, Peru’s insurance brokerage sector is positioned to not only grow in scale but also establish deeper, more sustained client relationships.

Drivers and Restraints Shaping Peru’s Insurance Brokerage Industry Trajectory

Gig Economy Insurance Growth Supporting Diversified Brokerage Revenue

The gig economy in Peru is expanding rapidly, particularly in urban centers where ride-hailing, food delivery, and freelance services are booming. Brokers are responding by designing insurance solutions for temporary and part-time workers who often lack formal protection. Independent brokers are offering micro health insurance and liability policies specifically for gig workers, enabling them to access affordable coverage through mobile-first channels. This has created a new revenue stream for brokers while increasing insurance penetration among non-traditional workers. The adaptability of brokers in designing products for fragmented labor markets has become a crucial growth engine for the industry.

Rising Health and Life Insurance Coverage Among Middle-Income Households

Health awareness and financial security have become top priorities for Peru’s expanding middle class, leading to increased uptake of health and life insurance products. Retail brokers are playing a critical role in distributing family health coverage with added benefits such as preventive care, hospitalization coverage, and multi-year premium discounts. Life insurance has also gained traction, with commercial brokers targeting SMEs to extend group life insurance to employees as part of retention strategies. The growth in health and life insurance distribution underscores the brokerage industry’s role in aligning financial products with evolving societal needs.

Poor Digital Infrastructure Limiting Broker Reach in Semi-Urban and Rural Areas

Despite progress in urban centers, Peru’s digital infrastructure remains underdeveloped in semi-urban and rural areas, limiting the ability of brokers to expand insurance penetration. Wholesale brokers, which rely on nationwide distribution, often struggle with inconsistent internet access and limited consumer awareness in remote provinces. This digital divide not only reduces the efficiency of mobile-first solutions but also hampers financial inclusion, creating a barrier to the industry’s full potential. Without targeted government or private investment in connectivity, brokers will face challenges in scaling their operations beyond metropolitan areas.

Lack of Actuarial Data Constraining Product Innovation for Brokers

Another key restraint is the limited availability of comprehensive actuarial data to support product pricing and risk assessment. Brokers often face difficulties in customizing products for niche markets, such as agriculture or climate-linked coverage, due to insufficient risk modeling information. Captive brokers working with insurers struggle to balance competitive premiums with sustainability when data inputs are weak. This restricts innovation, particularly in emerging areas like parametric insurance or telematics-based auto policies. Strengthening actuarial data systems will be essential to unlocking advanced insurance offerings in Peru’s brokerage sector.

Major Trends and Emerging Opportunities in Peru’s Insurance Brokerage Market

Telematics-Based Auto and Property Pricing Enhancing Risk Transparency

Telematics is emerging as a transformative trend in Peru’s auto and property insurance segments. Brokers are increasingly adopting usage-based pricing models, where premiums are determined by driving patterns, mileage, or property monitoring sensors. Retail brokers in Lima are piloting telematics-based auto insurance that allows urban drivers to reduce premiums by demonstrating safe driving behavior. Similarly, property brokers are experimenting with smart home data to design lower-risk profiles. These innovations enhance transparency, incentivize responsible behavior, and strengthen trust between brokers and clients.

Self-Service Platforms Redefining Insurance Distribution Channels

Digital self-service platforms are reshaping client-broker interactions, particularly among tech-savvy urban populations. Independent brokers and commercial brokers are launching online portals where customers can compare policies, renew coverage, and file claims without intermediaries. In Arequipa, mid-sized brokerage firms have reported increased adoption of self-service platforms among younger professionals seeking autonomy in policy management. This trend reduces administrative overhead for brokers while offering clients a seamless and transparent experience. Over time, self-service models are expected to become a dominant channel in Peru’s insurance brokerage ecosystem.

Embedded Insurance for Digital Goods Creating Cross-Sector Opportunities

The rise of e-commerce and digital goods in Peru is fueling demand for embedded insurance models. Brokers are partnering with online marketplaces to integrate insurance coverage for smartphones, laptops, and appliances at the point of purchase. For example, retail brokers in Lima are collaborating with e-commerce platforms to provide instant coverage for electronic devices, a trend that resonates strongly with Peru’s digitally active youth. This integration of insurance into consumer purchase journeys creates an entirely new avenue for distribution and revenue growth.

Joint Ventures with Reinsurers Accelerating Specialized Product Development

Wholesale brokers are increasingly pursuing joint ventures with international reinsurers to expand product diversity in Peru. These collaborations are enabling the introduction of specialized policies such as parametric climate insurance, marine coverage, and high-value property protection. In Trujillo, commercial brokers have launched agricultural insurance products backed by global reinsurers, helping farmers hedge against climate volatility. Such partnerships not only enhance product availability but also strengthen the credibility and capacity of local brokers in handling complex risks.

Regulatory Oversight and Government Initiatives Guiding the Brokerage Ecosystem

The Peruvian insurance brokerage industry operates under the supervision of the Superintendencia de Banca, Seguros y AFP (SBS), the national authority responsible for regulating financial services, insurance, and pension funds. SBS ensures compliance with licensing, solvency, and transparency requirements for brokers while actively promoting financial inclusion policies. Recent initiatives have included digital compliance guidelines to facilitate online brokerage operations and the encouragement of micro-insurance schemes for vulnerable populations. These regulations are vital for maintaining consumer trust and supporting sustainable growth in a sector that balances innovation with regulatory discipline.

Macroeconomic and Structural Factors Impacting the Market

Peru’s insurance brokerage sector is directly influenced by macroeconomic indicators such as urbanization rate and insurance penetration levels. According to IMF projections, Peru’s urbanization rate surpassed 79% in 2024, with major cities like Lima and Arequipa becoming hotspots for insurance demand. However, insurance penetration remains relatively low compared to regional peers, offering significant room for growth. Inflationary pressures and economic uncertainty in 2023–2024 have increased consumer interest in risk protection, particularly among middle-class households. At the same time, currency stability and fiscal reforms are improving long-term confidence in the insurance sector. These structural dynamics are shaping a brokerage landscape that is both opportunity-rich and dependent on regulatory stability for sustained expansion.

Competitive Landscape: Loyalty and Retention Programs Defining Broker Strategies

The competitive landscape in Peru’s insurance brokerage industry is becoming increasingly dynamic as both local and international players deploy loyalty-focused strategies. In January 2024, Rimac Seguros introduced multi-year retention discounts and wellness-linked health rewards through brokers in Lima. This initiative targeted Peru’s urban middle class, reinforcing the company’s leadership in loyalty-driven insurance offerings. Other brokers are also strengthening their portfolios by introducing bundled policies for families, SMEs, and gig workers. Independent brokers are leveraging self-service technology to differentiate their offerings, while wholesale brokers focus on cross-sector collaborations with reinsurers. Collectively, these strategies underscore how loyalty programs, digital adoption, and product specialization are shaping the future of Peru’s insurance brokerage landscape.

Conclusion: Loyalty-Driven Models and Digital Integration as Growth Pillars

Peru’s insurance brokerage market is evolving into a loyalty-focused, digitally enabled, and customer-centric ecosystem. With the sector projected to grow at an impressive CAGR of 11.1%, the emphasis on sustaining long-term client relationships through loyalty programs will define its competitive edge. Brokers that integrate wellness-linked benefits, leverage self-service platforms, and collaborate with reinsurers are best positioned to capture growth opportunities. At the same time, regulatory oversight from SBS ensures a balance between innovation and consumer protection, building confidence in a market where penetration remains below potential. Ultimately, loyalty programs, urban middle-class engagement, and digital transformation will enable Peru’s insurance brokerage sector to achieve sustained growth and resilience in a rapidly changing financial environment.