Export-Import Corporate Banking Solutions in Poland: Enabling SME and Trade Finance Growth

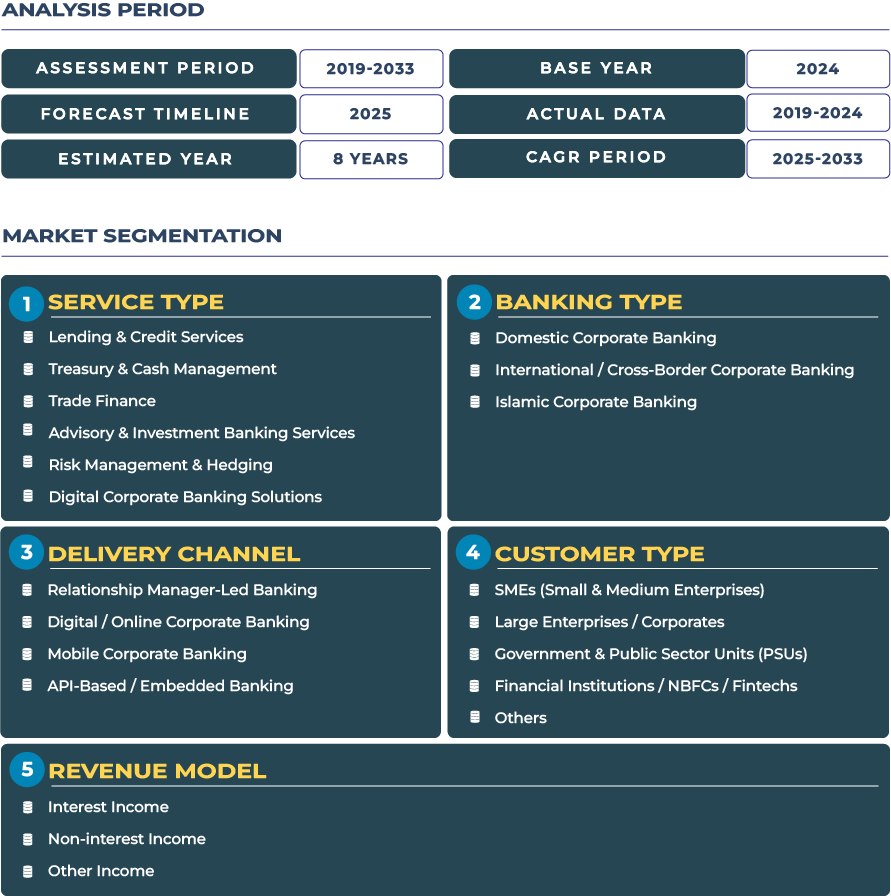

The Poland Corporate Banking Market is undergoing a transformative phase as Polish banks increasingly align their corporate offerings with the dynamic needs of small and medium-sized exporters. The rise of export-import SMEs, coupled with strong regional trade participation in the European Union, has positioned Poland as a strategic corporate banking hub in Central and Eastern Europe. In 2025, the market is valued at USD 19.3 billion and is projected to reach USD 27.2 billion by 2033, growing at a CAGR of 4.4% from 2025 to 2033, according to DataCube Research. This growth is driven by robust industrial exports, digital treasury adoption, and diversified credit portfolios supporting trade and manufacturing.

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Amid the evolving geopolitical landscape and inflationary pressures, Polish corporate banks are enhancing their trade finance, foreign exchange management, and export credit advisory services to ensure liquidity and resilience among enterprises. Institutions like Narodowy Bank Polski (NBP) and Bank Gospodarstwa Krajowego (BGK) play pivotal roles in stabilizing credit flow and supporting corporate sustainability through national guarantee programs and liquidity frameworks. This structure reflects a maturing corporate banking ecosystem focused on financial inclusion, risk management, and competitive cross-border integration.

Poland Corporate Banking Market Outlook: Strengthening Trade Finance and Digital Integration to Support Polish Enterprises

Poland corporate banking industry is advancing from traditional credit-driven frameworks to more integrated digital ecosystems that serve diversified corporate clients. The strategic expansion of export-import financing and digital cash management platforms demonstrates the market’s shift toward transaction-based revenue models and efficiency-led solutions. As manufacturing and logistics sectors expand their global footprint, banks are providing customized trade credit lines, documentary collections, and supply-chain finance tools to support seamless cross-border operations.

The resilience of the corporate banking sector in Poland also stems from the country’s macroeconomic stability and its rising appeal as a production base for European firms relocating supply chains from Asia. The introduction of corporate treasury digitization programs and real-time ERP-to-bank connectivity enhances the agility of Polish enterprises in managing working capital. Moreover, as geopolitical uncertainty persists, the growing reliance on domestic liquidity pools and regional syndicated loans is bolstering the market’s robustness and self-reliance.

Market Drivers and Restraints: Industrial Growth and Policy Shifts Shaping Corporate Banking Dynamics

Manufacturing & Export Expansion Driving Trade Finance Innovation

The Polish corporate banking sector benefits from a strong export-oriented economy led by manufacturing, automotive, and chemical industries. As exporters seek reliable trade finance and credit risk mitigation, corporate banks have responded with structured export credits and cross-border financing partnerships. The rapid digitization of ERP-bank integrations has enabled real-time reconciliation and cash visibility, particularly among mid-tier corporates that manage complex international contracts. The country’s integration into EU markets enhances access to multilateral financing programs, further accelerating the uptake of corporate lending and credit services.

Regulatory Shifts and Capital Constraints Challenge Large-Scale Lending

Despite sustained growth, Poland corporate banking landscape faces challenges arising from evolving EU banking regulations and balance sheet constraints. The need for deeper corporate credit databases and risk scoring models has intensified as banks assess exposure in volatile sectors. Political uncertainties in neighboring regions and ongoing energy price volatility affect large-ticket syndicated loans, prompting banks to adopt conservative lending strategies. The sector’s ability to balance prudence with innovation will define its trajectory over the next decade, especially as foreign investors increasingly monitor capital adequacy and liquidity ratios.

Trends and Opportunities: Digital Treasury and Regional Connectivity Driving Next-Generation Banking

ERP Integrations and Digital Treasury Solutions Redefining Corporate Operations

One of the defining trends in the Poland corporate banking industry is the integration of digital treasury solutions with ERP systems, allowing corporates to automate payments, reconcile accounts, and manage FX positions seamlessly. Banks are offering APIs and secure cloud connectors to strengthen corporate liquidity management and improve operational transparency. These integrations are particularly vital for Polish exporters that handle multi-currency transactions across European corridors, ensuring compliance and efficiency.

Supply Chain and Infrastructure Financing: Strategic Opportunity for Corporate Banks

Polish corporate banks are identifying lucrative opportunities in supply-chain finance and regional infrastructure funding. As the logistics and renewables sectors expand under the EU’s Green Deal agenda, local banks are partnering with international institutions to syndicate infrastructure loans and offer sustainability-linked credit facilities. Initiatives supporting the construction of transport corridors and energy transition projects are generating a steady pipeline of large corporate clients. This reflects an ongoing evolution of the corporate banking sector from conventional financing to strategic partnership-driven models.

Competitive Landscape: Strategic Collaborations and Digitalization Steering Market Leadership

The competitive structure of the corporate banking market in Poland is dominated by local and foreign institutions including PKO Bank Polski, Bank Pekao S.A., Santander Bank Polska, and ING Bank Śląski. These institutions are progressively introducing API-based ERP connectors, cross-border cash pooling services, and export-focused financing products tailored for Polish SMEs and corporates.

In 2024, several banks expanded their trade finance capabilities, offering enhanced guarantees and export credit insurance to mitigate risk in volatile international markets. Local institutions are also partnering with the Polish Ministry of Finance to streamline credit programs supporting domestic manufacturers. As digital platforms become the backbone of service delivery, corporate banks are investing in cloud-native treasury modules and AI-driven credit assessment systems to strengthen operational agility and risk management.