Precision-Driven Diagnostics: Taiwan’s Strategic Role in Asia In-Vitro Diagnostic Evolution

Taiwan, known for its world-class semiconductor and ICT industries, is steadily carving out a leadership position within the in-vitro diagnostic (IVD) ecosystem. The island’s strategic emphasis on precision health, digital integration, and clinical research is enabling it to punch above its weight in the Asia-Pacific diagnostics landscape. As the healthcare system matures and innovation diffusion accelerates, Taiwan is becoming a fertile ground for next-generation diagnostic tools, data-driven assays, and integrated laboratory platforms.

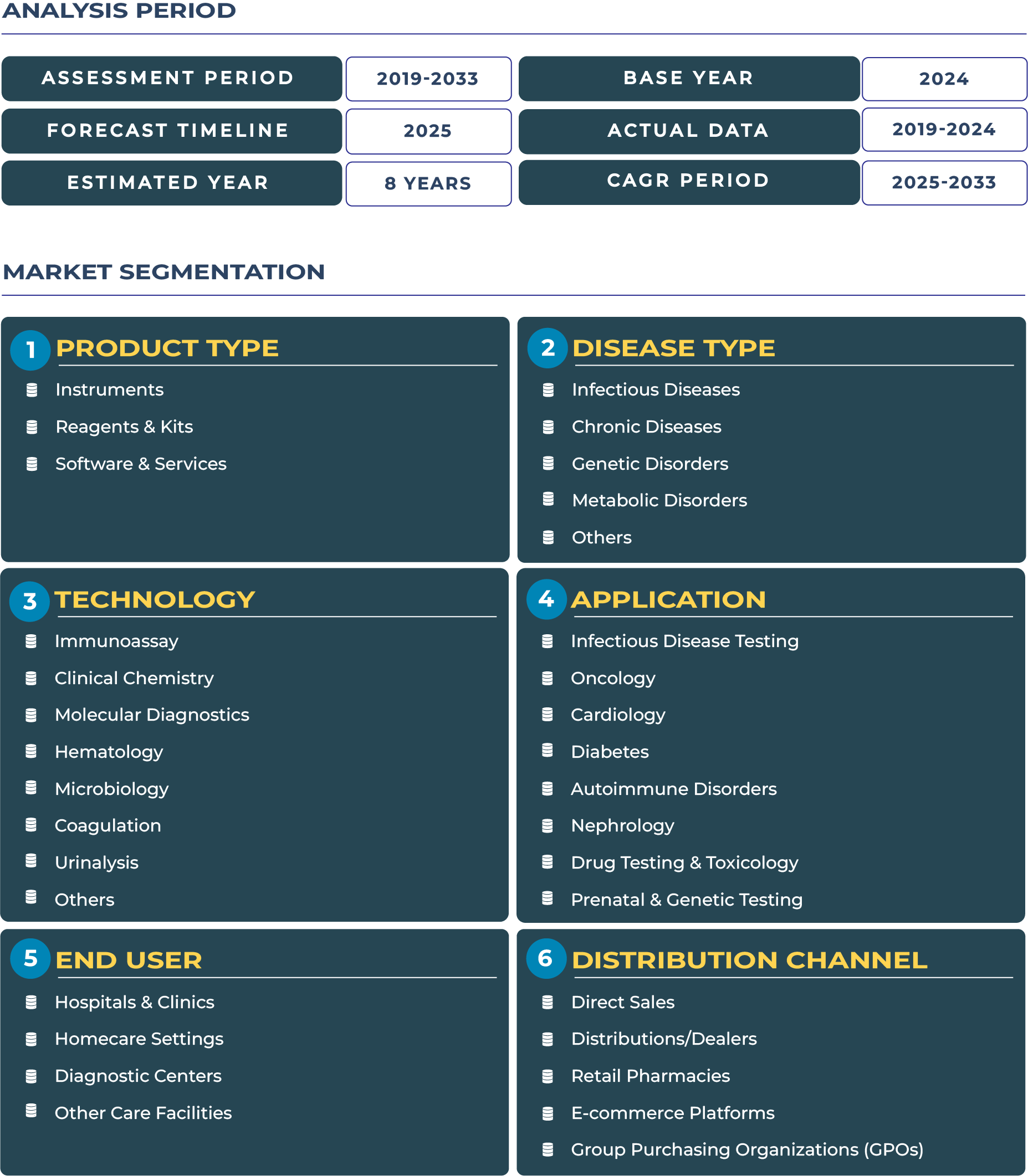

The Taiwan In-Vitro Diagnostic Market is projected to grow from approximately USD 1.13 billion in 2025 to about USD 2.42 billion by 2033, corresponding to a sturdy CAGR of 10.0%. This trajectory reflects converging strengths in healthcare coverage, R&D capacity, and government-led industrial strategy. The government’s “Precision Health Initiative,” which elevates diagnostics and biomedical innovation as one of Taiwan’s six core strategic industries, is catalyzing growth across the diagnostic value chain.

Taiwan’s universal health coverage, driven by its National Health Insurance (NHI) scheme in place since 1995, ensures broad diagnostic access across public and private settings. Coupled with seamless integration of health data via MediCloud and shared electronic medical records, the country maintains a robust base for scaling predictive diagnostics, biomarkers, and laboratory software solutions. As hospitals and specialty labs continue augmenting capacity with automation, multiplex assays, and point-of-care platforms, Taiwan IVD market is well-aligned for sustained expansion.

Drivers & Restraints: Momentum and Constraints in Taiwan’s Diagnostic Domain

Driving Forces: Clinical Specialization, Stable Funding, and Biomedical Innovation

Taiwan’s clinical environment, characterized by high specialization in oncology, cardiology, neurology, and infectious disease, demands advanced diagnostic platforms. The confluence of strong medical R&D, vibrant biotech clusters, and government backing fosters a favorable climate for reagent innovation, molecular assays, and algorithmic interpretation tools. Under the national biomedical policy, diagnostics has been prioritized for integration with AI, cloud, and semiconductor technologies.

Regulatory clarity and reimbursement stability also support the sector. The Taiwan Food and Drug Administration (TFDA) is responsible for medical device and diagnostic oversight, including IVD product registration. Efficient clinical trial frameworks further attract diagnostic validation and commercialization projects: Taiwan’s regulatory regime allows for streamlined review of multinational trials under its Clinical Trial Notification scheme. These attributes help international and domestic diagnostic firms pilot and scale solutions with confidence.

Constraining Factors: Market Scale, Price Pressures, and Export Focus

Despite its sophistication, Taiwan’s domestic scale is inherently limited by population size (~23 million). Excess capacity in premium diagnostic platforms may lead to underutilization unless export or regional adoption is pursued. Moreover, pricing containment pressures from NHI and private payers can discourage implementation of high-cost assays and instruments unless clear clinical value is demonstrated.

A further challenge stems from Taiwan’s historical orientation toward export in medtech and diagnostics. Some local diagnostic enterprises focus more on global markets than ramping advanced offerings domestically. This orientation may slow adoption of certain premium IVD innovations within Taiwan itself. In addition, stringent regulatory compliance and scrutiny may constrain agile iteration, especially for novel assays or next-gen platforms.

Trends & Opportunities: High-Value Diagnostics, Export Ambitions, and Cloud-Driven Insights

Trend: Premium Diagnostic Adoption and Clinical Trial Platforms

Taiwan increasingly emphasizes high-value diagnostic adoption, molecular assays, immunoassay panels, and next-generation sequencing are gaining traction in leading hospitals and specialty centers. The strong clinical trial ecosystem positions Taiwan as a hub for diagnostic validation, co-development, and data-driven device trials. AI-enabled diagnostic interpretation, automated image analysis, and digital pathology platforms are being piloted and scaled within Taiwan’s advanced medical centers, leveraging its data infrastructure and regulatory support for digital health.

Opportunity: Co-development, Niche Export, and Differentiated Positioning

Taiwan’s strength in semiconductors, precision manufacturing, and ICT offers diagnostic firms unique opportunities for co-developing differentiated, export-ready IVD solutions. Partnerships that blend local engineering know-how with bioassay expertise can yield specialized diagnostic platforms tailored for regions with similar disease profiles. The global demand for reliable point-of-care and multiplex tests creates space for Taiwan-based companies to scale beyond domestic boundaries.

Additionally, offering premium diagnostics bundled with clinical trial services, validation support, or cross-border reference lab services can enhance competitiveness. Niche diagnostics, rare disease panels, companion diagnostics, or biomarker-driven surveillance, represent high-margin segments where Taiwan’s technological base can yield global differentiation.

Competitive Landscape: Innovation Anchors and Strategic Alliances in Taiwan’s IVD Sector

The Taiwan IVD landscape features a mix of domestic innovators and international players. Leading manufacturers such as Roche, Abbott, and Siemens Healthineers operate through distribution and co-development arrangements in Taiwan. Indigenous players are also gaining traction, especially those leveraging Taiwan’s biotech and semiconductor competencies.

Diagnostic firms are increasingly choosing Taiwan as a regional R&D and validation hub, conducting pilot programs, KOL studies, and regulatory bridging. In many cases, Taiwanese academic medical centers serve as reference sites for diagnostic trials, enabling iterative testing before regional rollout. Moreover, cross-border diagnostic services, offering analysis or validation for overseas labs, affords Taiwanese diagnostic firms a platform to extend scale beyond national borders.