UAE Dental Devices Market Outlook: Medical Tourism and Digital Dentistry at the Forefront of Growth

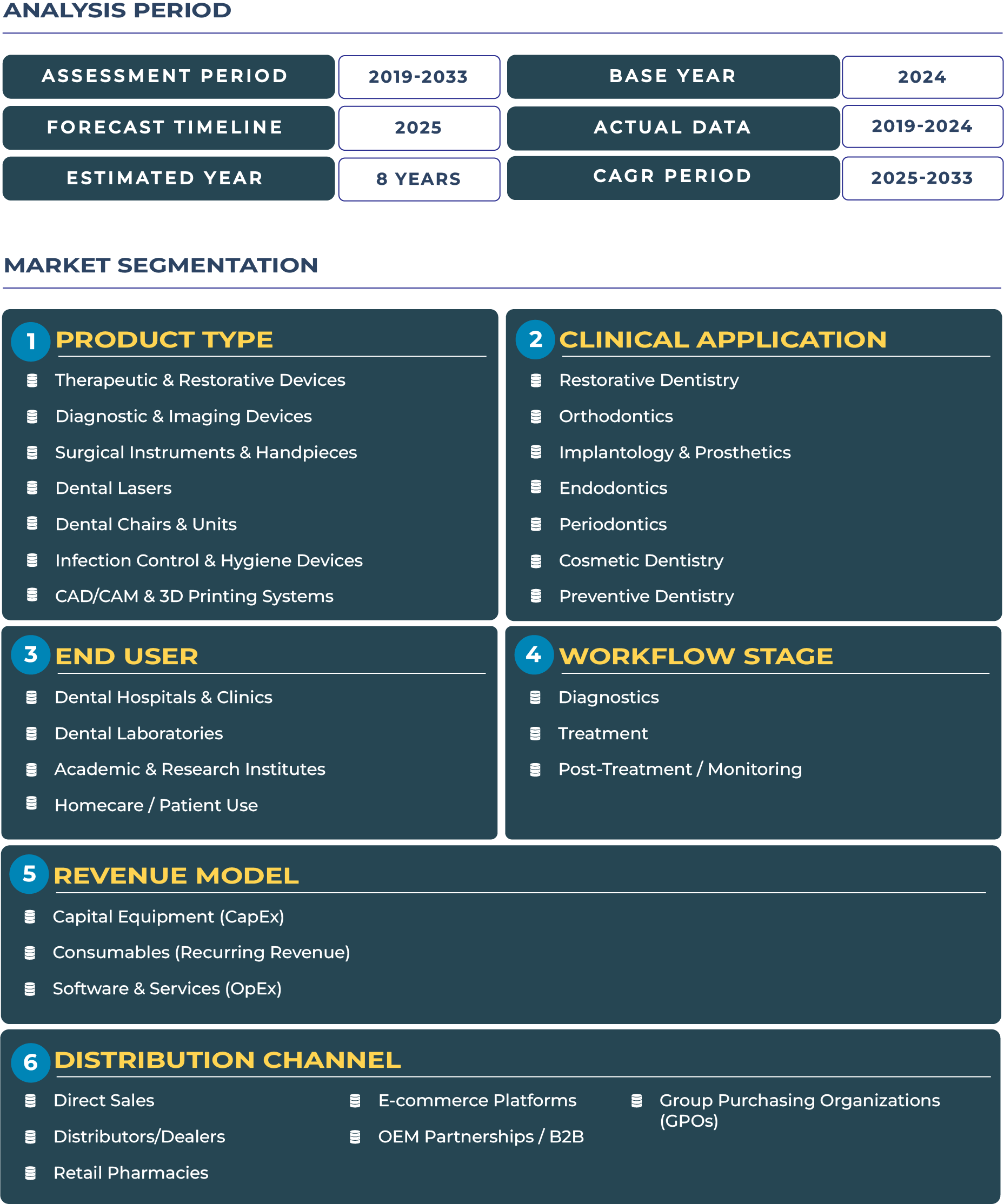

The UAE dental devices market is evolving as a strategic hub that combines luxury healthcare services, advanced digital dentistry, and medical tourism appeal. As Dubai and Abu Dhabi continue positioning themselves as global medical tourism destinations, dental care has emerged as one of the strongest pillars of this growth. Driven by a large expatriate population, high disposable incomes, and the UAE’s ambition to integrate next-generation digital technologies, the dental devices industry in the UAE is forecasted to expand significantly. Valued at USD 165.1 million in 2025, the market is projected to reach USD 368.6 million by 2033, reflecting a CAGR of 10.6% from 2025 to 2033. This growth trajectory is anchored by the rising demand for restorative, diagnostic, and imaging devices, alongside digital systems such as CAD/CAM and 3D printing that are transforming treatment experiences.

Expanding Through Medical Tourism and High-Tech Integration

The UAE’s reputation as a medical tourism hotspot provides a direct boost to the dental devices sector. Dental care, particularly cosmetic dentistry and implantology, attracts international patients who value precision treatments offered by luxury clinics across Dubai and Abu Dhabi. The growing adoption of CAD/CAM and 3D printing technologies allows dentists to deliver faster, customized solutions to patients seeking high-quality care in a single visit. Furthermore, the UAE government’s support for healthcare infrastructure through initiatives such as the Dubai Health Authority and its medical tourism initiatives reinforce the demand for advanced dental devices. By integrating digital dentistry with personalized patient care, the UAE is strengthening its position as a premium market for both residents and international visitors.

Key Growth Drivers Elevating the UAE Dental Devices Ecosystem

The growth of the UAE dental devices landscape is influenced by a unique combination of socio-economic and technological drivers. The large expatriate population, which represents nearly 88% of the UAE’s demographics, fuels consistent demand for orthodontic and restorative treatments. This is coupled with rising investments in private dental clinics that increasingly rely on diagnostic and imaging devices such as high-end dental imaging systems and lasers. Furthermore, medical tourism creates demand for luxury clinics that combine premium aesthetics with advanced surgical instruments. Collectively, these drivers accelerate market adoption while building a robust foundation for future expansion.

Challenges and Restraints: Addressing the Barriers to Growth

Despite its strong outlook, the dental devices market in the UAE faces a series of constraints. High operating and rental costs in premium cities like Dubai pose financial challenges for new entrants, particularly small and medium-sized dental clinics. In addition, stringent regulatory approvals and licensing processes can delay product launches, especially for innovative devices such as dental lasers and 3D imaging systems. Furthermore, the competitive supplier environment—with both global and regional brands competing aggressively—creates pressure on pricing, which may hinder smaller players from achieving sustainable growth.

Emerging Trends and Opportunities in the UAE Dental Devices Industry

One of the most noticeable trends in the UAE dental devices market is the rapid adoption of digital dentistry and imaging technologies. Clinics are embracing advanced solutions such as intraoral scanners and CAD/CAM systems to reduce treatment time and enhance patient satisfaction. Concierge dentistry services are gaining traction, targeting high-net-worth individuals and international tourists who prefer tailor-made care. Opportunities also exist for global players to establish demo and service centers in Dubai, enabling hands-on device trials and clinician training. Partnerships between hotels and dental clinics also create innovative medical tourism packages, further expanding opportunities for both insurers and healthcare providers.

Competitive Landscape: Strategic Moves Shaping the Market

The UAE dental devices ecosystem is characterized by the presence of both global leaders such as Straumann and strong local players catering to premium segments. Strategies include establishing demo/service centers in Dubai to capture the GCC and international tourist flow, as well as forming partnerships with luxury hotels to attract international patients. According to the Dubai Health Authority, medical tourism initiatives prioritized dental care as a central offering within wellness and healthcare tourism packages. This positions the UAE as a gateway market where technology-driven adoption converges with luxury healthcare experiences.