Advisory-Driven Risk Sharing for Socioeconomic Inclusion in South Africa’s Insurance Brokerage Market

Insurance brokers in South Africa have become critical intermediaries in shaping equitable access to financial protection. In a country marked by income disparity and health burdens, brokers are increasingly positioned as advisory-led connectors between private insurers and underserved populations. Their role extends beyond mere product distribution, as they advise families, small enterprises, and informal workers on sustainable coverage strategies. This advisory-driven risk-sharing mechanism is fostering socioeconomic inclusion, especially in healthcare and life insurance, where chronic disease prevalence and inequality remain pressing challenges.

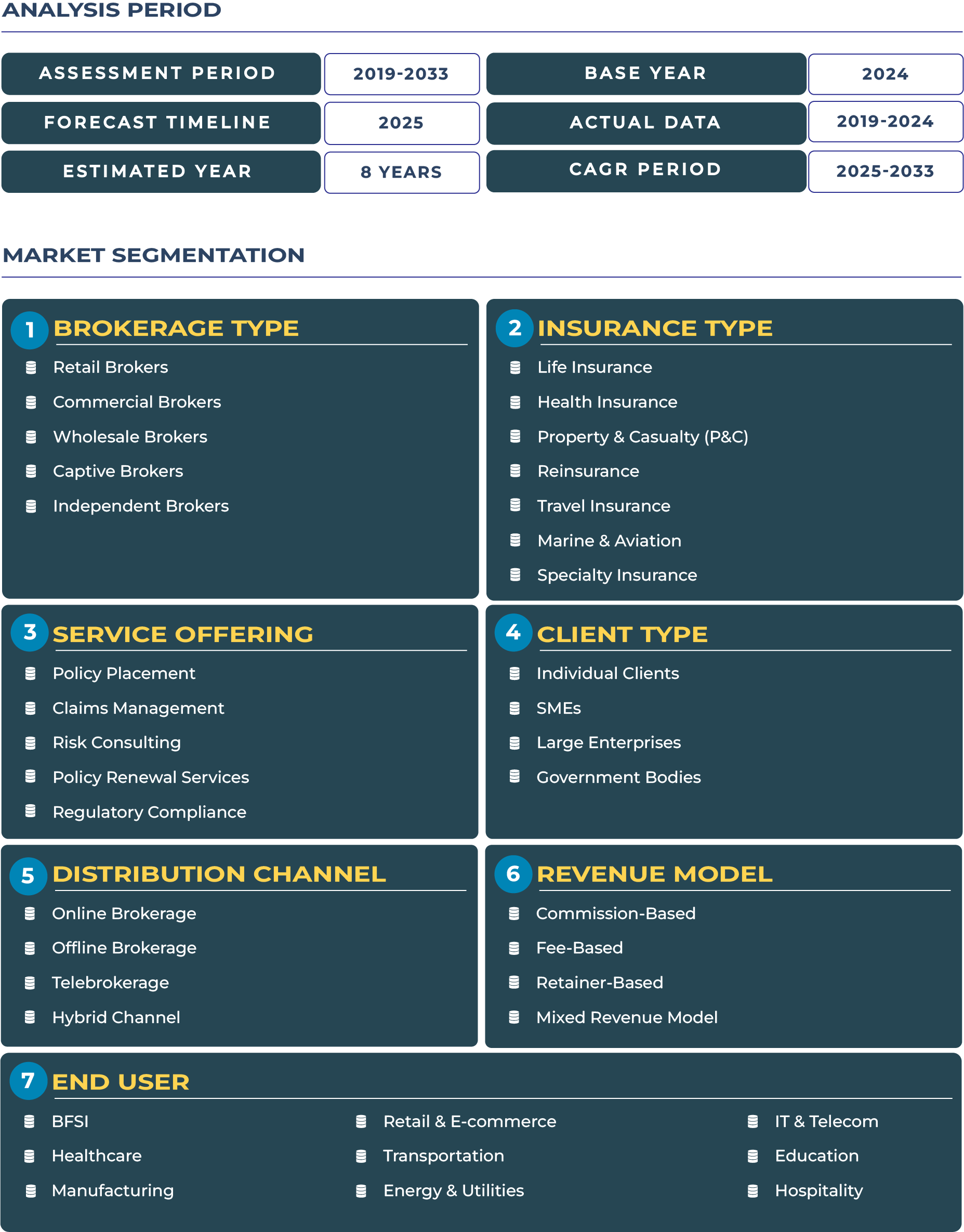

The South Africa Insurance Brokerage Market was valued at USD 369.7 million in 2025 and is projected to reach USD 575.5 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. This trajectory is being reinforced by rising urban demand for health coverage, the growing importance of cyber and property insurance, and an evolving regulatory landscape that emphasizes financial inclusion. Brokers are enabling hybrid models of public-private insurance adoption, creating resilient financial ecosystems for vulnerable communities while modernizing risk advisory for corporates. Their evolving relevance underscores a paradigm shift in how South Africa addresses socioeconomic protection through the insurance brokerage industry.

Market Drivers and Restraints Shaping South Africa’s Insurance Brokerage Ecosystem

Cyber Insurance and Life Protection as Core Growth Catalysts

The South African insurance brokerage sector is experiencing robust momentum driven by the demand for cyber coverage and comprehensive life protection. With financial institutions and SMEs facing a surge in cyber incidents, brokers are increasingly advising clients on layered cyber policies that mitigate operational disruptions and reputational risks. Similarly, heightened awareness of chronic illnesses such as diabetes and cardiovascular disease has accelerated demand for life and health coverage. Brokers, particularly independent brokers, are building advisory frameworks that tailor coverage for low- to mid-income families, enabling insurance penetration across previously underserved demographics. This growth is also fueled by South Africa’s resilient banking system, which provides strong distribution channels for broker-led advisory services.

Regulatory Complexity and Price Sensitivity Hampering Adoption

Despite growth drivers, significant hurdles temper market expansion. The insurance brokerage landscape is shaped by multi-layered regulatory frameworks under the Financial Sector Conduct Authority (FSCA), which often complicates compliance for smaller brokers. Excessive documentation requirements, licensing fees, and evolving regulatory mandates increase operating costs, making it difficult for retail brokers to remain competitive. Additionally, consumer price sensitivity in basic products such as motor and household insurance limits brokers’ ability to expand advisory-driven models. In rural and peri-urban markets, where insurance literacy remains low, affordability continues to challenge penetration, compelling brokers to balance advisory excellence with cost competitiveness.

Transformative Trends and Opportunities Defining the Insurance Brokerage Industry in South Africa

Digital Self-Service Platforms Redefining Client Engagement

One of the most prominent trends reshaping the South Africa insurance brokerage market is the adoption of self-service digital brokerage platforms. Increasing smartphone penetration and growing fintech adoption are enabling urban consumers to compare, customize, and purchase insurance products online with minimal friction. Wholesale brokers are leveraging AI-driven platforms to streamline risk assessments and client onboarding, reducing operational delays while improving transparency. The digitalization of insurance brokerage is not only meeting the preferences of tech-savvy consumers but also reducing dependence on traditional branch networks, creating a more agile insurance distribution ecosystem.

Insurance for SMEs and Cross-Border Advisory as Strategic Opportunities

Opportunities for brokers are emerging strongly in rural SME markets and cross-border insurance advisory. South Africa’s informal and small business sector contributes significantly to GDP, yet insurance adoption remains low due to lack of awareness and affordability. Captive brokers are designing micro-insurance products tailored for rural SMEs, covering asset loss, health risks, and liability protection. Furthermore, with South Africa’s position as a regional hub for trade, brokers are increasingly consulted for cross-border compliance, particularly in neighboring markets such as Namibia, Zimbabwe, and Botswana. This demand for compliance advisory and tailored SME insurance products positions brokers as strategic growth partners for regional economic resilience.

Regulatory Framework and Policy Influence on the Insurance Brokerage Sector

The South African insurance brokerage industry operates within a robust regulatory framework overseen by the Financial Sector Conduct Authority (FSCA). The regulator’s mandate emphasizes consumer protection, fair market practices, and financial inclusivity. Initiatives such as the National Treasury’s financial sector transformation policies aim to improve accessibility of insurance services to historically underserved groups. These regulations are fostering broker accountability while simultaneously creating opportunities for innovation in micro-insurance and public-private health initiatives. However, increased compliance demands require brokers to invest in legal advisory and digital record-keeping systems, reshaping cost structures across the insurance brokerage ecosystem.

Socioeconomic and Demographic Factors Impacting Brokerage Growth

The insurance brokerage market in South Africa is heavily influenced by socioeconomic dynamics such as income inequality and chronic disease prevalence. According to World Bank data (2024), South Africa remains one of the most unequal societies globally, with over 55% of its population living below the upper-middle-income poverty line. This disparity impacts insurance affordability and adoption, particularly in rural areas. At the same time, high incidences of chronic diseases are pushing households to seek financial safety nets, creating demand for health and life insurance policies. Brokers, especially commercial brokers, are aligning their advisory models to these realities, balancing affordability with long-term coverage sustainability. These factors are expected to play a decisive role in sustaining insurance penetration growth through the forecast horizon.

Competitive Landscape: Local and International Brokerage Strategies Driving Market Evolution

The competitive landscape in South Africa’s insurance brokerage sector is characterized by the presence of both local players and international firms. Companies such as Discovery, Marsh, Aon, and Alexander Forbes are actively shaping market direction through innovative strategies. For example, in February 2024, Discovery Insurance expanded its broker-led disease management plans targeting low-income urban zones, reinforcing its commitment to public-private risk-sharing. Similarly, Aon has enhanced its cyber risk advisory portfolio to support mid-sized businesses in Johannesburg and Cape Town, while Marsh is focusing on cross-border compliance solutions for regional corporates. Independent brokers, meanwhile, are thriving on niche advisory roles, particularly in property insurance and SME coverage. This competitive diversity underscores the sector’s adaptability to both local socioeconomic challenges and global insurance trends.

Conclusion: Insurance Brokers as Catalysts for Inclusive Risk Advisory in South Africa

The South Africa insurance brokerage market is undergoing a fundamental transformation, with brokers evolving from policy distributors to advisory-driven catalysts of socioeconomic resilience. As the market grows the brokerage firms are playing a pivotal role in addressing chronic disease burdens, income inequality, and financial exclusion. Their capacity to foster hybrid public-private models, digital self-service innovations, and SME-focused micro-insurance solutions highlights their importance in national economic stability. Regulatory frameworks under the FSCA are reinforcing consumer protection, while competitive dynamics are driving innovation across brokerage models. In essence, the South African insurance brokerage sector is positioning itself as a cornerstone of inclusive risk management, balancing profitability with broader social and economic imperatives.