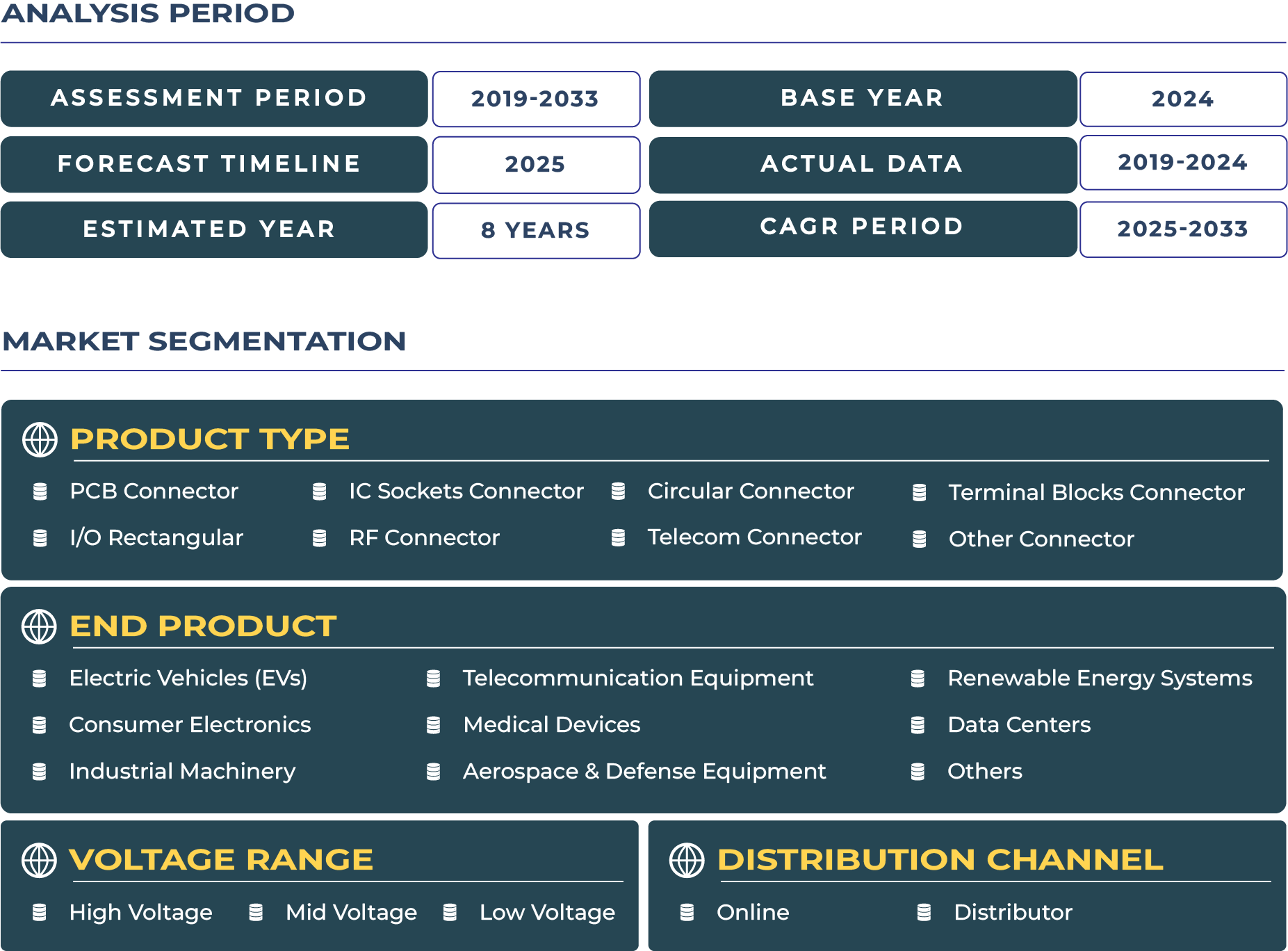

South Korea Connector Market Outlook

Fortifying Korea’s Automation Backbone: The Standardized & Rugged Connector Revolution

South Korea’s manufacturing renaissance is underpinned by the rise of connectors engineered for durability and standardized performance. In a nation defined by heavy-duty automation—from steelmaking to maritime logistics and battery infrastructure—connector reliability is no longer optional. The South Korea connector market is expected to reach USD 1.2 billion by 2033.

Connector Resilience: Backbone of Korea’s Automated Manufacturing Ecosystem

Korea’s advanced electronics assembly, including PCB and surface-mount systems, demands connectors that can withstand high vibration, thermal loads, and continuous use. In Ulsan’s automotive battery plants, circular MEC connectors are now specified with 10,000 mating cycles and IP67 protection to support battery swapping infrastructure—essential for electric fleet growth. These rugged connectors mitigate downtime under harsh conditions while facilitating plug-and-play operations. The standardization of connector types across Korean OEMs further reduces design variation and accelerates production ramp-ups, a critical factor in the connector industry’s competitive landscape.

Accelerated Battery Infrastructure and Port Electronics Fuel Demand for Rugged Connectivity

Two key market drivers—battery swapping infrastructure and maritime electronics—are crucial for Korea’s connector growth. While South Korea's national EV roadmap currently emphasizes charging infrastructure, the accelerating momentum in battery-swapping—especially for electric two-wheelers—signals a parallel evolution. Industry-led initiatives such as LG Energy Solution's in-house venture, Kooroo, plan to deploy over 1,000 swap stations by the end of 2025 across metropolitan regions. Complementing this, Gogoro, in partnership with local players like Bikebank, has rolled out over 70 swap stations across eight cities, including Seoul and Daegu. In coastal areas, port modernization projects in Busan and Incheon relied on marine-grade terminal block and RF connectors to withstand salt spray and high mechanical stress. These deployments validate the high demand for ruggedized connector systems tailored to battery and maritime applications.

However, the market faces significant restraints. Heavy R&D investment cycles—especially for specialized connectors—often generate slower returns. For instance, a Busan connector maker revealed in mid-2024 that returning cycle cost through product sales requires volumes beyond initial expectations. Additionally, vertical integration among Korean OEMs—such as LG Energy Solution integrating connector production into battery pack lines—reduces market access for third-party suppliers.

Automation Trends and Strategic Opportunities in SMT Integration and Ruggedized Design

The connector sector in South Korea is currently backing key trends. The deep adoption of surface-mount connectors in automated assembly lines supports high-density electronics production. Simultaneously, ruggedized connectors—especially industrial circular models—are trending in agriculture and mining, evidenced by a growing adoption of Korean-made IP68-rated I/O connectors by domestic heavy equipment OEMs.

Regulations Strengthening Connector Standardization and Quality Assurance

South Korea’s Ministry of Trade, Industry and Energy (MOTIE) implemented quality regulations in March 2024 mandating RoHS-compliant connectors in high-use industrial equipment. Connectors for battery infrastructure and industrial robots must now meet strict EMC and lifecycle standards. Compliance with these directives enhances export qualifications and supports Korea’s global brand reliability in high-precision connector modules.

5G, Automation Versus Environmental Compliance and Labor Challenges

South Korea leads globally in 5G infrastructure deployment, supporting telecom connector requirement. Over 50% of factories are equipped with 5G-enabled robotics, necessitating robust RF connectors. Meanwhile, RoHS compliance rates in Korean factories exceed 92%, enabling global connector exports. Conversely, labor cost inflation and a declining skilled-assembly workforce are impacting manufacturing margins. Some connector makers report 8% annual wage rises while OEM partners automate QC processes to mitigate these strains.

Competitive Landscape: Standardization Is Winning Strategy

South Korea’s connector ecosystem features both global giants and innovative domestic players. Amphenol Korea enhanced its terminal block lineup with ruggedized solutions tailored for marine and mining OEM exports. These product moves reflect Korea’s broader electronics export strategy, where compliance, modularity, and harsh-environment resilience are central to connector innovation across high-growth applications.