Specialty Insurance Market Introduction

Specialty insurance is purchased for special or unique items and unusual events such as flood, fire, earthquake, and family protection, that are usually not covered under other insurance policies. In the past few years, expenditure on specialty insurance by end users has increased at a massive rate. Now end users are more concerned about protecting themselves against frequent cyber-attacks on their critical business information and customers' data, weakening profitability, and natural catastrophes.

Market Dynamics

Increase in the number of cyber-attacks across industry-verticals has increased the need for cyber insurance against cyber-attacks. Further, an increase in awareness, especially in population group falling under 65+ years, is accelerating the specialty insurance market growth. Additionally, special risks associated with every business is increasing the uptake of specialty insurance among business owners across verticals. However, lack of awareness especially in emerging markets and lack of underwriting talent are anticipated to have an adverse effect on the specialty insurance market size during the forecast period.

Market Scope

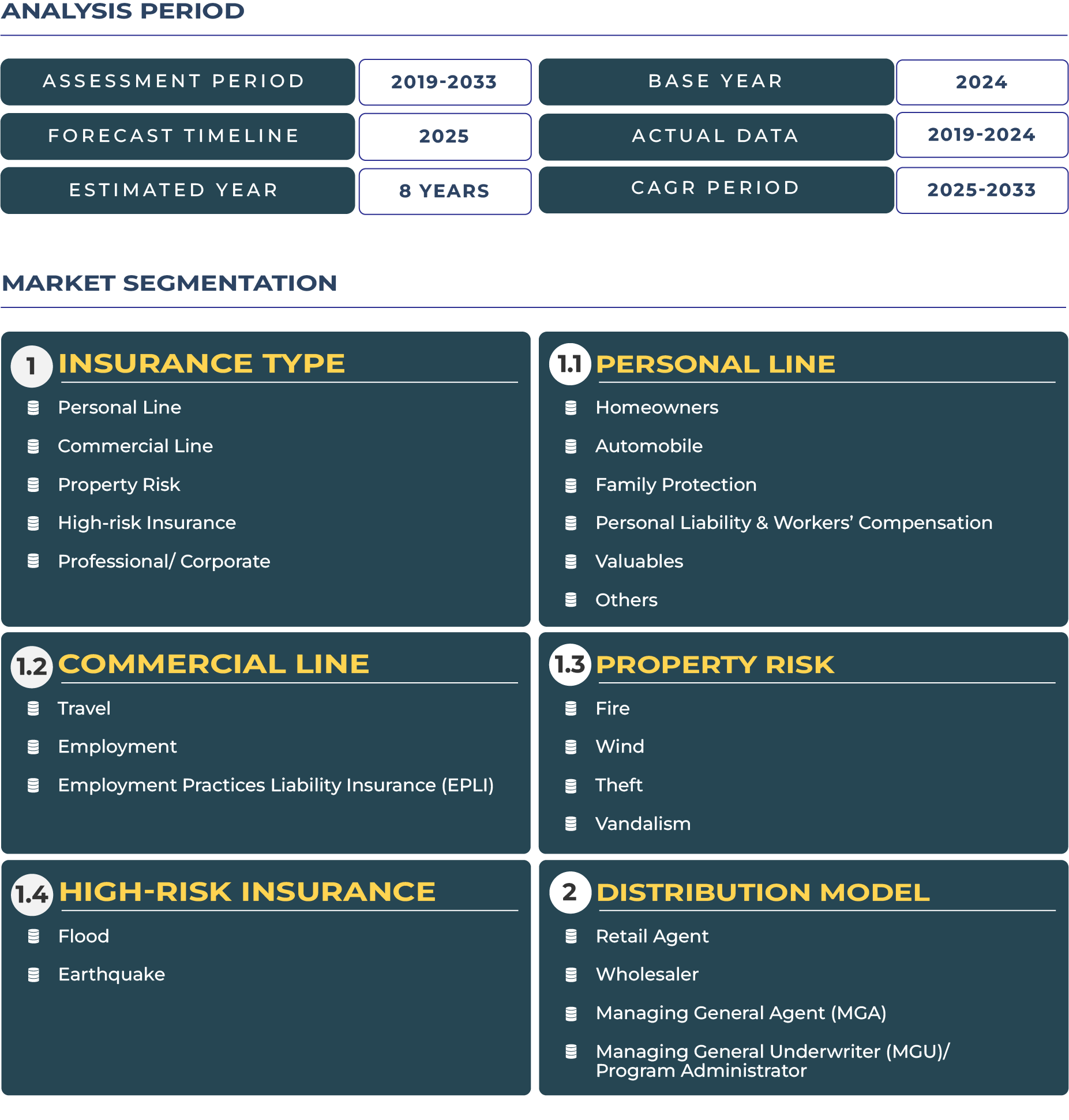

The global specialty insurance market is segmented into type, distribution model, and region.

By type, the specialty insurance market is bifurcated into personal line, commercial line, professional/ corporate, property risk, and high-risk insurance segments. The personal risk segment can be further analyzed across homeowners, automobile, family protection, personal liability & workers' compensation, valuables, and others. The commercial line segment can be sub-segmented into travel, employment, employment practices liability insurance (EPLI) etc. The property risk segment includes fire, wind, theft, and vandalism sub-segments. The high-risk segment is bifurcated into flood and earthquake sub-segments. Based on distribution model, the market is segmented into retail agent, wholesaler, and managing general agent (MGA)/ and managing general underwriter (MGU)/Program Administrator. By region, the specialty insurance market is analyzed across North America, Western Europe, Eastern Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA).

Specialty Insurance Market Competitive Landscape

Key vendors in the specialty insurance market are focused towards entering strategic mergers and acquisition with leading players to expand their portfolio, global presence, and customer base. Additionally, these players are inclined towards expanding business capabilities by inaugurating new business units to develop in-house consulting and strategic teams to secure higher returns and outperform competitors. Prominent players identified in the specialty insurance industry are Medical Mutual of NC, Lackawanna Insurance, HCC Insurance Group, Assurant Specialty, Great American Insurance (AFG), Caterpillar Insurance, Philadelphia Insurance, Travelers Companies, Chubb Group of Companies, and RLI Group among others.