Spain Fintech Market Outlook: Tourism-Linked Fintech: Trust via Hybrid Cash & Neo-Banking Experiences in Spain

Spain fintech narrative is increasingly shaped by its status as one of the world top tourism hubs. Tourists contribute significantly to seasonal payment volumes, creating a strong niche for hybrid financial solutions that blend physical access with digital-first convenience. This hybrid model is evident in the rise of branded ATMs connected to neo-banking platforms, and localized multi-currency offers catering to foreign visitors. With annual arrivals surpassing 80 million, Spain tourism corridors—from Barcelona to the Balearic Islands—are setting the stage for innovative fintech models that combine secure cash access, QR-based transaction systems, and flexible foreign exchange (FX) solutions.

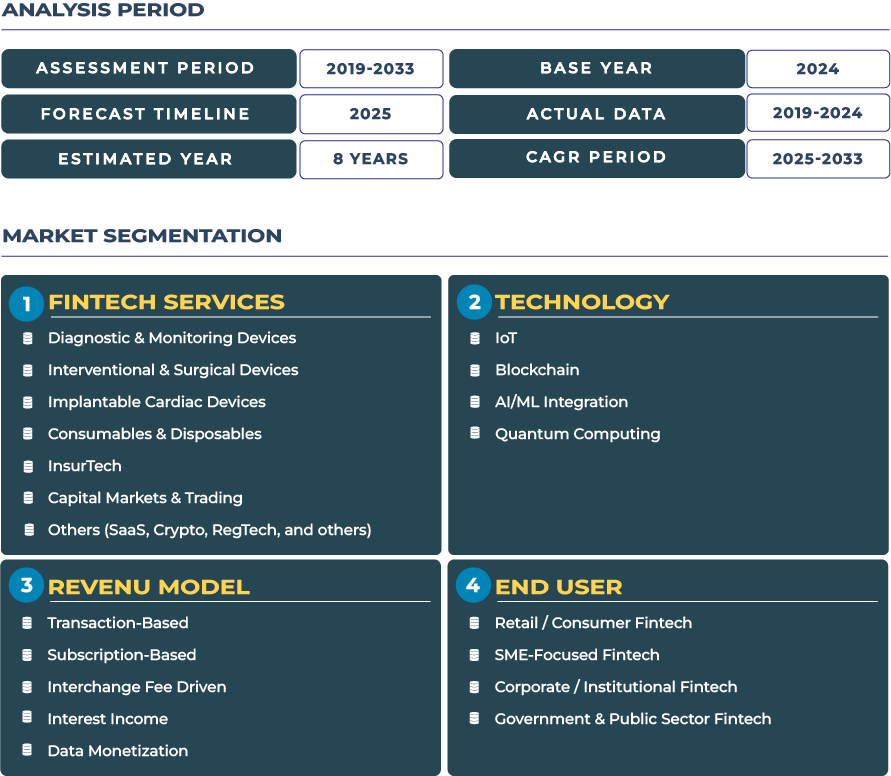

The Spanish fintech market is projected to reach USD 6.6 billion in 2025 and grow to USD 14.1 billion by 2033, reflecting a robust CAGR of 9.9% between 2025 and 2033. This growth underscores the resilience of Spain’s fintech ecosystem amid evolving consumer behaviour, geopolitical uncertainty in Europe, and the broader digital transformation of financial services. Backed by high mobile penetration and strong fintech adoption among young consumers, Spain continues to differentiate itself as a hub where local innovation intersects with cross-border opportunities.

Drivers and Restraints: Balancing High Adoption with Regulatory Fragmentation

Spain fintech industry benefits from some of the highest digital adoption rates in Southern Europe. Consumers are rapidly embracing mobile wallets, digital banking apps, and BNPL models. The presence of strong remittance corridors—particularly for Latin American and North African migrant communities—further supports transaction volumes across both consumer and SME segments. Local fintechs leverage this demand by launching affordable micro-lending solutions, while established players like BBVA invest heavily in digital-first offerings to retain competitive advantage. Another driver is the demand for real-time cross-border payments, spurred by Spain’s economic links with the European Union and Latin America.

However, the sector faces significant restraints. Fragmented regional regulations within Spain autonomous communities create hurdles for scaling fintech models nationally. Price-sensitive consumers also restrict premium service adoption, forcing fintechs to maintain thin margins. Additionally, the geopolitical climate in Europe—shaped by ongoing energy price volatility and capital flows linked to Russia-Ukraine tensions—creates economic uncertainty that could slow investment in the fintech ecosystem. Despite these challenges, Spain fintech sector is resilient, supported by strong consumer adoption and growing international investor interest.

Emerging Trends and Market Opportunities: From BNPL to Tourist-Focused Payment Models

Spain fintech landscape is witnessing rapid growth in mobile wallets and BNPL platforms, especially among youth demographics. The under-30 consumer base is increasingly opting for BNPL solutions integrated into e-commerce platforms, enabling short-term financing of retail, travel, and education expenses. Digital banking tailored for students and gig workers is also on the rise, with platforms offering zero-fee accounts and budget-tracking features.

Opportunities abound in tourist-focused payment innovations. Neo-banks and FX platforms are launching seasonal campaigns to capture international travelers, offering multi-currency QR payments, branded prepaid cards, and localized FX rates. Similarly, remittance-focused products targeting Spain’s migrant communities provide another growth avenue. By focusing on instant, low-cost transfers to Latin America and North Africa, fintechs are strengthening customer loyalty while expanding beyond traditional banking services. These trends are shaping a uniquely Spanish model of fintech innovation, rooted in cultural and demographic dynamics.

Government Regulation and Institutional Support for Spain’s Fintech Ecosystem

Spain regulatory framework for fintech is shaped by the CNMV (Comisión Nacional del Mercado de Valores) and the Banco de España. Both institutions play critical roles in supervising fintech operations, payment institutions, and crowdfunding platforms. Spain also participates in the European Union European Commission’s digital finance initiatives, aligning its policies with PSD2 directives and the upcoming European Digital Finance Strategy.

Regulatory sandboxes introduced in Spain have facilitated the entry of fintech startups by allowing them to test products under controlled environments. This framework is particularly effective in payment innovation and lending technology, helping new entrants validate business models without immediate compliance costs. However, the challenge remains to harmonize regional regulations to enable smoother national expansion. Government-backed initiatives, such as support for financial inclusion and SME digitization programs, further bolster the fintech market’s expansion across underserved communities.

Key Economic and Social Factors Impacting Spain’s Fintech Growth

Spain fintech sector is influenced by multiple external and internal dynamics. The surge in mobile payment transactions across urban centers like Madrid and Barcelona is accelerating consumer digitalization. BNPL is emerging as a significant contributor to online retail volumes, with e-commerce transactions projected to expand steadily through 2030. Spain’s demographic advantage—an urbanized, digitally literate youth population—fuels adoption across wealth management and neo-banking platforms.

At the same time, macroeconomic factors such as inflationary pressures, energy dependence, and labor market uncertainties influence consumer confidence. Spain’s fintech sector must navigate these economic fluctuations while leveraging opportunities presented by migrant remittances and rising tourism flows. The interplay of these factors highlights the importance of resilient and adaptive fintech business models in Spain.

Competitive Landscape: How Spain’s Fintech Companies Are Redefining Tourist and Consumer Finance

The Spanish fintech market is home to a mix of domestic players and international entrants. Local companies are innovating in lending technology, payments, and wealthtech solutions, while global platforms expand their presence through partnerships and acquisitions. A notable development came in June 2025, when Revolut announced Spain as the launch market for its first ATM network, providing hybrid access to cash for neo-banking customers. This move reflects the growing demand for integrated solutions where tourists and residents can seamlessly combine physical and digital financial services.

Product launches in Spain increasingly focus on seasonal and tourism-driven markets. For example, localized campaigns offering QR code-based multi-currency payments are targeting high-footfall destinations during peak seasons. Marketing strategies emphasize consumer trust, regulatory compliance, and low-cost cross-border services. Spain’s competitive advantage lies in its ability to combine tourism-driven transaction flows with the digital financial expectations of a highly connected domestic population.

Conclusion: Spain Fintech Industry as a Tourism-Powered Digital Finance Laboratory

Spain fintech market is carving out a distinctive position in the global landscape by aligning its digital finance strategy with its tourism economy and demographic profile. The market is not only fueled by rapid consumer adoption of mobile payments, BNPL, and digital banking, but also uniquely positioned to serve international tourists and migrant communities. This creates a financial ecosystem that blends trust-building mechanisms like ATM networks with cutting-edge digital innovations such as QR-based payments and real-time remittances.

The success of Spain fintech industry lies in its adaptability to both local and international consumer needs. Companies are leveraging Spain’s status as a tourism hub to introduce hybrid financial solutions that would be difficult to replicate in markets with lower cross-border transaction flows. Challenges remain in terms of fragmented regulations and economic uncertainty, but Spain’s fintech ecosystem demonstrates resilience through its ability to innovate within these constraints. In doing so, Spain positions itself as a laboratory for tourism-driven fintech innovation, with lessons that extend to other economies balancing domestic demand and global integration.