Vision 2030 and the Digital Banking Transformation of Saudi Retail Finance

Under the umbrella of Vision 2030, Saudi Arabia is aggressively reconfiguring its retail banking ecosystem through digital innovation, regulatory reform, and strategic fintech development. The government’s Financial Sector Development Program (FSDP) explicitly aims to elevate fintech, expand financial inclusion, and modernize payments infrastructure. As banking becomes increasingly mobile-first and tech-driven, consumer expectations are shifting toward seamless wallet experiences, instant loans, and embedded wealth features.

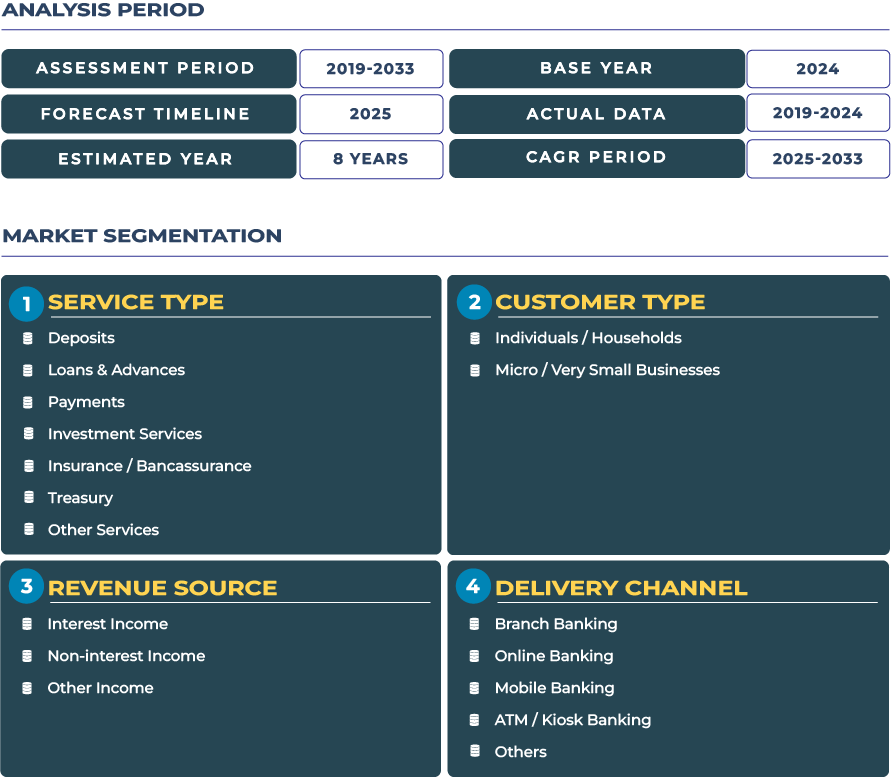

Note:* The market size refers to the total revenue generated by banks through interest income, non-interest income, and other ancillary sources.

Market Outlook That Demands Executive Focus: Why Saudi Arabia’s Retail Banking Roadmap Matters

The projected expansion from USD 24.0 billion to USD 34.2 billion over 2025–2033 positions Saudi retail banking as a dynamic growth frontier. Rather than branch proliferation, growth will be driven by digital deposit mobilization, micro-lending embedded in apps, instant payments, and upsell of investment and insurance modules. In Saudi cities like Riyadh, Jeddah, and Dammam, consumer habits are already aligning with mobile-first banking: opening accounts, transferring funds, applying for small loans, and managing portfolios are becoming app-native experiences. Banks that can convert transactional volume into funded relationships-via credit nudges, high-yield savings offers, or wealth advisory prompts-will secure a competitive edge.

Importantly, retail institutions are extending treasury-like services into mass tiers-liquidity sweep features, cash management tools, and short-dated investment instruments accessible via app. This blurring of retail and treasury capabilities increases yield per customer. The challenge lies in scaling such capabilities while maintaining capital discipline, risk governance, and regulatory compliance across multiple lines of business. Ultimately, the retail banking landscape in Saudi Arabia is evolving from a deposit-loan playbook to a holistic digital finance ecosystem, where growth is anchored by platform depth, modular product design, and integration with broader digital commerce and payments channels.

Drivers & Restraints Influencing Saudi Retail Banking Trajectory

Vision 2030 Reforms & Digital Adoption as Catalysts for Market Expansion

The FSDP is central to the growth trajectory of Saudi retail banking. It mandates fintech ecosystem expansion, modern payment rails, open banking frameworks, and regulatory sandbox environments. The Kingdom targets 525 fintechs by 2030, with over SAR 12.2 billion in venture capital support for innovation. The launch of digital banks such as STC Bank and D360 evidences the commitment to diversified banking models. The state is removing structural barriers and encouraging public-private partnerships to scale digital financial services. Concurrently, smartphone penetration in Saudi Arabia is exceptionally high, and digital payment adoption is accelerating-non-cash transactions accounted for over 79% of retail purchases in 2024. The maturity of the payments ecosystem supports bank and fintech integration. Together, these variables provide a favorable digital runway for retail banking growth.

Regulatory Complexity, Cost Pressures & Literacy Gaps as Growth Headwinds

Despite strong digital momentum, Saudi retail banking faces structural challenges. The multiplicity of regulatory demands-capital requirements, consumer protection, Sharia compliance, cyber risk regimes-imposes high compliance costs. For newer digital banks, licensing, risk reserves, and infrastructure creation raise barriers to scale. Meanwhile, in segments outside the urban elite, financial literacy remains a barrier: some consumers remain hesitant to use credit or investment tools. The government has already created a Financial Literacy Entity to embed financial knowledge into school curricula and support citizens’ digital finance engagement. Moreover, operating costs in Saudi Arabia remain high. Lastly, while digital penetration is strong in metro areas, remote and rural areas still lag in reliable connectivity, slowing full market inclusion. All of these restraints necessitate thoughtful rollout strategies, cost controls, and targeted education initiatives.

Trends & Opportunities Reshaping Saudi Retail Banking’s Future

Trend Focus: Mobile Wallets, Embedded Lending & Digital-Only Banking Accelerate Change

Digital wallets are becoming central banking interfaces. Their integration with payments, loyalty, and merchant services creates stickiness. Banks are embedding small credit offers, installment plans, and micro-insurance directly in wallet flows. The rise of neobanks and challenger models-especially STC Bank and D360-is disrupting traditional retail banking by offering lightweight, mobile-native experiences. These models often emphasize subscription services, instant credit decisions, and modular financial products. The shift from analog branches to digital-first channels is redefining acquisition, servicing, and retention strategies.

Opportunity Axis: Islamic Digital Banking & AI-Enabled Lending Innovation

An underleveraged growth path lies in embedding Sharia-compliant digital banking modules-halal investment accounts, profit-sharing deposits, murabaha-style lending, takaful within app ecosystems. Given Saudi Arabia’s cultural alignment, these modules can deepen adoption and differentiation. On the credit side, AI-enabled lending using alternative data can expand access to consumer and SME segments with thin credit files. Instant in-app lending decisions and point-of-sale credit integrated in commerce platforms offer a scalable route for retail banking expansion. These new lines of business can diversify revenue beyond interest spreads.

Competitive Landscape: Key Players & Strategic Moves in Saudi Retail Banking

The Saudi retail banking field is dominated by large institutions such as Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank, Alinma Bank, and Banque Saudi Fransi. SNB, as the largest bank, is doubling down on digital transformation and pursuing fintech collaborations. Al Rajhi leads in Sharia-compliant banking and continues to invest in digital product offerings. Recently, STC Bank secured regulatory greenlight to operate as a digital bank, injecting fresh dynamics into competition. D360 launched as a digital challenger under the FSDP initiative, supported by the state’s innovation agenda. Some incumbents are acquiring or partnering with fintech firms to accelerate loan decisioning, modular platforms, and app-based engagement features. Shared infrastructure, API-first architecture, and embedded finance partnerships with retail and telecom ecosystems are key strategic pathways. The leading banks are repositioning themselves not just as deposit-lending engines, but as digital platform orchestrators of consumer financial life.