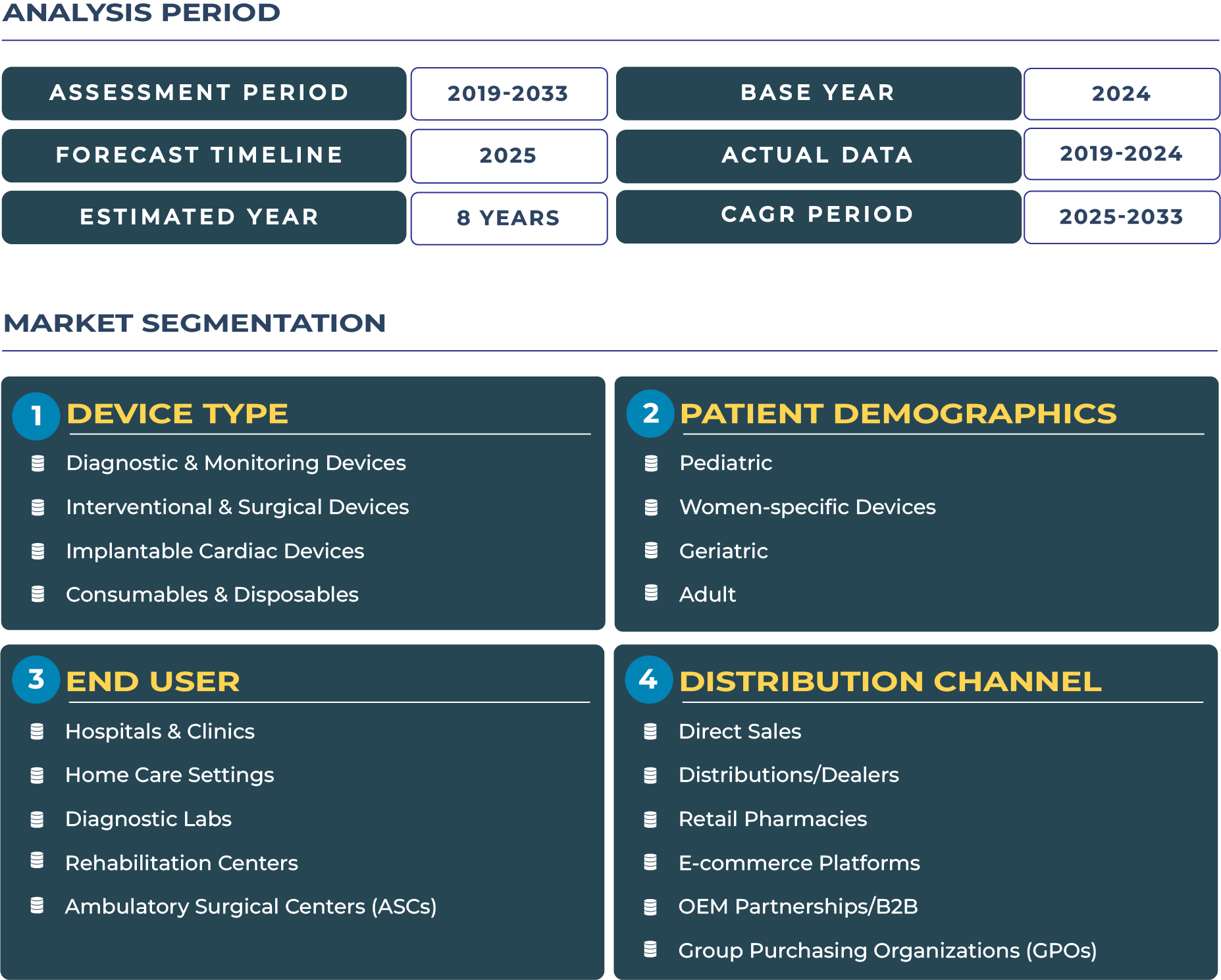

Singapore Cardiovascular Devices Market Outlook: Regional Innovation Hub Driving Clinical Leadership and Export Growth

The Singapore Cardiovascular Devices Market is expected to expand significantly, reaching USD 261.6 million in 2025 and USD 669.0 million by 2033, at a CAGR of 12.5%. Growth is anchored in Singapore’s strategic position as a medtech and clinical trials hub, offering companies a platform to validate devices and export them across Asia Pacific. The country’s regulatory clarity, advanced healthcare ecosystem, and reputation for clinical excellence strengthen its cardiovascular devices industry. Demand is further bolstered by private hospitals adopting advanced monitoring and interventional solutions, as well as by the continued focus on consumables and disposables to ensure continuity of care. With government-led initiatives fostering innovation, Singapore’s cardiovascular devices sector is positioned to achieve regional leadership in the coming decade.

Why Singapore’s Role as a Clinical Trial and Export Leader Defines the Future of Cardiovascular Devices

Singapore has emerged as one of Asia’s most advanced cardiovascular innovation hubs, where clinical trials, regulatory clarity, and export strategies converge to create a competitive edge in the global cardiovascular devices market. With a relatively small domestic market, Singapore’s value proposition lies in its ability to serve as a regional headquarters for multinational medical technology companies and as a preferred location for early-stage clinical validation. The country’s reputation for high medical standards and efficient regulatory pathways under the Health Sciences Authority (HSA) attracts global cardiovascular device companies seeking to test, validate, and launch high-value technologies. This model has enabled Singapore to become a reference site for advanced interventional devices, implantable cardiac solutions, and digital-first monitoring technologies.

Drivers & Restraints: How Singapore’s Medtech Positioning Accelerates Growth Amid Market Challenges

Strong regulatory frameworks and clinical excellence drive adoption. Singapore’s cardiovascular devices industry benefits from transparent and efficient regulatory processes established by the HSA, which are globally recognized for balancing innovation with patient safety. The country’s reputation as a trusted medtech hub attracts international companies to conduct regional trials for implantable cardiac devices and interventional surgical technologies. Private healthcare providers such as Parkway Pantai are early adopters of advanced cardiovascular solutions, ensuring patients access to world-class treatment. This combination of regulatory clarity, strong institutional infrastructure, and consistent government support has established Singapore as a magnet for high-value cardiovascular device innovation.

Small domestic market and evidence-heavy entry requirements limit speed of adoption. Despite these advantages, Singapore’s relatively small population base constrains the domestic demand for cardiovascular devices. Market entry is further challenged by stringent evidence requirements that often mandate extensive clinical validation before approval. While these standards build trust and credibility, they slow down adoption for companies that lack sufficient clinical trial data. In addition, Singapore’s high cost of operations and strong competition from established global medtech players create barriers for smaller manufacturers. As a result, the cardiovascular devices ecosystem in Singapore is highly competitive, and companies must leverage the market’s role as a regional headquarters rather than depend on domestic consumption alone.

Trends & Opportunities: Transforming Singapore into a Regional Cardiovascular Launchpad

Regional trials hub and private hospital adoption shape current trends. Singapore’s advanced research infrastructure and partnerships with academic medical centers are positioning the country as a hub for early-phase cardiovascular device trials. Major hospitals in Singapore are adopting monitoring devices and interventional technologies at scale, particularly in private centers where demand for premium care is high. At the same time, there is growing interest in digital-first monitoring solutions that leverage wearable technologies for early cardiac condition detection, aligning with Singapore’s broader national health strategy focused on preventive care.

Export-focused strategies and HQ positioning create major opportunities. Singapore’s cardiovascular devices market offers companies the opportunity to establish regional headquarters, using the country’s robust trade networks to export advanced medical devices to neighboring ASEAN markets. With free trade agreements and a strong reputation for quality, devices validated in Singapore are often fast-tracked into other Asian markets. Companies are increasingly using Singapore as a clinical trial base for implantable cardiac devices and advanced consumables, enabling faster regional rollouts. The government’s focus on medtech exports and research partnerships continues to reinforce the country’s competitive advantage in the global cardiovascular devices landscape.

Competitive Landscape: Strategies Driving Leadership in Singapore Cardiovascular Devices Industry

Singapore’s cardiovascular devices sector is characterized by collaboration between multinational companies, local innovators, and research institutes. Global leaders such as Medtronic and Abbott have established regional operations in Singapore to leverage the country’s reputation as a clinical validation hub. Local collaborations with A*STAR and academic hospitals enable testing and trial phases for interventional and implantable cardiac devices, ensuring faster integration into Asia Pacific markets. Strategies in the competitive landscape include positioning Singapore as a reference site for global product launches, leveraging partnerships with research institutions for validation, and building export pipelines to neighboring countries. Recent developments include increased regional trials activity in 2024, adoption of remote monitoring technologies by private hospitals, and growing interest in Singapore as a medtech headquarters for cardiovascular innovations. These dynamics reinforce Singapore’s role as a critical node in the global cardiovascular devices ecosystem.