Global Wealth Hub and Fintech Integration: How the UAE is Redefining Private Banking in the Gulf

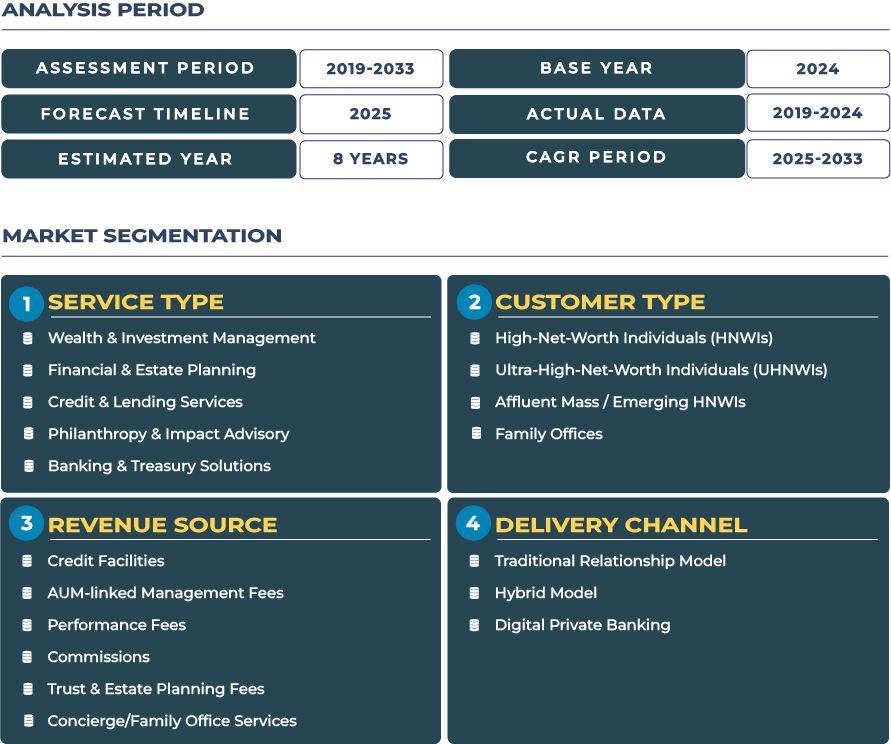

The United Arab Emirates (UAE) has emerged as a pre-eminent centre for private wealth management, driven by significant fintech integration, cross-border capital mobility and the rapid influx of high-net-worth individuals (HNWIs). Within this environment, the UAE private banking market is estimated at approximately USD 12.2 billion in 2025, and is projected to grow to about USD 22.2 billion by 2033, corresponding to a compound annual growth rate (CAGR) of roughly 7.8%. This growth reflects the UAE evolution beyond a regional base into a global private banking ecosystem-where wealth & investment management, banking & treasury solutions, and estate/advisory frameworks are aligned with mobile engagement, international diversification and next-generation digital platforms.

Market Outlook – Navigating the UAE Private Banking Landscape Amid Global Flows and Digital Transformation

The outlook for the UAE private banking industry is anchored by three core dynamics: its role as a global wealth-hub gateway, its advanced fintech infrastructure and a regulatory framework designed to attract international capital. Foreign UHNWIs and business families increasingly view the UAE as both a domicile and a servicing centre-seeking advisory services, credit & lending solutions, and cross-border wealth structuring. Domestic private banks and global entrants are deploying digital platforms that enable onboarding and portfolio servicing from multiple jurisdictions, thereby broadening reach and reducing cost-to-serve.

Note:* The market size refers to the total revenue generated by banks through various services.

Yet the path forward is not without structural challenges. The UAE remains exposed to global economic cycles, oil-price swings and regional geopolitical tension which can affect investor sentiment and cross-border flows. According to recent commentary, private banks in the Middle East are adapting to rising demand for cross-border structuring and digital-first engagement. (source: Euromoney) To capitalise on the robust growth forecast, private banking providers must deliver global investment access, fintech-enabled advisory, and multifaceted banking & treasury services while navigating regulatory compliance, evolving international standards and heightened competition within the Gulf Cooperation Council (GCC) region.

Drivers & Restraints – Key Forces Impacting Growth in the UAE Private Banking Sector

Growth Drivers: Offshore Hub Status, Expat Wealth Influx and Fintech Ecosystem Acceleration

The UAE status as a regional and international wealth centre acts as a primary growth driver. The country attracts affluent expatriates, sovereign wealth flows and family-office assets, all of which increase demand for wealth & investment management and banking & treasury solutions. Fintech advancements-such as digital onboarding, mobile wealth platforms and embedded analytics-have expanded private-banking access beyond traditional clients and enabled scalability. Regulatory reforms, free-zone licences and liberalised residency schemes further amplify cross-border inflows and wealth-migration strategies.

Growth Restraints: Market Saturation, Regulatory Adaptation and Intensified Competition

However, several factors restrain the UAE private banking market’s growth potential. The pace of entrant activity in Dubai and Abu Dhabi has increased competition for affluent clients, especially those migrating from tax-heavy jurisdictions. Local regulatory and compliance regimes continue to evolve in response to global standards (e.g., AML/CFT), which imposes higher costs and operational complexity for private banks. Moreover, the market is reaching a saturation point for domestic HNWI-driven growth-expansion increasingly depends on attracting global wealth and distinguishing service propositions in a crowded private-banking landscape.

Trends & Opportunities – Emerging Patterns and Strategic Growth Avenues in UAE Private Banking

Major Trends: Digital Family Offices, ESG Funds Integration and Offshore On-boarding Acceleration

The private banking industry in the UAE is witnessing a shift toward digital family-office models, where wealth-management firms offer technology-enabled platforms for governance, succession planning and investment oversight tailored to affluent families. ESG investing and sustainable-wealth propositions are increasingly embedded into private-banking advisory frameworks, aligned with global capital-markets demand and regional sovereign-wealth strategies. Concurrently, offshore onboarding capabilities-allowing international clients to establish relationships remotely and access global portfolios via the UAE base-are becoming more sophisticated, facilitating global wealth migration into the market.

Strategic Opportunities: Global Wealth Migration, Fintech-ESG Advisory and Cross-Border Client Solutions

The UAE private banking sector presents compelling strategic opportunities. Private banks and wealth-platform providers can leverage the UAE status as a wealth-migration hub to attract global HNWI families, offering combined on-shore and offshore advisory solutions. Fintech-driven ESG advisory opens new value layers, especially for younger affluent clients who prioritise values-based portfolios and impact-oriented investment. Finally, cross-border servicing models-linking the UAE with Asia, Europe and the Americas-enable private banks to provide multi-jurisdictional credit & lending solutions, extend treasury services globally and deepen engagement across client geographies.

Competitive Landscape – How Private Banking Firms Are Positioning to Lead in the UAE Market

The competitive framework in the UAE private banking market features major domestic players and expanding international entrants positioning for global wealth flows. A key institution is Emirates NBD, which offers bespoke private-banking and wealth-management solutions through its digital infrastructure and global product libraries. Firms are differentiating via strategies such as strengthening offshore onboarding technology to capture relocating UHNWIs, launching ESG-aligned investment suites, and building hybrid advisory models combining robo-human interaction. International banks are expanding their presence and dedicated teams in the UAE, recognising its role as a regional wealth-management hub and gateway to the broader Middle East, Africa and South-Asia (MEASA) region.

Strategic Imperatives for Stakeholders in the UAE Private Banking Market

To maximise opportunity in the UAE private banking market, industry stakeholders must align on several strategic imperatives. Firstly, building advisory depth that spans multiple service types-wealth & investment management, estate planning, credit & lending, philanthropy & impact advisory-is essential to meet affluent clients’ evolving demands. Secondly, digital transformation must be a priority: platforms must enable onboarding, analytics and real-time engagement while supporting cross-border portfolio execution. Thirdly, global connectivity matters: private banking firms must integrate international investment access, multi-currency treasury and on-/off-shore structuring. Finally, risk and regulatory management is critical: given heightened scrutiny on cross-border wealth flows and AML standards, firms must embed strong compliance frameworks. Those that execute these imperatives will secure differentiators in the UAE rapidly advancing private banking ecosystem.