South Korea Insurance Brokerage Market Accelerates with Digital and Freelance-Centric Growth

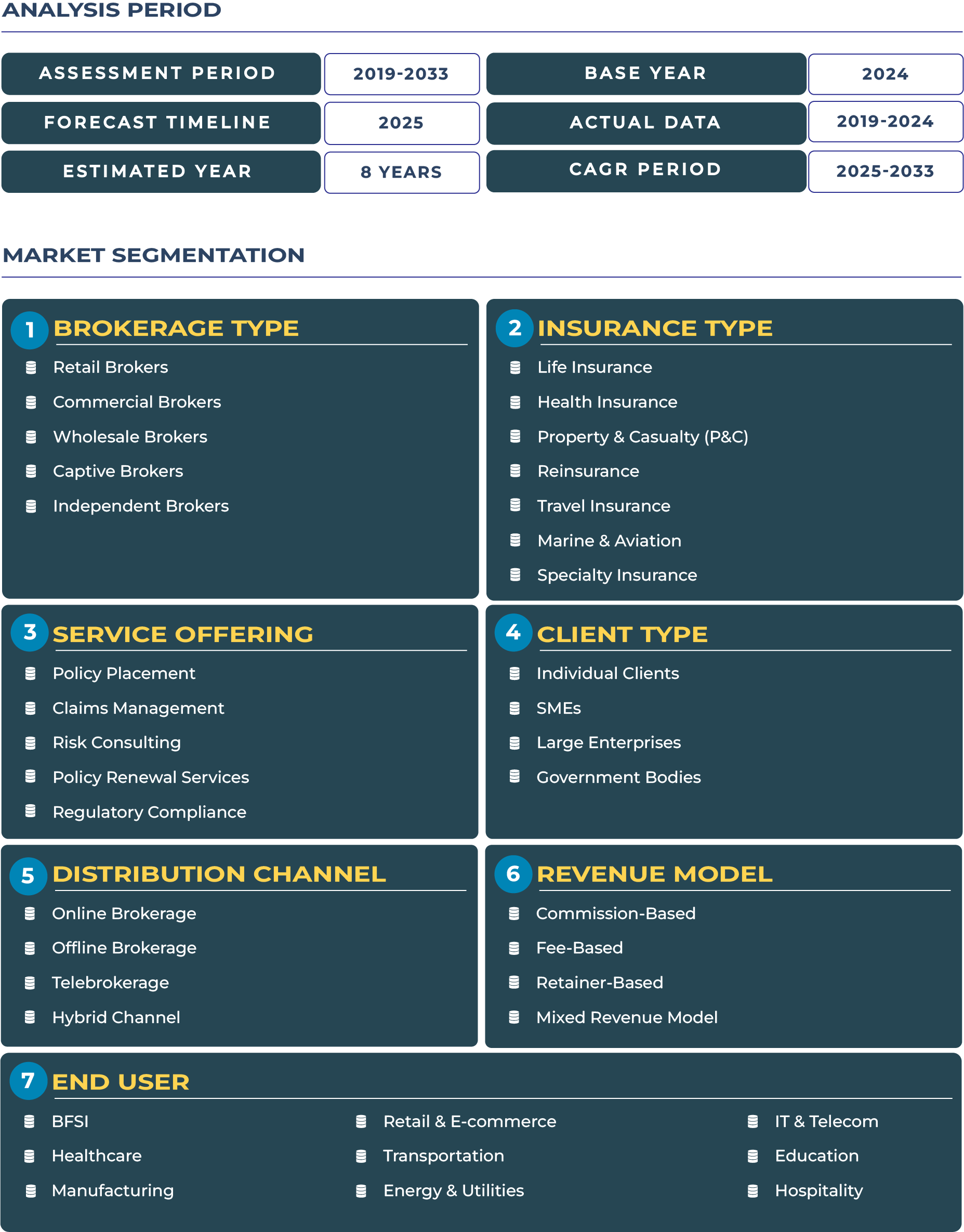

The South Korea insurance brokerage market is set for substantial expansion, projected to reach USD 6.78 billion in 2025 and advance to USD 14.50 billion by 2033, registering a steady CAGR of 10.0% between 2025 and 2033. This growth trajectory is supported by an increasingly digitized insurance ecosystem, rapid gig economy expansion, and rising cyber liability exposures. Brokers are strategically pivoting towards digital-first models, with API-driven platforms enabling real-time policy issuance and claims management. Furthermore, the increasing demand for health, cyber, and retirement-related products is reshaping the insurance brokerage industry in South Korea, offering brokers opportunities to diversify portfolios and expand client engagement.

Market Outlook: Technology-Led Brokerage Reinventing Client Engagement

South Korea’s insurance brokerage market is witnessing a structural transformation, underpinned by the country’s advanced digital economy, high internet penetration, and demand for flexible risk coverage. The proliferation of freelancers and gig workers, estimated at over five million by 2024, has spurred demand for personalized and affordable insurance solutions that traditional carriers have struggled to address. Brokers are capitalizing on this shift by deploying technology-driven systems that deliver tailored products at scale, with real-time underwriting and claims visibility. Commercial brokers are focusing heavily on cyber liability and technology-related coverage, reflecting heightened corporate exposure to digital threats. Retail brokers, on the other hand, are expanding health, accident, and annuity-linked offerings, appealing to South Korea’s urbanized and aging population.

In addition, macroeconomic conditions such as moderate GDP growth, government emphasis on insurtech innovation, and ongoing trade and geopolitical uncertainties in Northeast Asia have influenced the insurance brokerage landscape. Despite external risks, the insurance brokerage sector in South Korea is expected to remain resilient, leveraging innovation and regulatory support to expand penetration and deliver client-focused services. This positions South Korea as one of Asia’s most dynamic markets for insurance intermediation between 2025 and 2033.

Introduction: Real-Time Tech Platforms for Freelance and Cyber Brokerage

The evolution of the South Korea insurance brokerage market is being defined by the integration of real-time technology platforms that cater to the needs of freelancers and the rising demand for cyber risk coverage. With freelance and project-based employment gaining momentum, traditional one-size-fits-all insurance models are no longer sufficient. Brokers are utilizing API-enabled systems to instantly connect clients with tailored coverage, ranging from health micro-insurance to cyber liability for small-scale businesses and digital professionals. This transformation is reshaping the insurance brokerage ecosystem by blending scalability, personalization, and speed, ultimately creating a new benchmark for client engagement.

Drivers & Restraints: Forces Shaping Market Expansion

Gig Economy Coverage Needs Stimulating Brokerage Innovation

The expansion of South Korea’s gig economy has become a pivotal growth driver for the insurance brokerage industry. With millions of freelancers and digital workers seeking affordable protection, brokers are introducing customized plans such as micro-insurance packages, portable health coverage, and annuity-linked solutions designed for irregular income earners. Independent brokers are particularly effective in building loyalty within this segment by offering flexible premium structures and digital enrollment processes. As demand grows, brokers are leveraging analytics to create products that resonate with freelance workers who require simplicity, affordability, and transparency in coverage.

Demand for Cyber Insurance Creating Commercial Brokerage Opportunities

South Korea’s position as a digital leader has also exposed enterprises to rising cyber risks, prompting strong growth in commercial brokerage for cyber liability insurance. Data breaches, ransomware, and compliance challenges have forced corporations to seek specialized broker services. Commercial brokers are not only facilitating policies but also providing advisory functions that encompass risk assessment and compliance management. This is expanding brokerage revenues while positioning brokers as strategic partners in digital resilience.

High Churn and Reputational Risk Hampering Sector Stability

Despite its growth, the insurance brokerage sector faces significant headwinds. High customer churn is a recurring challenge, especially in the retail segment where aggressive competition and digital aggregators intensify switching behavior. Additionally, mis-selling and lack of transparency in certain cases have created reputational risks for brokers, leading to tighter regulatory scrutiny. Captive brokers face limitations in diversifying product offerings, which could weaken competitiveness compared to independent and wholesale brokers that enjoy broader market reach. Addressing these issues will require a balance between aggressive digital adoption and maintaining client trust through ethical, transparent practices.

Trends & Opportunities: Emerging Pathways in South Korea’s Brokerage Ecosystem

AI-Driven Underwriting Tools Reshaping Brokerage Efficiency

The deployment of AI-powered underwriting systems is enabling brokers to enhance operational efficiency and improve risk assessment. Retail and commercial brokers alike are leveraging these tools to deliver faster, more accurate quotes, thereby strengthening customer experience. In metropolitan hubs such as Seoul and Busan, brokers adopting AI and cloud platforms are already gaining competitive advantages in reducing processing times and improving product personalization.

Cloud-Based Brokerage Management Unlocking Scalability

Wholesale brokers are increasingly turning to cloud-based platforms to streamline operations, enhance data accessibility, and scale their business models. This approach enables integration with insurers and third-party service providers, fostering a seamless insurance value chain. The adoption of cloud tools is particularly strong among international brokers operating in South Korea, reflecting the country’s advanced digital infrastructure.

Micro-Insurance Models for Freelancers Expanding Market Reach

An emerging opportunity lies in micro-insurance solutions tailored for South Korea’s freelance workforce. These models allow for affordable, on-demand coverage that can be scaled based on income patterns, appealing to younger demographics entering the gig economy. Brokers are positioned to act as enablers in distributing these solutions through digital-first engagement models, enhancing accessibility in both urban and semi-urban regions.

Coverage for AI/ML-Based Liability Opening New Niches

As South Korea continues to lead in AI and robotics development, liability coverage for artificial intelligence and machine learning models is emerging as a significant opportunity. Brokers are expected to play a central role in structuring policies for firms engaged in AI-driven businesses, bridging gaps between evolving technologies and regulatory frameworks. This opportunity could significantly enhance commercial broker revenues over the forecast period.

Government Regulation: Policy Oversight Driving Sector Integrity

The Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) are central to regulating South Korea’s insurance brokerage landscape. Regulatory reforms in recent years have emphasized digital transparency, consumer protection, and fair market competition. Initiatives promoting insurtech adoption and consumer disclosure standards are strengthening trust in brokerage services. Government-backed efforts to expand cyber resilience through mandatory data protection measures are indirectly boosting the role of brokers in risk intermediation. This regulatory environment, though stringent, provides a strong foundation for sustainable market growth and investor confidence.

Key Impacting Factors: Digital Foundations and Economic Realities

Several structural factors are shaping the performance of South Korea’s insurance brokerage industry. The country’s internet penetration rate exceeding 96% in 2024 has enabled brokers to deliver digital-first services across urban and rural areas. Additionally, the rapid availability of API ecosystems is empowering brokers to integrate with insurers and fintech firms, enhancing product distribution efficiency. On the economic front, steady GDP growth and a technologically adaptive population provide tailwinds, while geopolitical tensions in the region, particularly with North Korea, introduce uncertainty that may influence investor confidence and risk appetites in the insurance sector.

Competitive Landscape: Strategies Redefining Market Dynamics

South Korea’s insurance brokerage landscape includes both domestic leaders and international players. Companies such as KB Insurance, Samsung Fire & Marine Insurance, Hanwha Life, Lotte Insurance, and Aon Korea are actively shaping the market. Strategic initiatives are focusing on technology integration, client loyalty, and product diversification. For instance, in January 2024, KB Insurance launched a broker portal integrating claims, wellness, and policy selection tools, a move designed to enhance client engagement and reduce churn. Independent brokers are expanding their reach by targeting SMEs with cyber liability and micro-insurance products, while captive brokers maintain strong footholds in bancassurance and loyalty-linked health solutions. This competitive environment emphasizes innovation, service diversification, and digital capability as core differentiators.

Conclusion: Real-Time Brokerage Poised for Resilient Growth

The South Korea insurance brokerage market stands at the intersection of digital readiness, consumer demand evolution, and regulatory oversight. The convergence of real-time brokerage systems, freelance workforce insurance needs, and rising cyber risks is creating new opportunities for both local and international brokers. While challenges such as high churn and reputational risk remain, the sector’s embrace of API-enabled platforms, micro-insurance models, and AI-based underwriting is paving the way for sustainable expansion. Between 2025 and 2033, the industry is expected to double in size, supported by a mix of technological sophistication and consumer-centric strategies. Brokers that align with these trends, foster transparency, and leverage regulatory incentives will be positioned as key enablers of South Korea’s insurance ecosystem transformation.