South Korea Dental Devices Market Outlook: How Digital Orthodontics and Cosmetic Dentistry Drive Growth

South Korea has earned a global reputation as a leader in digital orthodontics and cosmetic dentistry, with exports of aligners, orthodontic devices, and aesthetic dental equipment reaching global markets. Domestically, the market thrives on a strong consumer culture that places a premium on appearance, fueling demand for advanced orthodontic systems, CAD/CAM-driven restorative solutions, and aesthetic dental implants. This dual focus on innovation and beauty positions South Korea’s dental devices industry as a key player in both the local and international markets.

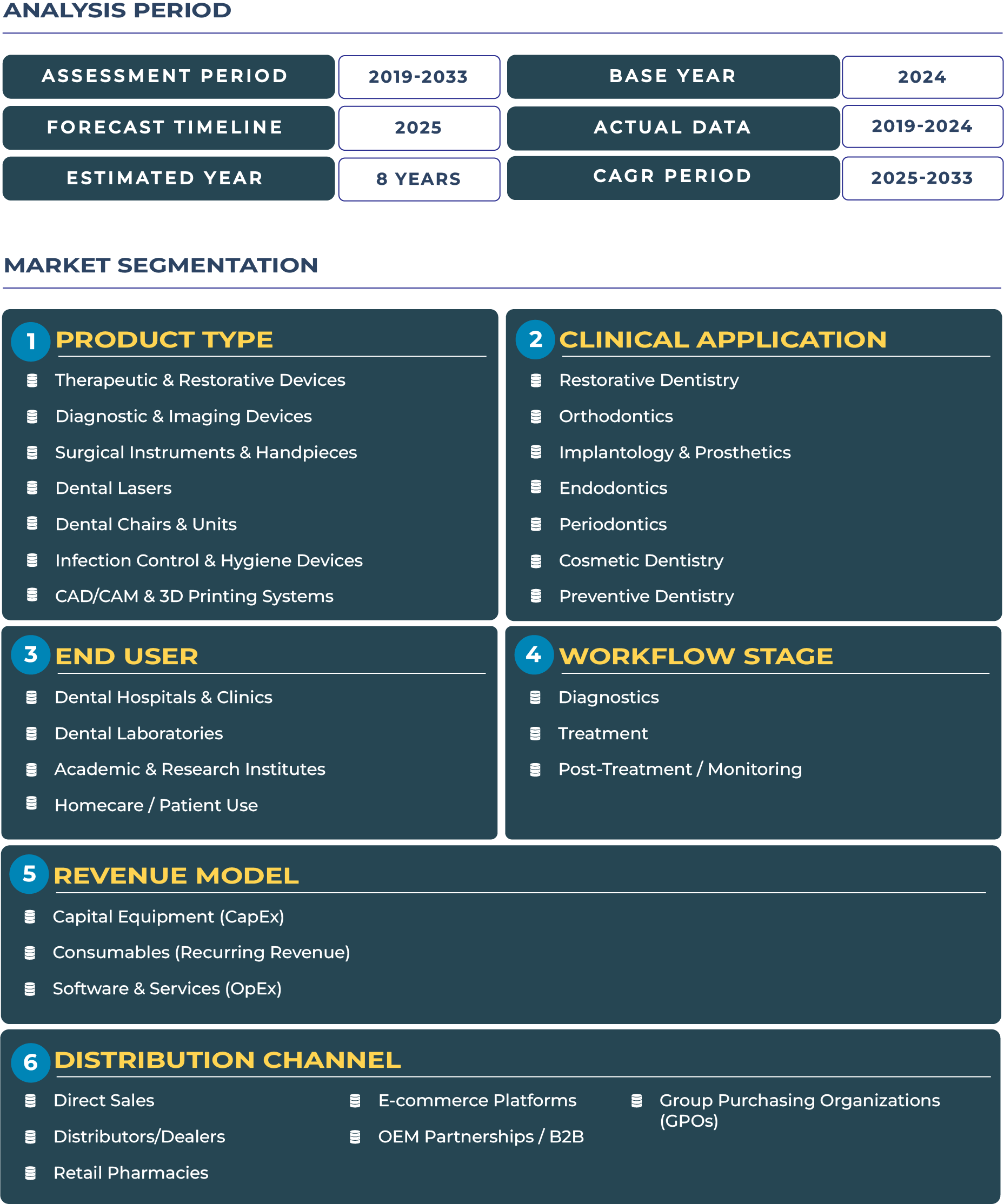

The South Korea dental devices market is expected to expand from USD 711.1 million in 2025 to USD 1,612.0 million by 2033, at a CAGR of 10.8% from 2025 to 2033. This robust growth reflects the country’s advanced digital workflows, rapid adoption of imaging and scanning technologies, and strong export base. Rising demand for therapeutic and restorative devices in cosmetic applications, alongside a thriving orthodontic segment, ensures the sector’s long-term momentum.

Key Growth Drivers Propelling South Korea Dental Devices Industry

The South Korea dental devices landscape is driven by several major factors. Foremost is the high demand for cosmetic dentistry, which extends beyond traditional oral health and into lifestyle-driven procedures. South Koreans’ focus on aesthetics has spurred a strong orthodontic and implant market, boosting both local consumption and international exports.

Another critical driver is the rapid adoption of digital solutions in clinics. From CAD/CAM units to intraoral scanners, South Korean dental practices in Seoul, Busan, and Incheon are quick to adopt new technologies, shortening treatment times and enhancing precision. Furthermore, the country’s strong orthodontic sector, led by advanced aligner systems, positions it as a global hub for cosmetic device manufacturing. Together, these drivers underscore the country’s ability to maintain a competitive edge in the global dental devices ecosystem.

Restraints Limiting Expansion in South Korea Dental Devices Landscape

Despite its strengths, the South Korea dental devices industry faces several challenges. One key issue is the relatively small domestic market size. Although consumer demand for cosmetic procedures is high, the limited population restricts absolute market volume compared to larger nations.

Another challenge is the intense competition among local OEMs, which leads to rapid product commoditization and pressures on pricing. While South Korea’s clinics are technologically advanced, there is also significant price sensitivity in basic consumables, which limits profitability for certain product categories. Finally, complex international trade dynamics and global economic pressures may affect export-driven growth, making diversification and premiumization crucial strategies for sustained expansion in the dental devices sector.

Emerging Trends and Opportunities in South Korea Dental Devices Ecosystem

The South Korea dental devices market is experiencing transformative trends. Among the most prominent is the rapid adoption of digital orthodontics and clear aligners, supported by strong consumer preference for minimally invasive, aesthetic solutions. Clinics are increasingly deploying digital workflows, including chairside CAD/CAM systems and 3D imaging scanners, to accelerate treatment delivery.

Another trend is the short product lifecycle for tech-based devices, where clinics regularly upgrade equipment to keep pace with evolving technologies. This has created opportunities for trade-in programs and service contracts that align with South Korea’s fast-moving, tech-savvy ecosystem. Moreover, opportunities are emerging in localized software support and bundled device packages, allowing firms to partner with major clinic chains for pilot rollouts in metropolitan hubs. Together, these trends position South Korea as one of the most dynamic markets in the global dental devices landscape.

Competitive Landscape: How Local and Global Leaders Compete in South Korea’s Dental Devices Sector

The South Korea dental devices industry is characterized by strong competition and rapid innovation. Local manufacturers dominate orthodontic device exports, while global leaders such as Straumann continue to expand their footprint through advanced implant solutions and premium restorative systems.

South Korea’s press and government updates highlighted the country’s rapid adoption of digital aligner technologies and the emergence of bundled offers that combine orthodontic devices with software-based monitoring platforms. Strategies such as launching trade-in and upgrade programs with large clinic chains and partnering with aligner software providers have become common, reflecting the market’s appetite for integrated solutions. The nation’s strong emphasis on exports, combined with domestic modernization, makes South Korea a high-value, innovation-driven dental devices market with global relevance.