Spain’s Sports Medicine Culture Strengthens Momentum in the In-vitro Diagnostic Market

Spain’s deep-rooted passion for sports, ranging from football to cycling, has intensified its focus on sports medicine, indirectly bolstering the In-vitro Diagnostic (IVD) market. The growing number of musculoskeletal and joint-related injuries among athletes and the aging population has driven diagnostic testing for early detection, biomarker tracking, and post-operative monitoring. As the country continues to invest in advanced trauma and orthopedic care under its universal healthcare model, IVD technologies are becoming vital in improving diagnostic precision and treatment personalization.

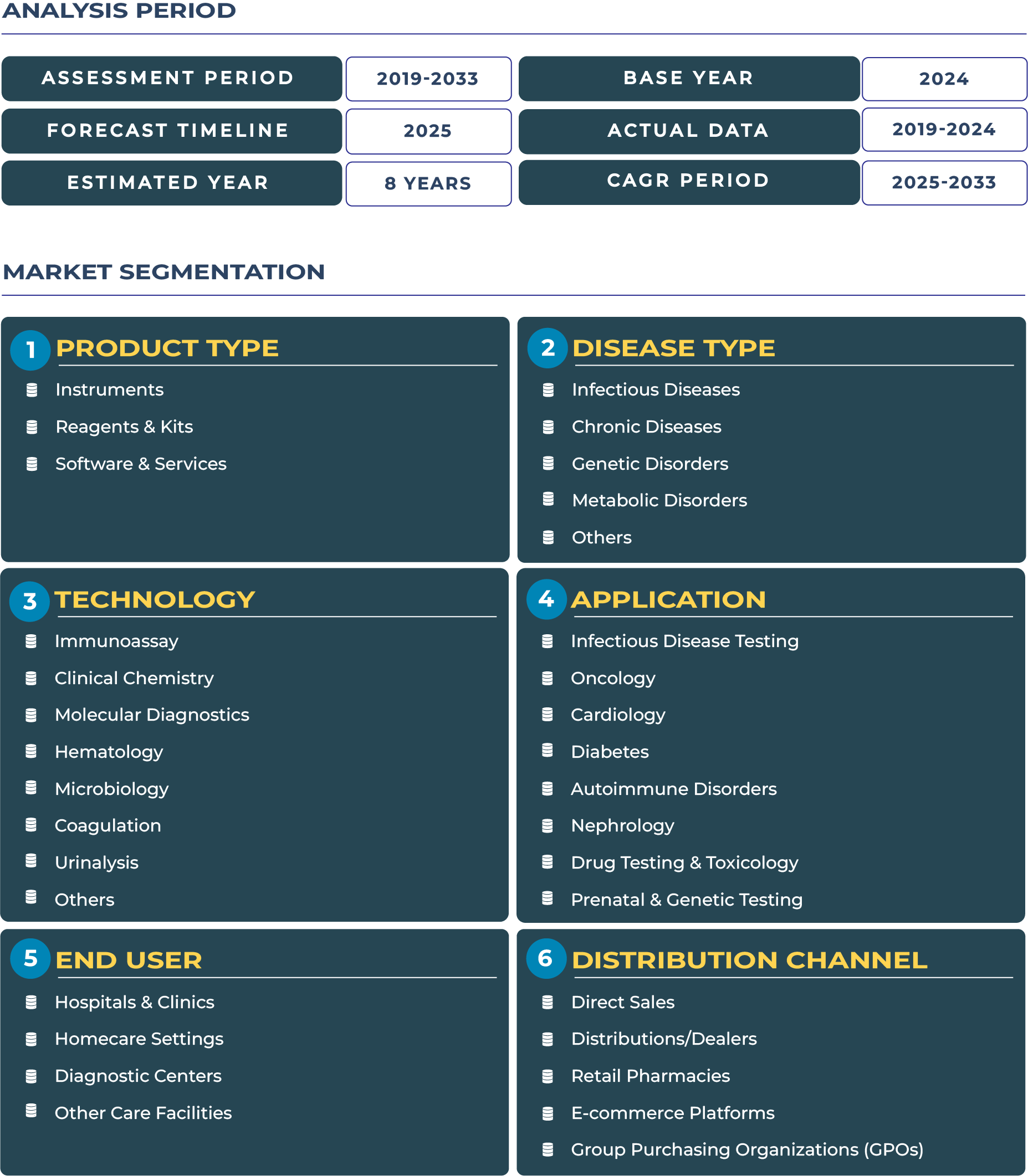

According to DataCube Research, the Spain In-vitro Diagnostic Market is estimated at USD 1.33 billion in 2025 and projected to reach USD 1.76 billion by 2033. This growth reflects the nation’s adoption of advanced diagnostic instruments, reagents, and software solutions that align with its push toward value-based and preventive healthcare. Institutions like the Spanish Ministry of Health are promoting precision diagnostics and expanding access to laboratory automation, enhancing efficiency in public and private hospitals alike.

Growing Private Healthcare Capacity and Orthobiologic Innovation Fuel Market Expansion

One of the primary growth drivers of Spain IVD market lies in the expansion of private healthcare infrastructure and increasing participation of private diagnostic laboratories. As the public healthcare system faces resource limitations, private players have emerged as key accelerators in offering faster, specialized diagnostic services. Companies are integrating next-generation instruments and AI-enabled reagent systems to improve analytical throughput and disease detection accuracy. Additionally, Spain’s interest in orthobiologics and regenerative medicine is stimulating diagnostic advancements, as precise cellular and protein analysis are critical for orthobiologic therapies and post-surgical assessments.

Another catalyst is the growing medical tourism industry, particularly in regions such as Madrid, Barcelona, and Valencia. Tourists seeking orthopedic and trauma-related treatments drive demand for preoperative and postoperative diagnostic evaluations. Advanced molecular and serological testing capabilities are now integrated into sports and rehabilitation clinics, reflecting Spain’s commitment to world-class diagnostic quality.

Fiscal Constraints and Tender-driven Procurement Pose Market Challenges

Despite the favorable growth trajectory, fiscal austerity measures and regional budget disparities remain key restraints for Spain’s in-vitro diagnostic industry. Public hospitals, bound by stringent tender-based procurement processes, often prioritize cost over technological innovation. This slows the adoption of modern diagnostic instruments and software platforms. Regional variations in healthcare funding also lead to uneven diagnostic service quality across autonomous communities.

Furthermore, Spain’s reliance on public funding introduces delays in technology upgrades and reagent supply chains, impacting laboratory turnaround times. Even though the Spanish Agency of Medicines and Medical Devices (AEMPS) continues to streamline approval processes for diagnostic tools, bureaucratic complexities persist at the regional procurement level. These dynamics limit the market’s full potential, especially in small and mid-sized laboratories that struggle with price competitiveness under tender regimes.

Emerging Trends and Opportunities Redefine Spain IVD Ecosystem

Spain in-vitro diagnostic sector is witnessing transformative trends driven by technological integration and decentralized care delivery. One key trend is the rise of ambulatory diagnostic centers and point-of-care testing (POCT), which offer faster and more accessible testing solutions. These facilities are particularly thriving in urban centers such as Madrid and Seville, where healthcare accessibility and sports medicine demand intersect. Another major development is the creation of regional centers of excellence for orthopedic and rehabilitation diagnostics, ensuring consistency in diagnostic protocols across healthcare networks.

In terms of opportunity, Spain’s private hospitals are increasingly developing diagnostic service bundles tailored for medical tourists, integrating sports medicine testing, post-trauma evaluations, and pre-surgical diagnostics. Such bundled offerings enhance convenience and support Spain’s reputation as a destination for specialized healthcare. Moreover, partnerships with diagnostic solution providers like Roche Diagnostics Spain are enabling private and public institutions to modernize their testing capabilities through automation and digital workflow solutions. Local universities and hospitals are also fostering clinical training programs to enhance the diagnostic workforce, ensuring sustainable expertise in IVD management.

Competitive Landscape: Strategic Collaborations and Innovation in Spain’s IVD Sector

The competitive environment of Spain’s in-vitro diagnostic landscape is characterized by a balanced mix of international leaders and regional innovators. Key global players such as Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers continue to dominate the high-end segment, while regional firms like Menarini Diagnostics enhance domestic accessibility through localized reagent manufacturing and service integration.

Recent developments highlight an ongoing shift toward strategic collaborations and digital transformation. In 2024, several Spanish private hospital groups entered partnerships with diagnostic firms to expand molecular testing for orthopedic and sports medicine applications. Focus areas include infection biomarkers, genetic predisposition screening, and post-surgical monitoring. The adoption of cloud-based diagnostic software is also accelerating, offering data-driven insights that support national healthcare digitization goals outlined by the European Commission. These innovations position Spain as a regional leader in precision diagnostics within Southern Europe, combining healthcare modernization with patient-centered outcomes.